albert Chan

UK Retail Sales: January 2022

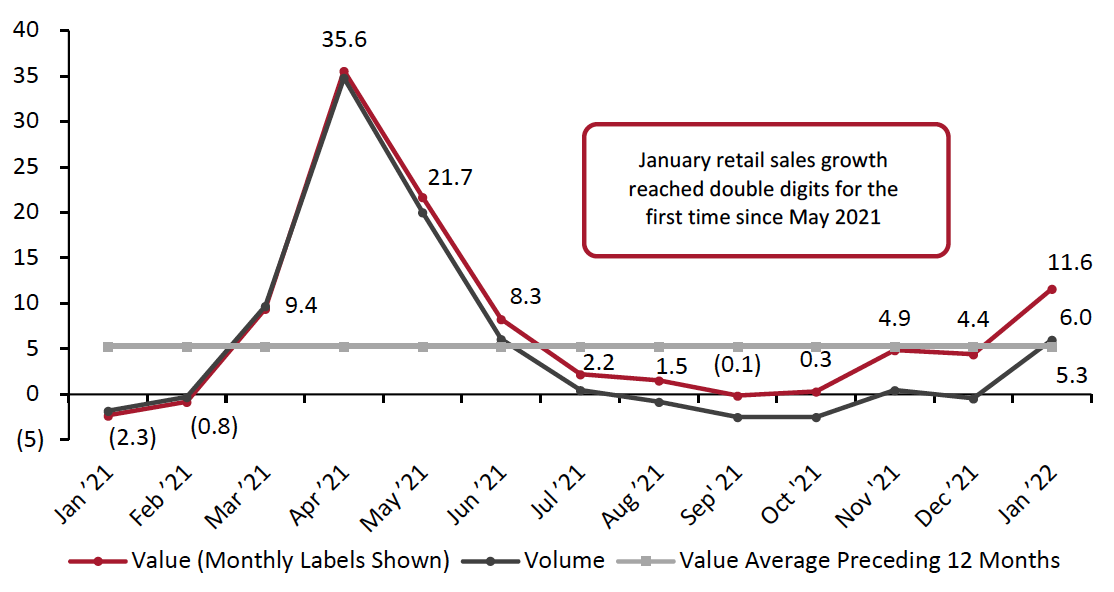

In January, total UK retail sales surged after a slow month of December. Year over year, total retail sales excluding automotive fuel grew 11.6%, marking a strong month of recovery against weak January 2021 comparatives when sales declined by 2.3%. On a two-year basis, January retail sales saw strong high-single-digit growth of 9.3% compared to pre-pandemic January 2020, although some sectors remain below their pre-pandemic sales values.

Shop-price inflation stood at 5.3% in January 2022, versus 4.8% in December 2021. January’s retail inflation was the highest rate since September 1991, according to our review of ONS data.

Total sales growth was also supported by the receding impacts of the Omicron variant in the UK. In January, sales volumes increased 6.0% from a year ago. On a month-over-month basis, the jump in sales volumes was the largest increase since April 2021, when nonessential retailing re-opened, according to the ONS. In aggregate, sales volumes are healthy, staying 3.6% higher than their pre-pandemic February 2020 values. In January, Prime Minister Boris Johnson lifted mask mandates in public places and ended proof of vaccination requirements to enter large-scale events.

Figure 1. Total UK Retail Sales (ex. Automotive Fuel and Unadjusted): YoY % Change [caption id="attachment_142070" align="aligncenter" width="700"]

Data in this report are not seasonally adjusted

Data in this report are not seasonally adjustedSource: ONS/Coresight Research[/caption]

