DIpil Das

What’s the Story?

We assess what the rapid expansion of initial public offerings (IPOs) means for US and UK retailers and brands. We discuss key retail sectors for IPOs, analyze the trajectory of brands and retailers entering public markets through IPOs from 2016 to 2021 and discuss the aftermarket performance of recently completed retail-focused IPOs. Finally, we summarize noteworthy retail-focused IPO developments in the pipeline for 2022 and present our insights into why the future of IPOs in retail is solid for 2022 and beyond.- Read our separate reports on mergers and acquisitions (M&A) and special purpose acquisition companies (SPACs), which offer an alternative exit path.

Why It Matters

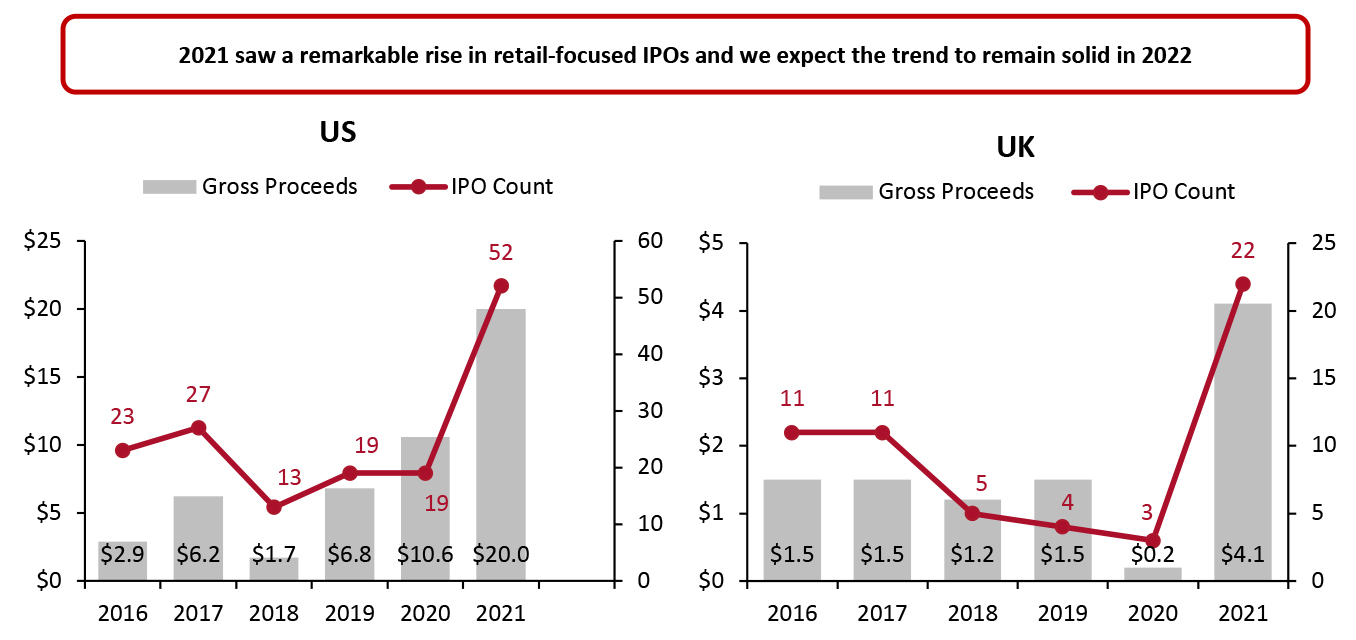

IPOs provide solid opportunities for brands and retailers to enter the public market and access funds for business expansion. Recently, we have witnessed a substantial acceleration in IPO trends among brands and retailers across the US and the UK. The US In 2021, 52 retail-focused IPOs debuted on US stock exchanges, raising $20.0 billion, compared to 19 IPO debuts in 2020, raising $10.6 billion, according to Coresight Research analysis of S&P Capital IQ data. The IPOs included companies in the consumer discretionary and consumer staples sectors, such as Internet and direct marketing retailers, apparel and footwear specialty stores, food retailers, home-goods retailers, packaged foods manufacturers, personal care products manufacturers, consumer durable and electronics stores, automotive retail and specialized consumer services providers, including payment platforms, among others. We expect the strong IPO trend in retail to continue through 2022, driven by anticipated continued strong equity market momentum, high liquidity availability and increasing Covid-19 vaccinations. The UK Unlike in the US, the retail-focused IPO market is small in the UK, but it is witnessing strong momentum. 2021 was an extraordinary year for retail-focused IPOs in the UK: 22 IPOs were listed on UK stock exchanges, raising $4.1 billion, versus three IPOs in 2020, raising only $161 million, according to our analysis of S&P Capital IQ data. The spectacular rise in retail-focused IPOs has been mainly driven by the public listings of Internet and direct marketing retailers (which we discuss in more detail later in this report). We expect the solid momentum and confidence in the UK retail and consumer goods IPO market to continue through 2022 and beyond, driven by a strong equity market and the rollout of Covid-19 vaccines.Figure 1. The US and the UK: Gross Proceeds of IPOs in the Retail Industry (Left Axis; USD Bil.) and IPO Count (Right Axis) [caption id="attachment_141842" align="aligncenter" width="700"]

Source: S&P Capital IQ/Coresight Research[/caption]

Source: S&P Capital IQ/Coresight Research[/caption]

