albert Chan

US Retail Sales: January 2022

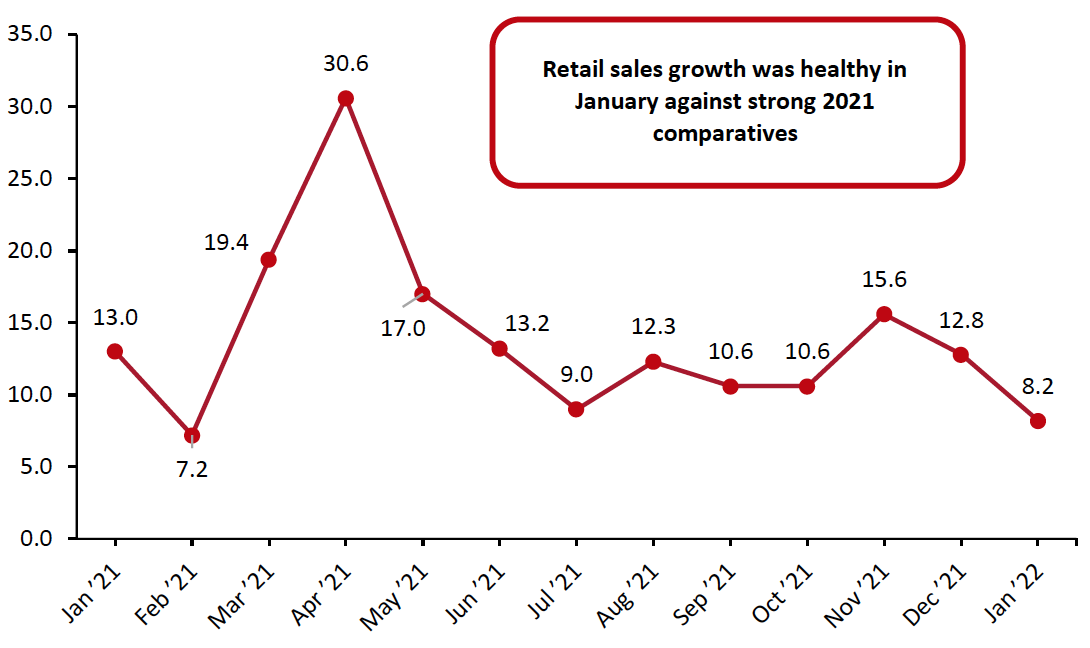

Coresight Research’s measure of core retail sales is the unadjusted year-over-year change, excluding sales of gasoline, motor vehicles and parts. This metric stayed healthy to start 2022. US retail sales grew 8.2% year over year, against strong January 2021 comparatives. Additionally, December’s retail sales growth remained in the double-digits despite a slightly lower revised figure. The Census Bureau revised December’s estimates from 13.3% year-over-year growth to 12.8%.

Retail sales growth was healthy in January, boosted by a strong month of job creation and continued average hourly wage growth. Furthermore, retail sales were likely boosted as new Covid-19 Omicron cases peaked in the US in January. Amid the surge of Omicron in the US, consumers spent more on goods rather than services as they increased their avoidance of public places in January.

We expect retail sales to remain elevated in February, due to the current high-inflationary environment. Retail sales estimates do not factor out inflation, and they are likely to be elevated by higher prices. The Federal Reserve Bank is expected to begin its process of hiking interest rates in March in an attempt to slow down inflation. While the initial hike will be incremental, the series of interest rate hikes the Fed is expected to implement will have a multiplier effect. For consumers, this means the cost of borrowing will be higher, mortgages will be more expensive, home prices may fall as a result, interest rates on credit cards will be higher and stock values will be lower. In aggregate, the Fed’s anticipated interest rate hikes in 2022 will cut into the wealth effect consumers are currently feeling. We expect retail sales growth may slow from mid-to-upper single digits to low single digits in the coming months. Overall, we expect retail sales growth to remain positive in 2022, a rise on top of the jump exhibited in 2021.

Figure 1. US Total Retail Sales ex. Gasoline and Automobiles: YoY % Change [caption id="attachment_141820" align="aligncenter" width="700"]

