albert Chan

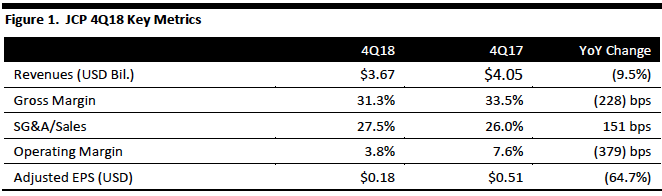

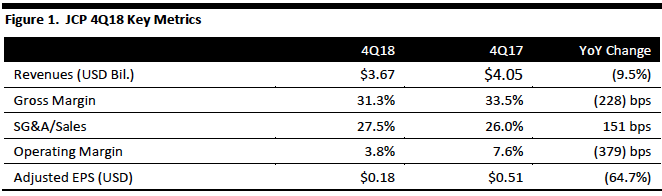

[caption id="attachment_78481" align="aligncenter" width="662"] Source: Company reports/Coresight Research[/caption]

4Q18 Results

JCPenney 4Q18 revenues were $3.67 billion, down 9.5% year over year, below the consensus estimate of $3.72 billion. The company reported 4Q18 adjusted EPS of $0.18, down 64.7% from last year and above the consensus estimate of $0.11.

Annual revenues were $11.66 billion, down 7.7% from $12.55 in the year ago period.

On a shifted basis, comparing sales for the weeks ending Feb 2, 2019, with the weeks ending Feb 3, 2018, comparable sales decreased 4%. On an unshifted basis, comparable sales decreased 6.0%, and for the full year, comparable sales decreased 3.1%. The company reported the decline was primarily due to a decrease in transactions, offset partially by an increase in average unit retail.

The company introducted three additions to its management team: Michelle Wlazlo, Chief Merchant; John Welling, Senior Vice President of Planning and Allocation; Mark Stinde, Senior Vice President of Asset Protection.

Management highlighted strategies and initiatives to achieve growth. First, the company is continuing its effort to reduce and enhance inventory. In 2018, JCPenney reduced unproductive inventory 13%. Second, the company is working to strengthen digital channels. Third, management reported it is redesigning its processes and will gice store associates enhanced technology tools. Lastly, the company is revamping its merchandise assortments to enhance styles and quality.

The company reported the divisions and categories that outperformed the total company comp for the quarter were jewelry, women's apparel, children's apparel and men's apparel. Mangement commented that its women’s apparel category comps were up 2% in the fourth quarter and that the company is making progress within this category in outerwear, activewear, dresses and with brands Liz Claiborne and Worthington. In men’s apparel, JCPenney highlighted strength in its active apparel and big and tall apparel categories. Special-sized apparel showed strong results with its men’s big and tall apparel business up double digits for the quarter.

JCPenney reported it saw strong category performance for the quarter in areas including athletic and active apparel, special-sized apparel, baby apparel and gear, outerwear apparel and toys. Underperforming categories in the fourth quarter included big-ticket areas in home such as major appliances and furniture as well as women's accessories and handbags.

Management highlighted that its decision to discontinue selling major appliances and have furniture available only online will allow the company to better meet customer expectations and improve financial performance. These businesses represented only 2.7% of sales in 2018 and the company was significantly negative in operating profit for the business unit.

Geographically, the Midwest and Southwest were JCPenney’s stronger performing regions while the Southeast was the most challenged.

Outlook

The company plans to close 18 full-line stores in 2019. JCPenney will also close nine ancillary home and furniture stores in 2019. The stores identified for closure are minimally cash flow postive, or require significant capital. JCPenney reported that comparable sales for the stores it will close were significantly below comparable sales of the remaining stores. The company expects to be cash flow positive for fiscal year 2019.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

JCPenney 4Q18 revenues were $3.67 billion, down 9.5% year over year, below the consensus estimate of $3.72 billion. The company reported 4Q18 adjusted EPS of $0.18, down 64.7% from last year and above the consensus estimate of $0.11.

