DIpil Das

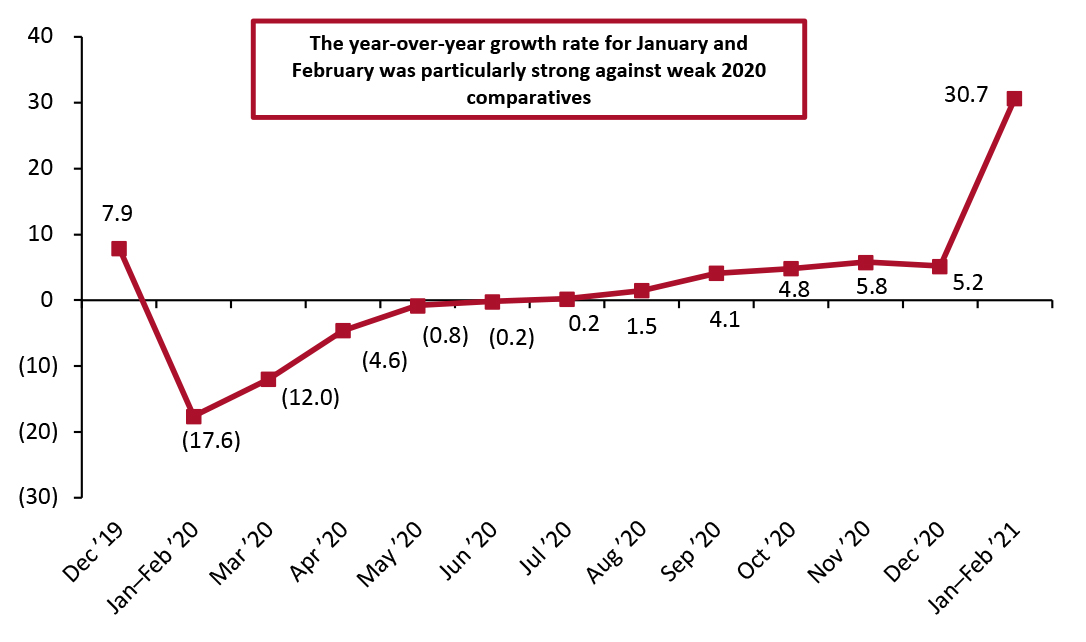

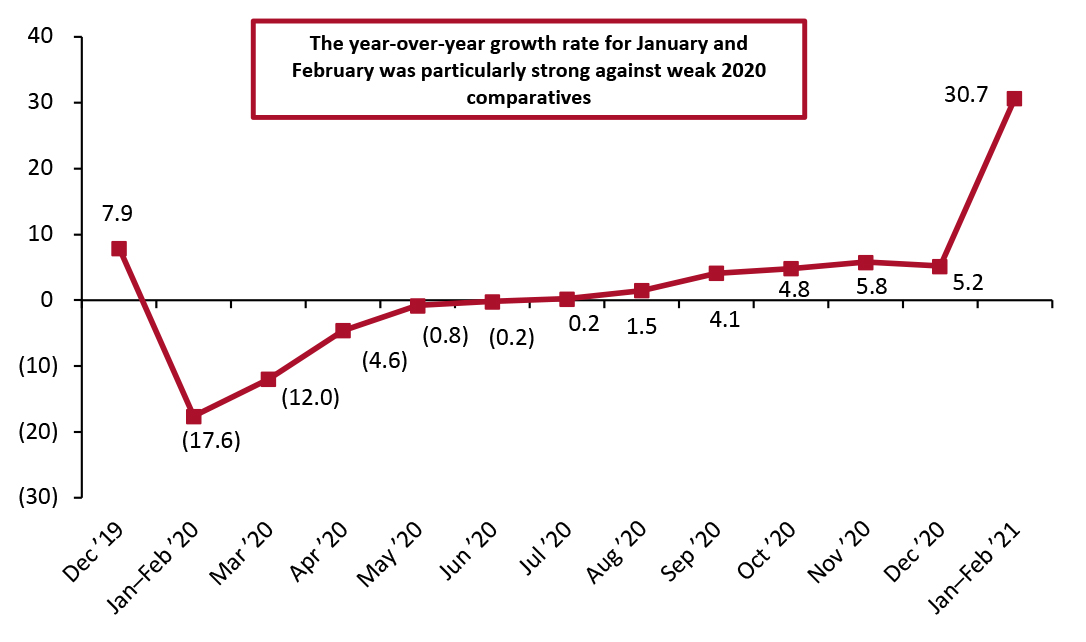

In January and February, China’s total retail sales (ex. food service, incl. automobiles and gasoline) jumped 30.7% year over year, reaching ¥6.3 trillion ($969.1 million). The significant year-over-year growth rate is partly because the country was suffering heavily from the outbreak of Covid-19 in the comparative period in 2020, with China witnessing a 17.6% decrease in retail sales in January and February 2020.

We calculate a 6.5% growth rate for retail sales in January and February 2021 compared to the same period in 2019, prior to the impacts of Covid-19. This illustrates that while the impact of the pandemic persists this year, retail sales are growing compared to pre-pandemic levels.

Figure 1 shows the recovery trajectory of total retail sales in China. We expect retail sales to continue to see impressive year-over-year growth in the coming months against weak 2020 comparatives.

Figure 1. Total China Retail Sales (ex. Food Service; incl. Automobiles and Gasoline): YoY % Change [caption id="attachment_124605" align="aligncenter" width="725"] January and February figures reported together

January and February figures reported together

Source: National Bureau of Statistics/Coresight Research [/caption] Retail Sales Growth by Sector All sectors saw positive year-over-year sales growth in January and February, ranging from 11% to nearly 100%:

Figure 2. China Retail Sales (ex. Food Service; incl. Gasoline and Automobiles), by Sector: YoY % Change [wpdatatable id=803 table_view=regular]

