DIpil Das

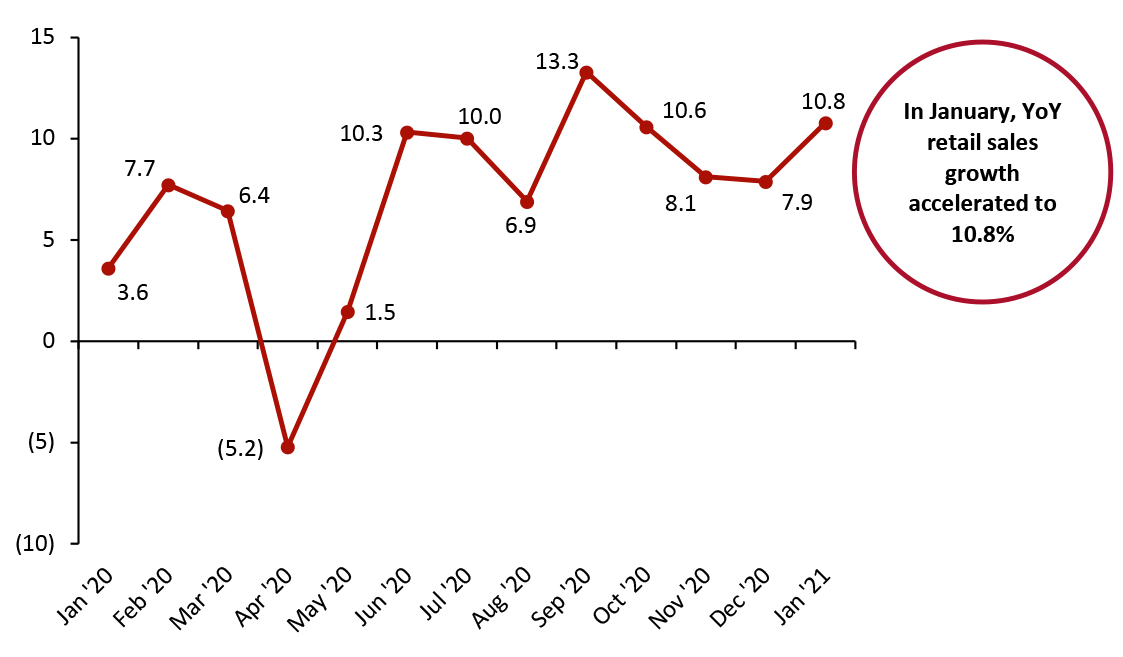

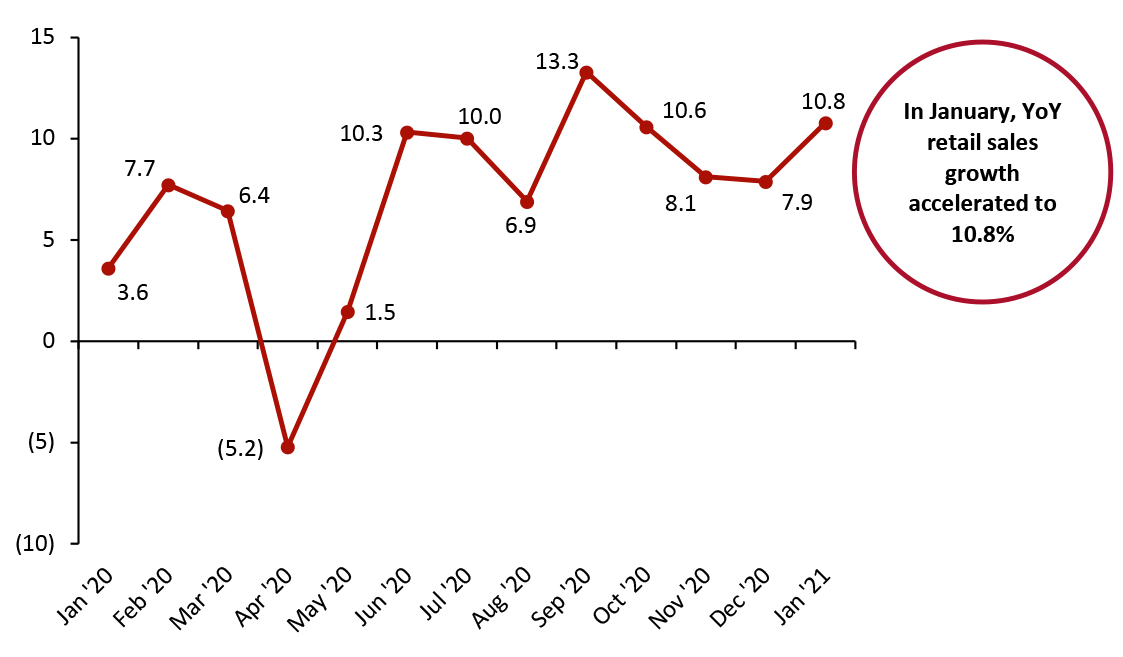

In the US Census Bureau’s first retail sales report for 2021, it reported that US retail sales growth accelerated to 10.8% year over year as stimulus checks boosted consumer spending.

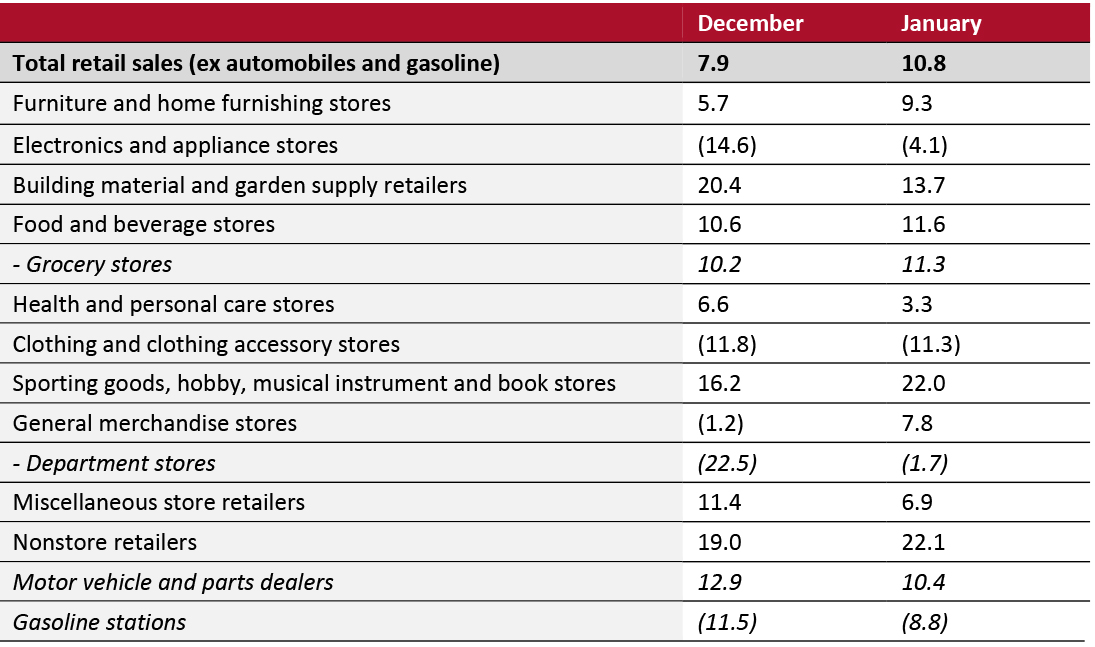

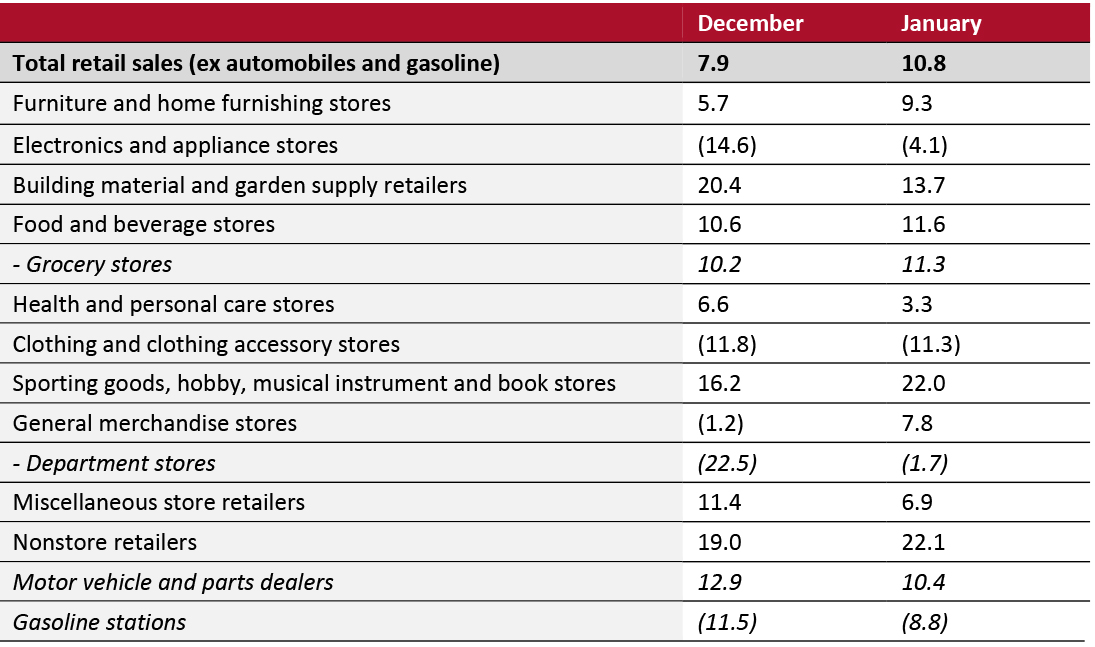

Coresight Research’s measure of core retail sales is the unadjusted year-over-year change, excluding gasoline and automobiles. This metric stood at 10.8% in January 2021 versus a revised 7.9% in December 2020. Nonstore retailers saw the strongest growth in January, of 22.1% year over year—even stronger than the sector’s revised 19.0% growth in December. Three other sectors saw double-digit year-over-year sales growth: home improvement (13.7%), food and beverage stores (11.6%), and sporting goods hobby, musical instruments and book stores (22.0%). The apparel sector was the hardest hit in January, experiencing a sales decline of 11.3% year over year.

January’s growth marked the first month of accelerating year-over-year growth since September last year, as shown in Figure 1.

Figure 1. US Total Retail Sales ex Gasoline and Automobiles: YoY % Change [caption id="attachment_123460" align="aligncenter" width="725"] Data are not seasonally adjusted