IPOs in US and UK Retail: Coresight Research Analysis

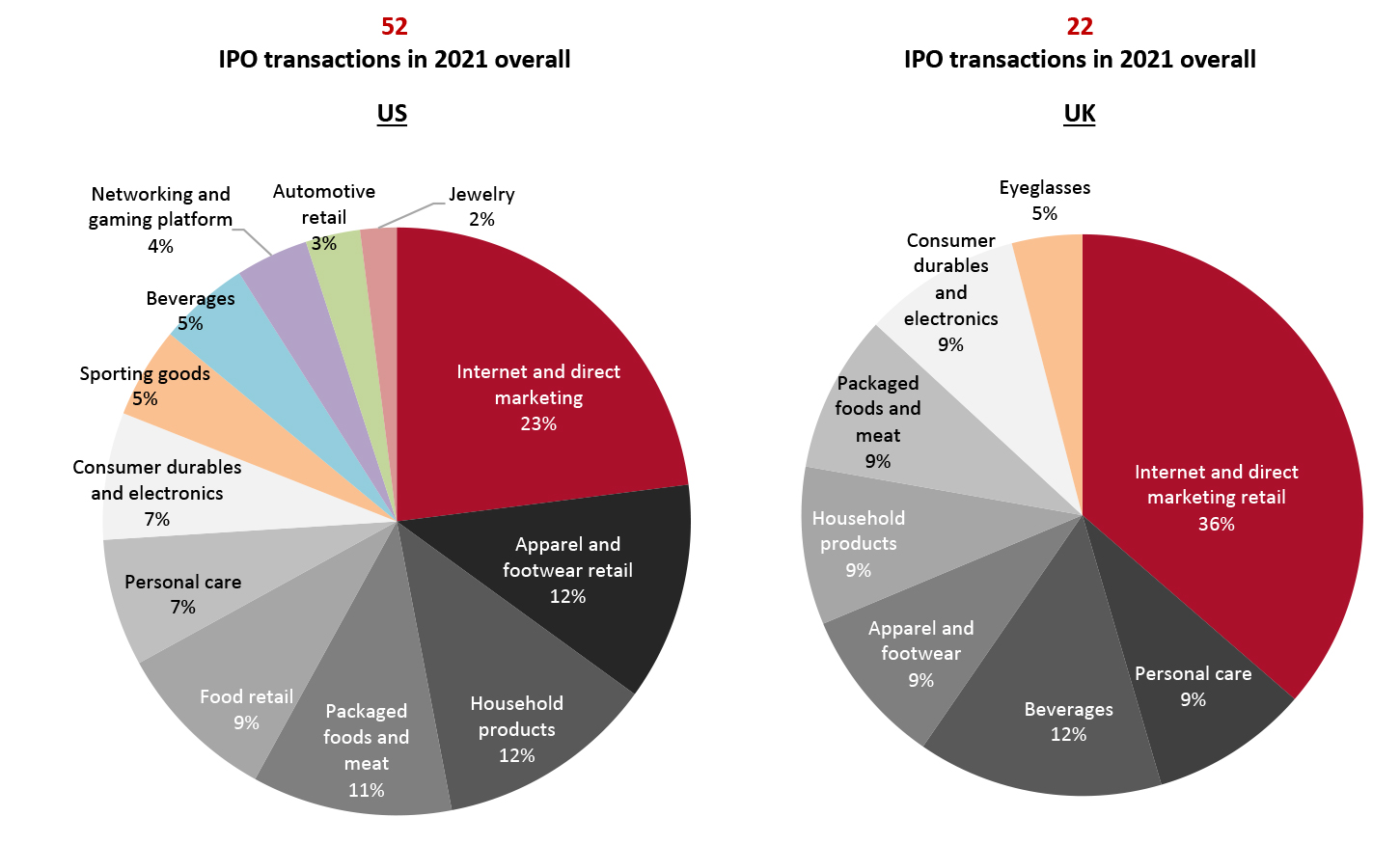

The US and the UK are witnessing bustling IPO markets. Retail-focused IPO issuances are increasing as public valuation multiples exceed private valuation multiples in the current equity markets of both nations. Valuation multiples are financial tools that assess one financial metric as a ratio of another for comparable analysis—for example, the price-to-earnings ratio and enterprise value to EBITDA are the most widely-used valuation multiples to facilitate comparisons among retail companies. Lower these ratios, and the investors find the companies more attractive. In 2022, we expect continued growth in retail-focused IPOs, with institutional and individual investors continuing to put cash to work despite a potential rise in interest rates. Key Retail Sectors for IPOs We assess the key retail areas that have witnessed the highest number of IPOs in the US and the UK for the full-year 2021. The US In 2021, the US retail-focused IPO market was diverse, with Internet and direct marketing retailers listing the highest number of retail and consumer goods IPOs, comprising about 23% of the total 52 transactions in the focus period, according to Coresight Research analysis of S&P Capital IQ data. Apparel and footwear retailers, which saw strong recoveries in 2021, listed the second-largest number of IPO transactions, comprising 12% of total transactions. Going forward, we expect to see continued growth momentum in Internet and direct marketing retail and apparel and footwear retail IPOs. We also expect to see more IPO transactions in the payment services sector, with more retailers and brand owners set to adopt a multi-channel approach and enhance their payment infrastructure in the current retail environment. The UK Like the US, the UK retail-focused IPO market saw transactions in several areas, with Internet and direct marketing retailers comprising the highest number and value of transactions: around 36% of the total 22completed IPOs in the focus period.Figure 2. The US and the UK: Completed Retail-Focused IPOs by Primary Industry, 2021 (% of Total Consumer IPOs) [caption id="attachment_141843" align="aligncenter" width="700"]

Source: S&P Capital IQ/Coresight Research[/caption]

Aftermarket Performance of Recently Completed Retail-Focused IPOs

Aftermarket performance—the variation in the price of the company’s newly issued stock up to one year after its IPO completion—is one of the useful metrics to gauge the success of an IPO.

However, price appreciation from the first day of trading to the current trading price does not necessarily indicate the successfulness of an IPO. The price-performance can be impacted by macroeconomic factors, global capital market conditions and normal practices of private equity firms selling some of their stakes to earn profits. To analyze the health of a newly public retailer, price-performance should be assessed along with other key indicators of success, including the company’s financials both top and bottom line, total valuation at the time of IPO launch, unique and differentiated business model, growing addressable market and robust future prospects.

