Nitheesh NH

Introduction

Not long ago, the furniture and home furnishing retail sector was largely a bastion for traditional brick-and-mortar stores. With the “touch and feel” aspect being integral to customers’ purchasing decisions, few could have envisioned that the online channel would have gained traction the way it has today. E-commerce in the furniture sector continues to grow rapidly. However, the influence of brick-and-mortar stores has not waned meaningfully, and the offline channel continues to be the most popular for consumers when buying furniture. The shopping journey is becoming more complex as cross-channel shopping trends continue to evolve, forcing retailers to rethink how they are engaging with customers. In today’s retail environment, both offline- and online-focused retailers are making efforts to firm up their offerings in their respective primary channels. Alongside this though, they are also making significant investments into building an omnichannel presence, in order to meet customer expectations. It is important to note that omnichannel is different from multichannel. In multichannel retail, online and offline channels typically operate as independent silos, while omnichannel retail offers a seamless experience and accounts for spillover between channels. In this report, we discuss how various retailers are pivoting toward an omnichannel approach and whether this trend is integral to the survival of major players in the sector. We focus our discussion on key retailers in the US, including IKEA, Home Depot, RH, Wayfair and Williams-Sonoma.Traditional Retailers Are Investing in Digital Capabilities and Alternative Store Formats

Retailers such as IKEA, Home Depot and Williams-Sonoma built their success on the foundation of strong and efficient brick-and-mortar operations, with IKEA being renowned for its large stores in city outskirts and Home Depot for its home-improvement superstores. However, although physical retail remains the format of choice for buying furniture, these forward-thinking retailers are investing in enhancing their digital capabilities and adopting an omnichannel approach. Among the torchbearers for this growing trend is IKEA. The Swedish furniture giant aims to extend its reach to around 3 billion customers by 2025. To achieve this target, the retailer is investing in its digital offering. For example, IKEA launched an augmented reality-powered application called IKEA Place in September 2017, through which customers can visualize how various IKEA products would fit within their homes by virtually placing 3D renderings into a space. In the same month, the company acquired TaskRabbit, a platform that helps users to connect with workers who can deliver and assemble furniture. In May 2019, IKEA announced that it started testing a new shoppable virtual reality app. In September 2019, the company enhanced its IKEA Place app with new features that combine augmented reality with artificial intelligence and allow users to receive curated and personalized home-furnishing tips and recommendations. IKEA’s e-commerce sales increased by 46% and constituted 11% of total sales of €36.7 billion ($40.5 billion) in fiscal year 2019; the company grew its total sales by 5% in the same year. It also saw 10% growth in website visitors, which totalled 2.6 billion, while in-store traffic stayed steady at 839 million. IKEA has also been exploring different store formats. The retailer opened a planning studio in Manhattan in April 2019, where customers can schedule appointments with an on-site consultant in order to design their home. It also opened a planning studio in Tottenham Court Road in London in October 2018. IKEA also launches pop-up stores based on specific themes and events. [caption id="attachment_103476" align="aligncenter" width="700"] IKEA Planning Studio in Tottenham Court Road, London

IKEA Planning Studio in Tottenham Court Road, LondonSource: Coresight Research[/caption] Furthermore, IKEA has been opening smaller stores in addition to order and collection points in city centers, where customers can visit to view products on display and then make purchases online via their cell phones or the self-service digital terminals. From IKEA’s perspective, the smaller stores in city centers allow it to enhance accessibility, offer customers the “try before you buy” opportunity and facilitate easy home-delivery arrangements. IKEA first announced its plans in November 2018, stating that it would open around 30 small-format stores in various major cities across the world, with the size of each depending on its location. Such stores have since opened in London, New York, Sydney and Warsaw, with another set to open in Tokyo in 2020. [caption id="attachment_103477" align="aligncenter" width="700"]

IKEA’s small-format store in Stratford, East London

IKEA’s small-format store in Stratford, East LondonSource: Coresight Research[/caption] The new store formats being introduced by IKEA appear to be complementary to its larger stores rather than replacing them. The retailer’s objective is to raise awareness and extend its reach and engagement among consumers through multiple touch points. Williams-Sonoma is another retailer that has been taking the omnichannel route. Building on its brick-and-mortar base, the company first launched an e-commerce website in 1999, and has since been investing in this channel to a point where e-commerce now accounts for almost 57% of the company’s revenues, according to its third quarter earnings call in November 2019. The retailer now considers its stores to offer an omnichannel advantage, with customers able to use services such as free product returns and buy online, pick up in store (BOPIS). The company launched a BOPIS service across all 221 stores under the Williams Sonoma banner in November 2017. In 2017, the company launched Design Crew, a design service initiative through which customers can visit any of the retailer’s stores or its website to arrange a free consultation with a design expert. Design Crew experts help customers to choose appropriate products and services for decorating, renovating, entertaining, cooking and gifting based on their individual needs. This service enables shoppers to visualize various products from across the company’s eight brands within their homes. These products are displayed both in store and online, and so Williams-Sonoma is using its Design Crew service to offer a seamless user experience across channels. The retailer is also experimenting in its brick-and-mortar format. The company’s West Elm brand opened a new, interactive pop-up store in New York in October 2019 for one month. The store, called Holiday House, was converted from a boutique condominium and offered tutorials and seasonal activations in collaboration with several lifestyle partners. [caption id="attachment_103478" align="aligncenter" width="700"]

