Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

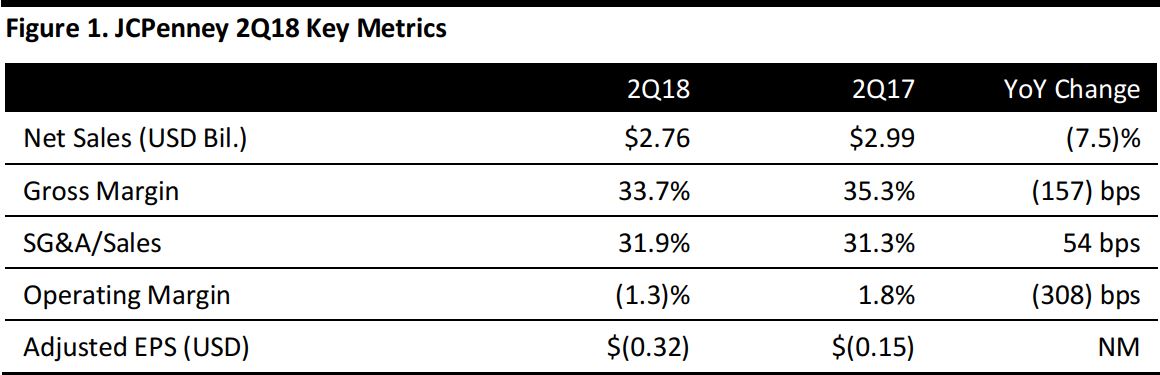

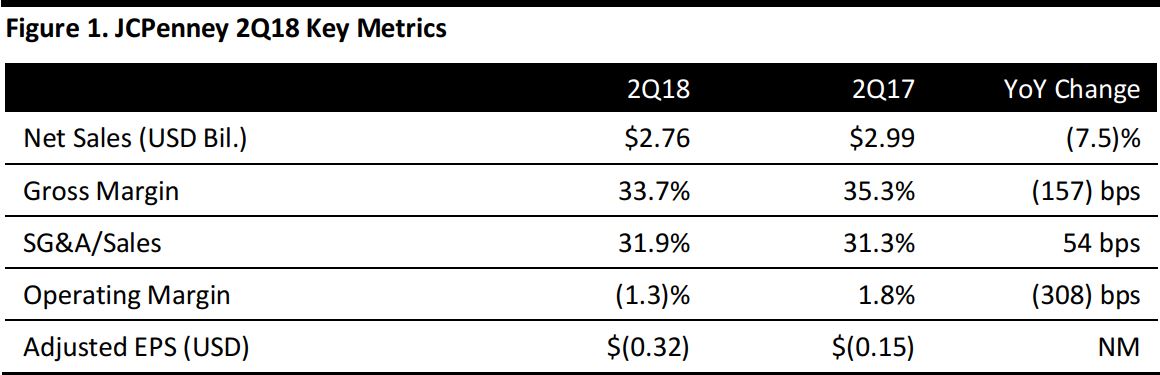

2Q18 Results

JCPenney reported 2Q18 net sales of $2.76 billion, down 7.5% year over year and below the $2.81 billion consensus estimate. Adjusted EPS was $(0.32), down from $(0.15) from the year-ago quarter and below the $(0.05) consensus estimate. The company stated that the closure of 141 stores in FY17 was the main reason for the net sales decline in 2Q18.

Comparable sales were up 0.2% for the period. In terms of divisions and categories that outperformed the total company comp for the quarter, the women’s apparel, children’s, jewelry, Sephora and salon. Divisions that underperformed included home, women’s accessories, shoes and handbags.

Geographically, the Gulf Coast, Southeast and Northwest were the strongest-performing regions during the period.

Inventory at the end of the quarter was $2.82 billion, an increase of 0.1% from the year-ago quarter, and up 1% on a comp store basis. According to management, to clear excess inventory, the company had to heavily discount merchandise which drove wider-than expected losses in the quarter.

Management noted that hiring a new CEO remains a top priority and that the board has met with several candidates. The company said it has drifted away from its core customer (female in the age range of 45 to 55-plus) while chasing the younger, millennial buyer.

Outlook

The company lowered its full-year guidance and now expects adjusted EPS of $(1.00)–$(0.80), from previous guidance of $(0.07)–$0.13 and the $0.04 consensus estimate. Comps are now expected to be flat, versus previous guidance for growth of 0.0%–2.0%

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research