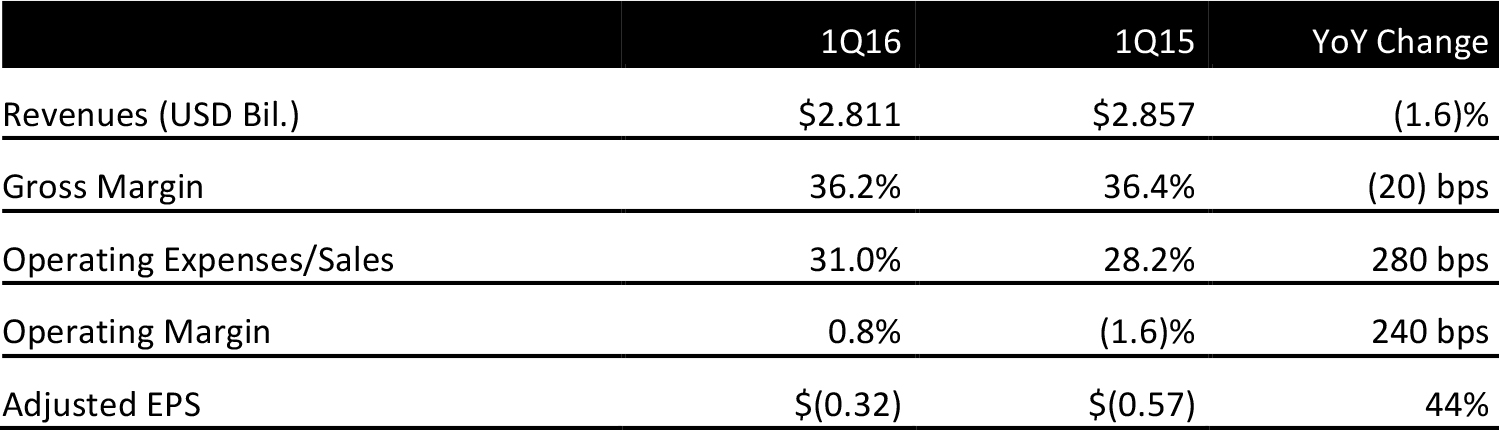

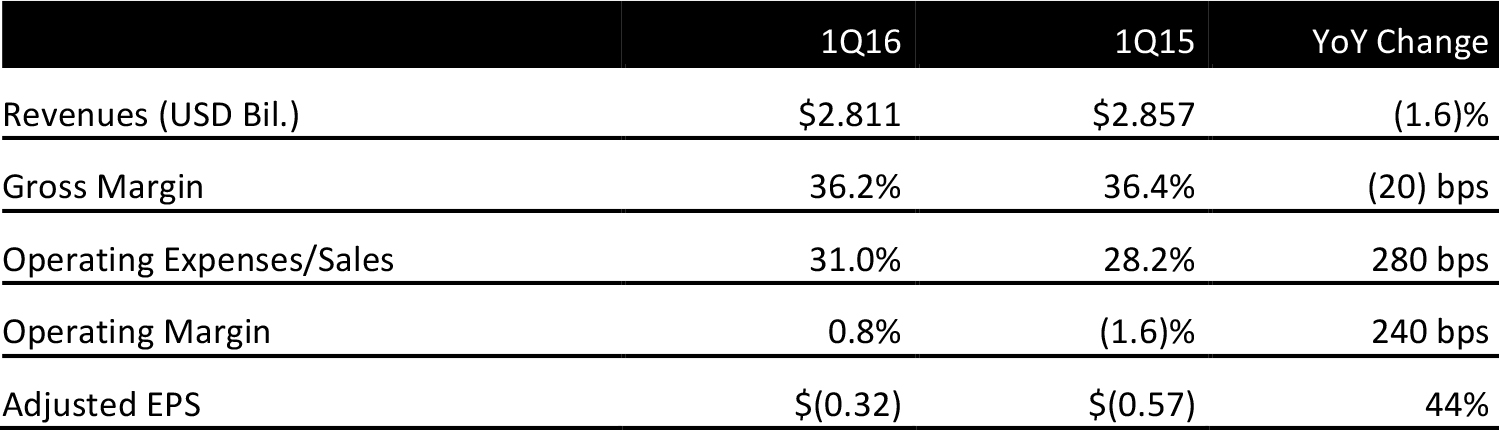

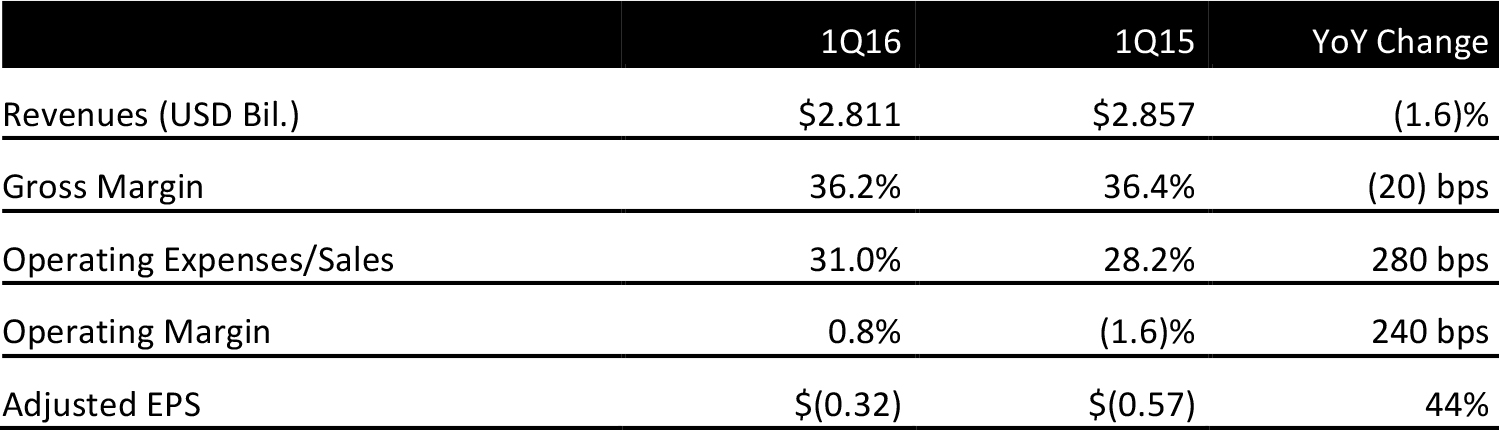

Source: Company reports

1Q16 RESULTS

JCPenney reported 1Q16 adjusted EPS of $(0.32) versus the consensus estimate of $(0.38). EBITDA was $176.0 million, beating the consensus of $129.1 million.

Total revenues were $2.8 billion versus consensus of $2.9 billion. Comps were down 0.4% versus consensus of 3.2%. Management commented that sales during the period were challenging. Comps were positive in February, then turned negative in March and early April before turning positive again at the end of April.

The top-performing categories were men’s, Sephora, and footwear and handbags. Geographically, the Northeast and Ohio Valley were the best-performing regions.

Inventory ended the quarter up 4.1% year over year compared to a 1.6% decline in sales during the quarter.

FY16 OUTLOOK

Management maintained most of its prior guidance for the full year, with the exception of its expectations for gross margin, which it now expects to increase by 10–30 basis points versus 40–60 basis points previously.

EBITDA is expected to be $1 billion versus consensus of $1.01 billion. Comps are still expected to be up 3%–4%. Adjusted EPS is expected to be positive, compared to consensus of $0.05. SG&A dollars are expected to decrease year over year. Free cash flow is expected to improve over 2015’s figure.

Management maintained its annual comp guidance despite the shortfall in the quarter, based on current sales trends, the strength of Sephora, and the company’s decision to accelerate the rollout of its appliance business.

The accelerated rollout of the appliance business and rapid growth of the online business drove the reduction in gross margin guidance.