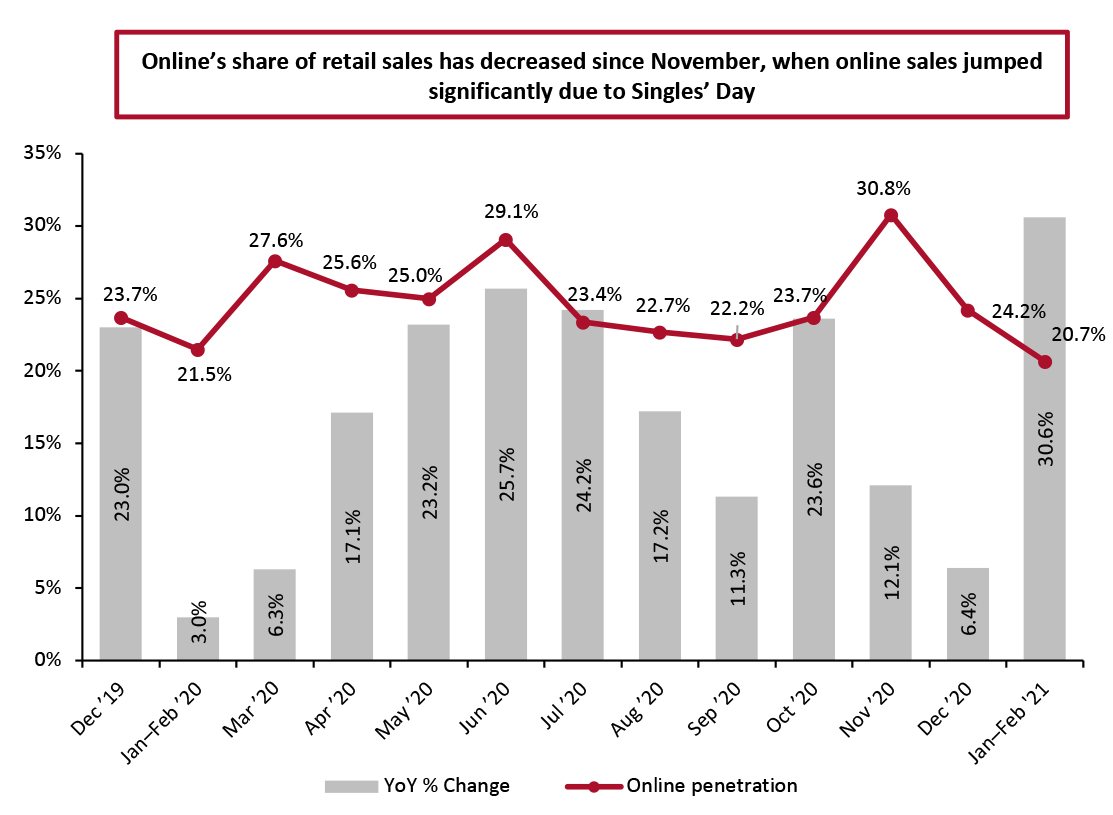

The sector breakdown is based on surveys from enterprises above a designated size, which refers to those with annual sales of ¥5 million (around $730,000) and above. Source: National Bureau of Statistics Online Retail Sales Account for 20.7% of Total Retail Sales In January and February, online retail sales growth in China reached 30.6% year over year. The channel accounted for 20.7% of total retail sales in the period, a decline from 24.2% in December and 30.8% in November. Online retail sales include food service as the National Bureau of Statistics does not provide online data that excludes food service. In Figure 3, online sales are benchmarked to total retail sales.

Figure 3. Online Retail Sales as % of Total Retail Sales (incl. Automobiles, Gas and Food Service) [caption id="attachment_124606" align="aligncenter" width="725"] Online retail sales include food service

Online retail sales include food service

Source: National Bureau of Statistics [/caption]

Figure 1. Total China Retail Sales (ex. Food Service; incl. Automobiles and Gasoline): YoY % Change [caption id="attachment_124605" align="aligncenter" width="725"]

January and February figures reported together

January and February figures reported together Source: National Bureau of Statistics/Coresight Research [/caption] Retail Sales Growth by Sector All sectors saw positive year-over-year sales growth in January and February, ranging from 11% to nearly 100%:

- Gold, silver and jewelry retailers saw the largest year-over-year sales growth, with a jump of 98.7%. These retailers suffered significantly at the height of the Covid-19 outbreak in China in the same period of 2020, witnessing a 41.1% year-over-year decrease, which provides a weak comparison for 2021 growth. Sales of gold, silver and jewelry items also saw impressive growth over the Chinese New Year holiday this year, which ran from February 11 to 17 and coincided with Valentine’s Day on February 14. During the holiday period, “certain closely monitored enterprises nationwide” saw 160.8% year-over-year sales growth.