West Elm Holiday House in New York

West Elm Holiday House in New YorkSource: West Elm[/caption] In December 2017, Home Depot launched a three-year, accelerated investment program called “One Home Depot,” which was designed to transform the company into a more digital-centric retailer. The program aims to allow customers to move seamlessly between digital and physical worlds. The program includes store enhancements, e-commerce capability development, delivery offerings and a comprehensive Pro ecosystem (which includes Home Depot’s professional customers such as renovators/remodelers, general contractors, handymen, property managers, building service contractors and specialty tradesmen). According to Internet Retailer’s 2019 Omnichannel Report, Home Depot ranked among the top three companies last year in terms of omnichannel service execution.

Digital-First Retailers Are Betting on Omnichannel for Growth

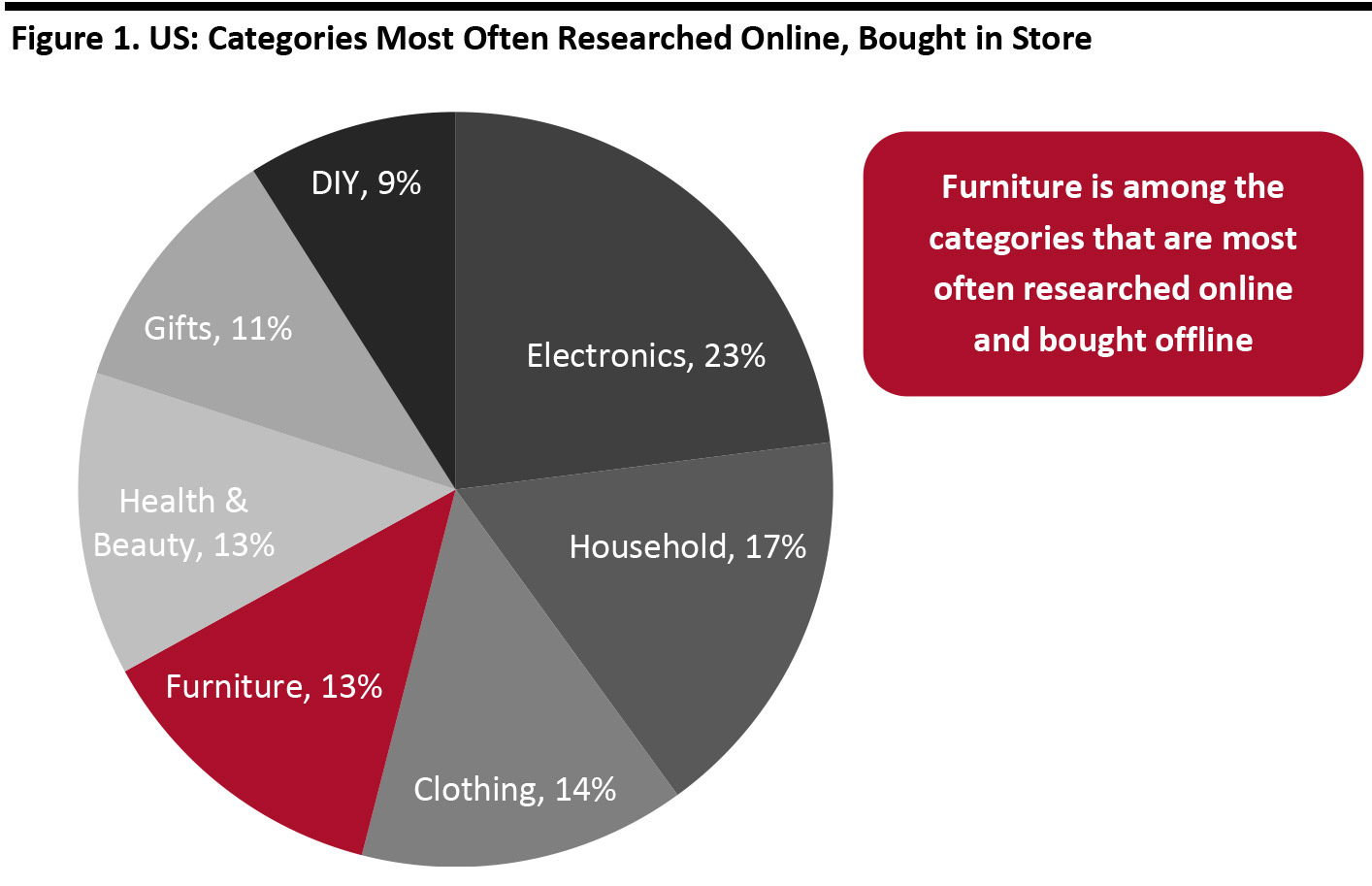

E-commerce has captured a notable share of the furniture market. According to Statista estimates, e-commerce accounted for 17% of US furniture and homeware sales in 2019, up from 16% in 2018. However, brick-and-mortar remains the preferred channel for buying furniture, and the absence of tactility in the online channel continues to be a limiting factor. Although the advent of augmented and virtual reality services is helping to alleviate consumer uncertainty around purchasing furniture online, the high cost of returns continues to be a significant challenge for online retailers, as they do not have physical stores that can double up as showrooms. Moreover, the growing trend of researching products online and the buying them offline looks set to continue unabated. According to JRNI’s Modern Consumer Research Report 2019, 75% of US consumers sometimes or often research online and purchase offline, compared to 57% who sometimes or often research offline and purchase online, across different categories. The survey found that 13% of US consumers selected furniture as the category for which they most often research online and purchase in store, reflecting that furniture is a considered purchase for which consumers are keen to gather information, compare products and experience items before buying. [caption id="attachment_103518" align="aligncenter" width="700"] Base: 1,000 US consumers surveyed during the period June 28 to July 4, 2019.

Base: 1,000 US consumers surveyed during the period June 28 to July 4, 2019.Source: JRNI[/caption] Amidst this context, there is a growing realization amongst digital-first retailers that an omnichannel presence is becoming imperative to enhance overall sales and sustain growth. Leading e-commerce-focused furniture and home furnishing retailers—such as Wayfair and Casper—are now trying to increase their market share by opening physical stores and establishing a brick-and-mortar presence. In August 2018, Casper announced plans to open 200 stores in North America—including 18 pop-up shops—over a period of three years. Wayfair opened its first full-service brick-and-mortar store in the Natick Mall in Natick, Massachusetts, in August 2019. [caption id="attachment_103480" align="aligncenter" width="700"]

