Source: Company reports/Fung Global Retail & Technology

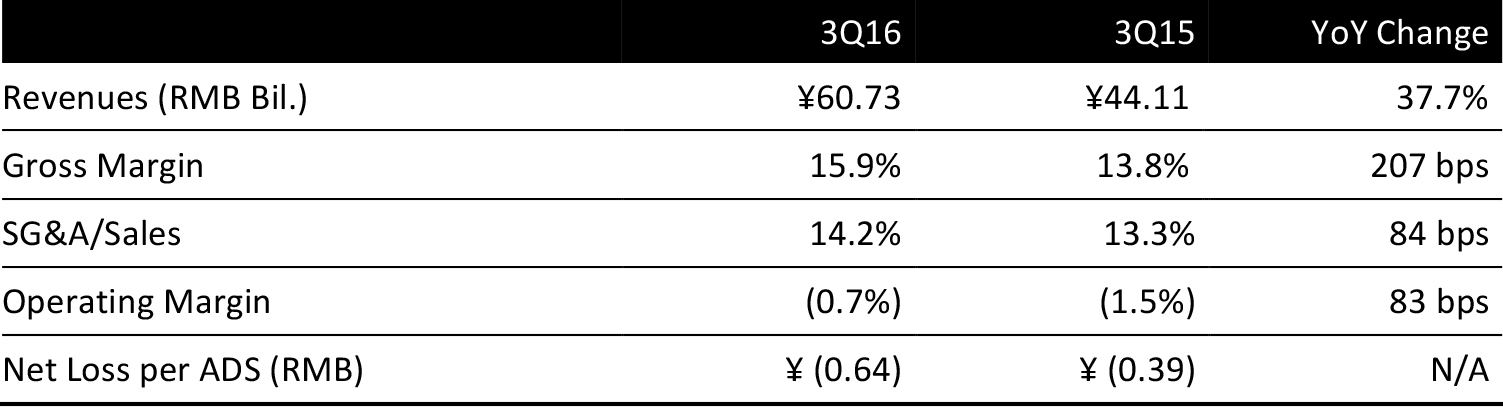

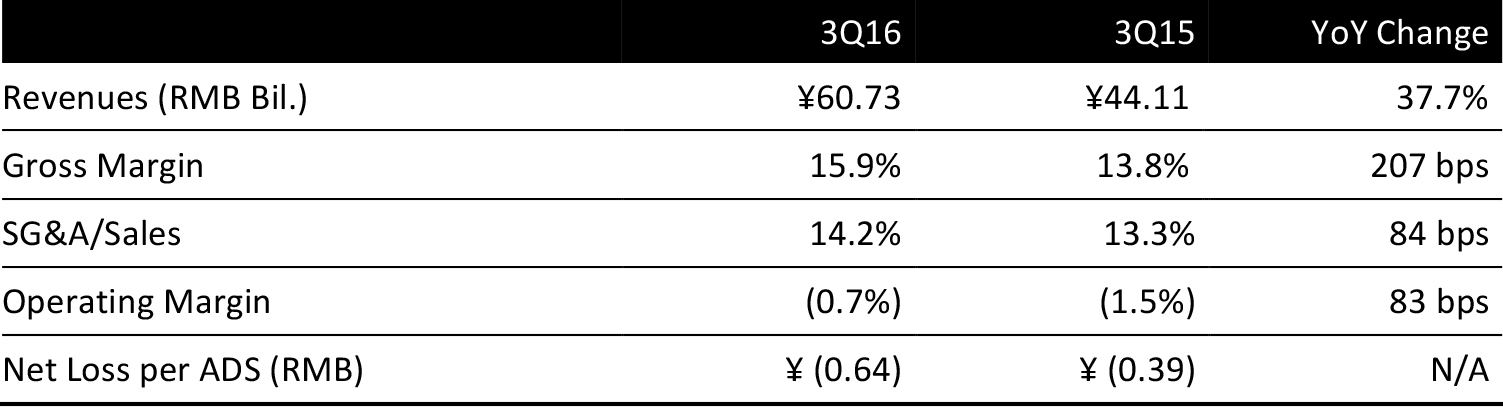

3Q16 RESULTS SUMMARY

JD.com reported 3Q16 revenues of ¥60.73 billion (US$9.1 billion), a 37.7% year-over-year increase, driven by the strong GMV growth of 43% year over year.

Net loss per ADS of ¥0.64 was ahead of consensus estimates for a net loss of ¥0.86, but widened from a net loss per ADS of ¥0.39 for 3Q15. Non-GAAP net income per ADS of ¥0.20 was ahead of consensus estimates for a non-GAAP net loss of ¥0.37 and compares to ¥0.02 for 3Q15.

BUSINESS PERFORMANCE

JD.com’s 3Q16 revenue grew 38% year over year, in tandem with total GMV growth of 43% over the same period.

- Online direct sales business: GMV increased 42% year over year to ¥86.8 billion in 3Q16.

- Online marketplace business: GMV, excluding virtual items, saw a 56% year-over-year increase to ¥68.8 billion in 3Q16.

- Electronics and home appliance products: GMV increased 36% year over year to ¥77.3 billion in 3Q16.

- General merchandise: GMV, excluding virtual items, increased 61% year over year to ¥78.3 billion in 3Q16. General merchandise accounted for over 50% of total GMV, up from 46% in the year-ago period.

- Annual active customer accounts increased by 57% year over year to 198.7 million in the 12 months ended September 30, 2016.

- Fulfilled orders, excluding virtual items, was 401.2 million in 3Q16, representing a 55% increase year over year. Fulfilled orders placed through mobile comprised 79.7% of total orders fulfilled.

PROPOSED SPIN-OFF OF JD FINANCE

JD.com’s board of directors has approved the company to explore a reorganization of JD Finance, including a possible spinoff, according to the earnings release. JD.com would dispose its entire equity stake in JD Finance, which would then be wholly owned by Chinese investors. The possible reorganization of JD Finance would likely allow it to expand its operations in certain licensed financial services businesses in China.

GUIDANCE

Management guided for net revenues for 4Q16 of ¥75.0-77.5 billion, representing year-over-year growth of 37-42%.

The consensus estimates for FY16 revenue is ¥256.5 billion, implying an increase of 40% year over year.