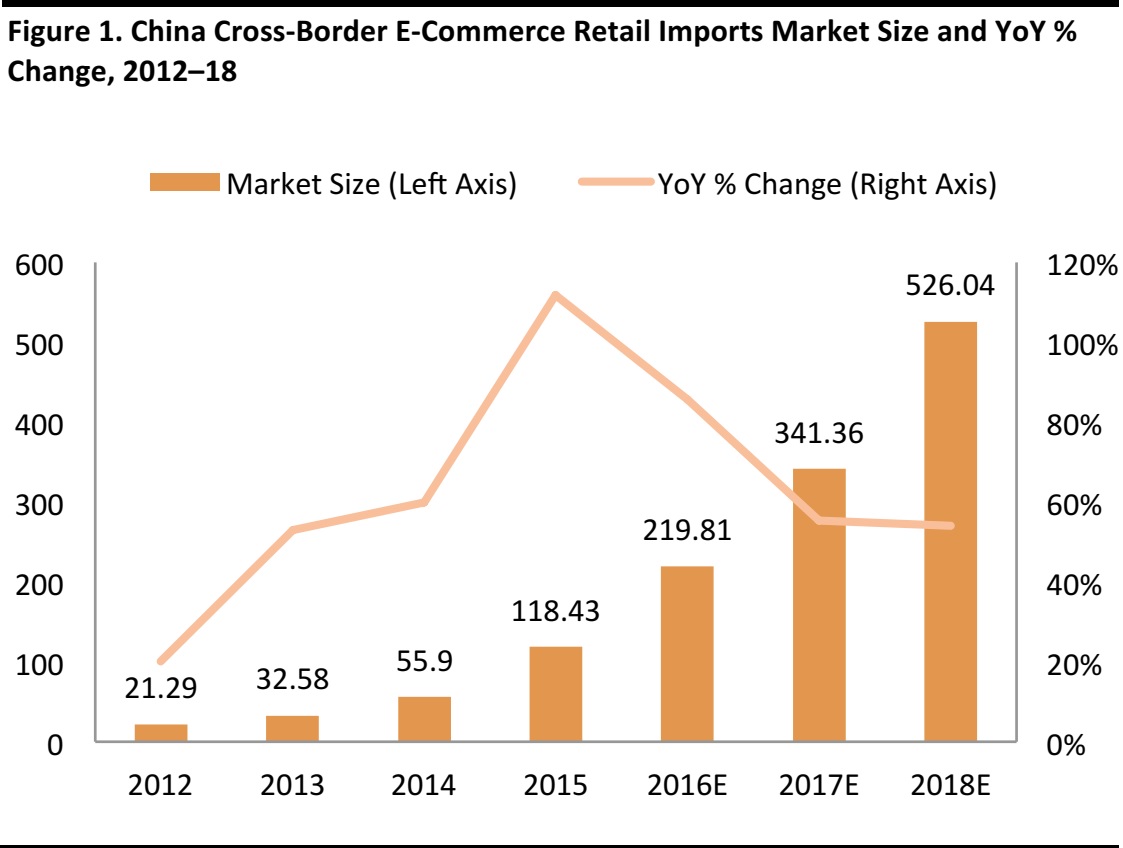

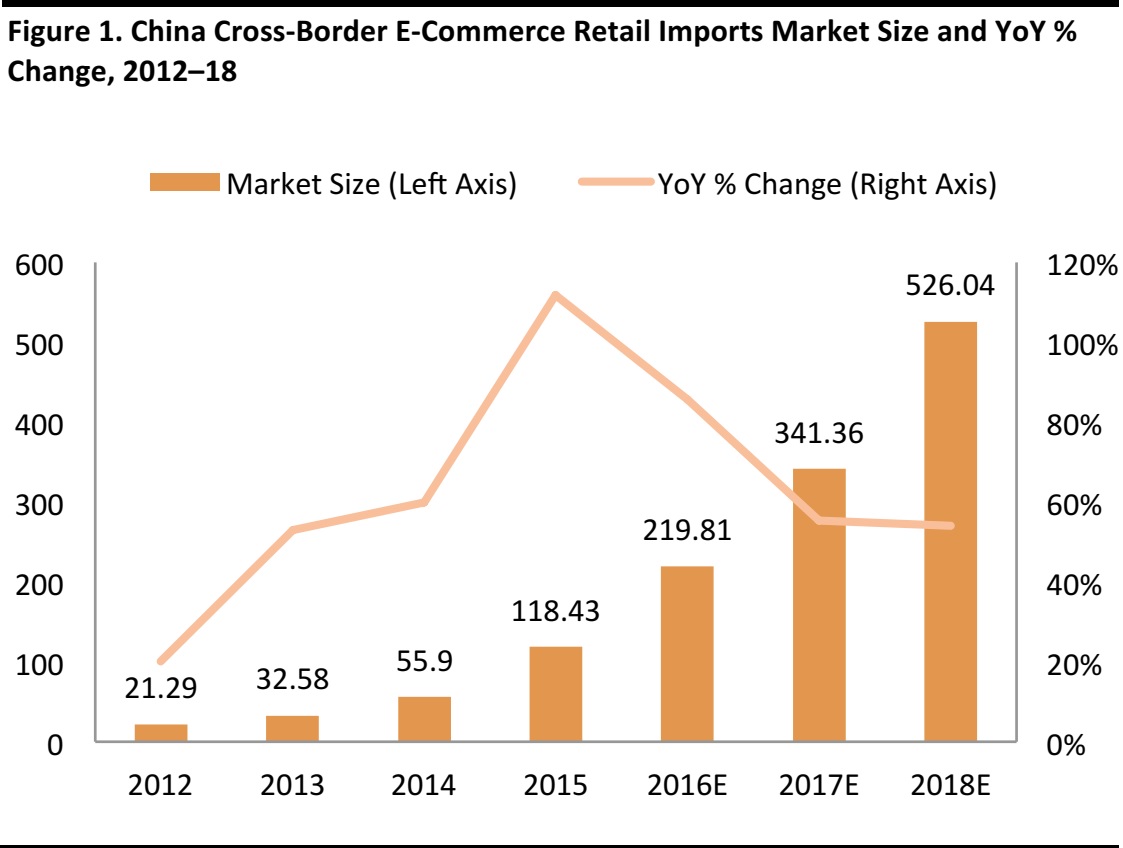

CBEC is digital commerce in which buyers and sellers in different countries make online transactions and deliver goods by using cross-border logistics. CBEC has been growing rapidly in China; the country’s CBEC imports market size was RMB 118 billion (US$17.7 billion) in 2015 and is expected to reach RMB 526 billion in 2018 (US$ 78.9 billion), according to forecasts from iResearch.

Source: iResearch/Fung Global Retail & Technology

There are several factors responsible for the rise of CBEC in China and the increase in Chinese shoppers who seek imported goods:

1)

Rising disposable income and the continued rise of upper-middle class consumers:

The Boston Consulting Group (BCG) expects that by 2020, 81% of consumption growth in China will come from households whose annual income is more than $24,000.

2)

Growing awareness of international brands:

Chinese consumers aspire to buy international brands or products that are not available in their country yet, and they perceive international brands to be of higher quality. According to McKinsey’s survey of China’s internet users, nearly one-fifth of digital consumers shop with vendors outside of China and they prefer items that are either expensive or scarce at domestic vendors.

3)

Supportive regulations:

The Chinese authorities have taken measures to reduce illegal gray-market imports and the friction of cross-border online purchases by introducing a new import duty regime that established trade zones and expedited customs clearance. Many leading CBEC platforms also launched initiatives to combat fraud, which made consumers feel more protected from counterfeit products.

4)

Price differentials betweenChina and overseas:

Chinese shoppers’ preference to buy from overseas is explained by higher prices at home. According to China’s Ministry of Commerce, the average price of wine and spirits in China is 64% higher than it is overseas, and the average price of watches in China is 33% higher.

