albert Chan

Executive Summary

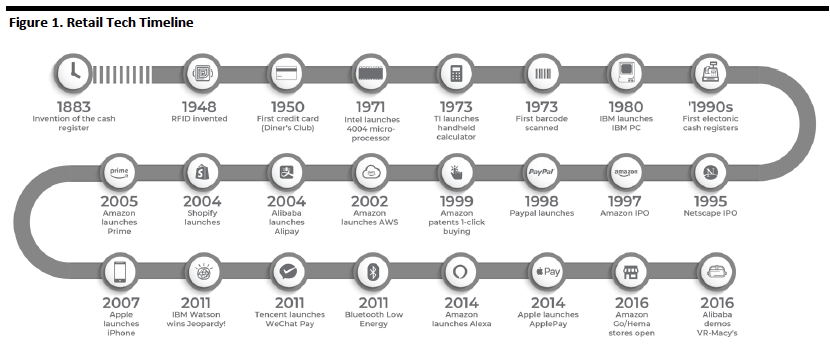

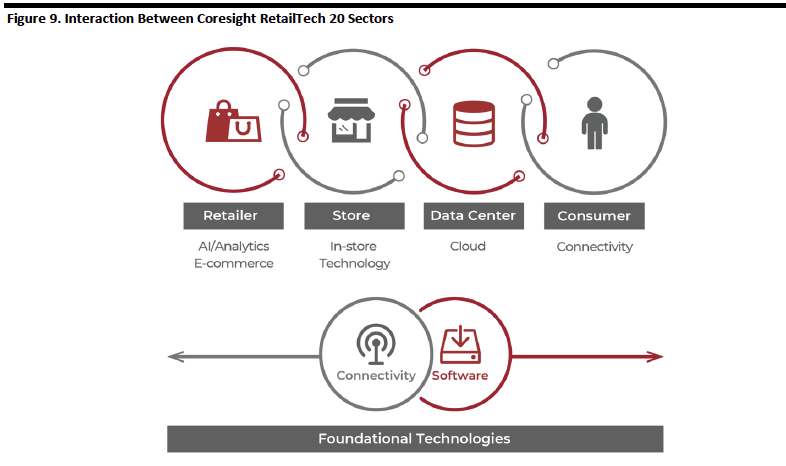

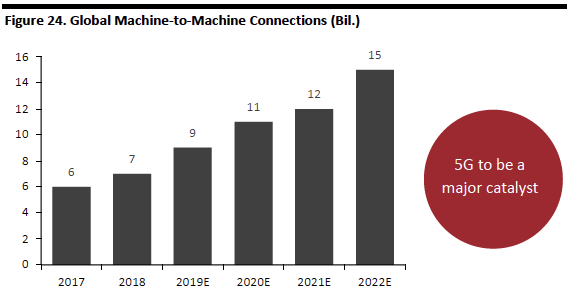

Retail has employed technology as far back as the invention of the abacus in 300-500 B.C. We had to wait a couple of millennia for the next breakthrough in 1883, when the cash register was invented. A century later, IBM launched the PC in 1980 – sparking the PC revolution. Just 15 years later, Netscape‘s 1995 IPO marked the coming Internet revolution. Not long thereafter, in 2007, came the iPhone, launching the smartphone revolution. What we are seeing is that not only are technology timelines compressing, but the magnitude of their impact is expanding exponentially: The Internet took far longer to impact retail than most pundits predicted, but the smartphone has moved shopping onto mobile platforms much more quickly. And soon we will have 5G wireless technology, which promises further transformations. Retailers spend a great deal on technology and store improvements, some $91.8 billion in 2017, according to data from the US Census Bureau. Still, retail’s capital spending lags other industries: While the overall market average is 4.63%, retailers spend a low-single-digit percentage of revenues on capital improvements, according to data from New York University Professor of Finance Aswath Damodaran. And of that relatively lower ratio of capital improvement spend, just 38% goes to technology (according to those retailers offering this breakdown), with the remaining 62% going to stores and store improvements. This report tackles the massive topic of technology in retail, looking at the background, the key players, the solutions on offer and what it all means for retail – with the caveat that such a huge topic is difficult to address all at once. We look at the companies that make up the Coresight RetailTech 20. We curated the top retail tech companies to create the list: They are the giants in the space, with nearly $1 billion in annual revenues, nearly $4 trillion in market capitalization and serving end-markets totaling at least $440 billion. To make the complex set of variables more manageable, we have divided the 20 companies into six segments – with the caveat that many big companies serve multiple segments: (1) AI/analytics; (2) Cloud; (3) Connectivity; (4) e-commerce; (5) In-store; and (6) Software Analytics and artificial intelligence (AI) offer great promise to solve the challenges faced in retail and other sectors. The two are often confused: They actually function differently and produce different outcome, but both technologies help retailers make use of mountains of consumer data to improve efficiency, better understand the customer to make relevant and personalized product selections and offers, as well as to remain competitive in a data-centric world. 5G wireless and the Internet of Things (IoT) promise to revolutionize retail and business the same way the advent of the Internet revolutionized the world. 5G will enable mobile users to connect a large number of nodes (such as people, vehicles, cities and traffic lights) to the Internet at high speeds, enabling all these devices to communicate with each other – potentially delivering enormous value that enriches our lives. Not to mention that consumers’ ability to shop anywhere, anytime will be further strengthened. What are the implications for retail? In this report, we explore AI and other technologies that offer the promise of enhancing retail:Introduction to Retail Tech

This report kicks off Coresight Research’s augmented coverage of retail technology, or “Retail Tech.” We hear a lot about retail. Technology receives a great deal of press; however, there is much less coverage that captures the place retail meets technology. This report seeks to fill that gap. This report also introduces the Coresight RetailTech 20, a selection of the 20 largest and most relevant global technology companies providing technology tailored for retail. This section discusses:- History of retail tech.