Casper New York

Casper New YorkSource: Coresight Research[/caption]

Not Every Retailer Is Buying in Entirely

Although omnichannel retail is gaining in prominence, some retailers are not yet convinced that it is necessary for them to adopt such an approach. Notable among these is RH, a California-headquartered home furnishings company. Although RH generates more than $1 billion of its business from its online channel, the retailer continues to predominantly focus on its brick-and-mortar presence. Analysis of retailers’ digital performance carried out by business intelligence firm Gartner L2 in August 2019 found that RH was among the worst-performing companies in terms of digital capabilities. The survey sorted various companies into five categories—genius, gifted, average, challenged and feeble—based on their digital capabilities. RH was classified as “feeble” for third consecutive year. Other retailers from the same industry that ranked higher than RH included Crate & Barrel, Ethan Allen, IKEA, Pier 1 Imports, West Elm and Williams-Sonoma. The results of this analysis reflect that RH has done little in recent years to enhance its digital marketing, social media presence (the company’s Twitter account appears to have last posted in 2011 and its Facebook account in 2014) and mobile optimization (when we visited the company’s site in February 2020, it did not optimize for a smartphone screen). However, RH’s CEO Gary Friedman does not appear too perturbed by these findings, as digital holds relatively low importance in his overall vision for the brand. According to Friedman, in an interview with CNBC, traditional retailers that are making significant investments into their e-commerce operations are creating “clutter” in the broader industry and experiencing deteriorating operating margins. He announced that RH will no longer report results separately for its store and direct channels, so as to align external reporting with the company’s management of its business. The direct channel includes e-commerce, source books and its trade and contract sales, which together constituted 44% of the company’s total sales in 2018. Meanwhile, RH is continuing to invest in physical retail by opening new galleries and concept stores, as it looks to chase growth through a route that is somewhat against the tide of conventional wisdom. [caption id="attachment_103482" align="aligncenter" width="700"] RH Gallery in New York

RH Gallery in New YorkSource: RH[/caption] RH’s recent results suggest that this strategy is working. The retailer registered record revenues of $677.5 million in its third quarter, ended November 2, 2019, representing a 6.4% increase over the same period of the previous year. It also registered a record adjusted operating margin of 13%, a 340-basis-point increase year over year. However, it remains to be seen whether the company’s focus on brick and mortar will be sustainable in the long term without complementing it with enhanced digital capabilities. Other retailers are also yet to invest significantly in an omnichannel strategy, owing to various constraints and challenges. We discuss some of these below.

