Source: Company reports/FGRT

2Q17 Results

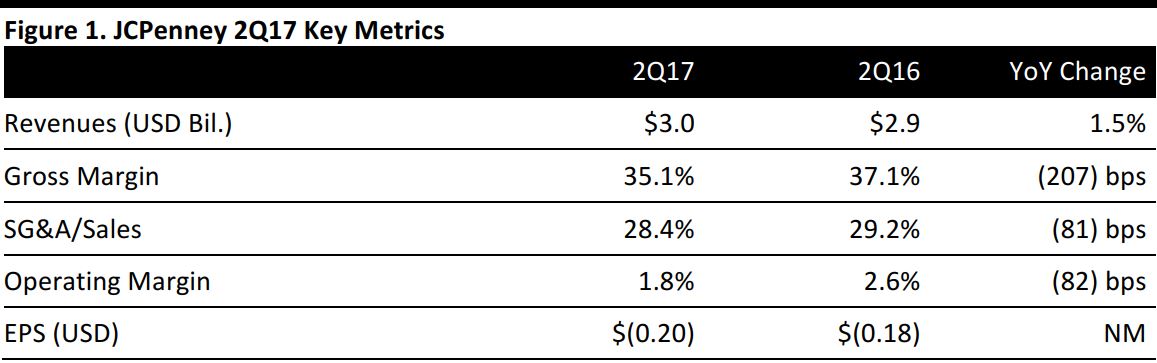

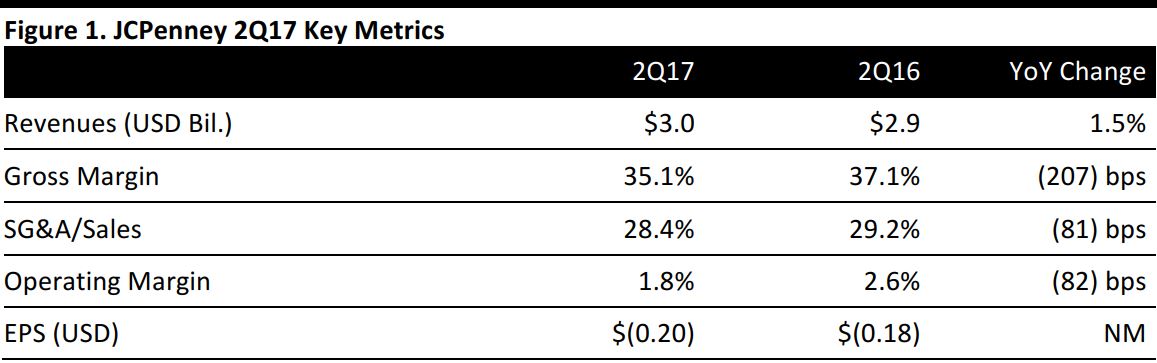

JCPenney reported 2Q17 revenues of $2.96 billion, up 1.5% year over year and beating the $2.84 billion consensus estimate.

EPS was $(0.20), missing the $(0.04) consensus estimate and down from $(0.18) in the year-ago quarter.

Comps declined by 1.3% in the quarter, but increased by 220 basis points sequentially. During the quarter, the company liquidated inventory in 127 closing stores, which had a negative impact on gross margin and EPS.

Apparel

Nearly all businesses experienced sales growth from the first quarter to the second quarter. Growth initiatives such as home and beauty, which include fine jewelry, salon and Sephora, delivered positive sales growth in the quarter. Shoes and handbags also delivered positive comps.

Although apparel in total delivered better comps, the category still underperformed corporate comps. While kids’ was the toughest segment in the first quarter, comps improved by 700 basis points in the second quarter. In addition, special sizes for women, kids and men experienced a 700-basis-point improvement in comps.

Appliances

Following the launch of 100 new appliance showrooms in May and the Memorial Day and Independence Day events, JCPenney saw nearly 300 basis points of improvement in comps in the quarter.

Beauty

The company remains pleased with its partnership with Sephora and opened 32 new Sephora locations in the quarter. JCPenney also expanded 31 existing Sephora locations, enabling it to enhance its product offering and experience in the most productive locations.

Salons

The salon business was characterized as “outstanding” in the quarter, and the company’s continued investment in rebranding should drive positive results starting in the second half of 2017.

Outlook

JCPenney offered the following reaffirmed/adjusted guidance for 2017:

- Comparable store sales growth of (1)%–1%

- Cost of goods sold: now up 30–50 basis points versus 2016 (versus up 20–40 basis points previously)

- SG&A dollars: down 1%–2% versus 2016

- Adjusted EPS: $0.40–$0.65