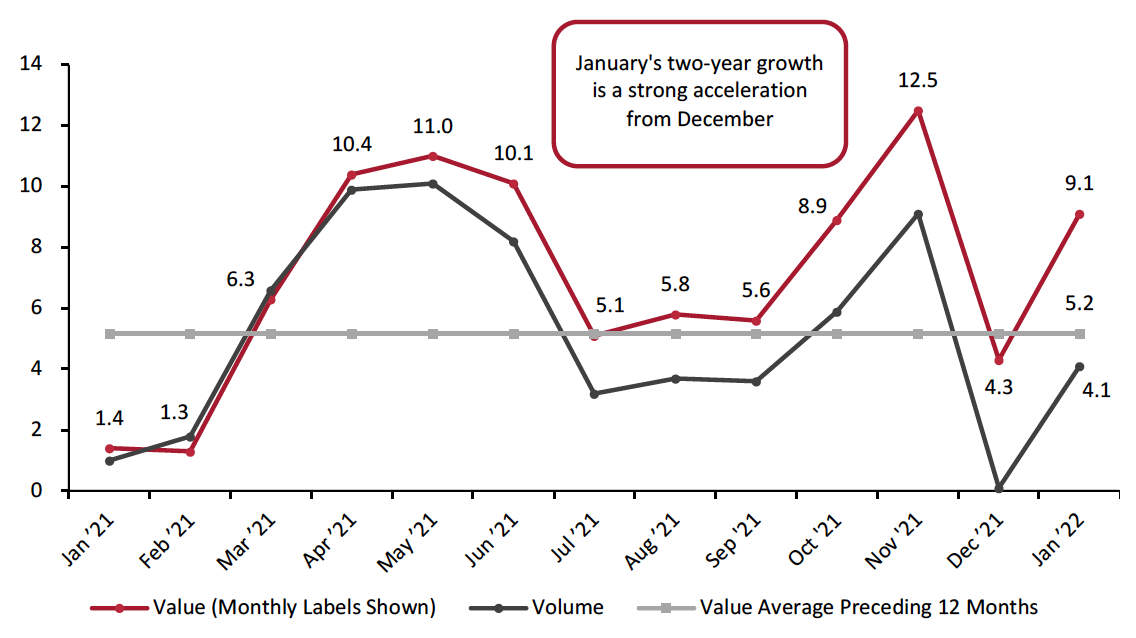

Against the more consistent comparatives of pre-pandemic January 2020, January 2022 retail sales growth marked the fifth highest month of sales growth, owing to consumers’ strong desires to return to stores with the worst impacts of the Omicron variant behind them.

Figure 2. Total UK Retail Sales (ex. Automotive Fuel and Unadjusted): % Change from Two Years Ago [caption id="attachment_142071" align="aligncenter" width="700"]

Data in this report are not seasonally adjusted

Data in this report are not seasonally adjustedSource: ONS/Coresight Research[/caption]

Retail Sales Growth by Sector

The lockdown measures imposed in 2020 had a major detrimental impact on retail sales, causing certain sectors to see dramatic sales declines and skewing year-over-year growth numbers. In 2021, retail sales growth recovered, although some sector remains below their pre-pandemic 2020 values.

Clothing specialists are on the path to recovery. In a strong month, clothing specialists saw sales rise by 72.4% against weak 2021 comparatives. Large clothing specialists’ sales grew 67.2%, while small clothing specialists more than doubled their sales, growing 135.2% compared to last year. Still, clothing-store sales remain below their pre-pandemic values, seeing sales decline by 12.1% on a two-year basis.

The complimentary footwear specialists sector witnessed sales increase by 81.9% from a year ago. Despite such high year-over-year growth, sales were 18.0% lower than pre-pandemic 2020.

Department stores—a sector also challenged by the pandemic—maintained healthy year-over-year growth of 13.5%. Against pre-pandemic values, sales declined by 5.6%

Sales at furniture and lighting stores rapidly picked up from a slow December, growing 51.4% from a year ago. In January, this sector recovered to surpass pre-pandemic values, growing 15.3% from two years prior.

Despite the global microchip shortage, sales at electrical goods specialists increased by 26.9% in January compared to 2021. Furthermore, the sector surpassed pre-pandemic values this month, growing sales by 8.4% on a two-year basis.

Grocery retailers saw sales decline 4.6% year over year. Despite the year-over-year decline, the sector stayed above pre-pandemic values, growing sales by 1.5% from January 2020.

