JD Sports Fashion

Sector: Apparel specialty retail

Countries of operation: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Ireland, Italy, Malaysia, Portugal, Singapore, South Korea, Spain, Sweden, Thailand, the Netherlands, the UK and the US

Key product categories: Sports and outdoor accessories, apparel and footwear

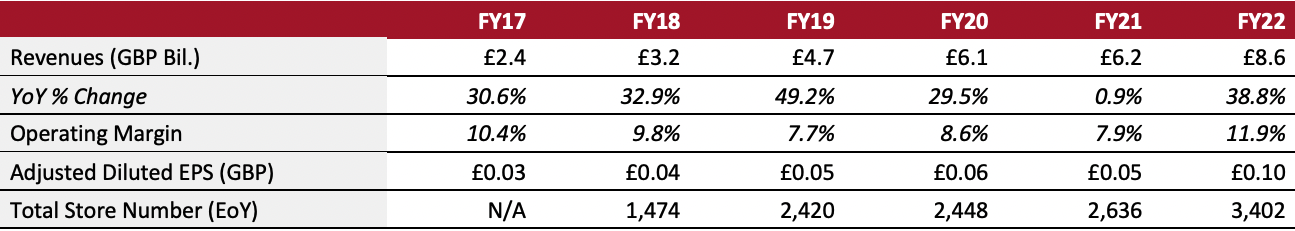

Annual Metrics

[caption id="attachment_153869" align="aligncenter" width="700"]

Fiscal year ends on January 29 of the following calendar year

Fiscal year ends on January 29 of the following calendar year[/caption]

Summary

Founded in 1981 and headquartered in Bury, the UK, JD Sports Fashion is a multichannel retailer of branded sportswear and casualwear. The company offers global brands, such as Adidas, NIKE, Puma and The North Face, alongside its own private-label brands, which include Chausport, DTLR Villa, Finish Line, Footpatrol, JD, JD Gyms, Livestock, Mainline, Perry Sport & Adventure Scotts, Shoe Palace, Size?, Sizeer, Sports Zone, Sprinter, and Tessuti. As of January 29, 2022, the company operates 3,402 stores across two business segments: sports fashion and outdoor.

Company Analysis

Coresight Research insight: JD Sports benefits from its buying scale, size, and strong relationships with its key vendor partners—including leading brand owners such as Adidas, NIKE, The North Face and Puma. Furthermore, its private-label brands help drive strong sales growth, providing a margin benefit and differentiating the company from its competitors. In fiscal 2022 (ended January 29, 2022), the company’s total sales increased by 38.8% year over year—driven by strong growth across both its operating segments, sports fashion and outdoor. Additionally, the company stated that it remains optimistic about long-term demand trends in its key categories such as athletic apparel, footwear and team sports. We expect that JD Sports will post positive sales growth in the fiscal 2023, as we believe consumer perspectives surrounding active lifestyles will remain unchanged even after the pandemic. Furthermore, new working-from-home setups will continue to support both the athleisure and outdoor apparel market.

Additionally, JD Sports is aggressively ramping up its international business, particularly in the US and Europe. Recently, the company acquired US-based apparel and footwear companies DTLR and Shoe Palace—and opened its most expensive ever flagship store in New York. Additionally, JD Sports expanded its European footprint through the acquisitions of Poland-based apparel and footwear retailer Marketing Investment Group and Greece-based sportswear retailer Cosmos. We also believe that the company’s recent strategic partnership with Authentic Brands Group—to launch Reebok’s footwear collections in over 2,850 JD Sports stores across North America and Europe—will bolster the company’s international presence.

| Tailwinds |

Headwinds |

- Huge size, buying scale and distribution footprint

- Private-label brands remain robust

- Continued strong athletic trends, present even before the pandemic

- Continued strong relationship with leading brand owners, such as Adidas, NIKE, Puma and The North Face, driving innovation

- Recent technology investments—including in distribution centers, and in-store digital devices such as iPads, kiosks and web tills, alongside its new “Pick from Store” option—will help to capitalize on the recent consumer shift to online retail

|

- Heightened competition, as well as vendor direct-to-consumer channel cannibalization