- The Coresight RetailTech 20.

- Retailer capital spending, including spending on technology.

- The advent of the Internet (enabling global connectivity).

- Amazon (defining the concept of e-commerce).

- the smartphone (enabling m-commerce).

Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Introducing The Coresight RetailTech 20

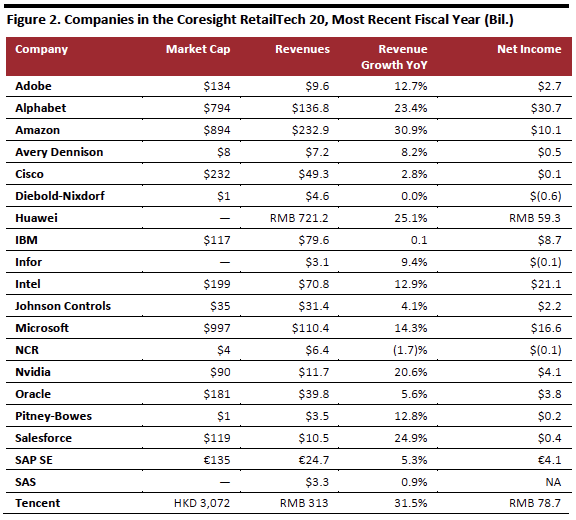

The table below contains the companies in the Coresight RetailTech 20, along with selected financial data. [caption id="attachment_89314" align="aligncenter" width="576"] Note: As of May 23, 2018

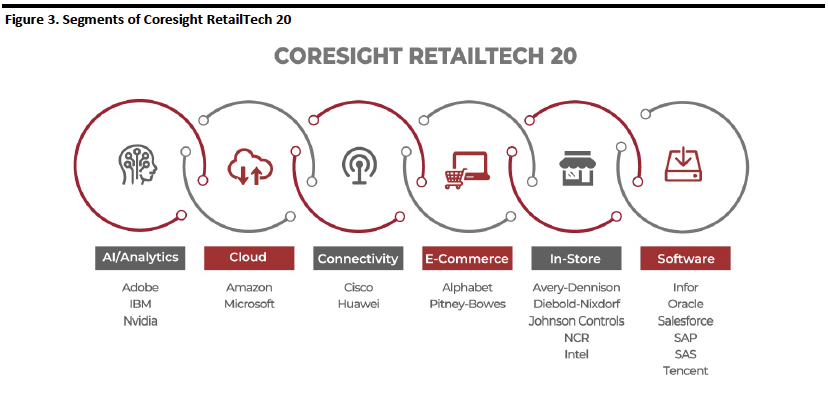

Note: As of May 23, 2018Source: S&P Capital IQ/Coresight Research[/caption] This figure groups the companies in the Coresight RetailTech 20: [caption id="attachment_89316" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Traditional Technology Pyramid

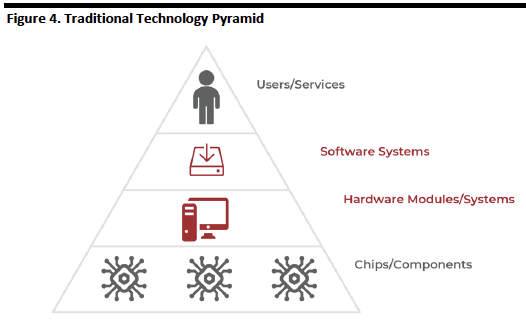

After breaking down the companies into more digestible categories based on the product or service they offer, bearing in mind many operate across categories, the next step is to take a look at the hardware, software and systems they use – again grouping what are actually thousands of various tasks into more digestible categories.

The diagram below illustrates a traditional view of technology, with increasing levels of abstraction and integration as one moves upward. On the bottom are the components — chips and components — which are integrated into hardware modules. The hardware modules are customized for the industry they support and given a human interface which become products or systems used by humans.

[caption id="attachment_89317" align="aligncenter" width="526"]

Source: Coresight Research[/caption]

Traditional Technology Pyramid

After breaking down the companies into more digestible categories based on the product or service they offer, bearing in mind many operate across categories, the next step is to take a look at the hardware, software and systems they use – again grouping what are actually thousands of various tasks into more digestible categories.

The diagram below illustrates a traditional view of technology, with increasing levels of abstraction and integration as one moves upward. On the bottom are the components — chips and components — which are integrated into hardware modules. The hardware modules are customized for the industry they support and given a human interface which become products or systems used by humans.

[caption id="attachment_89317" align="aligncenter" width="526"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

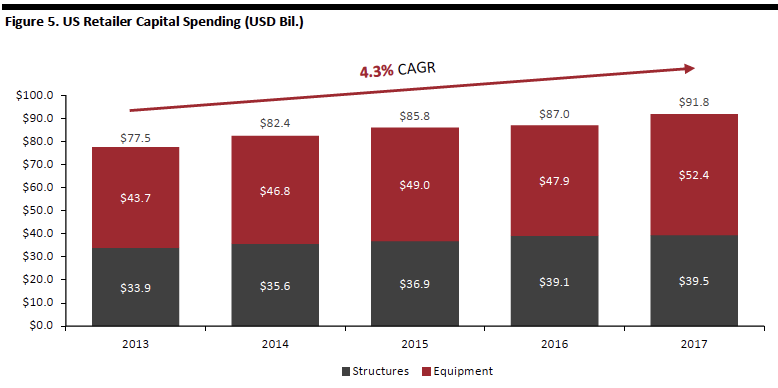

Retail Capital Spending

Retailers spend a great deal on technology and store improvements, some $91.8 billion in 2017, according to data from the US Census Bureau, increasing at a 4.3% CAGR during 2013-2017. Still, retail’s capital spending lags other industries: While the overall market average is 4.63%, retailers spend a low-single-digit percentage of revenues on capital improvements, according to data from New York University Professor of Finance Aswath Damodaran. And of that relatively lower ratio of capital improvement spend, just 38% goes to technology (according to those retailers offering this breakdown), with the remaining 62% going to stores and store improvements. [caption id="attachment_89318" align="aligncenter" width="700"] Source: US Census Bureau[/caption]

