Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology

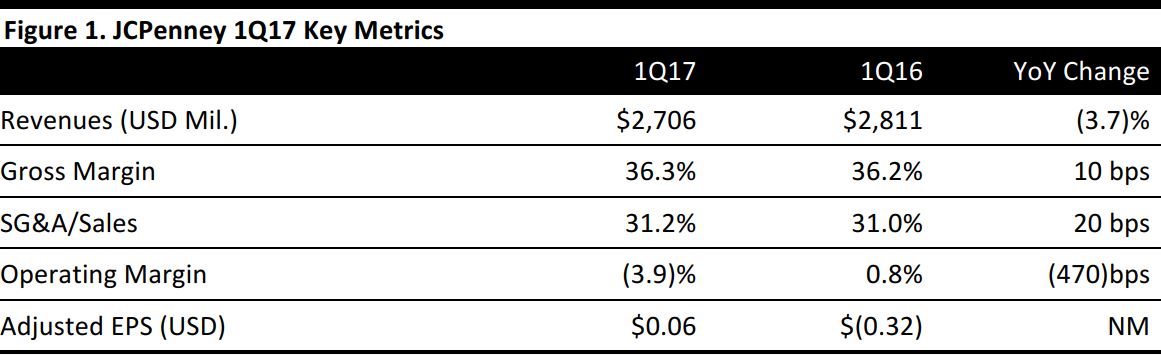

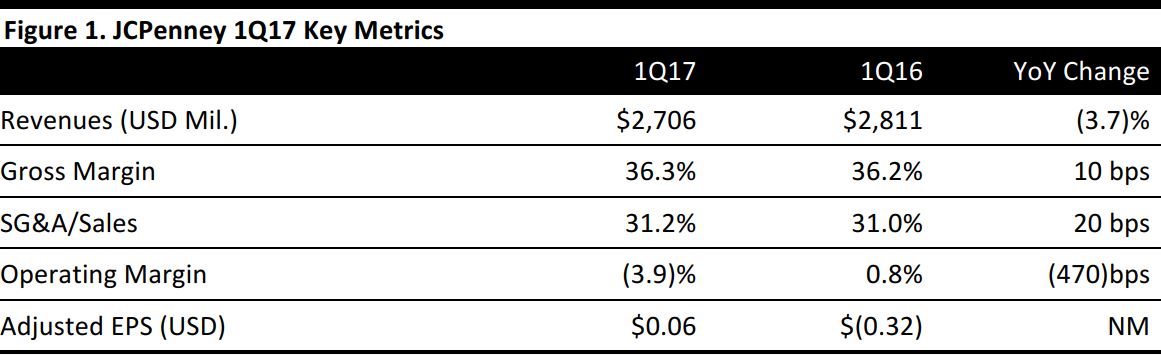

1Q17 Results

JCPenney reported 1Q17 adjusted EPS of $0.06 versus the consensus estimate of $(0.21).

Total revenues decreased by 3.7%, to $2.7 billion from $2.8 billion in the year-ago quarter. Comps were down 3.5% versus consensus of (0.6)%. Comps improved in March and April by 600 basis points compared with a “very challenging” February, according to the company. Management also noted an improvement in trends in the women’s apparel category, particularly in active apparel and dresses. The home, Sephora, fine jewelry and salon businesses all comped positively. The Southwest and Southeast were the best-performing regions in the quarter.

The company continues to focus on its growth initiatives, which include Sephora stores inside JCPenney and major appliances.

FY17 Outlook

Management reiterated its prior guidance for the full year. The company expects adjusted EPS of $0.40–$0.65 versus the consensus estimate of $0.65. The company expects full-year comps of (1)%–1%, a gross margin increase of 20–40 basis points and SG&A to be down 1%–2% on a dollar basis versus FY16.

Source: Company reports/Fung Global Retail & Technology

Source: Company reports/Fung Global Retail & Technology