- Recent aggressive disruption from in the sporting and outdoor goods space could pose an earnings risk

- High transportation costs amid supply chain bottlenecks

|

Strategy

In its fiscal 2022 annual report published in June 2022, the company reiterated its long-term growth strategy. It focuses on the following four key areas:

1. Maintain a dominant market position

- Forge a deep connection with its customers through the continual investment in its digital platforms, physical store portfolio and marketing

- Ensure that its overall product range remains authentic and appealing to customers, by constantly nurturing the global branded supplier relationships—both existing and new

- Update brand line-up regularly to ensure several choices of brands and exclusive products are available

- Maintain a rigorous analytical approach to manage product rate of sale and minimize markdown

2. Expand and refurbish store portfolio

- Work with landlords to ensure that its lease portfolio has the maximum flexibility and the lowest committed cost possible

- Drive store footfall by offering a largely exclusive product range, presented in a well-fitted store with world-class standards of retail theater

3. Enhance omnichannel capability

- Invest in digital platforms to maximize its reach and impact on consumers, ensuring a seamless shopping experience across all channels

- Expand its multichannel capabilities by investing in in-store digital devices, such as iPads, kiosk and web tills, and capitalize on the “Pick from Store” option, which allows customer access to its full stock listing regardless of location

4. Continue global expansion

- Open new stores in Asia Pacific, Europe and North America

- Continue M&A activity internationally

- Invest in its international multichannel capabilities through a multicurrency and multilanguage website estate

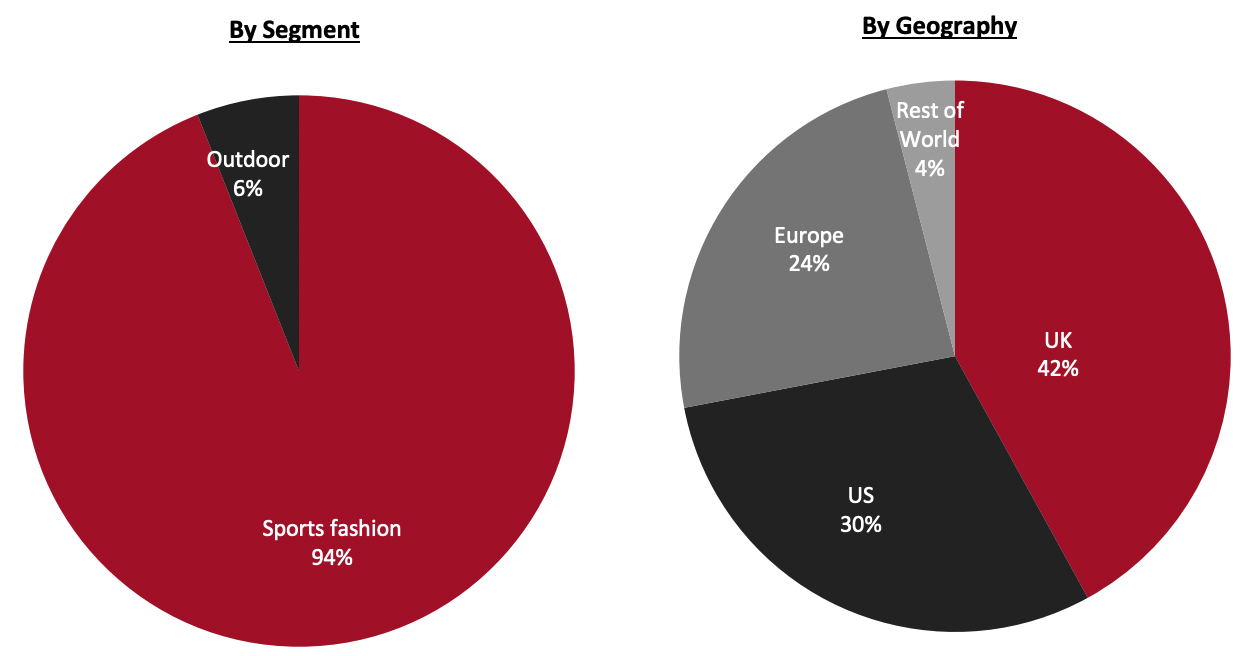

Revenue Breakdown (FY22)

