DIpil Das

China Retail Sales: January and February 2022

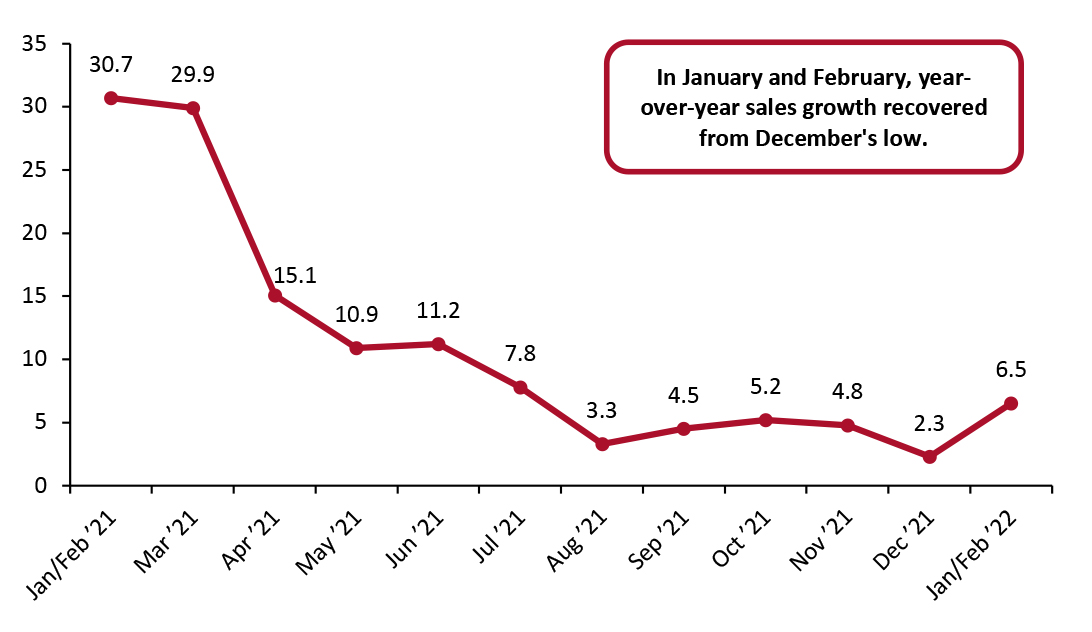

In January and February, China’s total retail sales growth (ex. food service, incl. automobiles and gasoline) increased by 6.5% year-over-year against a strong comparative period in 2021, with China witnessing a 30.7% increase in retail sales in January and February 2021. The latest data give us the first official national retail figures for the Chinese New Year period (the national holiday lasted from January 31 to February 6, 2022). We previously discussed the support to retail from elevated travel trends, year over year, and the Olympics, including in winter sports. However, any boost to sales from these factors is likely to be concealing soft underlying retail demand in China, evidence by weak retail sales expansion in prior months. Zero-Covid enforcement is likely to remain a cloud over the retail sector, and we do not see a compelling reason for the New Year to have marked a shift in trajectory for Chinese retail. Lockdowns will negatively impact March 2022 retail sales. We anticipate that retail sales will grow by low-to-mid single digits, on average, in the coming months, or more weakly should lockdowns become more widespread.Figure 1. Total China Retail Sales (ex. Food Service; incl. Automobiles and Gasoline): YoY % Change [caption id="attachment_143757" align="aligncenter" width="700"]

January and February figures are reported together

January and February figures are reported together Source: National Bureau of Statistics/Coresight Research [/caption] Retail Sales Growth by Sector All sectors except furniture saw positive year-over-year growth in January and February, ranging from 3.9% to 19.5%.

- Gold, silver and jewelryretailers saw the highest year-over-year sales growth among all sectors, with an increase of 19.5%. Compared to 2020, gold, silver and jewelry sales are up 130.5%.

- Alcohol and tobacco sector saw sales growth of 13.6% year over year, the second-strongest growth rate among all sectors. On a two-year basis sales increased by 68.6%.

- School, office supplies and computers specialists’ sales continue strong sales growth momentum in 2022. In January and February, school, office supplies and computer specialists’ saw sales growth of 11.1% compared to January and February 2021. Compared to 2020, school, office supplies and computer sales are up by 49.9%.

- In January and February, the apparel and footwear sector posted positive sales growth after five consecutive months of sales declines. The apparel and footwear category posted 4.8% sales growth compared to January and February 2021. On a two-year basis apparel and footwear sales increased by 55.3%.