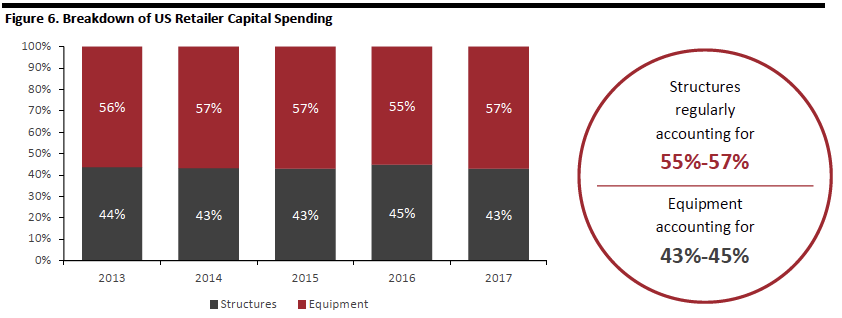

The figure below shows that the allocation of capex between structures and equipment has remained constant during 2013-2017, with structures regularly accounting for 56%-57% of capex and equipment accounting for 43%-45%.

[caption id="attachment_89320" align="aligncenter" width="700"]

Source: US Census Bureau[/caption]

The figure below shows that the allocation of capex between structures and equipment has remained constant during 2013-2017, with structures regularly accounting for 56%-57% of capex and equipment accounting for 43%-45%.

[caption id="attachment_89320" align="aligncenter" width="700"] Source: US Census Bureau/Coresight Research[/caption]

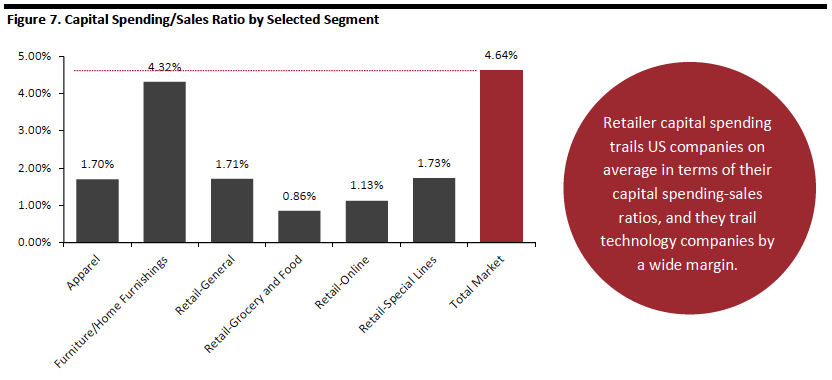

Retailer capital spending trails US companies on average in terms of their capital spending-sales ratios, and they trail technology companies by a wide margin. For example, business and consumer service companies spend 2.63% of revenues on capex, and system and application software companies spend 9.77% of revenues on capex.

Capex-sales ratios for selected retail segments are illustrated in the figure below.

[caption id="attachment_89322" align="aligncenter" width="700"]

Source: US Census Bureau/Coresight Research[/caption]

Retailer capital spending trails US companies on average in terms of their capital spending-sales ratios, and they trail technology companies by a wide margin. For example, business and consumer service companies spend 2.63% of revenues on capex, and system and application software companies spend 9.77% of revenues on capex.

Capex-sales ratios for selected retail segments are illustrated in the figure below.

[caption id="attachment_89322" align="aligncenter" width="700"] Source: Aswath Damodaran, NYU[/caption]

Retailer Tech Capex

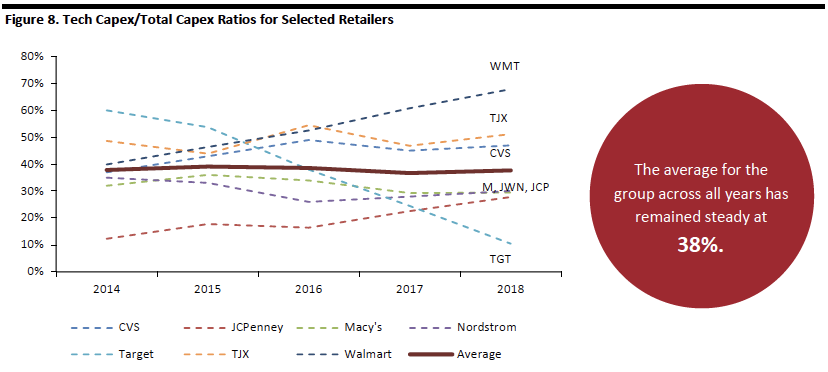

A selected group of retailers disclose the breakdown of their capital spending, and the capex/total capex ratios for retailers are shown in the figure below. The average for the group across all years has remained steady at 38%.

[caption id="attachment_89323" align="aligncenter" width="700"]

Source: Aswath Damodaran, NYU[/caption]

Retailer Tech Capex

A selected group of retailers disclose the breakdown of their capital spending, and the capex/total capex ratios for retailers are shown in the figure below. The average for the group across all years has remained steady at 38%.

[caption id="attachment_89323" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Although Target appears an outlier in the above figure, its capital spending on IT, supply chain and other remained constant at $568-620 million during 2016-2018, whereas total capital spending more than doubled during the period, driven by higher investments in existing stores.

Source: Company reports/Coresight Research[/caption]

Although Target appears an outlier in the above figure, its capital spending on IT, supply chain and other remained constant at $568-620 million during 2016-2018, whereas total capital spending more than doubled during the period, driven by higher investments in existing stores.

