Source: Company reports/FGRT

3Q17 RESULTS

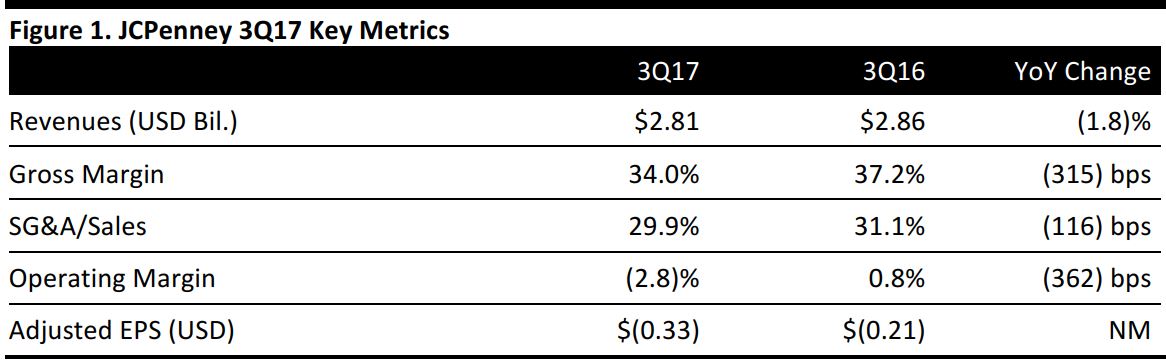

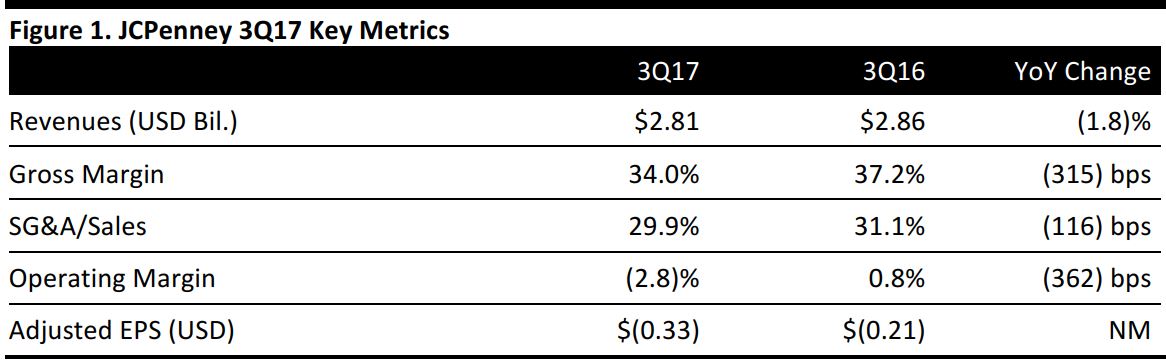

JCPenney reported 3Q17 revenues of $2.81 billion, down 1.8% year over year but beating the $2.76 billion consensus estimate.

Comps increased by 1.7%, beating guidance of 0.6%–0.8%. The company experienced a sequential comp sales improvement in nearly all merchandise categories.

Home, Sephora, footwear and handbags, women’s specialty, and salon were the best-performing divisions in the quarter. Geographically, the Gulf Coast and Midwest were the best-performing regions.

A decrease in gross margin was attributed to the liquidation of slow-moving inventory, higher shrinkage rates, and continued growth in the online and major appliance businesses.

A decrease in SG&A expense as a percentage of sales was attributed to reductions in store controllable costs, marketing efficiencies and corporate overhead.

Adjusted EPS was $(0.33), beating the $(0.41) consensus estimate but down from $(0.21) in the year-ago quarter.

Management commented that it took aggressive actions to clear slow-moving inventory in the quarter in order to create an improved apparel assortment ahead of the holiday season.

APPAREL

Footwear and handbags had higher comps than the corporate average, and fine jewelry and women’s specialty also generated positive comps in the quarter.

APPLIANCES

The appliances business more than doubled year over year and a plant showroom that opened in 2016 delivered 30% comp growth in the quarter. The company believes it is gaining market share in appliances.

BEAUTY

Management remains pleased with its ongoing partnership with Sephora and characterized the results from the launch of Fenty Beauty by Rihanna as outstanding, saying that additional items will be added for the holiday season. Sephora delivered strong positive comps, and the company opened a total of 38 Sephora locations in the quarter, bringing the total to 70 new openings this year.

SALON

The salon business was characterized as outstanding, and the company continues to invest to rebrand existing salons as The Salon by InStyle. JCPenney remains committed to making improvements in technology and modernizing its salon business.

OUTLOOK

The company reaffirmed its guidance for 2017 (which was updated on October 27). The company expects:

- Comparable store sales growth of (1)%–0%.

- Cost of goods sold to increase by 100–120 basis points versus 2016.

- SG&A dollars to decline by 1%–2% versus 2016.

- Adjusted EPS of $0.02–$0.08.