Omnichannel Implementation Comes with Challenges

As much as adopting an omnichannel approach can go a long way in helping retailers to stay relevant and well positioned against their competitors in the evolving retail landscape, companies need to be prepared to deal with the various challenges associated with its implementation. Technological Challenges Adopting an omnichannel strategy is likely to add complexity to business operations and supply chain management, especially during the transition phase. Retailers need to invest in advanced warehouse management systems to facilitate effective inventory tracking and ensure speedy delivery and fulfillment. When shifting to omnichannel, legacy technological infrastructure may be unable to ensure accurate inventory and order management across all channels. This means that upgrading technology is essential to successful omnichannel operations, which naturally requires significant investment. However, retailers could look to take a staggered approach by piloting their new strategy in a trial location and assessing whether they are ready for an omnichannel transformation, before introducing it on a company-wide scale. Data Synchronization During omnichannel transformation, synchronizing data across channels in a seamless manner is a common challenge. To succeed, retailers need to employ an enterprise data management strategy that enables them to efficiently collect and integrate information from multiple channels. Channel Conflicts The idea of omnichannel is to create a seamless journey for customers across retail channels. However, given that the journey of evolution into an omnichannel retailer has a single-channel origin, it is inherently difficult to avoid one channel getting preference over the other during the initial stages. One example of such a challenge is in inventory prioritization. In a scenario where a retailer must minimize inventory, it has to choose which channel gets preference on limited product, which leads to channel conflicts. That said, this challenge is not applicable to retailers that have a pooled inventory system in place for online and offline channels.Is Omnichannel the Future for Furniture Retail?

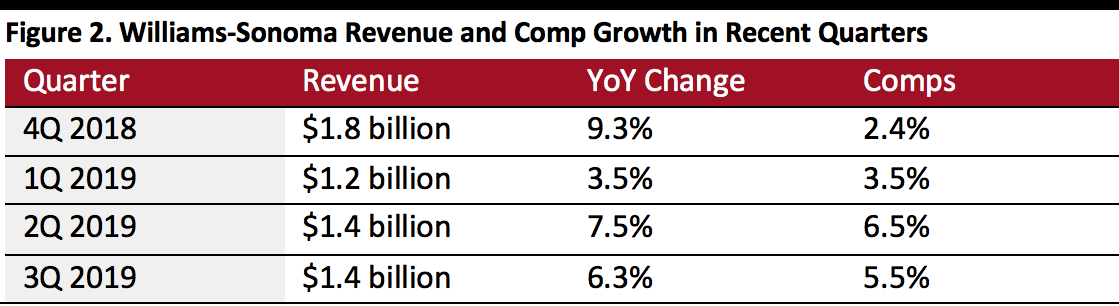

If the experience of Williams-Sonoma is anything to go by, omnichannel looks to be the way forward in furniture retail. In its third quarter, ended November 3, 2019, Williams-Sonama recorded revenue growth of 6.3% year over year, and e-commerce led this success with a 9.3% increase. Comps grew 5.5% year over year, and the company raised the low end of its guidance for fiscal year 2019. [caption id="attachment_103483" align="aligncenter" width="700"] Source: Company reports[/caption]

Not only has Williams-Sonoma managed to survive the disruption caused by e-commerce in the sector, it has also flourished in the changing environment through its digital transformation strategy.

As discussed earlier, other leading traditional and digital-first furniture and home-furnishing retailers like Casper, Home Depot, IKEA and Wayfair have all been making significant strides forward to evolve into strong omnichannel retailers.

Consumers today shop across channels, and if retailers can provide touch points and meet expectations at different stages of each buyer’s journey, they can strengthen their relationship with the customer to drive sales and loyalty.

Source: Company reports[/caption]

Not only has Williams-Sonoma managed to survive the disruption caused by e-commerce in the sector, it has also flourished in the changing environment through its digital transformation strategy.

As discussed earlier, other leading traditional and digital-first furniture and home-furnishing retailers like Casper, Home Depot, IKEA and Wayfair have all been making significant strides forward to evolve into strong omnichannel retailers.

Consumers today shop across channels, and if retailers can provide touch points and meet expectations at different stages of each buyer’s journey, they can strengthen their relationship with the customer to drive sales and loyalty.