Source: Company reports/Fung Global Retail & Technology

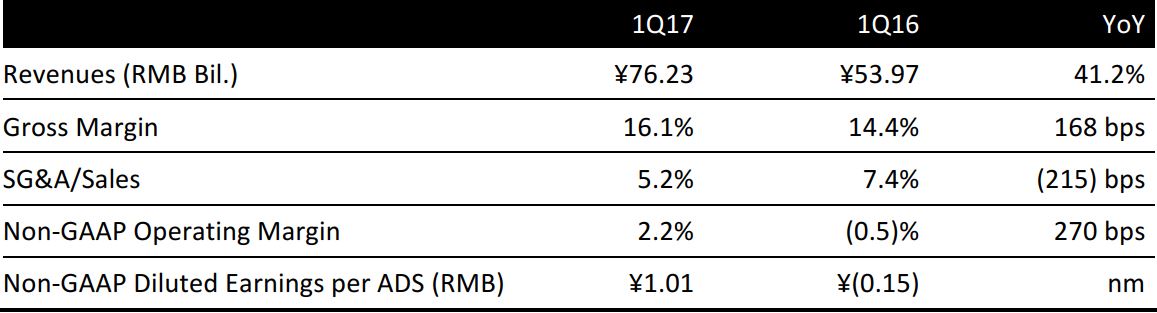

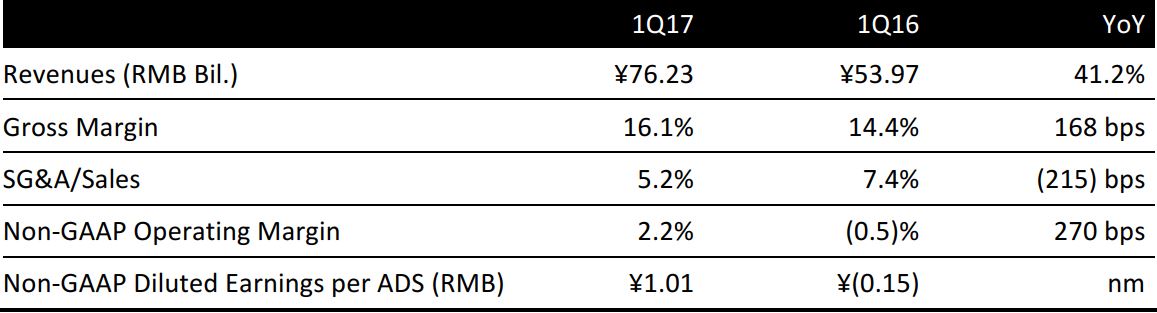

1Q17 Results Summary

JD.com reported 1Q17 revenues of ¥76.23 billion (US$11.1 billion), a 41% year-over-year increase, driven largely by strong GMV growth and solid execution. Diluted earnings per ADS was ¥0.17, compared to a net loss per ADS of ¥0.66 for 1Q16. Non-GAAP diluted earnings per ADS was ¥1.01, compared to a non-GAAP net loss per ADS of ¥0.15 in 1Q16.

Business Performance

JD.com’s 1Q17 revenues grew 41% year over year, driven mainly by 42% growth of GMV and 62% growth of net revenues from other services. The gross profit margin reached 16%, helped by an improvement in the e-commerce margin due to operating leverage.

GMV breakdown by format:

- Online direct sales business: GMV from the online direct sales business was ¥9 billion in 1Q17, up 42% year over year from 1Q16.

- Online marketplace business: GMV from the online marketplace business totaled ¥2 billion in 1Q17, a year-over-year increase of 43% from 1Q16.

GMV breakdown by merchandise:

- Electronics and home appliance products: GMV from electronics and home appliance products was ¥6 billion in 1Q17, an increase of 37% year over year from 1Q16.

- General merchandise: GMV from general merchandise and others was ¥5 billion in 1Q17, a year-over-year increase of 48% from 1Q16. General merchandise accounted for 50% of total GMV, up from 48% in 1Q16.

Orders and customers:

- Annual active customer accounts increased by 40% year over year to 236.5 million in the 12 months ended March 31, 2017.

- Fulfilled orders was 477.1 million in 1Q17, representing a 39% increase year over year from 342.1 million orders in 1Q16. Fulfilled orders placed through mobile comprised approximately 81% of total orders fulfilled, an increase of 56% year over year.

JD Finance Spin-Off

The reorganization of JD Finance is expected to be completed within 2Q17. The finance arm brought in net revenue of around ¥1.03 billion in 1Q17. Pursuant to the March 1 agreement, JD.com will dispose of its entire 68.6% equity stake in JD Finance, and will no longer hold legal ownership or effective control of JD Finance. JD.com will receive approximately ¥14.3 billion in cash and profit-sharing rights for 40% of the future pretax profit of JD Finance once JD Finance records a positive pretax income on a cumulative basis. The profit-sharing rights will be convertible into 40% of JD Finance’s equity interest, subject to applicable regulatory approvals.

Management Comment on JD Logistics

JD.com announced in April the establishment of JD Logistics, a new business group under the JD.com umbrella. It also mentioned that the purpose of setting up the logistics arm as a separate business group is to empower the group to be more autonomous in decision making, and thus be able to better serve third-party business partners leveraging its well established logistics network. JD.com currently operated 263 warehouses covering an aggregate gross floor area of approximately 5.8 million square meters.

Guidance

Management guided for net revenues of ¥88.0–¥90.5 billion for 2Q17, representing a growth rate of 35%–39% compared with 2Q16. The consensus estimate for FY17 revenue is ¥347.6 billion, implying an increase of 33.6% year over year.