- Auto retailers’ sales posted positive sales growth after six consecutive months of sales decline. Auto sales increased by 3.9% compared to January and February 2021. On a two-year basis, auto sales are up 94.9%

- Furniture specialists’ sales continue to decline in January and February but accelerated from sales declines in December 2021. Furniture sales declined by 6.0% in January and February compared to December’s 9.3% sales decline. However, on a two-year basis, sales increased by 52.1%.

- The food sector showed continued strong performance in January and February, exhibiting 7.9% year-over-year growth. On a two-year basis, food retail sales increased by 19.8%. Furthermore, beverage sales grew 11.4% from January and February 2021 and notably grew 56.0% when compared to 2020.

- The beauty sector continued to see gains in January and February, with sales growth accelerating to strong 7.0% growth compared to January and February 2021. On a two-year basis, beauty sales grew 59.6%.

- Construction and decoration sales increased in January and February after seeing a decline in December 2021. Compared to January and February 2021, construction and decoration sales increased by 6.2%. On a two-year basis, sales increased by 61.0%.

- Communication equipment retailers’ sales increased by 4.8% year-over-year. On a two-year basis, sales increased by 65.0%.

Figure 2. China Retail Sales (ex. Food Service; incl. Gasoline and Automobiles), by Sector: YoY% Change and Two-Year % Change [wpdatatable id=1832]

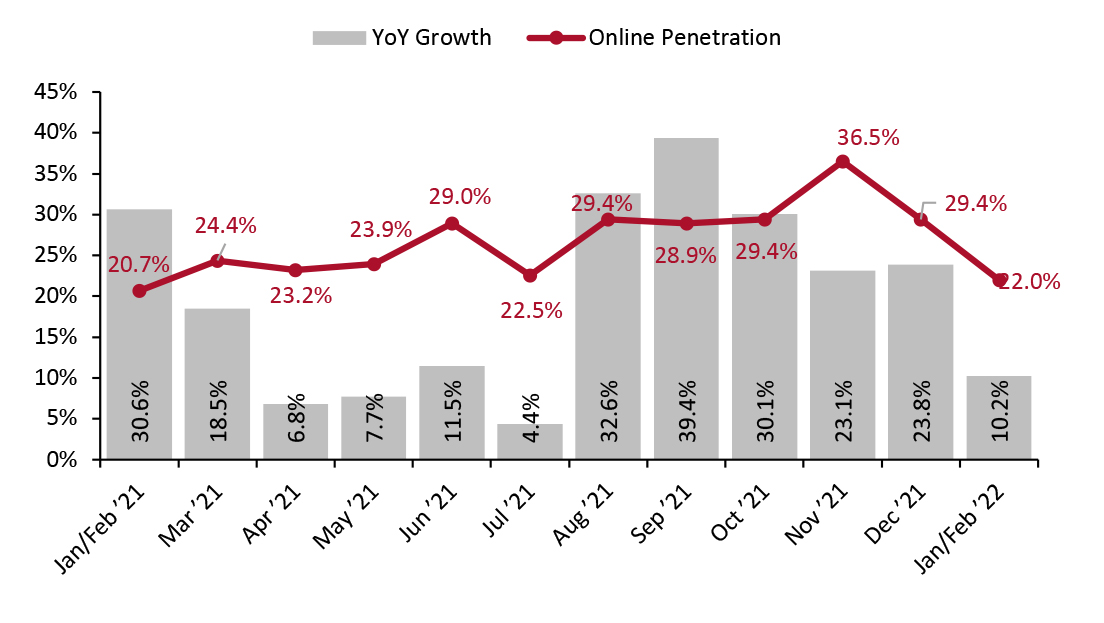

The sector breakdown is based on surveys from enterprises with annual sales of ¥5 million (around $730,000) and above Source: National Bureau of Statistics Online Retail Sales Account for 22.0% of All Retail Sales In January and February, online retail sales in China significantly decelerated year over year from December 2021 but growth remained positive at 10.2%. The channel accounted for 22.0% of total retail sales in the period, a decline from 29.4% in December and 36.5% in November. Online penetration in January and February decelerated possibly due to the increase in the number of passenger trips during the seven-day Chinese New Year holiday and duty-free shopping in Hainan. The penetration rate is likely to rise for March given recent regional lockdowns.

Figure 3. Online Retail Sales (YoY % Change) as a Proportion of Total Retail Sales (%) (incl. Automobiles, Gas and Food Service) [caption id="attachment_143758" align="aligncenter" width="700"]

Online retail sales include food service

Online retail sales include food service January and February figures are reported together

Source: National Bureau of Statistics [/caption]