DIpil Das

What’s the Story?

The fitness landscape in the US has transformed dramatically since the Covid-19 outbreak in March 2020, as consumers were forced to stay at home without access to gyms or fitness clubs, which have seen temporary closures and capacity restrictions. Home fitness has gained popularity as an alternative option to exercise and stay healthy, and consumer interest may remain heightened even post pandemic. In this report, we explore the booming home fitness market, including key players and trends.Why It Matters

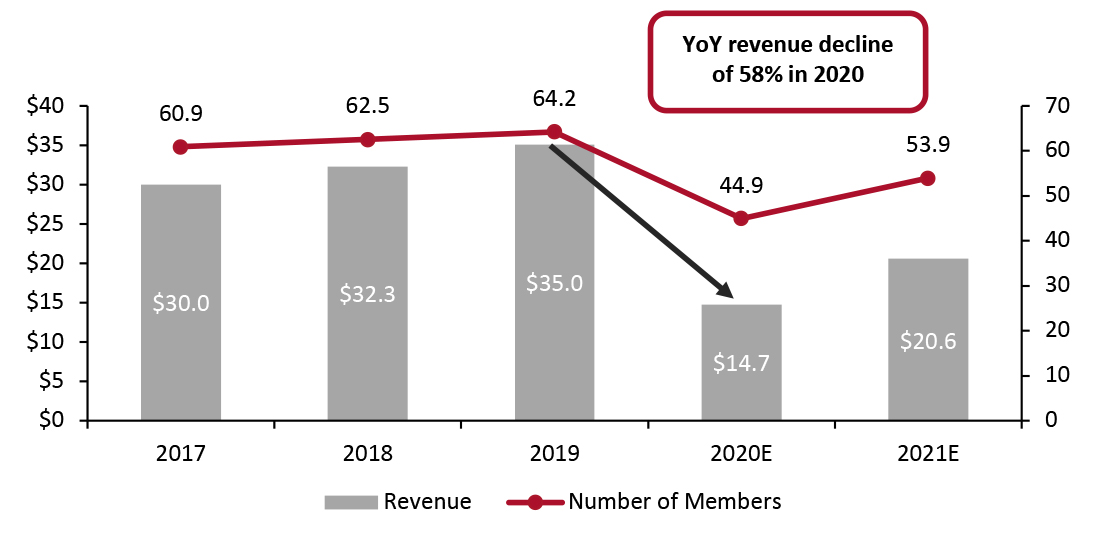

Before Covid-19, the fitness service industry had experienced a decade of steady growth. Fitness centers and gyms were then hit particularly hard by the pandemic, with almost all locations mandated to close in March 2020. Eight major fitness club operators filed for bankruptcy in 2020, and the IHRSA reported that 17% of fitness centers permanently closed last year. The IHRSA reported that revenue from US health and fitness clubs plunged by 58% year over year in 2020, to $15 billion. We estimate that membership declined by 30% to around 45 million, assuming around three in 10 members had canceled their gym membership during the pandemic (see Figure 1). The fall in revenue was more severe than the membership decline as many members chose to freeze their membership: According to a survey conducted by fitness consulting firm ClubIntel in November 2020, almost one-third of health club members in the US had paused their membership. However, demand for fitness remained strong, with consumers instead turning to at-home fitness equipment and solutions such as virtual classes. A survey conducted by media site The New Consumer and investment firm Coefficient Capital in December 2020 found that 76% of US consumers have tried working out at home since the outset of the pandemic and 66% of all respondents said they prefer it. For 2021, we estimate that US fitness centers will see a recovery of 20% in memberships and 40% in revenue, assuming the pandemic moderates with the rollout of vaccines. With many fitness clubs having developed digital fitness content to attract customers and offset losses amid closures, future revenue is likely to be supported by such online offerings, with clubs further enhancing their digital capabilities to boost customer loyalty and capitalize on the home fitness trend.Figure 1. Revenue from US Health and Fitness Clubs (USD Bil.; Left Axis) and Number of Members (Mil.; Right Axis) [caption id="attachment_126121" align="aligncenter" width="725"]

Source: IHRSA/Coresight Research[/caption]

Source: IHRSA/Coresight Research[/caption]