The US

Most of the completed retail-focused IPOs in 2021 have witnessed negative aftermarket performance, with an average decline of 31.1% from January 1, 2021, to January 28, 2022—mainly due to volatility in the stock markets, apprehensions around surges in the number of new coronavirus cases and concerns over the potential increase in interest rates. We provide a full list of completed retail-focused IPO transactions in the US in 2021, and aftermarket performance as of January 28, 2022, in Figure 3.

While aftermarket price performance of many recently publicly listed retailers and brands remains dismal, their overall growth story is robust. We analyze two well-known IPO debuts, including key reasons for their aftermarket performance, in more detail below.

Source: S&P Capital IQ/Coresight Research[/caption]

Aftermarket Performance of Recently Completed Retail-Focused IPOs

Aftermarket performance—the variation in the price of the company’s newly issued stock up to one year after its IPO completion—is one of the useful metrics to gauge the success of an IPO.

However, price appreciation from the first day of trading to the current trading price does not necessarily indicate the successfulness of an IPO. The price-performance can be impacted by macroeconomic factors, global capital market conditions and normal practices of private equity firms selling some of their stakes to earn profits. To analyze the health of a newly public retailer, price-performance should be assessed along with other key indicators of success, including the company’s financials both top and bottom line, total valuation at the time of IPO launch, unique and differentiated business model, growing addressable market and robust future prospects.

The US

Most of the completed retail-focused IPOs in 2021 have witnessed negative aftermarket performance, with an average decline of 31.1% from January 1, 2021, to January 28, 2022—mainly due to volatility in the stock markets, apprehensions around surges in the number of new coronavirus cases and concerns over the potential increase in interest rates. We provide a full list of completed retail-focused IPO transactions in the US in 2021, and aftermarket performance as of January 28, 2022, in Figure 3.

While aftermarket price performance of many recently publicly listed retailers and brands remains dismal, their overall growth story is robust. We analyze two well-known IPO debuts, including key reasons for their aftermarket performance, in more detail below.

- Poshmark

The Indian market has over 622 million active Internet users and a rapidly growing base of sustainability and value-conscious consumers. India is an ideal fit for our unique social commerce model, both from a cultural and business perspective. Though still very early, India is off to a strong start with higher-than-expected user growth as we begin building the community.

Moreover, in October 2021, Poshmark made its first-ever acquisition of Suede One, a US-based platform that combines computer vision, machine learning technologies and human expertise to conduct virtual authentication of sneakers. Through this acquisition, Poshmark aims to drive platform innovation, enhance customer experience and accelerate growth in high potential resale categories, such as sneakers.- Rent the Runway

Figure 3. The US: Retail and Consumer Goods Completed IPO Transactions, 2021 [wpdatatable id=1730 table_view=regular]

Source: Company reports/S&P Capital IQ/Coresight Research The UK Like the US, most of the recently completed retail and consumer goods IPOs in the UK are witnessing negative price performance; however, the average price decline of the UK’s IPO was relatively lower (versus the US’s transactions) at (18.5)% for the completed transactions in 2021. We provide a list of notable completed retail-focused IPO transactions in the UK in 2021, and aftermarket performance as of January 28, 2022, in Figure 4. We analyze two well-known IPO debuts, including key reasons for their aftermarket performance, in more detail below.

- Deliveroo

- Dr. Martens

Figure 4. The UK: Retail and Consumer Goods Completed IPO Transactions, 2021 [wpdatatable id=1732 table_view=regular]

Source: Company reports/S&P Capital IQ/Coresight Research Upcoming Noteworthy Retail and Consumer Goods IPOs We believe there will be no shortage of retail and consumer goods IPO candidates in the near future, with retailers and brand owners across industries looking to tap the public markets via IPOs. However, the significant investment opportunities in the retail sectors will likely make investors more selective and price-sensitive, reflecting on recent aftermarket performance. Below, we discuss some of the noteworthy upcoming retail and consumer goods IPOs in the US and the UK. The US

- Instacart

- Mattress Firm

- Shein

- Stripe

- The Fresh Market

- Walmart-owned Flipkart

- Huel

- THG Beauty

This commitment reflects the continued strong organic growth of the division and its position as the industry’s digital strategic partner globally, its growing U.S. footprint, expanding global social media presence [more than 3 million Instagram followers] and vertically integrated model. A separate listing for THG Beauty will position the business very well to focus investment in its key growth areas, including own-brand portfolio expansion.

