Source: Company reports/Fung Global Retail & Technology

3Q16 RESULTS

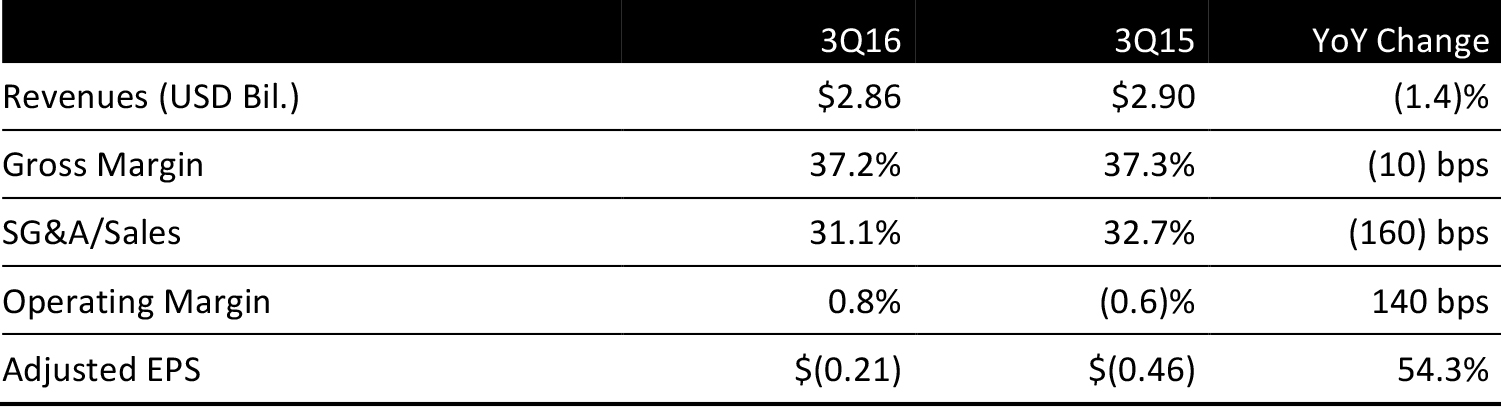

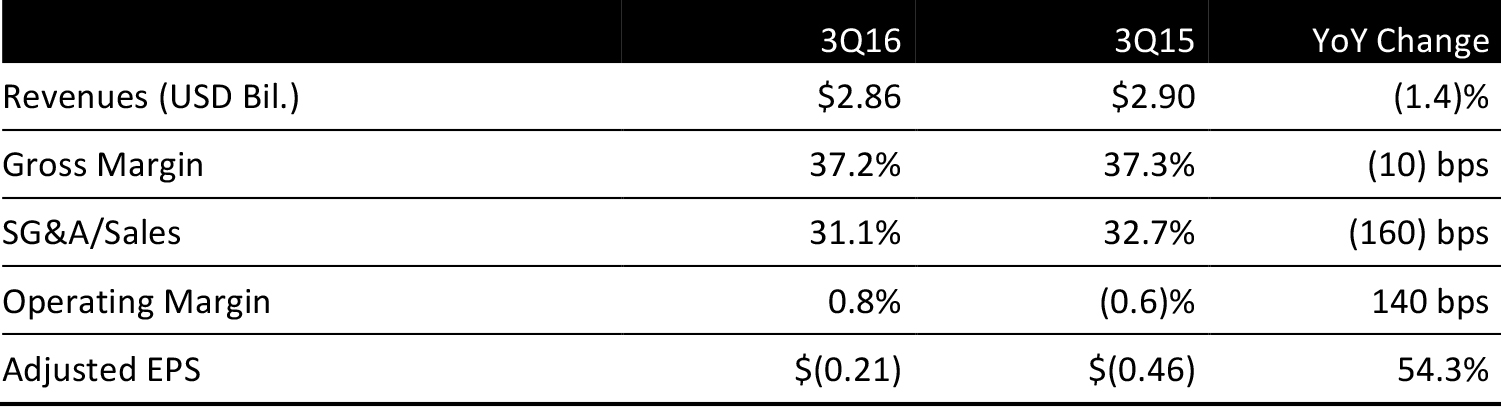

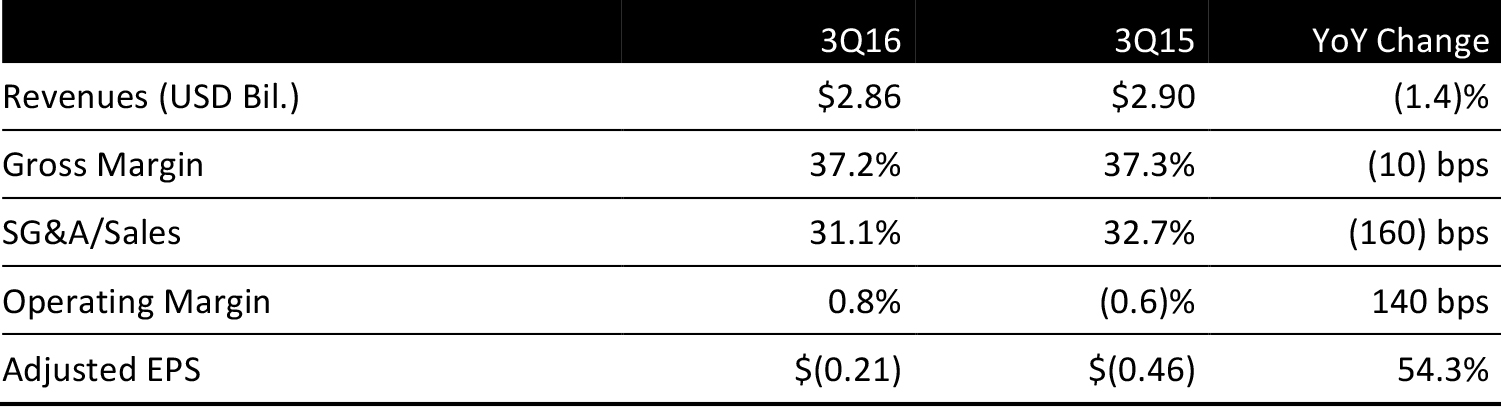

JCPenney reported 3Q16 adjusted EPS of $(0.21), in line with the consensus estimate.

Total revenues were $2.86 billion, below expectations of $2.95 billion. Comparable-store sales were down 0.8% versus expectations of a 2.2% increase. Comps were positive in October, driven by a comp benefit of more than 20 basis points from the company’s 500 new appliance showrooms. That said, apparel sales were soft. All apparel categories, including men’s, kids’ and women’s, performed below the total company comp, with men’s apparel posting the best performance. In women’s apparel, sales were soft in the contemporary, juniors and misses categories, but were strong in moderate dresses and junior bottoms.

Sephora, home, salon and fine jewelry were the top-performing divisions. Geographically, the Pacific and Northwest were the best-performing regions.

2016 OUTLOOK

Management lowered its guidance for the full year. Comps are now expected to increase by 1%–2%, down from 3%–4% previously, versus consensus of 2.2%. Gross margins are now expected to be flat, versus prior expectations of an increase of 10– 30 basis points.

Management maintained its SG&A guidance; SG&A dollars are expected to decline year over year. EBITDA guidance was also unchanged, and is expected to be $1 billion. Full-year EPS is expected to be positive. Free cash flow is also expected to improve versus 2015.