Annual revenues were $11.66 billion, down 7.7% from $12.55 in the year ago period.

On a shifted basis, comparing sales for the weeks ending Feb 2, 2019, with the weeks ending Feb 3, 2018, comparable sales decreased 4%. On an unshifted basis, comparable sales decreased 6.0%, and for the full year, comparable sales decreased 3.1%. The company reported the decline was primarily due to a decrease in transactions, offset partially by an increase in average unit retail.

The company introducted three additions to its management team: Michelle Wlazlo, Chief Merchant; John Welling, Senior Vice President of Planning and Allocation; Mark Stinde, Senior Vice President of Asset Protection.

Management highlighted strategies and initiatives to achieve growth. First, the company is continuing its effort to reduce and enhance inventory. In 2018, JCPenney reduced unproductive inventory 13%. Second, the company is working to strengthen digital channels. Third, management reported it is redesigning its processes and will gice store associates enhanced technology tools. Lastly, the company is revamping its merchandise assortments to enhance styles and quality.

The company reported the divisions and categories that outperformed the total company comp for the quarter were jewelry, women's apparel, children's apparel and men's apparel. Mangement commented that its women’s apparel category comps were up 2% in the fourth quarter and that the company is making progress within this category in outerwear, activewear, dresses and with brands Liz Claiborne and Worthington. In men’s apparel, JCPenney highlighted strength in its active apparel and big and tall apparel categories. Special-sized apparel showed strong results with its men’s big and tall apparel business up double digits for the quarter.

JCPenney reported it saw strong category performance for the quarter in areas including athletic and active apparel, special-sized apparel, baby apparel and gear, outerwear apparel and toys. Underperforming categories in the fourth quarter included big-ticket areas in home such as major appliances and furniture as well as women's accessories and handbags.

Management highlighted that its decision to discontinue selling major appliances and have furniture available only online will allow the company to better meet customer expectations and improve financial performance. These businesses represented only 2.7% of sales in 2018 and the company was significantly negative in operating profit for the business unit.

Geographically, the Midwest and Southwest were JCPenney’s stronger performing regions while the Southeast was the most challenged.

Outlook

The company plans to close 18 full-line stores in 2019. JCPenney will also close nine ancillary home and furniture stores in 2019. The stores identified for closure are minimally cash flow postive, or require significant capital. JCPenney reported that comparable sales for the stores it will close were significantly below comparable sales of the remaining stores. The company expects to be cash flow positive for fiscal year 2019.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

JCPenney 4Q18 revenues were $3.67 billion, down 9.5% year over year, below the consensus estimate of $3.72 billion. The company reported 4Q18 adjusted EPS of $0.18, down 64.7% from last year and above the consensus estimate of $0.11.

Annual revenues were $11.66 billion, down 7.7% from $12.55 in the year ago period.

On a shifted basis, comparing sales for the weeks ending Feb 2, 2019, with the weeks ending Feb 3, 2018, comparable sales decreased 4%. On an unshifted basis, comparable sales decreased 6.0%, and for the full year, comparable sales decreased 3.1%. The company reported the decline was primarily due to a decrease in transactions, offset partially by an increase in average unit retail.

The company introducted three additions to its management team: Michelle Wlazlo, Chief Merchant; John Welling, Senior Vice President of Planning and Allocation; Mark Stinde, Senior Vice President of Asset Protection.

Management highlighted strategies and initiatives to achieve growth. First, the company is continuing its effort to reduce and enhance inventory. In 2018, JCPenney reduced unproductive inventory 13%. Second, the company is working to strengthen digital channels. Third, management reported it is redesigning its processes and will gice store associates enhanced technology tools. Lastly, the company is revamping its merchandise assortments to enhance styles and quality.

The company reported the divisions and categories that outperformed the total company comp for the quarter were jewelry, women's apparel, children's apparel and men's apparel. Mangement commented that its women’s apparel category comps were up 2% in the fourth quarter and that the company is making progress within this category in outerwear, activewear, dresses and with brands Liz Claiborne and Worthington. In men’s apparel, JCPenney highlighted strength in its active apparel and big and tall apparel categories. Special-sized apparel showed strong results with its men’s big and tall apparel business up double digits for the quarter.