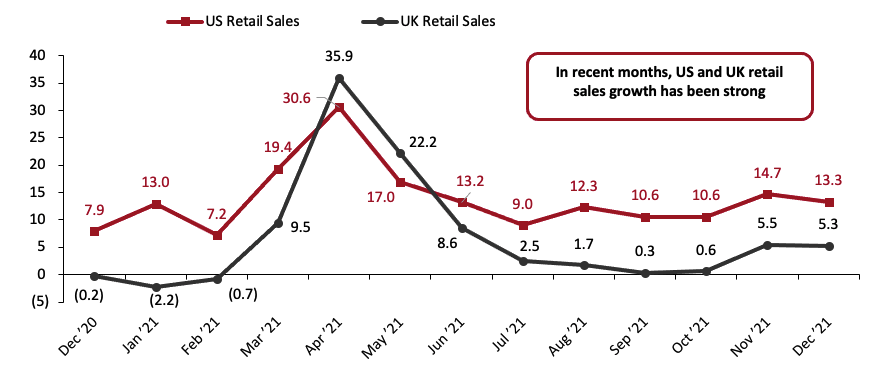

THG’s beauty division has been growing strongly in recent years. In fiscal 2020 (ended December 31, 2020), THG’s beauty revenues increased by 57.1% year over year to £751.6 million ($866.0 million). Similarly, in the first half of 2021 (ended June 30, 2021), THG beauty’s revenues grew 59.0% year over year. Lately, THG’s beauty division has ramped up its M&A activity to expand its business. In August 2021, THG acquired Cult Beauty, a luxury beauty e-commerce company, for £275.0 million ($316.9 million). Cult Beauty stocks over 300 brands, including Charlotte Tilbury, Drunk Elephant and Huda Beauty. Likewise, in December 2020, THG acquired US-based online skincare retailer Dermstore for $350 million in cash, adding to its portfolio of US and international beauty brands. At the time of acquisition, THG noted that Dermstore will add sales of about $180 million to THG’s sales in fiscal 2021. Additionally, in October 2020, THG acquired skincare brand Perricone for $60 million, adding the US label to the company’s beauty stable. Key Considerations for Private Retailers Entering the Public Market Via IPOs As brand owners and retailers grow, there comes a point at which going public becomes the most effective way to raise capital. With IPO market momentum growing strongly, many private retailers are assessing their readiness to become public companies. However, navigating the IPO pathway to going public is an enormous undertaking, and many retailers should assess the resource and time commitment required. We discuss key considerations at various phases of an IPO, along with the benefits and challenges of the IPO route for retailers, in our separate IPOs in Retail report published in June 2021. We believe that environmental, social and governance (ESG) considerations will continue to grow in importance for investors. Therefore, all retail-focused IPO candidates should clearly communicate their ESG impact to potential shareholders as part of their equity story and IPO diligence. This should be a key focus of pre-IPO readiness. Some of the recent key IPOs with sustainability-focused or mission-driven components include Allbirds, Rent the Runway, ThredUp and The Honest Company. The following two sections outline our key insights into IPO growth and potential headwinds in 2022. Five Key Insights into the Growth of Retailed-Focused IPOs In 2022, we expect to see a continued retail-focused IPO activity trend as brand owners and retailers take advantage of strong equity market momentum and high liquidity availability. Below, we examine five factors that we believe will drive retail-focused IPO activity in the US and the UK in 2022. 1. Ongoing Recovery in the US and the UK Retail Sectors The robust ongoing recovery seen in sales across industries in the US and the UK retail sectors will drive the retail-focused IPOs growth in 2022—with an inflow of funds from both domestic and international investors. The optimism linked to Covid-19 vaccinations is one key factor that will drive further retail recovery in 2022. In the US, 75% of the population have received at least one shot and 64% are fully vaccinated as of January 31, 2022, according to the US Center for Disease Control and Prevention. By comparison, approximately 76% of the UK population–about 52 million people–have received at least one vaccine shot and 71% are fully vaccinated as of January 31, 2022, according to the UK government.Figure 5. US and UK, Total Retail Sales: YoY % Change [caption id="attachment_141862" align="aligncenter" width="700"]

