DIpil Das

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

2Q19 Results

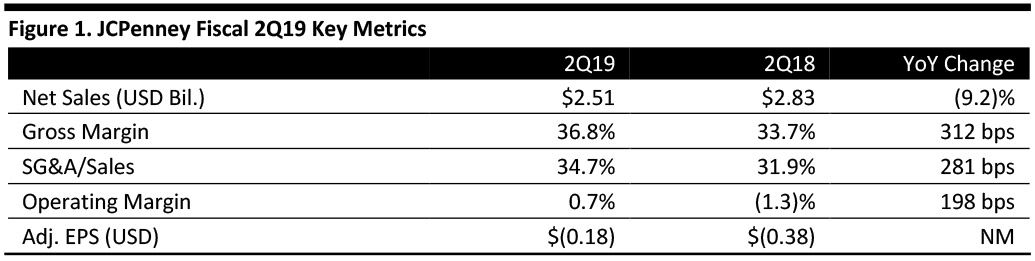

JCPenney reported fiscal 2Q19 net sales of $2.51 billion, lower than the consensus estimate of $2.64 billion, and down 9.2% year over year. Total revenues for 2Q19 including credit income was $2.62 billion compared to $2.83 billion in the year-ago quarter, down 7.4%. The company reported adjusted 2Q19 EPS excluding items of $(0.18) compared to $(0.38) one year earlier and higher than the consensus estimate of $(0.31).

Comparable sales decreased 9.0% for the quarter, compared to the consensus estimate of down 5.1%. JCPenney’s comparable sales decreased by 6.0% for the quarter with the exclusion of major appliances and in-store furniture categories.

Management noted improvements in the quarter in the following areas: (1) the company reduced inventory by 12.5% year over year; (2) increased in-store and online selling margins through the exit of the major appliance category; and (3) reduced permanent markdowns.

Management commented on tariffs and highlighted that the company has been proactive in developing contingencies for sourcing its private brands for nearly a decade and diversifying the country of origin, which has reduced its exposure to China. There is minimal impact on the company’s business resulting from the first three tariff tranches. The company continues to evaluate the details of the fourth tariff tranche and is working through a risk mitigation strategy.

The company announced a new partnership with ThredUP, the world's largest online consignment store. JCPenney will offer an in-store ThredUp experience featuring an assortment of resale women’s fashion and handbags in 30 stores with a 500- to 1,000-square-foot presentation in select markets. Management said that it is excited about the prospects of creating a new in-store experience that makes high-end brands attainable, as well as catering to eco-minded consumers who want more sustainable options in their wardrobe.

Management commented that it is working on aligning its merchandising and marketing strategies for the second half of 2019 to focus on back to school and holiday. For example, the company said it is strengthening looks in its most-wanted merchandise categories and seeks to drive a more dominant positioning of its national brand denim. In the fall, the company is also amplifying its women's brands.

JCPenney has created a test concept called the “styling room” for its in-store customers where the fitting rooms are enhanced with digital billboards and mannequins are positioned outside the fitting room area that display on-trend merchandise. Wall displays and fixtures suggest accessories and Sephora beauty products that help to complete the look. The company has selected its most passionate stylists to provide personalized service to the styling room. Management said that the initial customer response has been positive, with over 90% of customers responding that the styling room helped them to feel that shopping at JCPenney is a fun experience.

Outlook

The company reaffirmed its guidance to be cash flow positive for fiscal year 2019. The company expects comparable sales to in a range of (7.0)%-(8.0)%. The company expects comparable sales, excluding the impact of major appliances and in-store furniture categories, to be in the range of (5.0)%-(6.0)%.