Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

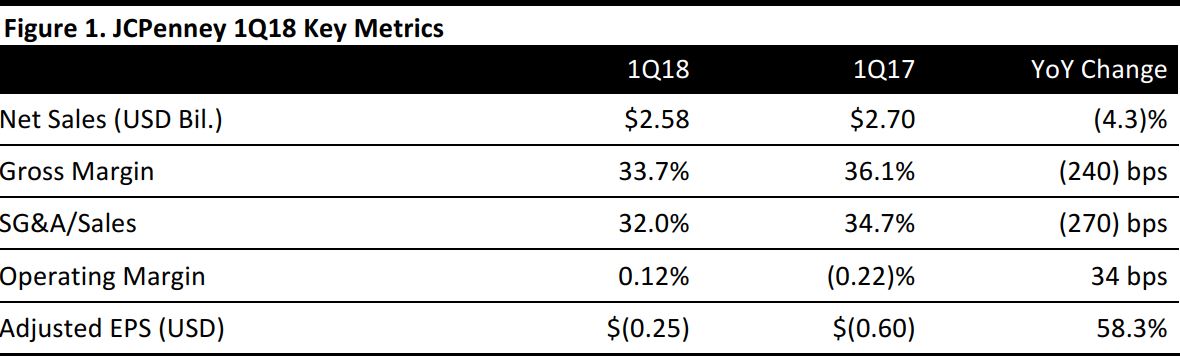

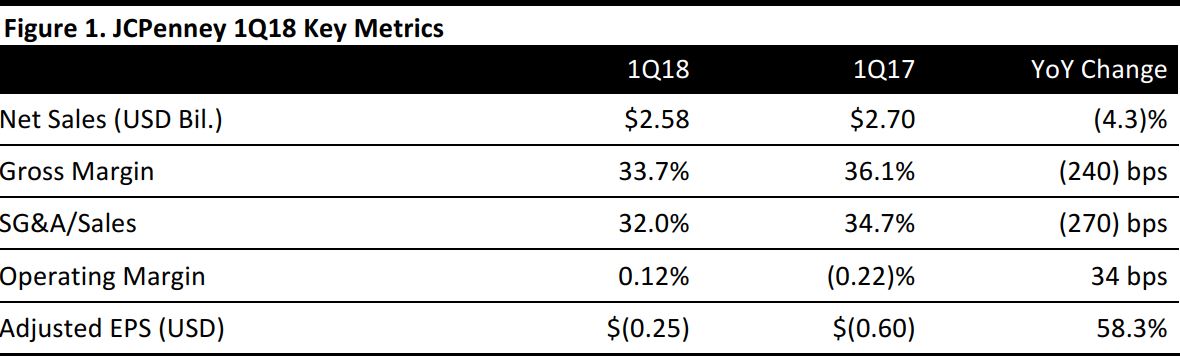

1Q18 Results

JCPenney reported 1Q18 net sales of $2.58 billion, down 4.3% year over year and below the $2.62 billion consensus estimate. Adjusted EPS was $(0.25), versus the $(0.24) consensus estimate and up from $(0.60) in the year-ago quarter. The company stated that the closure of 141 stores in FY17 was the main reason for the net sales decline in 1Q18.

Comparable sales were up 0.2% for the period. Management pointed to unseasonal weather as a key factor that negatively impacted quarterly comps.

In terms of divisions and categories, the jewelry, Sephora, men’s and salon businesses performed best in 1Q18. Geographically, the Gulf Coast and Southeast were the strongest-performing regions during the period.

Outlook

JCPenney revised its full-year guidance. The company now expects comp growth of 0.0%–2.0% and adjusted EPS of $(0.07)–$0.13, compared with the consensus estimate of $0.17.

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research