Company Developments

Company Developments

| Date |

Development |

| August 1, 2022 |

JD Sports sells its Footasylum footwear chain to German investment group Aurelius for £37.5 million ($45.9 million). |

| July 8, 2022 |

JD Sports appoints Andrew Higginson as Non-Executive Chairman of the company, effective July 11, 2022. Higginson has over 28 years of experience, including about 15 years at Tesco. |

| June 30, 2022 |

JD Sports sells Morgan Hill, California, headquarter of its Shoe Palace banner to a joint venture between Westbrook Partners and Ridge Capital Investors for $45 million. |

| June 22, 2022 |

JD Sports acquires a 60% stake in Bolton-based Total Swimming Group from Olympic swimmers Adrian Turner and Rebecca Adlington Steve Parry for £15.1 million ($18.5 million). |

| May 25, 2022 |

JD Sports appoints Kath Smith as Interim CEO of the company. Smith has more than 25 years’ experience in the apparel and footwear sector, including as Managing Director of Adidas and Reebok brands. |

| January 13, 2022 |

JD Sports enters a sponsorship deal with the UK-based esports organization Excel esports. Through the deal, JD looks to target casual and competitive e-gaming audiences. |

| December 20, 2021 |

JD Sports partners with Authentic Brands Group to launch Reebok’s footwear collections in over 2,850 JD Sports stores across North America and Europe. All stores (including both online and physical) under the retailer’s banner, including Finish Line, JD, DTLR, Shoe Palace, Size, Sprinter and SportZone, will start selling Reebok products from fall 2022. |

| October 22, 2021 |

JD Sports acquires an 80% stake in Greece-based sportswear and casualwear retailer Cosmos, in a bid to bolster its European footprint. As of October 2021, Cosmos operated 57 stores in Greece and three in Cyprus. In the year ended December 2020, Cosmos generated revenues of about €52.0 million ($60.5 million). |

| October 8, 2021 |

JD Sports acquires a majority stake in bicycle retailer Wheelbase. Wheelbase has a strong online presence selling premium bikes to customers across the UK. Furthermore, Wheelbase operates three stores across the North of England. |

| September 9, 2021 |

JD Sports joins mobile commerce platform OOOOO Entertainment to launch live video commerce in the UK. |

| June 30, 2021 |

JD Sports completes intergroup sale of Netherlands-based Sports Unlimited Retail (SUR) to Spain-based Iberian Sports Retail Group (ISRG), a subsidiary of JD Sports. The deal is valued at €16.5 million ($30.7 billion). |

| May 11, 2021 |

JD Sports acquires the independent menswear retailer Oi Polloi. The acquisition includes online assets and the brand’s store in Manchester’s Northern Quarter. |

| March 17, 2021 |

JD Sports completes the acquisition of the US-based footwear retailer DTLR Villa. Through the acquisition, JD Sports seeks to expand its presence in the northern and eastern regions of the US. |

| March 12, 2021 |

JD Sports enters into an agreement to acquire a 60% stake in apparel and footwear company Marketing Investment Group (MIG). As of March 2021, MIG operated 410 stores across nine countries in Central and Eastern Europe. |

| December 16, 2020 |

Acquires US-based footwear company Shoe Palace for $325 million. The acquisition provides JD Sports with a solid geographical footprint in the western region of the US through a network of 167 stores. |

| October 26, 2020 |

Launches a multistorey flagship store in New York Times Square to drive the company’s reputation in the US. The flagship store, spanning 18,000 square feet, is the retailer’s most expensive store to date. |

| July 29, 2020 |

Acquires the gym chain Xercise4Less after it fell into administration. As of July 2020, Xercise4Less operated 51 gyms across the UK. |