Source: ONS/US Census Bureau/Coresight Research[/caption]

2. Strong Equity Markets

The US and UK equity markets are witnessing strong growth momentum, and this makes IPOs an attractive investment option. The strong trends in these two nations’ equity markets are likely to continue in 2022.

3. Lofty Valuation and Pricing Volatility

In 2021, the US and UK stock markets witnessed new uptrends, driven by massive liquidity—to capitalize on attractive valuations, speculators invested significantly in IPOs in 2021, bolstering IPO trends. In 2022 and beyond, we expect entrepreneurial speculative firms to continue to invest in IPOs to capitalize on volatile capital markets and make a short-term profit, although this may come at the cost of small individual investors.

4. Growing Interests from Private Equity Players

In 2021, we saw a surge in private equity-backed IPO listings, and we expect the momentum to continue in 2022. Many private equity firms have been seeking exits from investments made in the past. The strong equity market provides profitable opportunities for those buyout firms taking their portfolio companies public. We see the retail sector as a likely point of interest for institutional and individual investors.

Recent high-profile private-equity-backed IPOs include the public listings of US-based apparel and footwear retailers Allbirds and JOANN and UK-based apparel and footwear retailer Dr. Martens and UK-based food delivery company Deliveroo.

5. Increased Receptiveness of the Market to Emerging Growth IPOs

Investors are taking an active interest in companies that have benefited from pandemic-related consumer shifts to e-commerce. For example, public Internet and digital marketing retailers are gaining traction among investors.

Potential Headwinds

We believe the following two key factors could hinder retail-focused IPO activity in the US and the UK in 2022.

Rising inflation and Increase in Interest Rates

To counter inflation, on December 18, 2021, the US Central Bank announced that the government could bring the stimulus to an end in March 2022, after which the bank would raise key interest rates. The Fed expects three interest rate increases in 2022, followed by three more in 2023. Similarly, on December 16, 2021, the Bank of England hiked the key interest rate to 0.25%, from 0.1%, to counter inflation.

An increase in interest rates could cool down IPO activity since higher interest rates will increase the opportunity cost for investment in growing public companies. In 2021, a part of the IPO market’s runaway success was owing to investors seeking higher returns than they might get in fixed-income markets. A higher interest rate could make those fixed-income investments start to look a little more appealing, which could hinder retail-focused IPO activity to some extent.

Proposed Increase in US Corporate Tax

In 2021, US president Joe Biden proposed an increase in various taxes in the US, including raising the corporate tax from 21% to 25%, to help finance the government’s infrastructure proposal. We believe the increase in the US corporate tax rate proposed by President Biden could decrease the attractiveness of investment in US public companies while leading to more investment overseas.

Nevertheless, the proposed tax changes are still under discussion and are heavily opposed by the US opposition party and business lobbies.

Source: ONS/US Census Bureau/Coresight Research[/caption]

2. Strong Equity Markets

The US and UK equity markets are witnessing strong growth momentum, and this makes IPOs an attractive investment option. The strong trends in these two nations’ equity markets are likely to continue in 2022.

3. Lofty Valuation and Pricing Volatility

In 2021, the US and UK stock markets witnessed new uptrends, driven by massive liquidity—to capitalize on attractive valuations, speculators invested significantly in IPOs in 2021, bolstering IPO trends. In 2022 and beyond, we expect entrepreneurial speculative firms to continue to invest in IPOs to capitalize on volatile capital markets and make a short-term profit, although this may come at the cost of small individual investors.