ILLUSTRATION: CHINA’S RUSH FOR INFANT FORMULA

Speakers at the luncheon cited the popularity of international infant formula brands in China and the success of CBEC channels in distributing the product to illustrate how international retailers’ could use e-commerce to reach Chinese consumers.

Source: Shutterstock

The Chinese infant formula market is defined by food safety scandals. This led to a huge demand for infant formula produced by international brands which are perceived to have better quality control. The popularity of overseas infant formula in China gave rise to parallel trading by profiteers who resell foreign infant formula to Chinese customers. This prompted a number of countries including Australia, Britain, Hong Kong and New Zealand, to limit in-store purchases.

Faced by in-store channel limitations, international brands had to find a more efficient channel to reach Chinese customers. In response, they set up online stores which allowed them to sell products directly in China.

JD WORLDWIDE’S POSITIONING

JD Worldwide is the cross-border service of JD and operates both, the third-party marketplace and self-operating models.

On the JD Worldwide marketplace, international brands can open individual storefronts and sell directly to Chinese consumers. JD has 321% market share, behind T-mall with 51% share. On its self-operating platform, JD Worldwide buys inventory from overseas distributors and sells to Chinese customers.

Source: Shutterstock

In order to strengthen its position as a distributor for brands, JD Worldwide has taken the following steps:

- The company has a zero tolerance policy for counterfeit products on its platform and regularly checks supply sources. They also have mystery shoppers who go to JD Worldwide and buy high-value items to test the system.

- JD Worldwide’s in-house logistics service is one of the company’s primary distinguishing features. The platform’s delivery pledge guarantees that 85% of orders are delivered on the same day or the next day. JD owns 234 large warehouses in 50 cities.

- JD has a marketing partnership with WeChat, a popular social messaging app which has more than 700 million monthly active users. The partnership includes an exclusive WeChat shopping channel which increases access to China’s digital shoppers.

CHINA’S CBEC TAX REFORM UNLIKELY TO BE A THREAT TO GROWTH

In April 2016, the Chinese authorities implemented new import tax regulations and required customs clearance certificates for CBEC imports. The latter was subsequently postponed. Under the new tax regulations, online purchases are subject to an import value-added tax (VAT) and a consumption tax instead of a parcel tax.

JD is confident the recent tax reform is unlikely to slow the growth of CBEC in China. According to Mr. Li, even after factoring in the cross-border sales tax, the after-tax prices of many products on cross-border shopping websites are still lower than those offered by traditional retailers and importers. The overall tax rate after the reform is roughly 11.9%, below the 30–50% tax rate for regular import channels.

Source: Shutterstock

These new regulations also signal the authorities’ willingness to strive for regulatory clarity to standardize CBEC and reduce the risk of import tariff and tax circumvention.

CONCLUSION

We expect CBEC imports to China will increase to satisfy Chinese consumers’ demand for overseas imports. International retailers can reach Chinese shoppers with or without a physical store presence in China by selling through CBEC channels. In our view, JD is deftly positioned to capitalize on this opportunity given the company’s understanding of the evolving consumer preferences in the country and the regulatory landscape, and its commitment to authentic products and investment in logistics capabilities.

CBEC is digital commerce in which buyers and sellers in different countries make online transactions and deliver goods by using cross-border logistics. CBEC has been growing rapidly in China; the country’s CBEC imports market size was RMB 118 billion (US$17.7 billion) in 2015 and is expected to reach RMB 526 billion in 2018 (US$ 78.9 billion), according to forecasts from iResearch.

CBEC is digital commerce in which buyers and sellers in different countries make online transactions and deliver goods by using cross-border logistics. CBEC has been growing rapidly in China; the country’s CBEC imports market size was RMB 118 billion (US$17.7 billion) in 2015 and is expected to reach RMB 526 billion in 2018 (US$ 78.9 billion), according to forecasts from iResearch.