DIpil Das

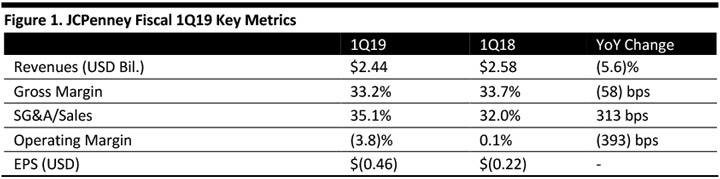

[caption id="attachment_88807" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

JCPenney reported fiscal 1Q19 revenues of $2.44 billion, lower than the consensus estimate of $2.48 billion, and down 5.6% year over year. The company reported 1Q19 EPS of $(0.46), lower than the consensus estimate of $(0.39).

Comparable sales decreased 5.5% for the quarter compared to the consensus estimate of (4.2)%. The comparable sales decline was primarily driven by a decrease in transactions partially offset by an increase in average transaction cost. Divisions that outperformed the total company comp for the quarter were fine jewelry, children's apparel, women's and men's apparel. The company said it had softer sales across the home, women's accessories and handbag categories.

SG&A expenses in the first quarter included approximately $40 million in one-time expense reductions related to the sale of the leasehold interest of its Paramus, New Jersey, store, as well as the reversal of previously accrued risk insurance reserves. Additionally, the company adopted new lease accounting standards which include home office lease expenses in SG&A expenses, which were $5 million in Q1.

The company reported its best-performing categories and brands in women's apparel included dresses, active, Liz Claiborne and a.n.a. Management said its fine jewelry business saw strength in categories such as modern bride, gold and fashion gems. The children's apparel business outperformed the company comp with strength in young boys, baby apparel and gear businesses. Men's apparel outpaced the company comp with strength in active, licensed and big and tall categories, and the company’s special-sized apparel showed strong results with men's big and tall apparel business up double digits in the quarter.

Management said it is continuing to enhance its inventory position. JCPenney reduced inventory 16% in the quarter, following a 13% reduction at the end of 2018. The company reported it liquidated nearly all its appliance, furniture and floor model inventory in Q1, following the decision to eliminate the categories. This cut total inventory approximately $83 million, or 2.8%, during the quarter.

As JCPenney previously announced, its 2019 plans include closing 18 full-line stores and nine ancillary home and furniture stores. During Q1, the company closed three full-line stores and expects to close the remaining 15 full-line stores and most ancillary home and furniture stores in the second quarter.

Management reported it is redesigning and improving store processes, including a new checkout to streamline tasks and enhance the customer experience. The company tested a new centralized pickup and returns area, with plans to expand this concept to 500 stores during the second quarter.

Outlook

The company expects to be cash flow positive for fiscal year 2019.

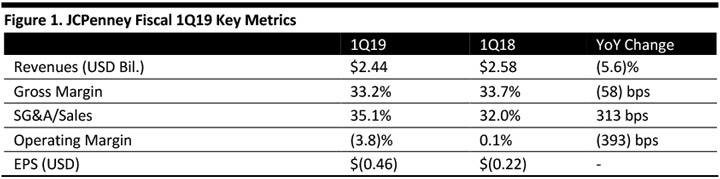

Source: Company reports/Coresight Research[/caption]

1Q19 Results

JCPenney reported fiscal 1Q19 revenues of $2.44 billion, lower than the consensus estimate of $2.48 billion, and down 5.6% year over year. The company reported 1Q19 EPS of $(0.46), lower than the consensus estimate of $(0.39).

Comparable sales decreased 5.5% for the quarter compared to the consensus estimate of (4.2)%. The comparable sales decline was primarily driven by a decrease in transactions partially offset by an increase in average transaction cost. Divisions that outperformed the total company comp for the quarter were fine jewelry, children's apparel, women's and men's apparel. The company said it had softer sales across the home, women's accessories and handbag categories.

SG&A expenses in the first quarter included approximately $40 million in one-time expense reductions related to the sale of the leasehold interest of its Paramus, New Jersey, store, as well as the reversal of previously accrued risk insurance reserves. Additionally, the company adopted new lease accounting standards which include home office lease expenses in SG&A expenses, which were $5 million in Q1.

The company reported its best-performing categories and brands in women's apparel included dresses, active, Liz Claiborne and a.n.a. Management said its fine jewelry business saw strength in categories such as modern bride, gold and fashion gems. The children's apparel business outperformed the company comp with strength in young boys, baby apparel and gear businesses. Men's apparel outpaced the company comp with strength in active, licensed and big and tall categories, and the company’s special-sized apparel showed strong results with men's big and tall apparel business up double digits in the quarter.

Management said it is continuing to enhance its inventory position. JCPenney reduced inventory 16% in the quarter, following a 13% reduction at the end of 2018. The company reported it liquidated nearly all its appliance, furniture and floor model inventory in Q1, following the decision to eliminate the categories. This cut total inventory approximately $83 million, or 2.8%, during the quarter.