4. Growing Interests from Private Equity Players

In 2021, we saw a surge in private equity-backed IPO listings, and we expect the momentum to continue in 2022. Many private equity firms have been seeking exits from investments made in the past. The strong equity market provides profitable opportunities for those buyout firms taking their portfolio companies public. We see the retail sector as a likely point of interest for institutional and individual investors.

Recent high-profile private-equity-backed IPOs include the public listings of US-based apparel and footwear retailers Allbirds and JOANN and UK-based apparel and footwear retailer Dr. Martens and UK-based food delivery company Deliveroo.

5. Increased Receptiveness of the Market to Emerging Growth IPOs

Investors are taking an active interest in companies that have benefited from pandemic-related consumer shifts to e-commerce. For example, public Internet and digital marketing retailers are gaining traction among investors.

Potential Headwinds

We believe the following two key factors could hinder retail-focused IPO activity in the US and the UK in 2022.

Rising inflation and Increase in Interest Rates

To counter inflation, on December 18, 2021, the US Central Bank announced that the government could bring the stimulus to an end in March 2022, after which the bank would raise key interest rates. The Fed expects three interest rate increases in 2022, followed by three more in 2023. Similarly, on December 16, 2021, the Bank of England hiked the key interest rate to 0.25%, from 0.1%, to counter inflation.

An increase in interest rates could cool down IPO activity since higher interest rates will increase the opportunity cost for investment in growing public companies. In 2021, a part of the IPO market’s runaway success was owing to investors seeking higher returns than they might get in fixed-income markets. A higher interest rate could make those fixed-income investments start to look a little more appealing, which could hinder retail-focused IPO activity to some extent.

Proposed Increase in US Corporate Tax

In 2021, US president Joe Biden proposed an increase in various taxes in the US, including raising the corporate tax from 21% to 25%, to help finance the government’s infrastructure proposal. We believe the increase in the US corporate tax rate proposed by President Biden could decrease the attractiveness of investment in US public companies while leading to more investment overseas.

Nevertheless, the proposed tax changes are still under discussion and are heavily opposed by the US opposition party and business lobbies.

What We Think

We expect 2022 to be a solid year for the US and UK retail-focused IPO markets despite inflation worries, driven by strong equity market momentum, liquidity availability and optimism linked to Covid-19 vaccinations. In 2022 and beyond, we expect the retail and consumer goods IPO pipeline to further broaden in terms of sector representation, including more of the sectors that witnessed a strong recovery from the pandemic in 2021—such as specialist stores and personal care—in addition to the bustling Internet and direct marketing retail sector. An uptick in retail IPO activity could well intensify the competition for investment, placing greater focus on preparing early for IPO. IPOs provide robust opportunities for brand owners and retailers to access capital for liquidity and to fund expansion. However, if a private retailer is considering an IPO to enter the public market, it needs to weigh all of the pros and cons of an IPO carefully and take into account the alternative financing options available, such as SPACs. Implications for Brand Owners and Retailers- As we discussed in detail in our separate report, brand owners and private retailers should consider the long-term consequences of the public listing and ensure that entering the public market via IPO is aligned with their long-term goals and aspirations.

- Retailers can maximize the valuation in the IPO by ensuring that their equity story provides investor confidence that the company’s management is focused on the right growth channels in the marketplace to display the growth trajectory. A retailer’s equity story should include the addressable market, company strategy, growth drivers, financial projections and management experience.

- Brands and retailers should also incorporate ESG considerations into their equity story as investors see ESG as a key element to build a more sustainable business, which can adapt well to potential market shifts.

- Brands and retailers entering the public market via IPOs should remain vigilant for proposed regulatory changes and a potential stock market correction arising from growth in pricing volatility and the pace at which the world recovers from the pandemic.

- Developing a well-defined and comprehensive IPO tax and restructuring strategy across the entire enterprise will be helpful to retailers in post-IPO operations and in realizing the true value from the transaction.