Source: Company reports/Coresight Research

4Q17 Results

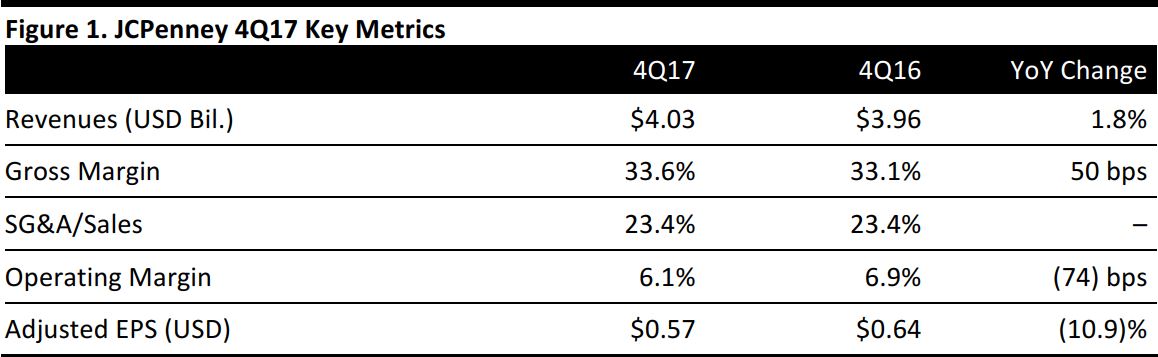

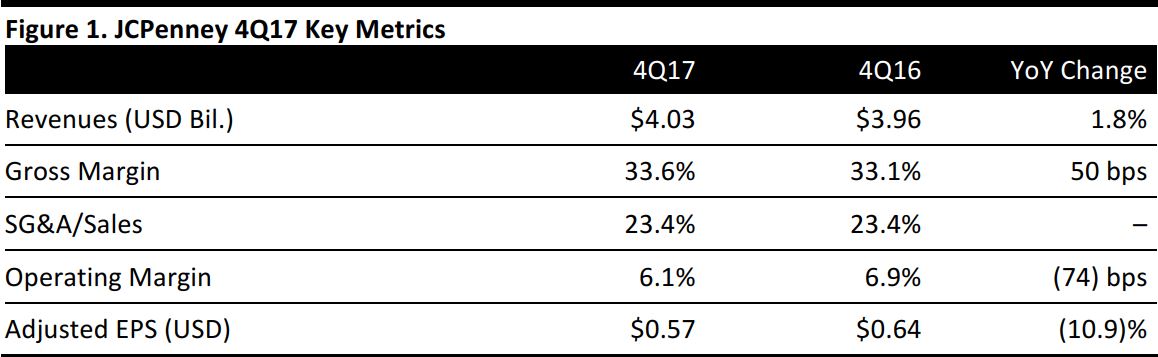

JCPenney reported 4Q17 revenues of $4.03 billion, up 1.8% year over year but below the $4.05 billion consensus estimate. Adjusted EPS was $0.57, beating the $0.47 consensus estimate and down from $0.64 in the year-ago quarter.

Comparable sales were up 2.6%, slightly below the consensus estimate of 2.7%. Comparable sales for the full year were up 0.1%. The comp improvement was led by increases in average unit retail and units per transaction and positive traffic trends.

Results by Category

Jewelry, home, Sephora, footwear, handbags, and salon were the company’s top-performing categories during the quarter.

- JCPenney reported that fine jewelry is a key component of its business strategy and that its jewelry business comped positively in every quarter in 2017. Jewelry comps rose by double digits in the fourth quarter.

- The company reported that its home refresh initiatives resulted in double-digit sales growth in the home division in every quarter in 2017, and the company expects the momentum to continue into 2018. More than70% of JCPenney customers are homeowners, and the company has targeted more than 300 malls as marketing opportunities to merchandise appliances, mattresses, furniture, and home installs.

- JCPenney opened 70 new Sephora locations in 2017 and currently operates 641 Sephora outlets inside JCPenney stores, meaning that Sephora shops are in nearly 75% of stores. JCPenney plans to open approximately 30 Sephora locations in 2018.

- The company announced that the launch of new categories for the holiday season, including toys, TVs and other giftable items, was successful.

- The company plans to focus on enhancing its women’s apparel offering to better align with customer preferences, particularly in activewear, dresses, contemporary and casual sportswear.

Geographically, the Gulf Coast and Southeast were the company’s best-performing regions in the quarter, while the West Coast was the most challenging region.

Store closures: JCPenney closed 141 stores in FY17, most of which were closed (or were in the process of closing) late in the second quarter. The company currently operates 875 stores.In2Q18, the company expects to close approximately seven more stores.

The combination of the sales generated from the 53rd week in 2017 and the store closures in 2Q17 will have a significant impact on total net sales in FY18. The company expects that total net sales will fall by approximately 430 basis points year over year in FY18 and by approximately 560 basis points in 1Q18.

FY17 Results

Total net sales decreased by 0.3% year over year, from $12.55 billion in FY16 to $12.51 billion in FY17. The decline was due to store closures in FY17 and was partially offset by incremental sales inthe 53rdweek.

Outlook

JCPenney guided for FY18 same-store sales growth of 0.0%–2.0%, compared with the consensus estimate of 0.7%. The company expects adjusted EPS of $0.05–$0.25, compared with the consensus estimate of $0.20.