As JCPenney previously announced, its 2019 plans include closing 18 full-line stores and nine ancillary home and furniture stores. During Q1, the company closed three full-line stores and expects to close the remaining 15 full-line stores and most ancillary home and furniture stores in the second quarter.

Management reported it is redesigning and improving store processes, including a new checkout to streamline tasks and enhance the customer experience. The company tested a new centralized pickup and returns area, with plans to expand this concept to 500 stores during the second quarter.

Outlook

The company expects to be cash flow positive for fiscal year 2019.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

JCPenney reported fiscal 1Q19 revenues of $2.44 billion, lower than the consensus estimate of $2.48 billion, and down 5.6% year over year. The company reported 1Q19 EPS of $(0.46), lower than the consensus estimate of $(0.39).

Comparable sales decreased 5.5% for the quarter compared to the consensus estimate of (4.2)%. The comparable sales decline was primarily driven by a decrease in transactions partially offset by an increase in average transaction cost. Divisions that outperformed the total company comp for the quarter were fine jewelry, children's apparel, women's and men's apparel. The company said it had softer sales across the home, women's accessories and handbag categories.

SG&A expenses in the first quarter included approximately $40 million in one-time expense reductions related to the sale of the leasehold interest of its Paramus, New Jersey, store, as well as the reversal of previously accrued risk insurance reserves. Additionally, the company adopted new lease accounting standards which include home office lease expenses in SG&A expenses, which were $5 million in Q1.

The company reported its best-performing categories and brands in women's apparel included dresses, active, Liz Claiborne and a.n.a. Management said its fine jewelry business saw strength in categories such as modern bride, gold and fashion gems. The children's apparel business outperformed the company comp with strength in young boys, baby apparel and gear businesses. Men's apparel outpaced the company comp with strength in active, licensed and big and tall categories, and the company’s special-sized apparel showed strong results with men's big and tall apparel business up double digits in the quarter.

Management said it is continuing to enhance its inventory position. JCPenney reduced inventory 16% in the quarter, following a 13% reduction at the end of 2018. The company reported it liquidated nearly all its appliance, furniture and floor model inventory in Q1, following the decision to eliminate the categories. This cut total inventory approximately $83 million, or 2.8%, during the quarter.

As JCPenney previously announced, its 2019 plans include closing 18 full-line stores and nine ancillary home and furniture stores. During Q1, the company closed three full-line stores and expects to close the remaining 15 full-line stores and most ancillary home and furniture stores in the second quarter.

Management reported it is redesigning and improving store processes, including a new checkout to streamline tasks and enhance the customer experience. The company tested a new centralized pickup and returns area, with plans to expand this concept to 500 stores during the second quarter.

Outlook

The company expects to be cash flow positive for fiscal year 2019.

Source: Company reports/Coresight Research[/caption]

1Q19 Results

JCPenney reported fiscal 1Q19 revenues of $2.44 billion, lower than the consensus estimate of $2.48 billion, and down 5.6% year over year. The company reported 1Q19 EPS of $(0.46), lower than the consensus estimate of $(0.39).

Comparable sales decreased 5.5% for the quarter compared to the consensus estimate of (4.2)%. The comparable sales decline was primarily driven by a decrease in transactions partially offset by an increase in average transaction cost. Divisions that outperformed the total company comp for the quarter were fine jewelry, children's apparel, women's and men's apparel. The company said it had softer sales across the home, women's accessories and handbag categories.

SG&A expenses in the first quarter included approximately $40 million in one-time expense reductions related to the sale of the leasehold interest of its Paramus, New Jersey, store, as well as the reversal of previously accrued risk insurance reserves. Additionally, the company adopted new lease accounting standards which include home office lease expenses in SG&A expenses, which were $5 million in Q1.

The company reported its best-performing categories and brands in women's apparel included dresses, active, Liz Claiborne and a.n.a. Management said its fine jewelry business saw strength in categories such as modern bride, gold and fashion gems. The children's apparel business outperformed the company comp with strength in young boys, baby apparel and gear businesses. Men's apparel outpaced the company comp with strength in active, licensed and big and tall categories, and the company’s special-sized apparel showed strong results with men's big and tall apparel business up double digits in the quarter.

Management said it is continuing to enhance its inventory position. JCPenney reduced inventory 16% in the quarter, following a 13% reduction at the end of 2018. The company reported it liquidated nearly all its appliance, furniture and floor model inventory in Q1, following the decision to eliminate the categories. This cut total inventory approximately $83 million, or 2.8%, during the quarter.

As JCPenney previously announced, its 2019 plans include closing 18 full-line stores and nine ancillary home and furniture stores. During Q1, the company closed three full-line stores and expects to close the remaining 15 full-line stores and most ancillary home and furniture stores in the second quarter.

Management reported it is redesigning and improving store processes, including a new checkout to streamline tasks and enhance the customer experience. The company tested a new centralized pickup and returns area, with plans to expand this concept to 500 stores during the second quarter.

Outlook

The company expects to be cash flow positive for fiscal year 2019.