Segment Overviews

In this report, we break out the Coresight RetailTech20 in six broad segments:- AI/analytics.

- Cloud.

- Connectivity.

- E-commerce.

- In-store technology.

- Software.

Source: Company reports/Coresight Research[/caption]

AI/Analytics

AI is getting a lot of attention in technology, financial and other circles and sparking a global race for leadership. Decades of research into AI and neural networks, combined with dramatic increases in computing power, have finally delivered the breakthroughs that can power systems to analyze the massive amounts of data we are now collecting and make sense of it.

These breakthroughs have resulted in some stunning amounts being paid to acquire AI companies and invest in startups – and created a number of popular buzzwords. The reality is AI merely offers ways to analyze and identify data within the realm of computer science. In many cases, the term AI is incorrectly applied to what is in fact only analytics: analytics can leverage AI, but analytics in itself is not AI.

AI

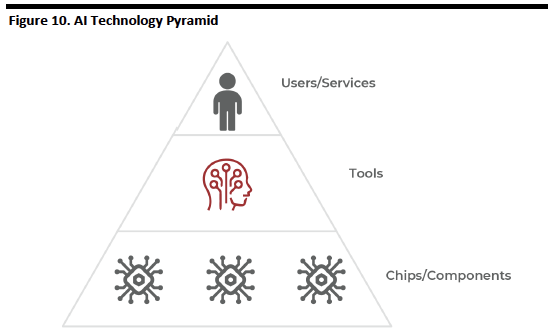

The figure below echoes the traditional technology pyramid. At the bottom are suppliers offering chips and components to vendors of hardware tools such as servers and computing clusters, which are then used and operated by service providers. At the top of the pyramid are consumer services (not covered in this report) such as voice-operated assistants and language translators.

IBM and Nvidia are classified as AI providers due to the interest they have received for their AI offerings, but IBM also provides a broad range of products and services while Nvidia’s AI capabilities are based in its design of graphical processing units for computer gaming. In addition, most cloud-based service providers also offer AI tools such as machine learning as part of their offerings. In addition, many software and service providers are developing their own AI chips.

[caption id="attachment_89326" align="aligncenter" width="548"]

Source: Company reports/Coresight Research[/caption]

AI/Analytics

AI is getting a lot of attention in technology, financial and other circles and sparking a global race for leadership. Decades of research into AI and neural networks, combined with dramatic increases in computing power, have finally delivered the breakthroughs that can power systems to analyze the massive amounts of data we are now collecting and make sense of it.

These breakthroughs have resulted in some stunning amounts being paid to acquire AI companies and invest in startups – and created a number of popular buzzwords. The reality is AI merely offers ways to analyze and identify data within the realm of computer science. In many cases, the term AI is incorrectly applied to what is in fact only analytics: analytics can leverage AI, but analytics in itself is not AI.

AI

The figure below echoes the traditional technology pyramid. At the bottom are suppliers offering chips and components to vendors of hardware tools such as servers and computing clusters, which are then used and operated by service providers. At the top of the pyramid are consumer services (not covered in this report) such as voice-operated assistants and language translators.

IBM and Nvidia are classified as AI providers due to the interest they have received for their AI offerings, but IBM also provides a broad range of products and services while Nvidia’s AI capabilities are based in its design of graphical processing units for computer gaming. In addition, most cloud-based service providers also offer AI tools such as machine learning as part of their offerings. In addition, many software and service providers are developing their own AI chips.

[caption id="attachment_89326" align="aligncenter" width="548"] Source: Coresight Research[/caption]

Tools

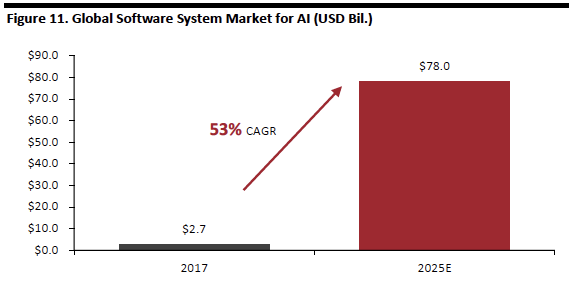

The global software system market for AI was $2.7 billion in 2017, growing at a 53% CAGR through 2025, according to QY Research. These figures indicate a software market of more than $6 billion in 2019.

[caption id="attachment_89327" align="aligncenter" width="572"]

Source: Coresight Research[/caption]

Tools

The global software system market for AI was $2.7 billion in 2017, growing at a 53% CAGR through 2025, according to QY Research. These figures indicate a software market of more than $6 billion in 2019.

[caption id="attachment_89327" align="aligncenter" width="572"] Source: QY Research[/caption]

Most cloud service providers offer AI functions with their service offering, including:

Source: QY Research[/caption]

Most cloud service providers offer AI functions with their service offering, including:

- Alibaba Cloud offers a machine learning platform for AI.

- Amazon AWS offers a full suite of machine-learning tools, including forecasting, TensorFlow, text and image recognition, translation and inference acceleration.

- Huawei Cloud offers a machine-learning service, as well as image, speech, handwriting and optical character recognition.

- IBM Cloud offers a broad array of tools based on its Watson AI platform, including the Watson Studio for building and training AI models and Watson Discovery for uncovering connections in data.

- Microsoft Azure offers tools for knowledge mining, machine learning, as well as a suite of AI apps and agents.

- Oracle Cloud offers an AI platform that includes AI tools, data-management tools, AI infrastructure, an autonomous database and an AI ecosystem.

- Tencent Cloud offers AI applications for multimedia content management and optical character recognition.

