albert Chan

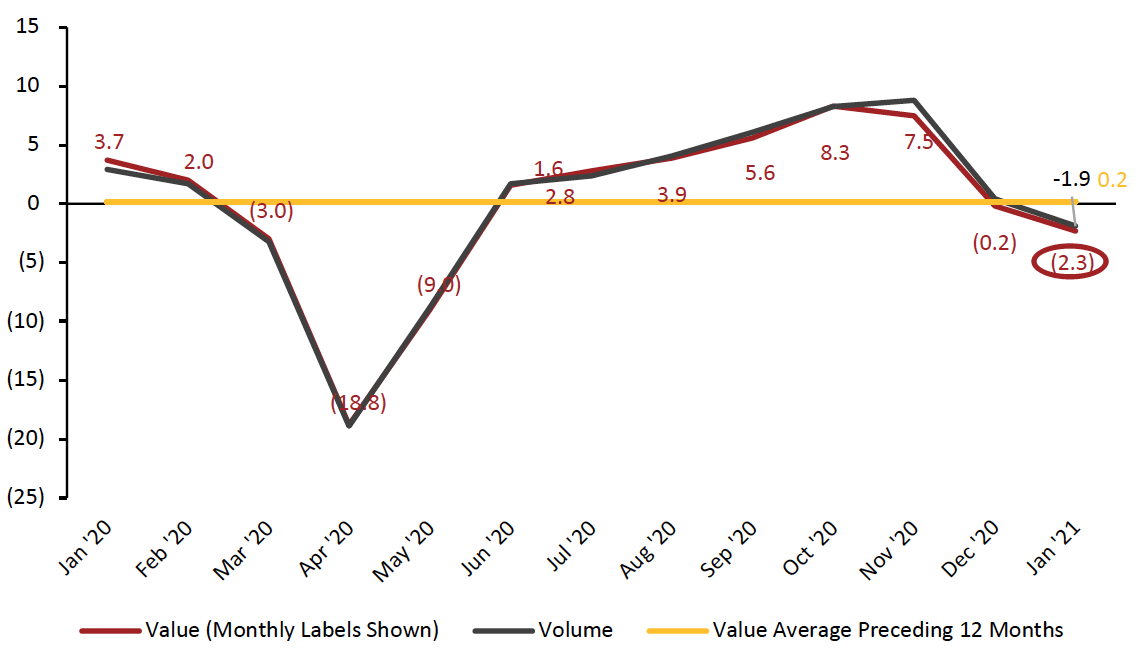

In January, total UK retail sales fell 2.3% year over year, the second consecutive month of year-over-year shrinkage following a 0.2% decline in December 2020. Apparel and footwear, book, computer and electronics retailers all suffered severely in January, each seeing a sales decline of at least 20%.

Amid a third national lockdown in England, nonessential retailers (most nonfood retailers) were forced to close from January 5 (separate lockdowns have been enforced in devolved nations of the Northern Ireland, Scotland and Wales). Continued solid growth from food retailers, along with accelerating growth of sales by Internet pure plays, prevented overall sales from falling further.

Figure 1. Total UK Retail Sales (ex Automotive Fuel and Unadjusted): YoY % Change

[caption id="attachment_123566" align="aligncenter" width="700"] Data in this report are not seasonally adjusted

Data in this report are not seasonally adjustedSource: ONS/Coresight Research[/caption]

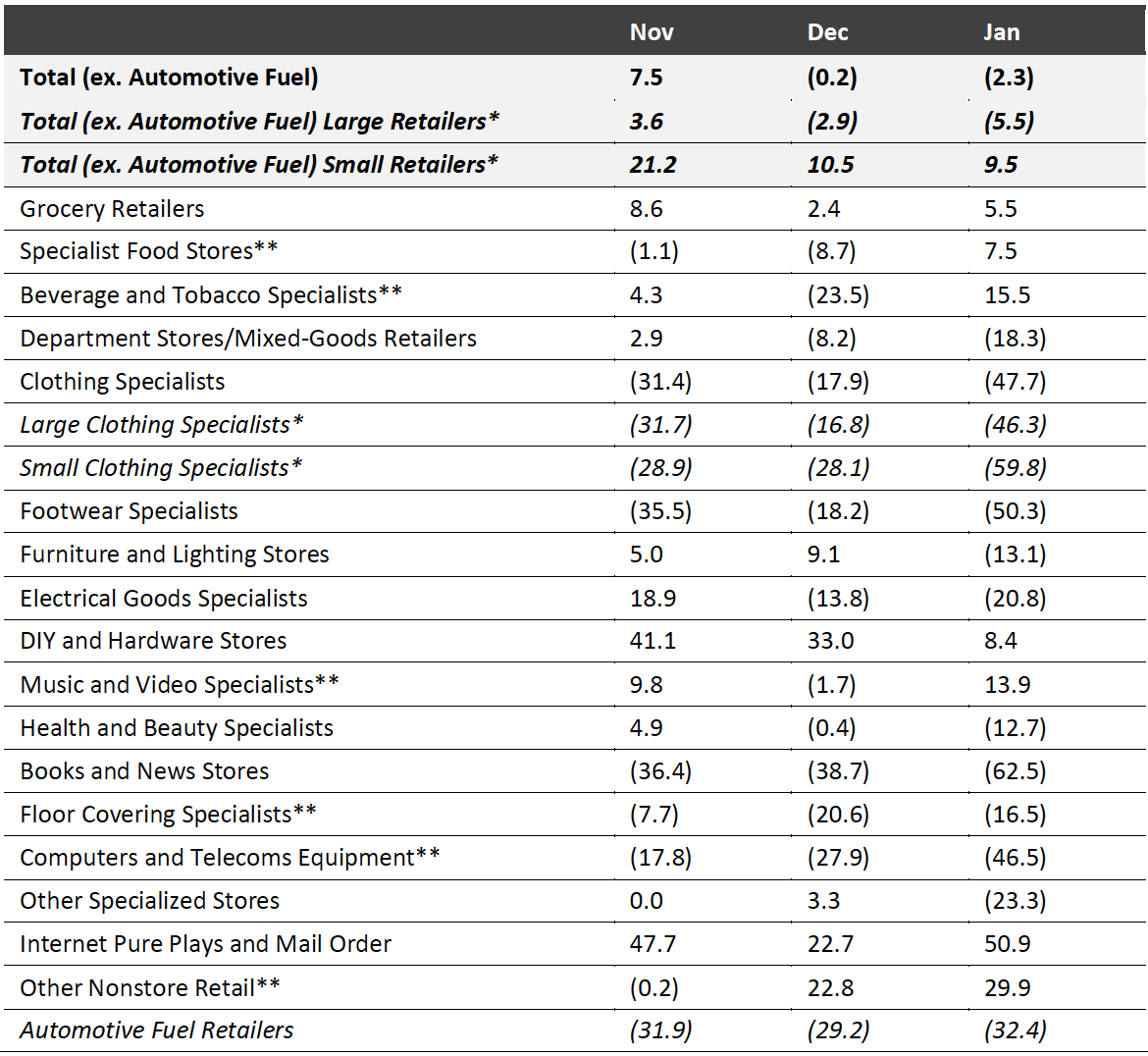

Retail Sales Growth by Sector

Despite overall retail sales falling in January, certain major sectors experienced strong growth.

Grocery retailers posted year-over-year growth of 5.5%—increasing from 2.4% growth in December 2020. Specialist food stores saw sales rise by 7.5%, following a disappointing December in which sales fell by 8.7%. These data reflect the closure of food-service businesses (for dining in) and indicate that consumers continue to focus their spending on essentials.

With many consumers stuck at home, DIY and hardware stores posted 8.4% year-over-year growth—a solid rise, but disappointing after 33.0% growth in December. With the closure of nonessential retailers, Internet pure plays and mail order retailers saw sales growth of 50.9%— the largest rise of any sector and significantly higher than December’s 22.7% growth.

Clothing specialists continued to be hit hard by the lockdown, seeing sales decline by 47.7%, which was far more substantial than the 17.9% decline in December (when England had a tiered system of localized restrictions but was not under a full lockdown). Books and news stores saw the sharpest decline in January, continuing to suffer from the drastic reduction in consumers who commute, as well as the general trend of consumers reducing the amount of time they spend with print media and the ease with which they can purchase books online. Sales in this sector fell by 62.5% in January.

After posting decent numbers in November in the lead-up to the holiday season, health and beauty retailers saw sales decline by 0.4% in December and 12.7% in January.

Chances of a solid department store recovery that were buoyed by the sector’s 2.9% year-over-year sales growth in November were further quashed by the January lockdown: The sector saw sales decline by 18.3%, following the 8.2% year-over-year contraction in December.

Music and video specialists saw 13.9% growth in January. Although this is a rebound from a slight decline in sales in December, it continued the general trend of solid growth in the sector as consumers invest in at-home entertainment.

Figure 2. UK Retail Sales, by Sector: YoY % Change

[caption id="attachment_123567" align="aligncenter" width="550"] *A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers.

*A small retailer is defined as one with fewer than 100 employees or with revenues of £60 million or less per year; all others are large retailers.**A relatively fragmented sector, in which reported figures have traditionally been volatile. Source: ONS[/caption]

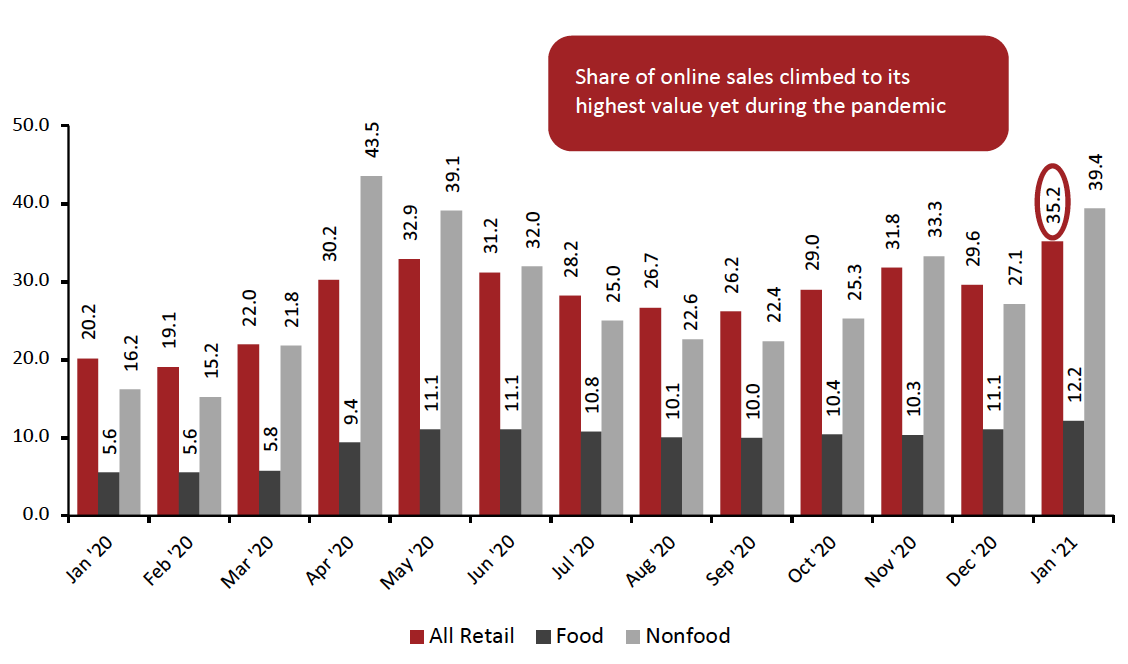

Online Retail Sales Account for 36% of All Retail Sales

Supported by the closure of nonessential stores in England from January 5 and similar lockdowns in other UK nations, total online retail sales climbed 75.0% in January after rising by 45.6% in December. Internet sales by food retailers rose 144.6% year over year in January, up from 92.5% growth in December, while nonfood retailers saw online sales climb 87.3%, up from 62.6% growth in December. Nonfood store online sales growth was driven by a substantial rise in sales by household goods stores, which saw 112.8% online sales growth in January following relatively underwhelming growth of 34.2% in December.

After falling slightly in December, online sales grew as a percentage of overall retail sales in January to 35.2%. In January 2020, online sales accounted for just over 20% of sales. The current high proportion of online sales is indicative of consumers’ continuing concerns over the virus as new variants spread quickly and lockdowns keep consumers in their homes. Growth in online sales as a percentage of overall sales was driven by an increase in the proportion of nonfood sales that occurred online: In January 2021, 39.4% of nonfood sales occurred online, the highest value recorded since May 2020 and up more than 12 percentage points from December.

Figure 3. Online Retail Sales as % of Total Retail Sales

[caption id="attachment_123569" align="aligncenter" width="700"] “Food” and “Nonfood” data are for store-based sectors; “All Retail” total includes nonstore retail, which is not charted

“Food” and “Nonfood” data are for store-based sectors; “All Retail” total includes nonstore retail, which is not chartedSource: ONS[/caption]

Covid-19 Lockdown Timeline

Lockdown 1: The UK was put into lockdown on March 23, 2020, initially for three weeks, in an attempt to limit the spread of the coronavirus. Nonessential retail stores were closed.

On April 16, the government extended the lockdown by another three weeks.

On May 11, Prime Minister Boris Johnson announced that the government would begin easing restrictions in a phased manner, allowing nonessential stores to reopen from the start of June. However, garden centers were allowed to reopen from May 13 and furniture stores from May 23.

On May 26, the government announced that all nonessential retailers in England and Northern Ireland—including department stores and small independent shops—would be allowed to reopen from June 15, but stores would need to implement measures to meet the necessary social distancing and hygiene standards.

On June 23, Johnson announced that restaurants, pubs, museums, cinemas and hotels could reopen on July 4.

On September 14, a new “rule of six” prohibited social gatherings of more than six people, unless they are from the same household.

On September 22, Johnson outlined a slew of new restrictions in the wake of a fresh spike in the number of infections. These included the closing of bars, pubs and other hospitality services by 10:00 p.m., effective September 24.

On October 7, the Scottish government implemented tighter restrictions, largely on the hospitality industry. Retail was not directly affected, although stores were requested to enforce two-meter distancing.

On October 12, the UK government announced a three-tier lockdown system, which classifies regions based on the severity of infection rates. In the week beginning October 19, a number of regions in England, including London and Manchester, moved into higher “tiers” of control, which include restrictions on households mixing and, in some cases, some service industries; however, these did not change the direct rules for retailers.

On October 23, a 17-day lockdown began in Wales, with nonessential retailers being forced to close once more.

Lockdown 2: On October 31, Prime Minister Johnson announced a second lockdown for England for the period November 5 to December 2. All nonessential retail was forced to close, “including, but not limited to, clothing and electronics stores, vehicle showrooms, travel agents, betting shops, auction houses, tailors, car washes and tobacco and vape shops.” Food shops, supermarkets, garden centers and certain other retailers providing essential goods and services could remain open. Nonessential retail could remain open for delivery to customers and click-and-collect. Hospitality venues such as restaurants, bars and pubs were forced to close but could still provide takeaway and delivery services. Also forced to close were entertainment venues, indoor and outdoor leisure facilities, and personal care services.

Following the lockdown, UK regions were placed into different tiers, each of which had different restrictions.

On December 8, the UK’s National Health Service started vaccinations, with the aim of vaccinating the most vulnerable groups of people by February 15, 2021.

On December 21, the UK government scrapped a planned easing of rules on the mixing of households over the Christmas period. In England and Scotland, households in many areas were banned from mixing; in some areas, households could mix on Christmas Day only. The devolved Welsh and Northern Irish administrations implemented their own restrictions.

Lockdown 3: On January 4, 2021, Johnson announced a lockdown in England, effective January 5 and with an unspecified end date but with laws formally expiring on March 31. Scotland, Wales and Northern Ireland also implemented lockdowns.

On January 19, Scotland’s First Minister Nicola Sturgeon announced that that country’s lockdown would be extended until at least the middle of February.

On January 27, the government announced that travelers arriving from “red list” countries must quarantine in hotels specified by the government.