Figure 3. UK Retail Sales, by Sector: YoY % Change [wpdatatable id=1747] [wpdatatable id=1748]

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers **A relatively fragmented sector, in which reported figures have traditionally been volatile Source: ONS

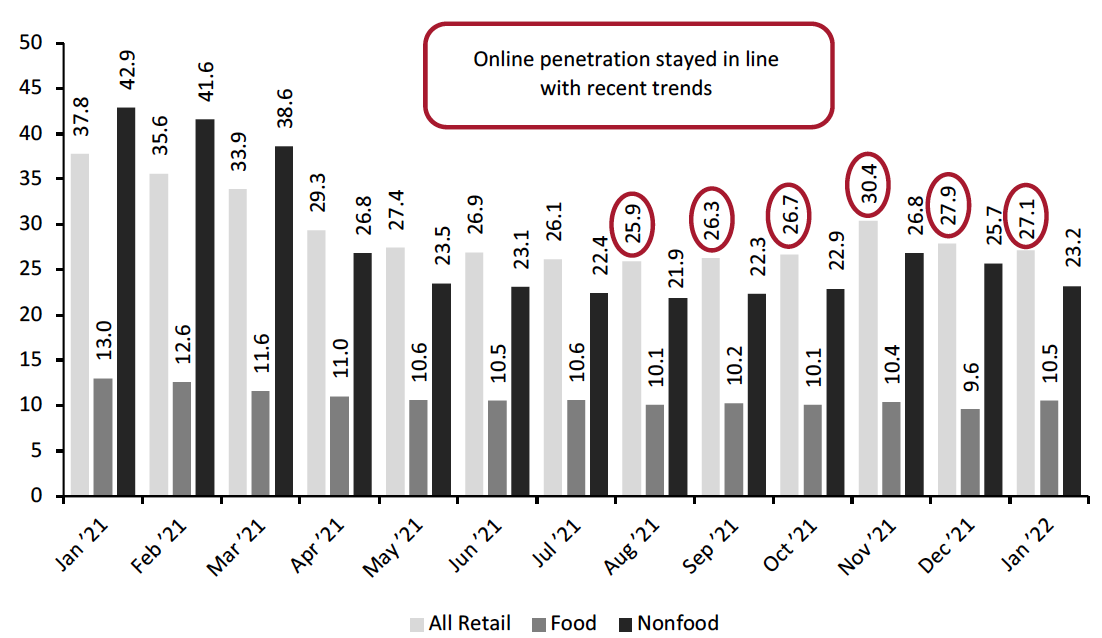

Online Retail Sales Decline by 20.0%Despite strong overall retail sales growth in January, online sales declined by 20.0%. January marked the eighth consecutive month of online sales declines and represented the greatest year-over-year decline within those eight months.

Online sales declines were driven by a 24.3% decline in online sales at predominantly nonfood stores. Within nonfood stores, sales of household goods declined the most. Household good sales declined by 31.4%, non-specialized stores by 21.3%, and textile, clothing, and footwear stores by 16.2%, year over year. Online food retail also saw sales decline substantially by 21.8%.

As shown in Figure 4 below, online sales as a percentage of overall retail in January remained in line with recent trends. Online sales accounted for 27.1% of overall retail sales, down slightly from December’s 27.9% figure.

Figure 4. Online Retail Sales as % of Total Retail Sales [caption id="attachment_142072" align="aligncenter" width="700"]

Food and Nonfood data are for store-based sectors; All Retail total includes nonstore retail, which is not charted

Food and Nonfood data are for store-based sectors; All Retail total includes nonstore retail, which is not chartedSource: ONS[/caption]

Covid-19 Lockdown Timeline

Lockdown 1: The UK was put into lockdown on March 23, 2020, initially for three weeks, in an attempt to limit the spread of the coronavirus. Nonessential retail stores were closed.

On April 16, the government extended the lockdown by another three weeks.

On May 11, Prime Minister Boris Johnson announced that the government would begin easing restrictions in a phased manner, allowing nonessential stores to reopen from the start of June. However, garden centers were allowed to reopen May 13 and furniture stores May 23.

On May 26, the government announced that all nonessential retailers in England and Northern Ireland—including department stores and small independent shops—would be allowed to reopen from June 15, but stores would need to implement measures to meet the necessary social distancing and hygiene standards.