Home Fitness: In Detail

Home Fitness Gains Traction At-home workouts were on the rise even before the pandemic, thanks to their convenience and accessibility for exercisers. The cost to exercise at home varies, from free exercise videos to less than $50 for a pair of dumbbells or exercise bands to over $1,000 for bikes or treadmills. The average gym membership in the US costs $52 per month—around $624 per year, according to IHRSA. Although the cost of home gyms could outweigh the gym membership fee at some fitness chains, the convenience and time saved makes home fitness an attractive option for many. The pandemic has further accelerated the at-home fitness trend. Fitness app Freeletics found that Americans invested an average of $95.79 in at-home fitness during April–June, 2020. Providers of connected fitness equipment have reported significant sales growth due to Covid-19: Peloton’s sales skyrocketed 232% year over year in the quarter ended September 30, 2020; and Tonal reported a staggering 700% year-over-year growth in sales in 2020. We estimate that the total home fitness market, which includes fitness apps, wearables and equipment grew by 35% last year, to total $16.8 billion. Services have long comprised a larger part of the fitness industry—as shown in Figure 1, the health and fitness club sector was worth $35 billion before the crisis, in 2019. However, fitness products took the lead in 2020 due to the pandemic, totaling around $2 billion more than health and fitness club revenues during the year. The estimated increase in spending on home fitness totaled $4.4 billion in 2020 (as charted below) while the estimated decrease in spending on services was a much more substantial $20.7 billion. Only a minority share (of around 22%) of the savings from fitness services flowed to fitness products during the year—implying that, as spending starts to flow back to fitness services in 2021 and into 2022, the home fitness segment can hold on to much of its gains. The surge in demand for home fitness solutions will sustain as more consumers embrace active lifestyles. Against strong comparatives for 2020, we expect moderation in 2021, with the market set to total $16.2 billion this year.Figure 2. US Home Fitness Market (USD Bil.) [caption id="attachment_126122" align="aligncenter" width="725"]

Source: Statista/Coresight Research[/caption]

Competitive Landscape

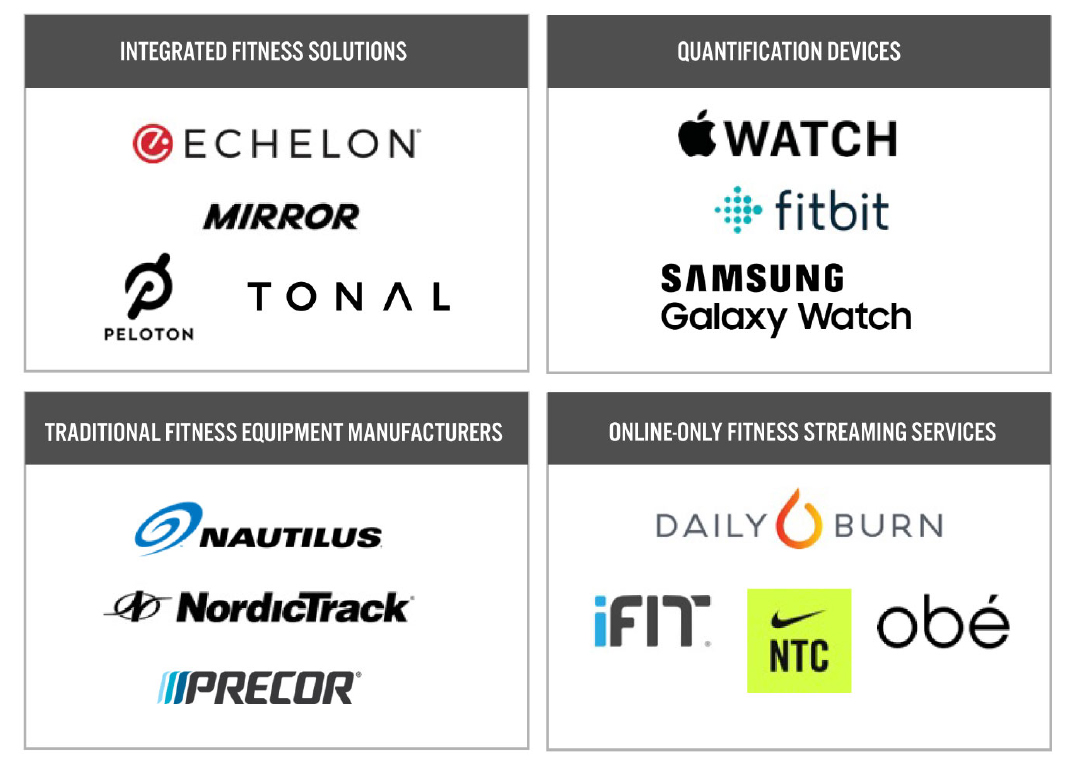

In Figure 3, we summarize the major players in the US home fitness market under four primary umbrellas: integrated fitness solutions, which usually offer connected fitness equipment that provides live and on-demand content; traditional fitness equipment manufacturers; and online-only fitness streaming services or apps. We discuss selected players in further detail below.