Data are not seasonally adjusted

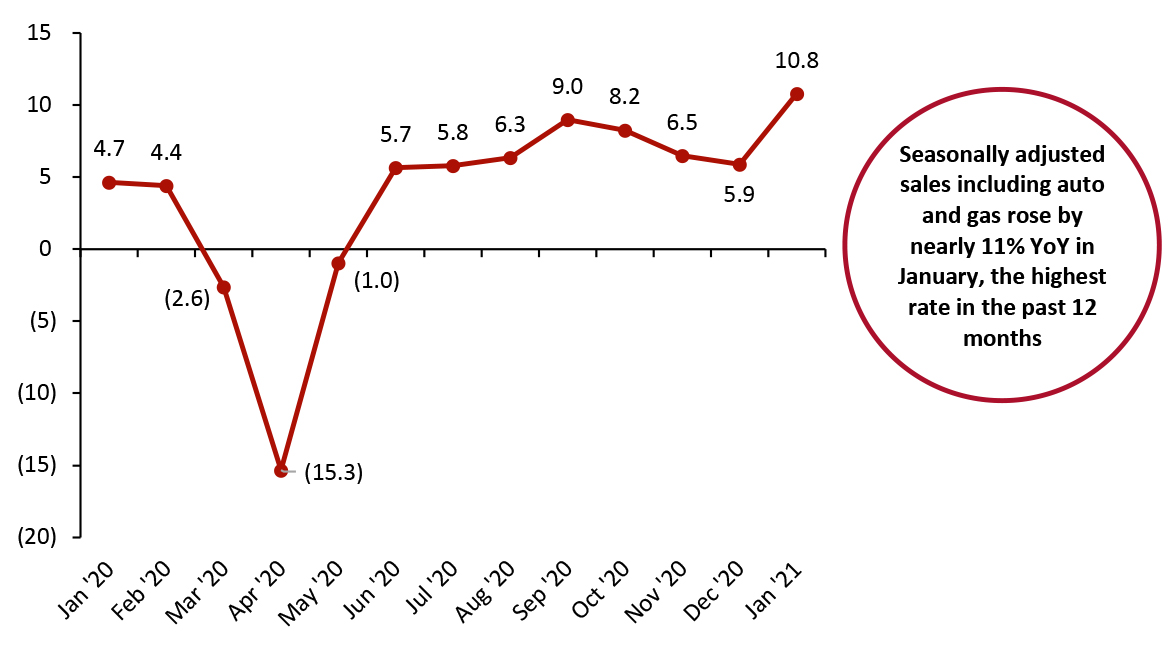

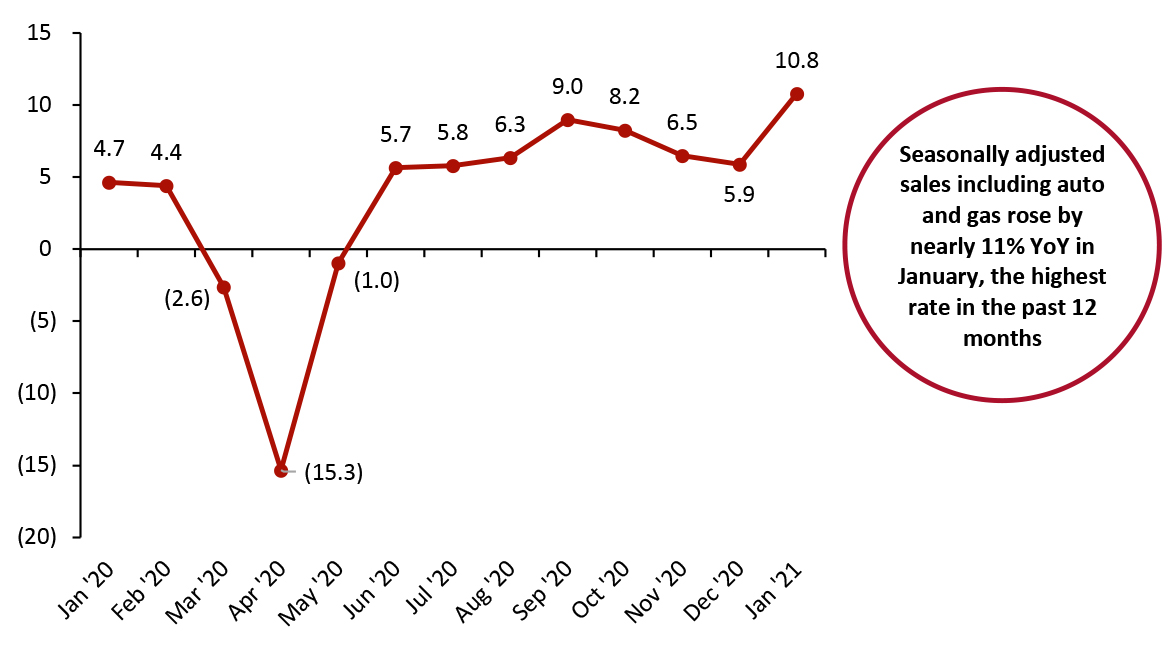

Source: US Census Bureau/Coresight Research [/caption] Seasonally adjusting retail sales data and including automobiles and gasoline, January saw the strongest growth of the past 12 months, growing by 10.8% in January, nearly double the growth of the metric in December.

Figure 2. US Total Retail Sales incl. Gasoline and Automobiles: YoY % Change [caption id="attachment_123461" align="aligncenter" width="725"] Data are seasonally adjusted