On June 23, Johnson announced that restaurants, pubs, museums, cinemas and hotels could reopen on July 4.

On September 14, a new “rule of six” prohibited social gatherings of more than six people, unless they are from the same household.

On September 22, Johnson outlined a slew of new restrictions in the wake of a fresh spike in the number of infections. These included the closing of bars, pubs and other hospitality services by 10:00 p.m., effective September 24.

On October 7, the Scottish government implemented tighter restrictions, largely on the hospitality industry. Retail was not directly affected, although stores were requested to enforce two-meter distancing.

On October 12, the UK government announced a three-tier lockdown system, which classified regions based on the severity of infection rates. In the week beginning October 19, a number of regions in England, including London and Manchester, moved into higher tiers of control, which include restrictions on households mixing and, in some cases, some service industries; however, these did not change the direct rules for retailers.

On October 23, a 17-day lockdown began in Wales, with nonessential retailers being forced to close once more.

Lockdown 2: On October 31, Prime Minister Johnson announced a second lockdown for England for the period November 5 to December 2. All nonessential retail was forced to close, “including, but not limited to, clothing and electronics stores, vehicle showrooms, travel agents, betting shops, auction houses, tailors, car washes and tobacco and vape shops.” Food shops, supermarkets, garden centers and certain other retailers providing essential goods and services could remain open. Nonessential retail could remain open for delivery to customers and click- and-collect. Hospitality venues such as restaurants, bars and pubs were forced to close but could still provide takeaway and delivery services. Also forced to close were entertainment venues, indoor and outdoor leisure facilities, and personal care services.

Following the lockdown, UK regions were placed into different tiers, each of which had different restrictions.

On December 8, the UK’s National Health Service started vaccinations, with the aim of vaccinating the most vulnerable groups of people by February 15, 2021.

On December 21, the UK government scrapped a planned easing of rules on the mixing of households over the Christmas period. In England and Scotland, households in many areas were banned from mixing; in some areas, households could mix on Christmas Day only. The devolved Welsh and Northern Irish administrations implemented their own restrictions.

Lockdown 3: On January 4, 2021, Johnson announced a lockdown in England, effective January 5 and with an unspecified end date but with laws formally expiring on March 31. Scotland, Wales and Northern Ireland also implemented lockdowns.

On January 19, Scotland’s First Minister Nicola Sturgeon announced that that country’s lockdown would be extended until at least the middle of February.

On January 27, the government announced that travelers arriving from “red list” countries must quarantine in hotels specified by the government.

On February 22, the government laid out a roadmap to ending lockdowns in England. Restrictions will start to be eased from March 29, nonessential retail stores and services such as hairdressers will be allowed to reopen from April 12, and final restrictions will be ended on June 21.

On March 25, the UK lowered the Covid-19 risk level from four to three on a scale of five.

On April 12, the government eased raft of restrictions across England, with gyms, zoos, theme parks, pubs and restaurants allowed to reopen for outdoor service and shops and hairdressers again permitted to serve customers.

On April 20, Sturgeon announced that Scotland will move to Covid protection Level 3 from Level 4 on April 26, meaning hospitality venues such as cafés, pubs and restaurants and beauty salons can reopen.

On May 17, England eased restrictions further with groups of up to six people from different households allowed to socialize indoors, pubs and restaurants can serve indoors and entertainment venues such as museums, cinemas, and theatres can reopen.

On June 14, England delayed the final stage of easing lockdown restrictions by month, until July 19, due to the increase in cases of the more transmissible Delta variant.

After more than a year under some form of restriction, England lifted almost all remaining Covid-19 rules on July 19, 2021. This included the opening of nightclubs and lifting capacity restrictions on big events and performances.

On December 13, British health secretary Sajid David announced that approximately 200,000 people nationwide had tested positive for the Omicron variant. On December 14 Prime Minister Boris Johnson put forth a new policy of mask mandates and proof of vaccine certification to enter nightclubs and other crowded public spaces.

On January 19, 2022, Prime Minister Johnson lifted the mask mandate and no longer required proof of vaccination to enter large or crowded places, signaling the worst of the Omicron variant was behind in the UK.