Management Team

- Kath Smith—Interim CEO

- Andrew Higginson—Non-Executive Chairman

- Neil Greenhalgh—CFO

- Jon Davis—Managing Director

- Nigel Keen—Property Director

- Barry Loftus—Information Technology Director

- Gavin Kavanagh—Head of International Merchandising Projects

Source: Company reports/S&P Capital IQ

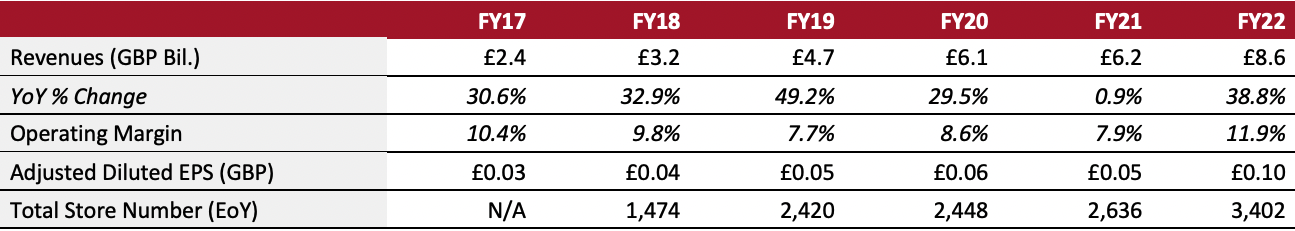

Fiscal year ends on January 29 of the following calendar year[/caption]

Summary

Founded in 1981 and headquartered in Bury, the UK, JD Sports Fashion is a multichannel retailer of branded sportswear and casualwear. The company offers global brands, such as Adidas, NIKE, Puma and The North Face, alongside its own private-label brands, which include Chausport, DTLR Villa, Finish Line, Footpatrol, JD, JD Gyms, Livestock, Mainline, Perry Sport & Adventure Scotts, Shoe Palace, Size?, Sizeer, Sports Zone, Sprinter, and Tessuti. As of January 29, 2022, the company operates 3,402 stores across two business segments: sports fashion and outdoor.

Company Analysis

Coresight Research insight: JD Sports benefits from its buying scale, size, and strong relationships with its key vendor partners—including leading brand owners such as Adidas, NIKE, The North Face and Puma. Furthermore, its private-label brands help drive strong sales growth, providing a margin benefit and differentiating the company from its competitors. In fiscal 2022 (ended January 29, 2022), the company’s total sales increased by 38.8% year over year—driven by strong growth across both its operating segments, sports fashion and outdoor. Additionally, the company stated that it remains optimistic about long-term demand trends in its key categories such as athletic apparel, footwear and team sports. We expect that JD Sports will post positive sales growth in the fiscal 2023, as we believe consumer perspectives surrounding active lifestyles will remain unchanged even after the pandemic. Furthermore, new working-from-home setups will continue to support both the athleisure and outdoor apparel market.

Additionally, JD Sports is aggressively ramping up its international business, particularly in the US and Europe. Recently, the company acquired US-based apparel and footwear companies DTLR and Shoe Palace—and opened its most expensive ever flagship store in New York. Additionally, JD Sports expanded its European footprint through the acquisitions of Poland-based apparel and footwear retailer Marketing Investment Group and Greece-based sportswear retailer Cosmos. We also believe that the company’s recent strategic partnership with Authentic Brands Group—to launch Reebok’s footwear collections in over 2,850 JD Sports stores across North America and Europe—will bolster the company’s international presence.