JCPenney reported it saw strong category performance for the quarter in areas including athletic and active apparel, special-sized apparel, baby apparel and gear, outerwear apparel and toys. Underperforming categories in the fourth quarter included big-ticket areas in home such as major appliances and furniture as well as women's accessories and handbags.

Management highlighted that its decision to discontinue selling major appliances and have furniture available only online will allow the company to better meet customer expectations and improve financial performance. These businesses represented only 2.7% of sales in 2018 and the company was significantly negative in operating profit for the business unit.

Geographically, the Midwest and Southwest were JCPenney’s stronger performing regions while the Southeast was the most challenged.

Outlook

The company plans to close 18 full-line stores in 2019. JCPenney will also close nine ancillary home and furniture stores in 2019. The stores identified for closure are minimally cash flow postive, or require significant capital. JCPenney reported that comparable sales for the stores it will close were significantly below comparable sales of the remaining stores. The company expects to be cash flow positive for fiscal year 2019.

Source: Company reports/Coresight Research[/caption]

4Q18 Results

JCPenney 4Q18 revenues were $3.67 billion, down 9.5% year over year, below the consensus estimate of $3.72 billion. The company reported 4Q18 adjusted EPS of $0.18, down 64.7% from last year and above the consensus estimate of $0.11.

Annual revenues were $11.66 billion, down 7.7% from $12.55 in the year ago period.

On a shifted basis, comparing sales for the weeks ending Feb 2, 2019, with the weeks ending Feb 3, 2018, comparable sales decreased 4%. On an unshifted basis, comparable sales decreased 6.0%, and for the full year, comparable sales decreased 3.1%. The company reported the decline was primarily due to a decrease in transactions, offset partially by an increase in average unit retail.

The company introducted three additions to its management team: Michelle Wlazlo, Chief Merchant; John Welling, Senior Vice President of Planning and Allocation; Mark Stinde, Senior Vice President of Asset Protection.

Management highlighted strategies and initiatives to achieve growth. First, the company is continuing its effort to reduce and enhance inventory. In 2018, JCPenney reduced unproductive inventory 13%. Second, the company is working to strengthen digital channels. Third, management reported it is redesigning its processes and will gice store associates enhanced technology tools. Lastly, the company is revamping its merchandise assortments to enhance styles and quality.

The company reported the divisions and categories that outperformed the total company comp for the quarter were jewelry, women's apparel, children's apparel and men's apparel. Mangement commented that its women’s apparel category comps were up 2% in the fourth quarter and that the company is making progress within this category in outerwear, activewear, dresses and with brands Liz Claiborne and Worthington. In men’s apparel, JCPenney highlighted strength in its active apparel and big and tall apparel categories. Special-sized apparel showed strong results with its men’s big and tall apparel business up double digits for the quarter.

JCPenney reported it saw strong category performance for the quarter in areas including athletic and active apparel, special-sized apparel, baby apparel and gear, outerwear apparel and toys. Underperforming categories in the fourth quarter included big-ticket areas in home such as major appliances and furniture as well as women's accessories and handbags.

Management highlighted that its decision to discontinue selling major appliances and have furniture available only online will allow the company to better meet customer expectations and improve financial performance. These businesses represented only 2.7% of sales in 2018 and the company was significantly negative in operating profit for the business unit.

Geographically, the Midwest and Southwest were JCPenney’s stronger performing regions while the Southeast was the most challenged.

Outlook

The company plans to close 18 full-line stores in 2019. JCPenney will also close nine ancillary home and furniture stores in 2019. The stores identified for closure are minimally cash flow postive, or require significant capital. JCPenney reported that comparable sales for the stores it will close were significantly below comparable sales of the remaining stores. The company expects to be cash flow positive for fiscal year 2019.