Source: Yole Développement[/caption]

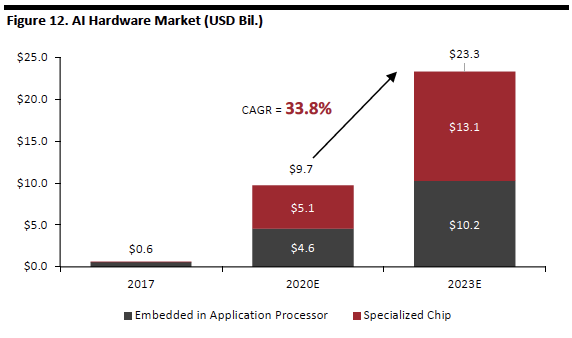

Chips used for AI include the following, generally used in the data center or the edge of the network (i.e., near the user):

Source: Yole Développement[/caption]

Chips used for AI include the following, generally used in the data center or the edge of the network (i.e., near the user):

- ASIC: application-specific integrated circuit.

- CPU: central processing unit.

- FPGA: field programmable gate array.

- GPU: graphics processing unit.

- Alibaba: Internal research arm Academy for Discovery, Adventure, Momentum and Outlook working on a chip called Ali-NPU to be available to public-cloud customers.

- Amazon: Amazon Web Services announced its Inferentia AI chip to be available in late 2019.

- Apple: A12 Bionic chip for the iPhone X uses a neural engine for photo enhancement.

- AMD: EPYC processors and Radeon Instinct GPUs to develop and test machine-learning and deep-learning systems.

- Baidu: Kunlun AI chip for edge and cloud computing.

- Facebook: Reportedly seeking engineers to design ASICs and FPGAs for applications.

- Google: Tensor Processing Units for the data center and the edge.

- Huawei: Ascend 910 chip for data centers and Ascend 310 for connected devices such as smartphones, smartwatches and IoT devices.

- IBM: Announced in February 2019 it is working with Applied Materials, Mellanox Technologies (to be acquired by NVIDIA), Samsung, Synopsis and Tokyo Electron.

- Intel: Announced the Nervana Network Processor for Inference to be available in the second half of 2019.

- Micron: Offers flash and dynamic random-access memory (RAM) for AI-capable servers in data centers.

- Microsoft: Has hired chip designers and created a deep-learning platform called Project Brainwave; recently selected Xilinx to supply coprocessors for its Azure cloud infrastructure.

- NVIDIA: Leading supplier of GPUs, including Tesla (used for deep learning and accelerated computing), and processors DRIVE AGX, SHIELD and Jetson AGX for applications such as autonomous driving, home AI and robotics.

- Qualcomm: Currently testing its Cloud AI chip with Microsoft and another partner for mass production in 2020.

- Samsung: The Exynos 9820 mobile SOC for smartphones (embedded in the Galaxy 10) includes a neural processing unit for AI functions.

- Toshiba: Deep neural networks are embedded in the Visconti 5 image-processing chip for advanced driver assistance systems.

- Xiaomi: Formed Dayu (“big fish” in Mandarin) to develop AI of things (AIoT) chips.

- Xilinx: Expanding its traditional FPGAs to include functions such as machine learning on the same chip.

- Communication: online personalization, conversational robots, chatbots and voice shopping.

- Optimization of pricing: demand forecasting, market and competitor analysis, and promotional strategies.

- Rationalization of inventory: automated shelf and inventory audits, demand forecasting, automated replenishment, and excess stock reduction.

- Experiential retail: delivery of new ways to discover, buy and pay.

- Relex: offers unified retail planning solutions.

- Revionics: provides SaaS using prescriptive analytics and machine learning to help retailers optimize pricing, promotions, markdowns and space.

- Trax: offers computer vision technology that helps retailers collect, measure and analyze the state of physical shelves.

Source: Global Market Insights[/caption]

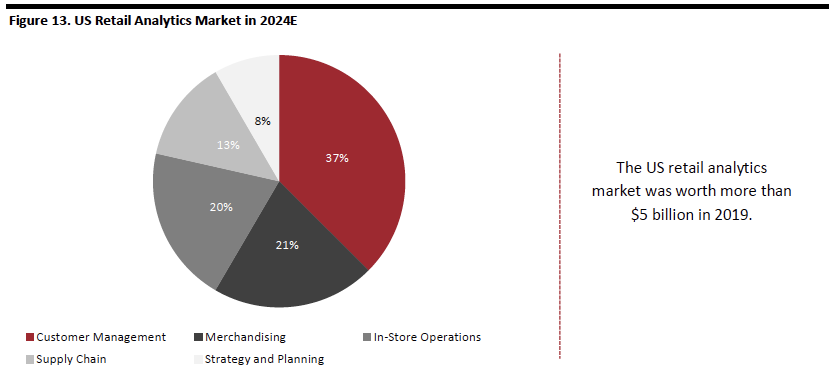

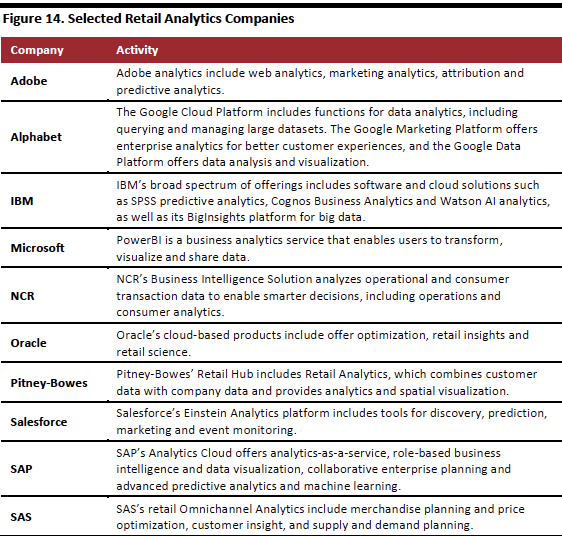

We are seeing more technology companies cross boundaries, moving into different product and service offering segments and analytics is no different.