Data are not seasonally adjusted

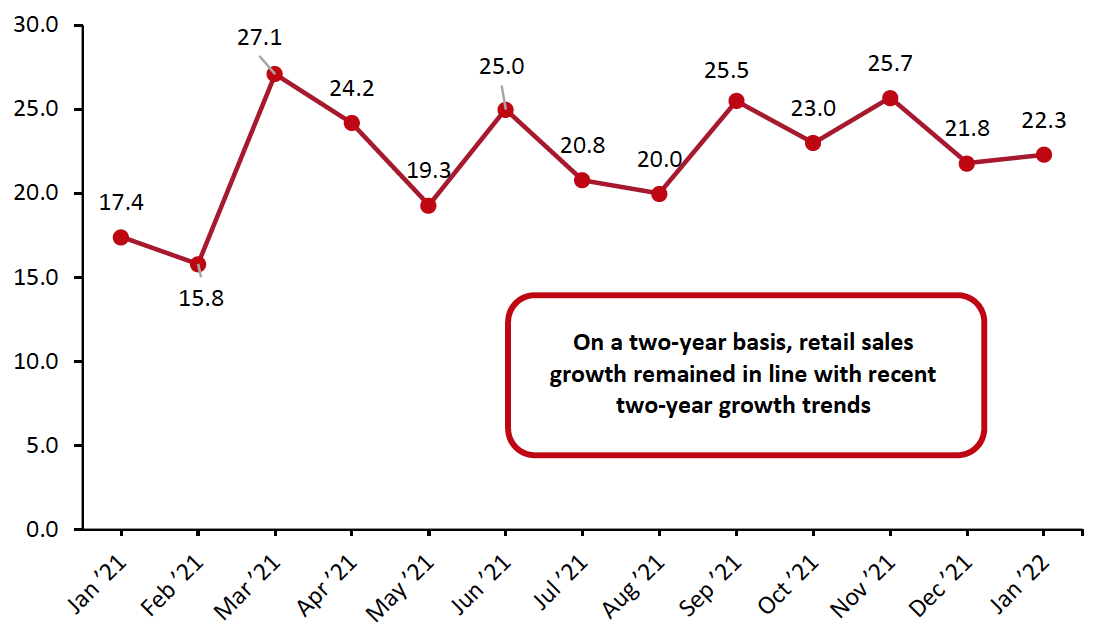

Data are not seasonally adjusted Source: US Census Bureau/Coresight Research[/caption] In relation to the more consistent pre-pandemic comparatives of January 2020, retail sales remained in line with recent two-year growth trends, picking up pace from a revised December estimate and rising to 22.3%.

Figure 2. US Total Retail Sales ex. Gasoline and Automobiles: % Change from Two Years Ago [caption id="attachment_141821" align="aligncenter" width="700"]

Source: US Census Bureau/Coresight Research[/caption]

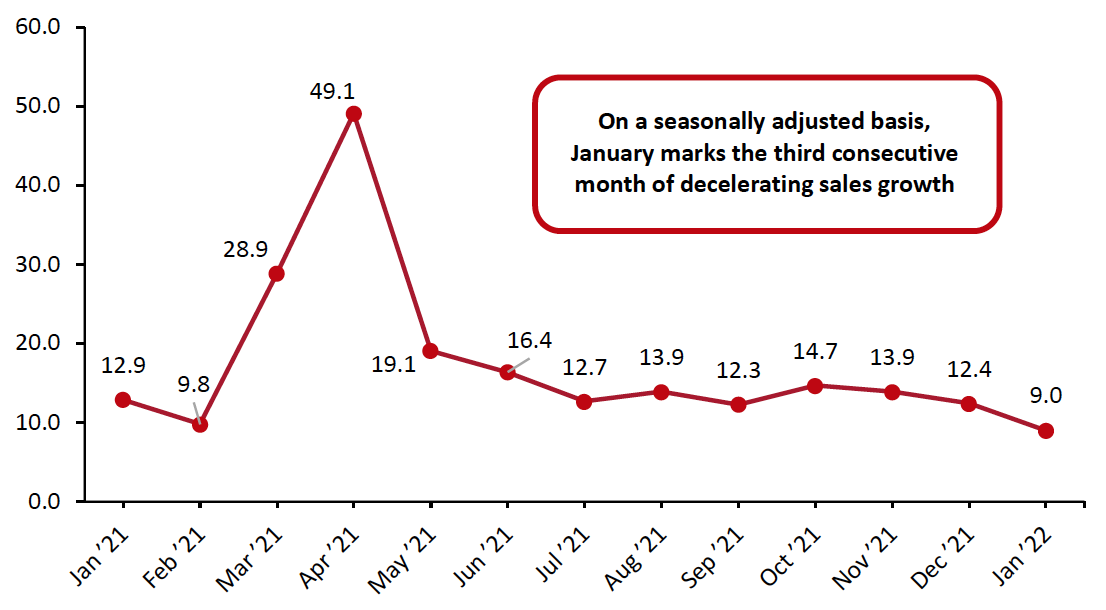

Seasonally adjusted retail sales, including automobiles and gasoline, grew 9.0% year over year, slightly decelerating from December’s 12.4% growth. In January, the sales of motor vehicles and parts declined month over month owing to the global microchip shortage. Additionally, sales at gasoline stations have risen strongly due to volatile gas prices.

Source: US Census Bureau/Coresight Research[/caption]

Seasonally adjusted retail sales, including automobiles and gasoline, grew 9.0% year over year, slightly decelerating from December’s 12.4% growth. In January, the sales of motor vehicles and parts declined month over month owing to the global microchip shortage. Additionally, sales at gasoline stations have risen strongly due to volatile gas prices.