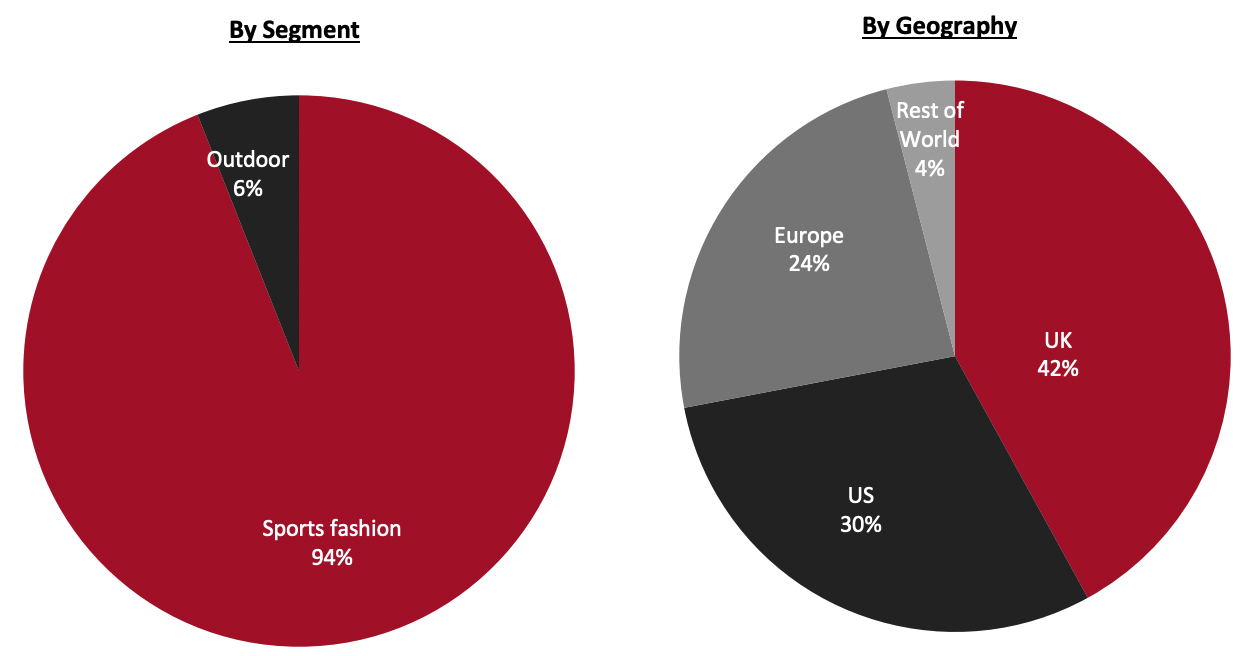

Fiscal year ends on January 29 of the following calendar year[/caption]

Summary

Founded in 1981 and headquartered in Bury, the UK, JD Sports Fashion is a multichannel retailer of branded sportswear and casualwear. The company offers global brands, such as Adidas, NIKE, Puma and The North Face, alongside its own private-label brands, which include Chausport, DTLR Villa, Finish Line, Footpatrol, JD, JD Gyms, Livestock, Mainline, Perry Sport & Adventure Scotts, Shoe Palace, Size?, Sizeer, Sports Zone, Sprinter, and Tessuti. As of January 29, 2022, the company operates 3,402 stores across two business segments: sports fashion and outdoor.

Company Analysis

Coresight Research insight: JD Sports benefits from its buying scale, size, and strong relationships with its key vendor partners—including leading brand owners such as Adidas, NIKE, The North Face and Puma. Furthermore, its private-label brands help drive strong sales growth, providing a margin benefit and differentiating the company from its competitors. In fiscal 2022 (ended January 29, 2022), the company’s total sales increased by 38.8% year over year—driven by strong growth across both its operating segments, sports fashion and outdoor. Additionally, the company stated that it remains optimistic about long-term demand trends in its key categories such as athletic apparel, footwear and team sports. We expect that JD Sports will post positive sales growth in the fiscal 2023, as we believe consumer perspectives surrounding active lifestyles will remain unchanged even after the pandemic. Furthermore, new working-from-home setups will continue to support both the athleisure and outdoor apparel market.

Additionally, JD Sports is aggressively ramping up its international business, particularly in the US and Europe. Recently, the company acquired US-based apparel and footwear companies DTLR and Shoe Palace—and opened its most expensive ever flagship store in New York. Additionally, JD Sports expanded its European footprint through the acquisitions of Poland-based apparel and footwear retailer Marketing Investment Group and Greece-based sportswear retailer Cosmos. We also believe that the company’s recent strategic partnership with Authentic Brands Group—to launch Reebok’s footwear collections in over 2,850 JD Sports stores across North America and Europe—will bolster the company’s international presence.

Company Developments

Company Developments