[caption id="attachment_89330" align="aligncenter" width="562"]

Source: Global Market Insights[/caption]

We are seeing more technology companies cross boundaries, moving into different product and service offering segments and analytics is no different.

[caption id="attachment_89330" align="aligncenter" width="562"] Source: Company reports[/caption]

Other large companies involved in retail data analytics include 1010data, FLIR, RetailNext, Teradata and Zebra Technologies.

Emerging innovators in analytics and predictive analytics include DynamicAction, Euclid Analytics, First Insight, Jetlore, Kiana Analytics, Precima, Profitect and Quantifind.

Implications for Retail

Data-centric e-commerce companies have stepped up competition for traditional retailers, who have collected an enormous amount of customer data but now face the challenge of making sense of it – and using it to bolster their business. The promise is and have begun to face the challenge to create insights from this data to get to know their customer to offer relevant, personalized products and services.

Cloud

The idea of cloud computing began in the 1960s, based on the idea that computing resources could be provided by a distributed network. One idea led to the founding of Advanced Research Projects Agency Network (ARPANET) in 1969, which led to the advent of today’s Internet. Another idea viewed computing resources as a public utility, which, accompanied by an explosion in computing technology and networking speeds, led to today’s cloud computing.

Another major advance was the second-generation Internet, termed Web 2.0, in the late 1990s, as Internet companies such as Google began offering browser-based applications, leading to the provision of software as a service (SaaS). One important milestone was the founding of Salesforce.com in 1999.

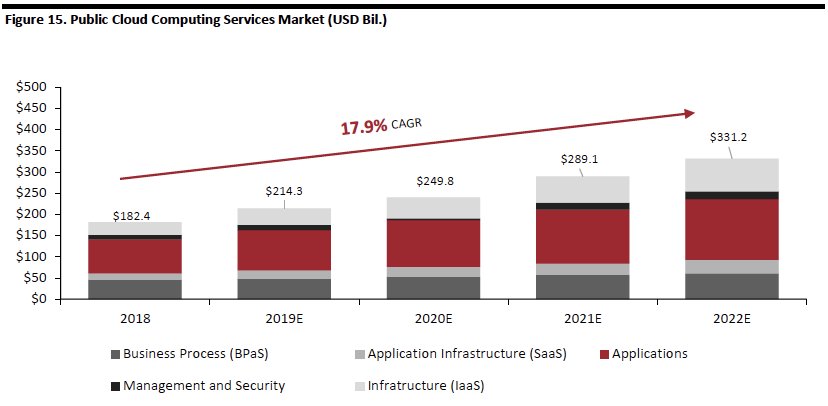

The cloud computing market is estimated at $214.3 billion in 2019 and is estimated to grow at a 17.9% CAGR during 2017-2022E by Gartner, as illustrated in the figure below. These estimates include business process, platform, infrastructure, software, management, security and advertising services.

[caption id="attachment_89331" align="aligncenter" width="700"]

Source: Company reports[/caption]

Other large companies involved in retail data analytics include 1010data, FLIR, RetailNext, Teradata and Zebra Technologies.

Emerging innovators in analytics and predictive analytics include DynamicAction, Euclid Analytics, First Insight, Jetlore, Kiana Analytics, Precima, Profitect and Quantifind.

Implications for Retail

Data-centric e-commerce companies have stepped up competition for traditional retailers, who have collected an enormous amount of customer data but now face the challenge of making sense of it – and using it to bolster their business. The promise is and have begun to face the challenge to create insights from this data to get to know their customer to offer relevant, personalized products and services.

Cloud

The idea of cloud computing began in the 1960s, based on the idea that computing resources could be provided by a distributed network. One idea led to the founding of Advanced Research Projects Agency Network (ARPANET) in 1969, which led to the advent of today’s Internet. Another idea viewed computing resources as a public utility, which, accompanied by an explosion in computing technology and networking speeds, led to today’s cloud computing.

Another major advance was the second-generation Internet, termed Web 2.0, in the late 1990s, as Internet companies such as Google began offering browser-based applications, leading to the provision of software as a service (SaaS). One important milestone was the founding of Salesforce.com in 1999.

The cloud computing market is estimated at $214.3 billion in 2019 and is estimated to grow at a 17.9% CAGR during 2017-2022E by Gartner, as illustrated in the figure below. These estimates include business process, platform, infrastructure, software, management, security and advertising services.

[caption id="attachment_89331" align="aligncenter" width="700"] Source: Gartner[/caption]

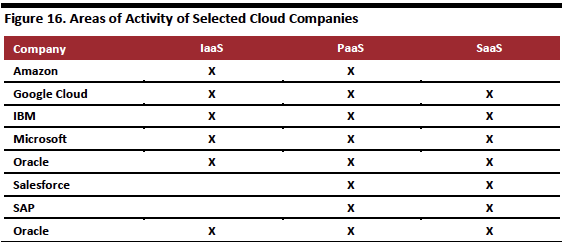

Cloud offerings can be broken down into three categories:

Source: Gartner[/caption]

Cloud offerings can be broken down into three categories:

- Hardware and real estate (data centers).

- Cloud software and services.

- Purely cloud-based software providers.

- IaaS (infrastructure as a service): Provides virtualized computing resources over the internet.

- PaaS (platform as a service): Provides a platform, enabling customers to develop, run, and manage applications without the need for their own infrastructure or software development.

- SaaS (software as a service): A software distribution model in which the provider hosts applications and makes them available to customers over the Internet.

