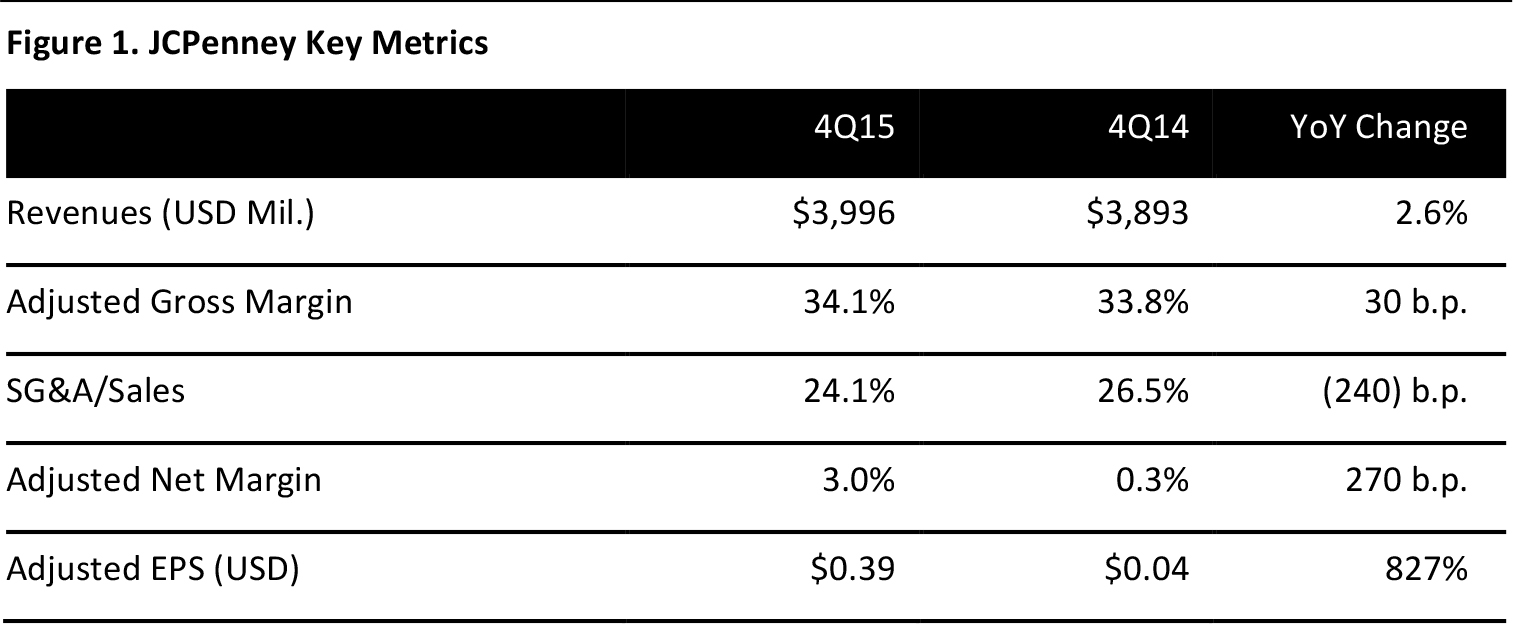

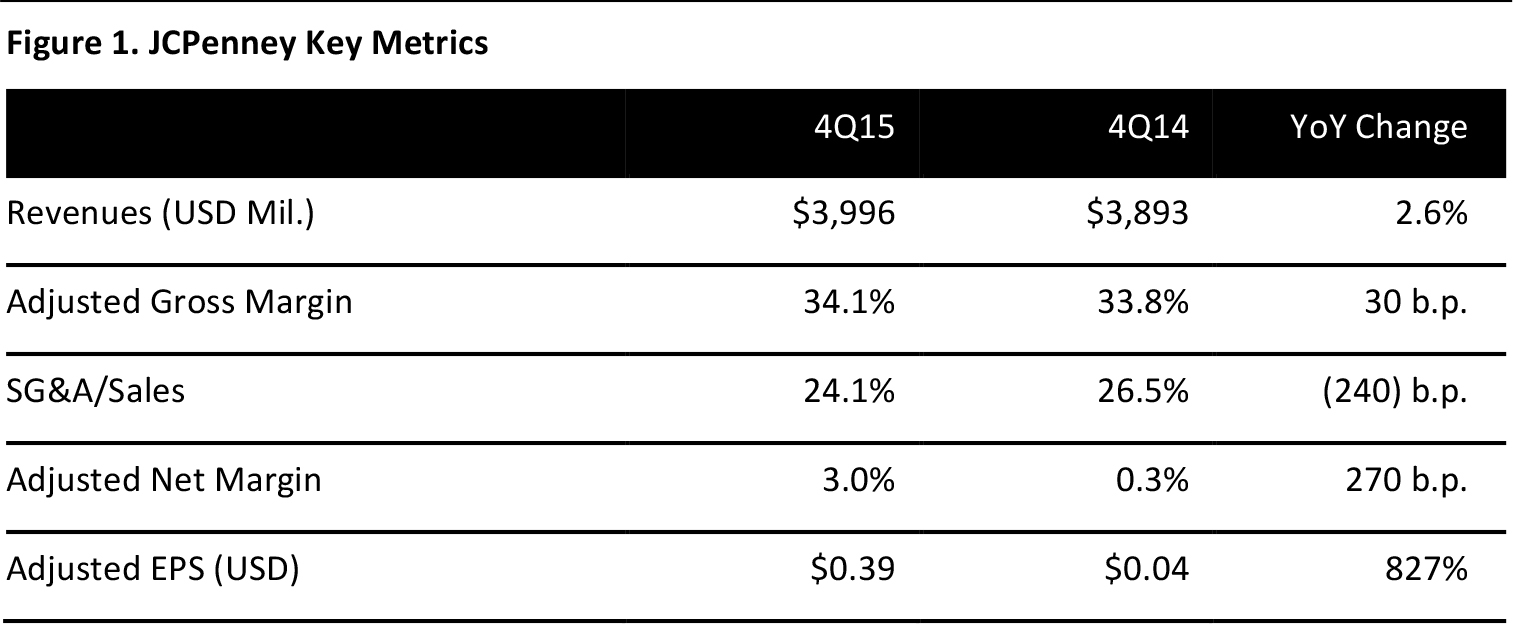

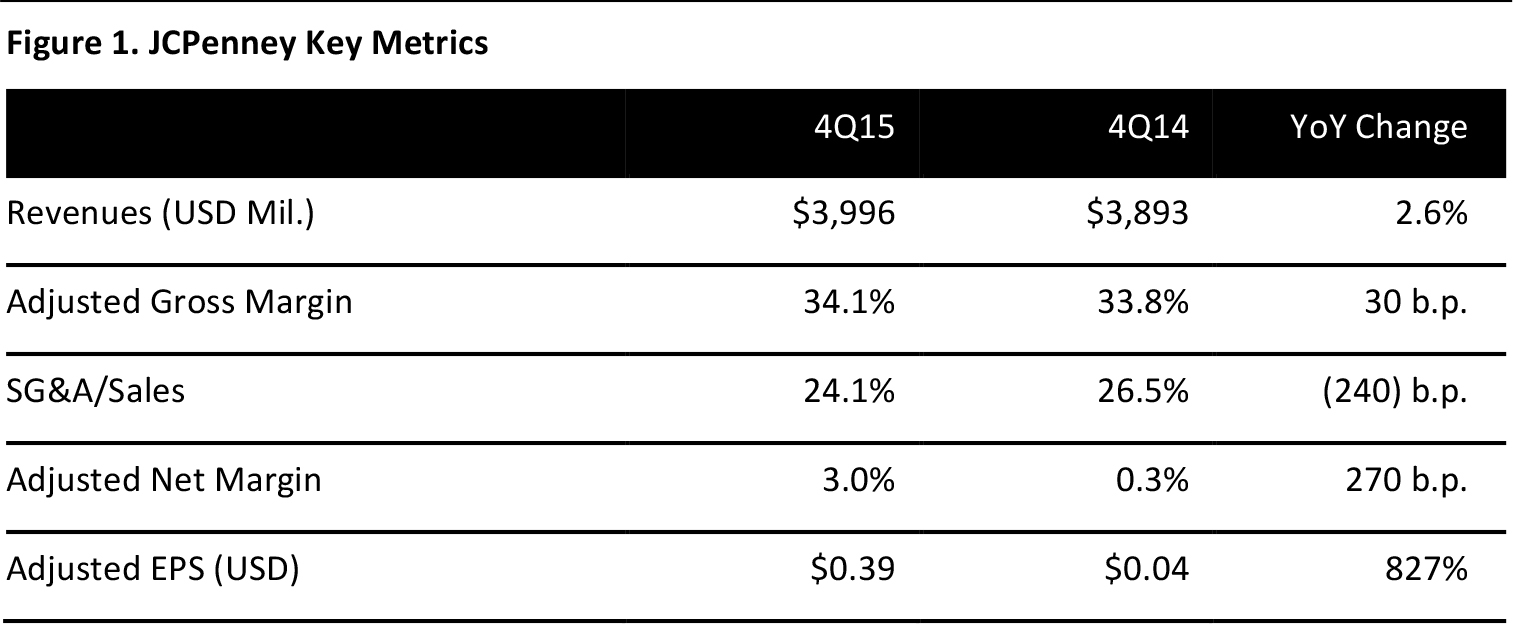

Source: Company reports

JCPenney reported 4Q15 adjusted EPS of $0.39 versus the consensus estimate of $0.22. Adjusted EBITDA was $381.0 million versus consensus of $324.3 million.

Total revenue was $4.0 billion versus expectations of $3.99 billion. Comps were up 4.1% versus consensus of 3.9%. JCPenney’s focus on private label, omni-channel and revenue per customer is resonating, as the company is gaining back some of its lost market share. Home, Sephora, footwear and handbags were the top-performing categories. The best-performing regions were the Western and Northeastern regions, although all regions posted positive comps.

Inventories were up 2.6% at the end of the period, in line with sales growth of 2.6% for the fourth quarter.

Full year guidance calls for EPS to be positive versus consensus of $(0.28). Adjusted EBITDA is expected to be $1 billion versus consensus of $901.6 million. Comps are expected to be up 3%–4%. Gross margins are expected to increase by 40–60 basis points, while SG&A dollars are expected to decline. Free cash flow is expected to improve year over year.