- Sales by automobile retailers grew 77.6% year over year—the second-strongest growth rate—indicating the continued impact of new policies from the Chinese government from late 2020 regarding the development of the automobile industry. It is also worthwhile to note that automobile retailers suffered the second-largest year-over-year growth declines in January and February 2020, with a decrease of 37.0%.

- Sales by furniture retailers grew 58.7% year over year. This growth is propped up by 33.5% declines witnessed in January and February last year by these retailers. However, unlike the two above mentioned sectors, sales by furniture retailers are still lower than the same period in 2019, with a 13.2% decrease compared to pre-Covid levels.

- Retailers of communication equipment, such as mobile phones, saw 53.1% year-over-year growth in January and February, following on from significant growth of 43.6% in November and 21.0% in December. According to data published in March 2021 by China’s National Bureau of Statistics, the average sales growth rate for communication equipment items in 2019 and 2020 reached more than 18%.

- The construction and decoration material sector saw strong growth of 52.8% in January and February. Similarly to sales by furniture retailers, sales in the construction and decoration material sector are still below the pre-Covid level, representing a 16.3% decline compared with 2019.

- The apparel and footwear sector grew 47.6% year over year in January and February. The sector saw a huge year-over-year decline of 30.9% in the same period of 2020.

- Beauty retailers saw 40.7% year-over-year growth in January and February. Compared to the same period of 2019, sales by beauty retailers saw a 23.7% increase. The gross merchandise value (GMV) of beauty products on Alibaba’s platforms increased by 40.4% year over year in January and 11.31% in February, according to business intelligence provider Huachuang Business.

- Food retailers saw steady growth of 10.9% in January and February, following on from 8.2% growth in December, as shown in Figure 2. The food sector has performed steadily overall, with little fluctuation related to the Covid-19 crisis. Food saw 9.7% year-over-year growth in January and February of 2020 (the highest growth rate among all sectors), and 10.1% in the same period of 2019.

