Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

4Q16 Results

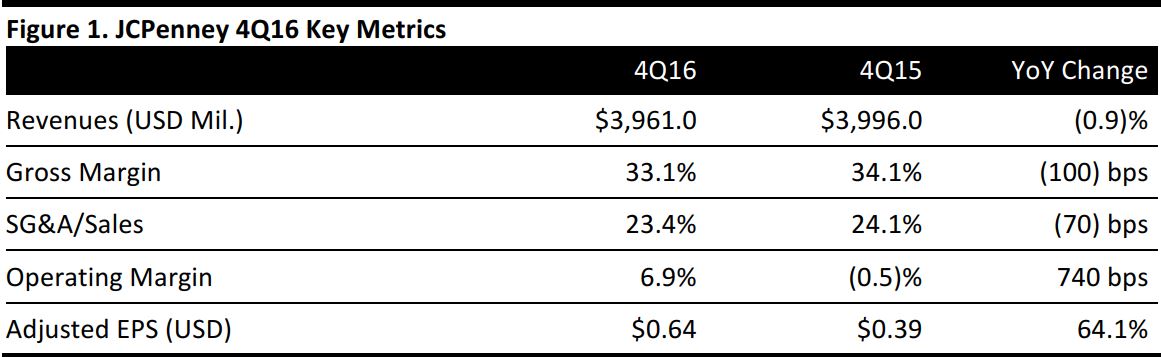

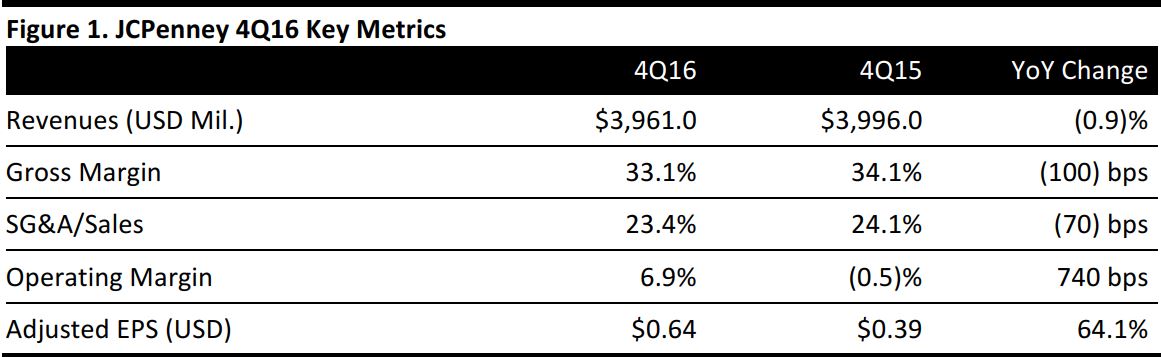

JCPenney reported 4Q16 adjusted EPS of $0.64, beating the consensus estimate of $0.61. Reported 4Q16 revenues were $4.0 billion, down 0.9% from the year-ago period. Total comps were down 0.7% versus the consensus estimate of a 0.5% decline.

December was the best-performing month in the quarter and the company delivered low-single-digit comps for the combined December and January period.

Gross margin was 33.1%, down from 34.1% in the year-ago quarter and missing consensus of 34.1%. This was primarily due to increased promotions and accelerated growth in online and appliance sales. Home, Sephora, salon and fine jewelry were the top-performing categories. The Southeast and Pacific regions were the best-performing regions of the country. Comps for apparel categories and men’s, kids’ and women’s were all below the company comp for the quarter.

JCPenney announced store closure plans that include closing two distribution centers and 130–140 stores over the next few months. The total store closures represent about 13%–14% of the company’s store portfolio and less than 5% of total sales. The company will focus on growing beauty, home and special sizes at existing stores. Management believes that this strategy will enable it to effectively compete with online retailers. The annual cost savings from store operations are estimated to be $200 million. The company expects to record $225 million in charges during the first half of 2017.

FY17 Outlook

With the announced store closure plans, JCPenney now expects adjusted EPS of $0.40–$0.65 for FY17. Comps are expected to be (1)%–1%. Gross margin is expected to be up 20–40 basis points versus 2016.

The company plans to expand its online offerings and to increase its number of online SKUs by more than 140% in 1Q17, on top of 40% SKU growth in 4Q16. With expanded partnerships with activewear retailers such as Nike and Adidas, JCPenney expects to see improvement in the activewear category and some lift in sales in women’s apparel. For the overall women’s apparel category, the company will work on simplifying the floor and achieving a better balance between casual and professional wear.

Regarding supply chain initiatives, the company expects its speed-to-market time will be reduced by 40% for some trend-driven private label brands.

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology