Source: Company reports/Coresight Research

Fiscal 3Q18 Results

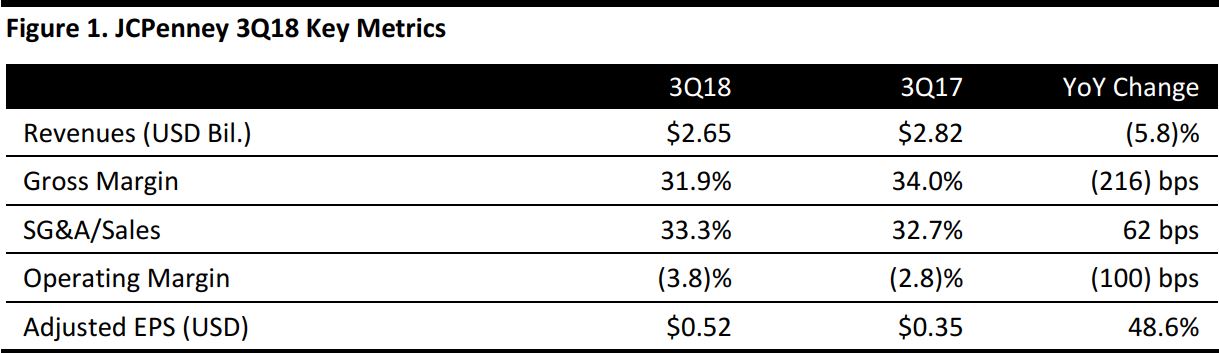

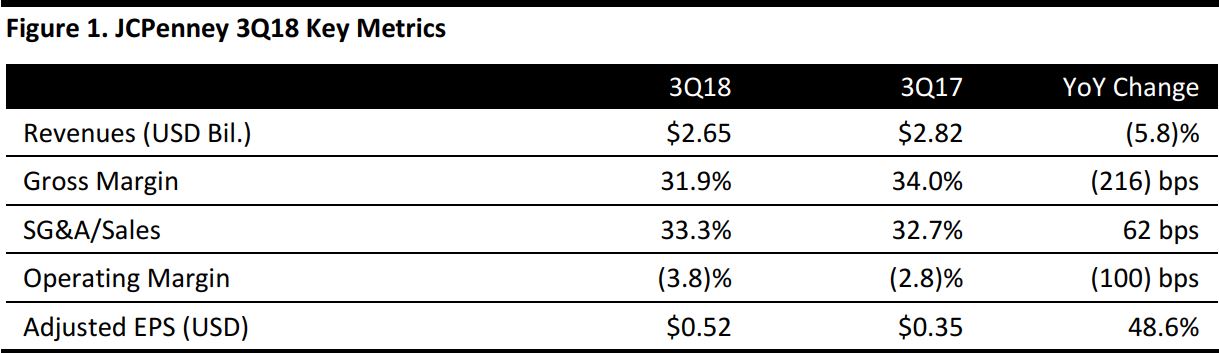

JCPenney reported 3Q18 revenues of $2.65 billion, down 5.8% year over year and below the consensus estimate of $2.76 billion. Adjusted EPS was $0.52 up 48.6% from the year ago quarter, below the consensus estimate of $0.56 but above last year’s EPS of $0.35. The company reported that the decrease in gross margin was primarily the result of the decision to liquidate slow-moving and aging inventory during the quarter.

The company’s comparable sales were down 5.4% for the third quarter. The company reported that divisions in categories that performed well include Jewelry, Women’s Apparel, and Men’s. Within Women’s Apparel, the categories that comped positive include dresses and active wear and cold-weather accessories. Brands that comped positive include Liz Claiborne and Worthington.

Men’s apparel also outpaced company comps with strength in the Big & Tall business, active and seasonal categories. The company reported that its Big & Tall business was up nearly 15% this quarter compared to last quarter. Customers are reacting positively to its partnership with basketball star Shaquille O’Neal with a curated selection of men’s clothing and furnishings designed with the big and tall customer in mind. The Shaquille O’Neal XLG collection was rolled out to 350 of JCPenney’s stores and jcpenney.com in 2018.

The company reported it is focusing on the holiday, and has added 40% more toys to its assortment.

Outlook

Management noted that given the recently announced CEO and interim CFO, the company will withdraw its previous 2018 full-year earnings guidance and update its full year comparable store sales guidance. FY18 comps are expected to be down low-single digits and the company continues to expect to achieve positive free cash flow for the year.