Figure 2. China Retail Sales (ex. Food Service; incl. Gasoline and Automobiles), by Sector: YoY % Change [wpdatatable id=803 table_view=regular]

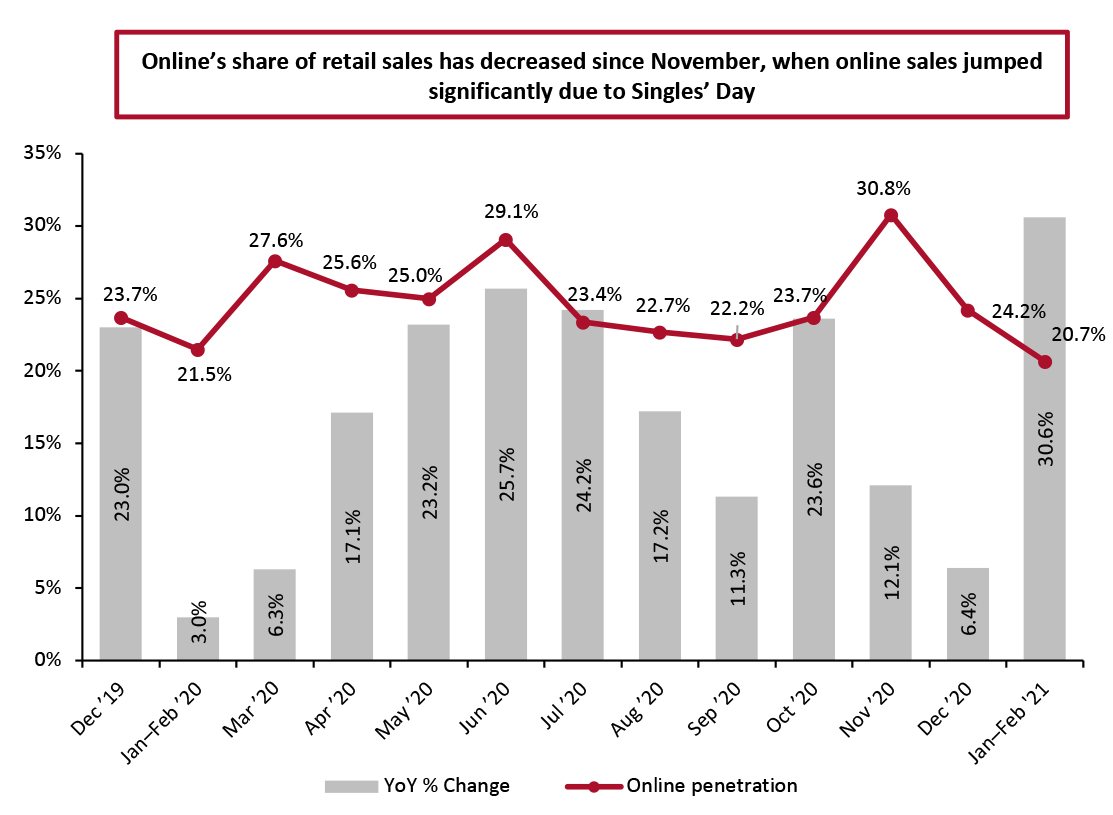

The sector breakdown is based on surveys from enterprises above a designated size, which refers to those with annual sales of ¥5 million (around $730,000) and above. Source: National Bureau of Statistics Online Retail Sales Account for 20.7% of Total Retail Sales In January and February, online retail sales growth in China reached 30.6% year over year. The channel accounted for 20.7% of total retail sales in the period, a decline from 24.2% in December and 30.8% in November. Online retail sales include food service as the National Bureau of Statistics does not provide online data that excludes food service. In Figure 3, online sales are benchmarked to total retail sales.

Figure 3. Online Retail Sales as % of Total Retail Sales (incl. Automobiles, Gas and Food Service) [caption id="attachment_124606" align="aligncenter" width="725"]

Online retail sales include food service

Online retail sales include food service Source: National Bureau of Statistics [/caption]