Source: Cloudwars.co/company reports[/caption]

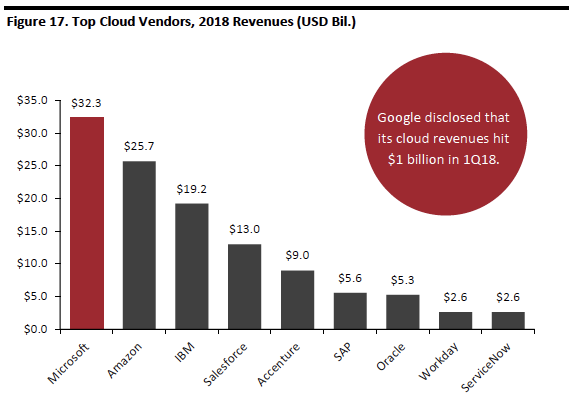

The figure below provides revenues for selected cloud vendors in 2018, with one notable exception — Google — which rarely discloses its cloud revenues. Google disclosed that its cloud revenues hit $1 billion in 1Q18, and the research firm Canalys estimates the company’s cloud revenues were $2.2 billion in 4Q18.

[caption id="attachment_89355" align="aligncenter" width="574"]

Source: Cloudwars.co/company reports[/caption]

The figure below provides revenues for selected cloud vendors in 2018, with one notable exception — Google — which rarely discloses its cloud revenues. Google disclosed that its cloud revenues hit $1 billion in 1Q18, and the research firm Canalys estimates the company’s cloud revenues were $2.2 billion in 4Q18.

[caption id="attachment_89355" align="aligncenter" width="574"] Source: Cloudwars.co[/caption]

Selected cloud vendors:

Alibaba Cloud: Founded in 2009, offers “elastic computing,” database services, domain and websites, storage and CDN (content delivery networks), networking, security, analytics and big data, application services, monitoring and management, in addition to AI. The company’s cloud business exited 3Q18 at a $4 billion annual revenue run rate.

Amazon AWS: Launched in 2002, offers a broad range of global compute, storage, database, and other service offerings, including analytics, blockchain, IoT, machine learning, mobile, robotics and security, identity and compliance.

Huawei Cloud: Established in 2017, offers more than 160 services to more than 6,000 partners in more than 170 countries and regions. Service offerings include compute, storage, network management, security, database and applications.

IBM Cloud: Launched in 2011, offers a full-stack (which includes the front and back ends) cloud platform that spans public, private and hybrid environments, comprising more than 170 products and services covering data, serverless environments, data containers, AI, IoT and blockchain.

Microsoft Azure: Released in 2010, offers more than 600 services, including IoT, running SAP. AI, Blockchain, Big Data and analytics, e-commerce and business intelligence.

Oracle Cloud: Based on Oracle Fusion applications launched in 2011, offers software as a service, platform as a service, infrastructure as a service and a Cloud Marketplace, which features more than 4,000 apps and services.

Tencent Cloud: Launched in 2013, offers compute, storage, database, CDN and acceleration and networking functions. The company disclosed its cloud revenues were RMB 6 billion (US$900 million) in 3Q18.

Other Chinese cloud providers include Kingsoft and NetEase.

Implications for Retail

In addition to cutting capital expenditure, cloud computing offers numerous benefits for retailers, such as flexibility, efficiency and value in terms of updates and availability from locations worldwide.

Target and Walmart have voiced their discomfort at their suppliers’ presence on AWS, which is owned by their fierce rival Amazon. This discomfort emerged following Amazon’s acquisition of Whole Foods, which put the company in direct competition with Target and Walmart in the grocery sector. Since then, Walmart has built its own server farms, five years in the making, and Target has become a large customer of Google Cloud.

Connectivity

Consumers and businesses connect electronically and wirelessly to each other. These are some of the present-day and future technologies that transmit this data:

Source: Cloudwars.co[/caption]

Selected cloud vendors:

Alibaba Cloud: Founded in 2009, offers “elastic computing,” database services, domain and websites, storage and CDN (content delivery networks), networking, security, analytics and big data, application services, monitoring and management, in addition to AI. The company’s cloud business exited 3Q18 at a $4 billion annual revenue run rate.

Amazon AWS: Launched in 2002, offers a broad range of global compute, storage, database, and other service offerings, including analytics, blockchain, IoT, machine learning, mobile, robotics and security, identity and compliance.

Huawei Cloud: Established in 2017, offers more than 160 services to more than 6,000 partners in more than 170 countries and regions. Service offerings include compute, storage, network management, security, database and applications.

IBM Cloud: Launched in 2011, offers a full-stack (which includes the front and back ends) cloud platform that spans public, private and hybrid environments, comprising more than 170 products and services covering data, serverless environments, data containers, AI, IoT and blockchain.

Microsoft Azure: Released in 2010, offers more than 600 services, including IoT, running SAP. AI, Blockchain, Big Data and analytics, e-commerce and business intelligence.

Oracle Cloud: Based on Oracle Fusion applications launched in 2011, offers software as a service, platform as a service, infrastructure as a service and a Cloud Marketplace, which features more than 4,000 apps and services.

Tencent Cloud: Launched in 2013, offers compute, storage, database, CDN and acceleration and networking functions. The company disclosed its cloud revenues were RMB 6 billion (US$900 million) in 3Q18.

Other Chinese cloud providers include Kingsoft and NetEase.

Implications for Retail

In addition to cutting capital expenditure, cloud computing offers numerous benefits for retailers, such as flexibility, efficiency and value in terms of updates and availability from locations worldwide.

Target and Walmart have voiced their discomfort at their suppliers’ presence on AWS, which is owned by their fierce rival Amazon. This discomfort emerged following Amazon’s acquisition of Whole Foods, which put the company in direct competition with Target and Walmart in the grocery sector. Since then, Walmart has built its own server farms, five years in the making, and Target has become a large customer of Google Cloud.