Source: Statista/Coresight Research[/caption]

Competitive Landscape

In Figure 3, we summarize the major players in the US home fitness market under four primary umbrellas: integrated fitness solutions, which usually offer connected fitness equipment that provides live and on-demand content; traditional fitness equipment manufacturers; and online-only fitness streaming services or apps. We discuss selected players in further detail below.

Figure 3. US Home Fitness Market: Competitive Landscape [caption id="attachment_126123" align="aligncenter" width="725"]

Source: Coresight Research[/caption]

DailyBurn

DailyBurn is a health and fitness company that provides multi-platform workout videos and nutrition programs:

Source: Coresight Research[/caption]

DailyBurn

DailyBurn is a health and fitness company that provides multi-platform workout videos and nutrition programs:

- DailyBurn Tracker is an online service that provides fitness plans, nutritional tracking and social motivation.

- Meal Snap enables users to take pictures of their meal to access instant information on the foods in the meal and their calorie counts.

- Food Scanner is a nutritional tracking tool that enables users to scan barcodes on food products to access detailed nutritional information.

Source: Mirror[/caption]

NIKE made its premium health and fitness content free for everyone throughout 2020 due to Covid-19, to help health-oriented consumers maintain their exercise routines. The company also expanded its content to mindset, nutrition and sleep on its platforms. NIKE was able to attract more potential users as well as drive online sales. The company grew weekly active users on the Nike Training Club app by triple digits in its fourth quarter of fiscal 2020, ended May 31, 2020, which led to increased purchases—the Nike commerce app also saw triple-digit growth in both downloads and monthly active buyers.

2. Home Fitness Becomes More Personalized and Gamified

We have seen companies increasingly leverage technology to make the at-home workout experience more personalized and gamified, in order to retain users.

AI is being implemented in fitness products to learn users’ exercise and recovery behaviors and optimize their fitness regimes to enable them to hit goals. Tonal’s wall-mounted connected weight-training equipment uses electromagnetic technology to create resistance. Users can choose different workout goals, and with AI, Tonal automatically provides resistance for various exercises and adjusts the weight in real time. The equipment also incorporates up to 17 sensors to provide real-time guidance on a user’s form, replicating a personal trainer. Aly Orady, CEO of Tonal, noted that the brand increased its sales eightfold in 2020.

Similarly, home workout system provider Tempo Studio leverages motion sensors and AI technology to deliver instant feedback to users. The sensor pinpoints 25 essential joints and generates a 3D model of the user’s body for assessment, so that during workouts, AI trainers can provide personalized feedback and notes.

VR is another technology that is reshaping the home fitness market. Supernatural develops one-to-one workouts in a fun and exhilarating way, designed for VR headset Oculus Quest. The app combines virtual fitness coaches, virtual landscapes and music to create various fitness classes. Each workout is also personalized based on users’ measurements.

[caption id="attachment_126125" align="aligncenter" width="725"]

Source: Mirror[/caption]

NIKE made its premium health and fitness content free for everyone throughout 2020 due to Covid-19, to help health-oriented consumers maintain their exercise routines. The company also expanded its content to mindset, nutrition and sleep on its platforms. NIKE was able to attract more potential users as well as drive online sales. The company grew weekly active users on the Nike Training Club app by triple digits in its fourth quarter of fiscal 2020, ended May 31, 2020, which led to increased purchases—the Nike commerce app also saw triple-digit growth in both downloads and monthly active buyers.

2. Home Fitness Becomes More Personalized and Gamified

We have seen companies increasingly leverage technology to make the at-home workout experience more personalized and gamified, in order to retain users.

AI is being implemented in fitness products to learn users’ exercise and recovery behaviors and optimize their fitness regimes to enable them to hit goals. Tonal’s wall-mounted connected weight-training equipment uses electromagnetic technology to create resistance. Users can choose different workout goals, and with AI, Tonal automatically provides resistance for various exercises and adjusts the weight in real time. The equipment also incorporates up to 17 sensors to provide real-time guidance on a user’s form, replicating a personal trainer. Aly Orady, CEO of Tonal, noted that the brand increased its sales eightfold in 2020.

Similarly, home workout system provider Tempo Studio leverages motion sensors and AI technology to deliver instant feedback to users. The sensor pinpoints 25 essential joints and generates a 3D model of the user’s body for assessment, so that during workouts, AI trainers can provide personalized feedback and notes.

VR is another technology that is reshaping the home fitness market. Supernatural develops one-to-one workouts in a fun and exhilarating way, designed for VR headset Oculus Quest. The app combines virtual fitness coaches, virtual landscapes and music to create various fitness classes. Each workout is also personalized based on users’ measurements.

[caption id="attachment_126125" align="aligncenter" width="725"] Source: Supernatural[/caption]

3. Fitness Clubs Make a Pivot to Digital

As fitness clubs struggle to survive during the pandemic, many have pivoted to digital to stay connected with consumers. According to fitness consulting firm ClubIntel, 72% of fitness clubs now offer on-demand and livestreaming workout classes as of September 30, 2020, up from 25% in 2019.

One of America’s largest national chain gyms, Planet Fitness, began offering free online workout classes on its app in March 2020 for both members and non-members. On its third-quarter 2020 earnings call, the company reported high adoption of, and engagement on, its app, leading Planet Fitness to test a standalone digital-only membership at $5.99 per month, which could attract new customers and retain existing ones.

Partnering with digital fitness platforms was another approach for relatively smaller gym chains. Equinox-owned value chain Blink Fitness collaborated with fitness app Sworkit to give its members access to customizable at-home workouts. Premier health club Life Time has included Apple Fitness+ as part of its membership since late December 2020.

Source: Supernatural[/caption]

3. Fitness Clubs Make a Pivot to Digital

As fitness clubs struggle to survive during the pandemic, many have pivoted to digital to stay connected with consumers. According to fitness consulting firm ClubIntel, 72% of fitness clubs now offer on-demand and livestreaming workout classes as of September 30, 2020, up from 25% in 2019.

One of America’s largest national chain gyms, Planet Fitness, began offering free online workout classes on its app in March 2020 for both members and non-members. On its third-quarter 2020 earnings call, the company reported high adoption of, and engagement on, its app, leading Planet Fitness to test a standalone digital-only membership at $5.99 per month, which could attract new customers and retain existing ones.

Partnering with digital fitness platforms was another approach for relatively smaller gym chains. Equinox-owned value chain Blink Fitness collaborated with fitness app Sworkit to give its members access to customizable at-home workouts. Premier health club Life Time has included Apple Fitness+ as part of its membership since late December 2020.

What We Think

It is no surprise that gym-goers shifted to home fitness and invested in fitness equipment and wearables during the pandemic. We believe that the home fitness trend is here to stay, as more consumers are seeking active lifestyles but want the convenience and accessibility that home fitness solutions offer. Although current heightened interest may wane in line with consumers becoming more comfortable with returning to gyms due to the gradual rollout of vaccines, we believe that digital fitness will continue to be an important part of consumers’ daily lives, and the market will remain above pre-pandemic levels in the long term. The IHRSA told Coresight Research that it expects the future of fitness to be omnichannel. In its “2020 Health Club Consumer Report,” the IHRSA stated that one in five health club members used a premium online fitness service in 2019, and consumers will most likely continue to expect virtual offerings due to the shift to at-home exercise. However, the IHRSA believes that this will be alongside visiting the gym, as consumers are eager to engage in programs at their health and fitness facilities, such as small group classes and personal training. Although we do not think that home fitness will necessarily replace gyms, it does provide variety for consumers’ workout routines. The pandemic has paved the way for a hybrid approach to fitness in the future, with a blend of in-person and virtual workouts. We believe that the home fitness space will continue to expand well beyond the pandemic. According to IHRSA, 68% of Americans that started using an online fitness service during the pandemic plan to continue to do so in the future. We estimate that the home fitness market surpassed fitness services (health clubs) last year due to the pandemic. While the services market is expected to recover and overtake products again this year, we believe the gap between two will remain narrow as consumers embrace omnichannel fitness. Importantly, the estimated increase in spending on home fitness in 2020 was equivalent to only around 22% of the estimated reduction in spending on health and fitness clubs. This implies that the home fitness market can hold on to much of its gains amid a partial return of spending to services in 2021 and 2022. Implications for Brands/Retailers- Activewear brands can leverage online fitness content to stay connected with consumers, expand their reach and create brand awareness. They can also incorporate e-commerce features into their fitness apps or platforms to boost sales.

- Digital fitness companies should continue to improve the overall user experience with upgraded hardware and software to replicate in-person workouts in order to retain users in the post-pandemic future.

- Digital fitness companies can better leverage technology such as AI and VR to make the workout experience more personalized, interactive and entertaining, thus motivating users to increase their engagement levels.