Data are seasonally adjusted

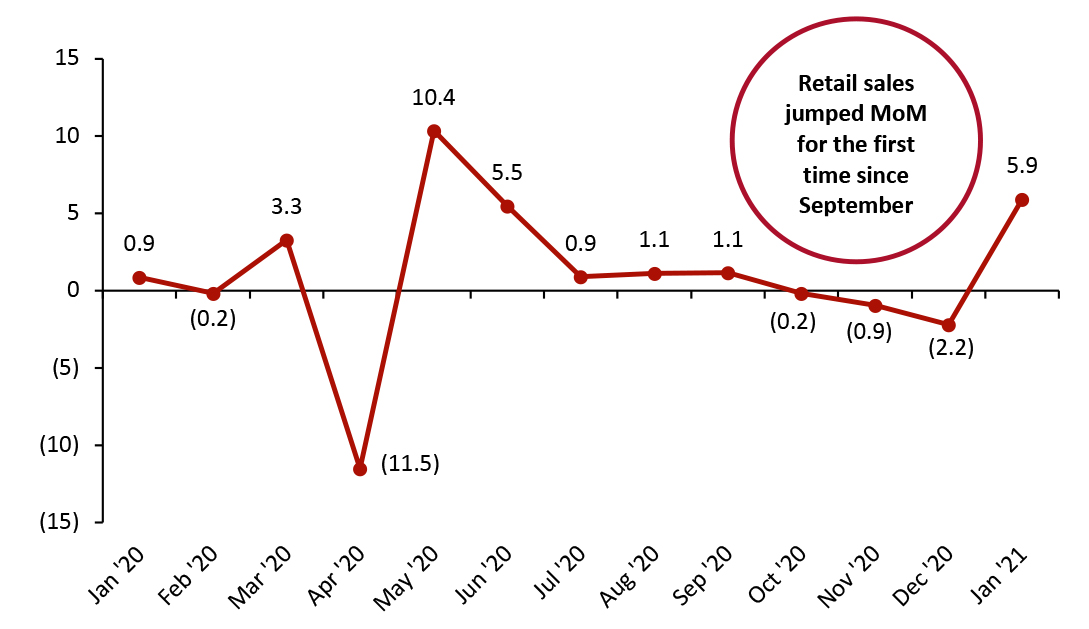

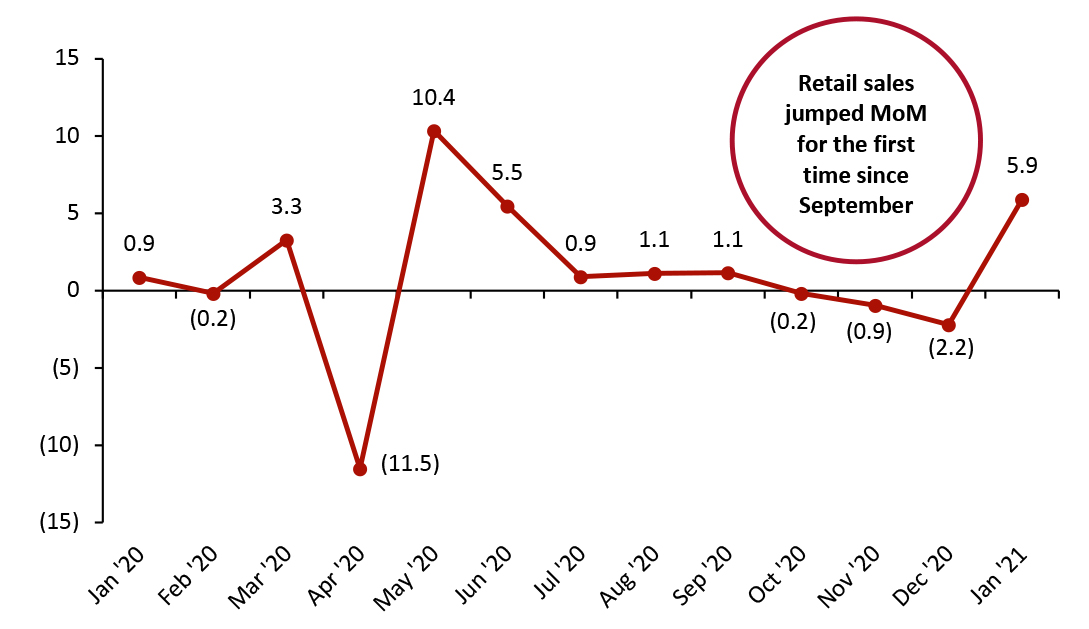

Source: US Census Bureau/Coresight Research [/caption] Adjusted Retail Sales Decrease Slightly Month over Month Seasonally adjusted retail sales excluding gasoline and automobiles rose on a month-over-month basis for the first time since September 2020, jumping 5.9% in January 2021. In previous months, declining month-over-month growth seemed to indicate that the shift in consumer spending from services to goods during the Covid-19 pandemic may have peaked. The acceleration of adjusted sales this month indicates that consumers are prioritizing spending on goods. However, February sales data will be indicative as to how much of this recovery is related to stimulus checks or whether we will see sustained growth.