Figure 3. US Total Retail Sales Incl. Gasoline and Automobiles: Seasonally Adjusted YoY % Change [caption id="attachment_141822" align="aligncenter" width="700"]

Data are seasonally adjusted

Data are seasonally adjustedSource: US Census Bureau/Coresight Research[/caption]

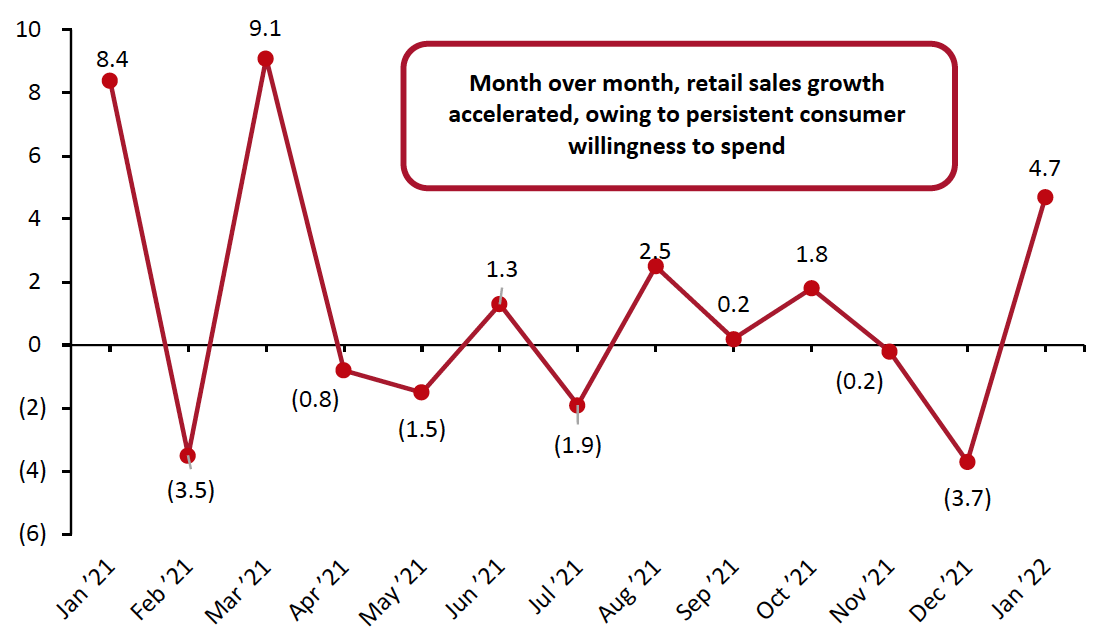

Sales Increase Month over Month

On a month-over-month basis, seasonally adjusted sales (excluding automobiles and gas) were very strong, surpassing economist estimates by growing 4.7% month over month. Consumers are continuing to prove their willingness to spend despite the current inflationary environment and record low consumer sentiment. In January, consumer sentiment fell back from December, in reaction to persistently high inflation.

Figure 4. US Total Retail Sales ex. Gasoline and Automobiles: MoM % Change [caption id="attachment_141823" align="aligncenter" width="700"]

Data are seasonally adjusted

Data are seasonally adjustedSource: US Census Bureau/Coresight Research[/caption] Retail Sales Growth by Sector Overall retail sales growth was healthy in January, against strong 2021 comparatives. In this section, we compare January 2022 sales to January 2021 sales. In a solid month of growth, some sectors saw double-digit growth compared to last year, while two notable sectors saw sales decline:

- To start 2022, clothing and clothing accessory stores posted the strongest month of sales increases, growing 19.1% year over year. Strong clothing sales are being driven by a consumer adaption to a new normal, including a hybrid work environment, leading to new wardrobe changes.

- General merchandise stores saw sales increase by 6.4% year over year. The department store subsector continued its healthy recovery, growing sales 10.3% from a year ago.

- Electronics and appliance stores are feeling the tangible impacts of the global microchip shortage. Sales declined by 3.0% compared to a year ago, a sudden slowdown from December’s 11.7% year-over-year growth.

- Sporting goods, hobby, musical instrument and book stores also exhibited a sales slowdown. Sales declined marginally by 0.8% from a year ago, largely owing to strong 2021 comparatives. On a two-year basis, the sector remains healthy seeing sales increase by 25.5%

- Nonstore retailers saw solid sales growth of 8.9% from a year ago, against strong January 2021 comparatives. Nonstore retailer sales were likely boosted this month by elevated consumer avoidance of public places due to the Omicron variant. With the worst of the Omicron variant now behind the US, should sales remain healthy in the coming months, it would suggest that e-commerce is continuing to grow even against strong 2021 comparatives.

- Food and beverage stores saw sales increase by 7.2% year over year in January and grocery stores sales increased by 8.1% year over year. While these metrics are healthy on the surface, consumer prices for food at home rose 7.4% in January from a year ago, according to the Bureau of Labor Statistics. When factoring out inflation, sales gains in this sector are rather marginal.

- Building material and garden supply retailers were the only sector to see sales growth accelerate (except for motor vehicle and parts dealers, which we do not include in our metric of retail sales). Sales grew 12.7% in January, gaining speed from December’s 11.7% revised growth.

Figure 5. US Total Retail Sales, by Sector: YoY % Change from One Year Ago (Top) and Two Years Ago (Bottom) [wpdatatable id=1728] [wpdatatable id=1729] Data are not seasonally adjusted Source: US Census Bureau/Coresight Research