Figure 3. US Total Retail Sales ex. Gasoline and Automobiles: MoM % Change [caption id="attachment_123462" align="aligncenter" width="725"] Data are seasonally adjusted

Data are seasonally adjusted

Source: US Census Bureau/Coresight Research [/caption] Retail Sales Growth by Sector Several sectors saw strong year-over-year sales growth :

Figure 4. US Total Retail Sales, by Sector: YoY % Change [caption id="attachment_123463" align="aligncenter" width="725"] Data are not seasonally adjusted

Data are not seasonally adjusted

Source: US Census Bureau/Coresight Research [/caption]

Figure 1. US Total Retail Sales ex Gasoline and Automobiles: YoY % Change [caption id="attachment_123460" align="aligncenter" width="725"]

Data are not seasonally adjusted

Data are not seasonally adjusted Source: US Census Bureau/Coresight Research [/caption] Seasonally adjusting retail sales data and including automobiles and gasoline, January saw the strongest growth of the past 12 months, growing by 10.8% in January, nearly double the growth of the metric in December.

Figure 2. US Total Retail Sales incl. Gasoline and Automobiles: YoY % Change [caption id="attachment_123461" align="aligncenter" width="725"]

Data are seasonally adjusted

Data are seasonally adjusted Source: US Census Bureau/Coresight Research [/caption] Adjusted Retail Sales Decrease Slightly Month over Month Seasonally adjusted retail sales excluding gasoline and automobiles rose on a month-over-month basis for the first time since September 2020, jumping 5.9% in January 2021. In previous months, declining month-over-month growth seemed to indicate that the shift in consumer spending from services to goods during the Covid-19 pandemic may have peaked. The acceleration of adjusted sales this month indicates that consumers are prioritizing spending on goods. However, February sales data will be indicative as to how much of this recovery is related to stimulus checks or whether we will see sustained growth.

Figure 3. US Total Retail Sales ex. Gasoline and Automobiles: MoM % Change [caption id="attachment_123462" align="aligncenter" width="725"]

Data are seasonally adjusted

Data are seasonally adjusted Source: US Census Bureau/Coresight Research [/caption] Retail Sales Growth by Sector Several sectors saw strong year-over-year sales growth :

- Nonstore retailers saw 22.1% year-over-year growth in January, following a strong December (when sales grew 19.0%) and overtaking home improvement (building material and garden supply retailers) to experience the strongest growth of the month.

- Home-improvement retailers again saw strong growth of 13.7% year over year, but that rise fell far short of the 20.4% growth the sector experienced in December. Through most of the pandemic, home-improvement sales have been strong, as consumers spend more time in the home and take advantage of low interest rates, indicated by increased housing starts. January’s drop in sales growth may indicate that consumers are reducing their emphasis on at-home projects as they grow weary of at-home activities.

- Sports and hobby goods retailers saw a 22.0% increase in sales versus December’s 16.2% growth. This strong increase in sales may be due to consumers purchasing at-home fitness equipment to stay fit through a winter in which many gyms remain closed and outdoor fitness activities are less viable in cold temperatures.

- Food and beverage stores saw strong growth of 11.6% in January versus 10.6% in December. Similarly, grocery stores saw 11.3% growth in January, slightly higher than December’s 10.2% growth. Consumers continue to avoid restaurants, with our latest consumer survey indicating that less than one-quarter of consumers have visited a restaurant in the past two weeks, shifting food spending toward groceries.

- General merchandise stores saw 7.8% growth, a turnaround from the sector’s 1.2% decline in December. This can be largely attributed to the recovery of department stores (a subset of general merchandise stores), which saw a sales decline of 22.5% in December vastly improve to a decline of just 1.7% in January.

- Health and personal care stores saw sales increase by 3.3% in January, down from 6.6% growth in December.

- Furniture and home-furnishing stores saw 9.3% growth, improving from a 5.7% increase in December.

- Clothing store sales decreased by 11.3% in January, roughly the same as the 11.8% decline in December, as consumers continued to shop more for apparel online—our latest consumer survey indicated that while more than one in four consumers had bought clothing online in the past two weeks, just 17.3% had purchased apparel in a store.

- Electronics and appliance store sales decline again in January, albeit at a slower rate than recorded in December. Sales declined by 4.1% year over year in January versus 14.6% in December.

Figure 4. US Total Retail Sales, by Sector: YoY % Change [caption id="attachment_123463" align="aligncenter" width="725"]

Data are not seasonally adjusted

Data are not seasonally adjusted Source: US Census Bureau/Coresight Research [/caption]