Connectivity

Consumers and businesses connect electronically and wirelessly to each other. These are some of the present-day and future technologies that transmit this data:

- Wireline

- Copper wire.

- Fiber optics.

- Wireless

- Bluetooth.

- Cellular.

- Satellite.

- Wi-Fi.

Source: ITCandor[/caption]

The technology pyramid in Figure 4 also reflects how diverse the massive industry is that provides telecom and networking equipment. Except for wireless base stations and handsets, several technology trends have largely merged the previous categories of wireline telecom equipment, data networking equipment and video-transmission equipment, thanks to data services such as voice over Internet protocol (VoIP) and streaming video.

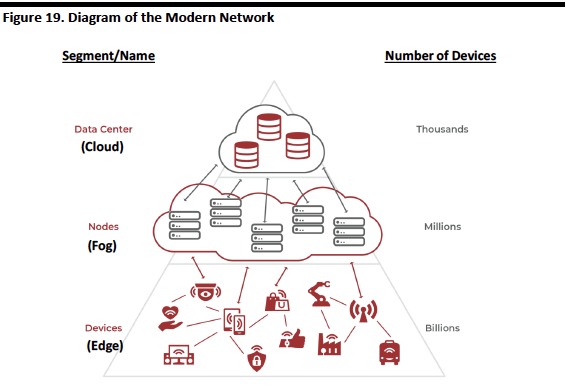

Today, we classify networks into three categories: the cloud, which contains several data centers located at unspecified parts of the network; the fog, which contains nodes of servers and processers located near the end-users; and, the edge of the network, which connects to users’ devices such as smartphones, PCs and devices at the edge, or last mile, of the network.

[caption id="attachment_89336" align="aligncenter" width="566"]

Source: ITCandor[/caption]

The technology pyramid in Figure 4 also reflects how diverse the massive industry is that provides telecom and networking equipment. Except for wireless base stations and handsets, several technology trends have largely merged the previous categories of wireline telecom equipment, data networking equipment and video-transmission equipment, thanks to data services such as voice over Internet protocol (VoIP) and streaming video.

Today, we classify networks into three categories: the cloud, which contains several data centers located at unspecified parts of the network; the fog, which contains nodes of servers and processers located near the end-users; and, the edge of the network, which connects to users’ devices such as smartphones, PCs and devices at the edge, or last mile, of the network.

[caption id="attachment_89336" align="aligncenter" width="566"] Source: Intel[/caption]

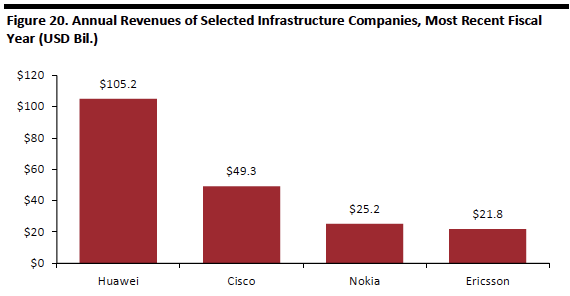

The figure below, which includes selected telecom and data-networking equipment companies, shows that Huawei has more than twice the revenues of its nearest competitor, Cisco.

[caption id="attachment_89337" align="aligncenter" width="570"]

Source: Intel[/caption]

The figure below, which includes selected telecom and data-networking equipment companies, shows that Huawei has more than twice the revenues of its nearest competitor, Cisco.

[caption id="attachment_89337" align="aligncenter" width="570"] Source: Company reports[/caption]

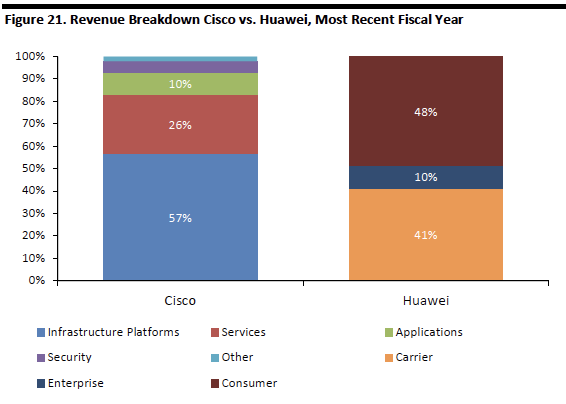

The figure below compares Cisco’s versus Huawei’s reported revenue by self-reported segment. Huawei’s revenues excluding its consumer segment were $53.7 billion, comparable to Cisco’s total revenues of $49.3 billion, though Huawei breaks out its carrier business. As mentioned above, with the advent of digital voice technologies, the distinction between telecom and datacom gear is becoming increasingly unclear.

[caption id="attachment_89338" align="aligncenter" width="566"]

Source: Company reports[/caption]

The figure below compares Cisco’s versus Huawei’s reported revenue by self-reported segment. Huawei’s revenues excluding its consumer segment were $53.7 billion, comparable to Cisco’s total revenues of $49.3 billion, though Huawei breaks out its carrier business. As mentioned above, with the advent of digital voice technologies, the distinction between telecom and datacom gear is becoming increasingly unclear.

[caption id="attachment_89338" align="aligncenter" width="566"] Source: Company reports[/caption]

Cisco believes that the cloud, AI, the IoT, 5G wireless and Wi-Fi 6 are coming together to revolutionize how businesses operate and deliver experiences, and the company claims to be building the only integrated, secure technological foundation to accommodate these technologies. The new technology will enable the secure connection of users and devices from any location. Moreover, Cisco is integrating AI and machine learning across the entire portfolio to offer its customers greater insights, creating better and faster business results.

At the time of this report’s writing, Huawei had been added to the US Commerce Department’s Entity List, which means it has been determined to be acting contrary to US national security or foreign policy interests. However, on May 20, 2019 Huawei was granted a 90-day temporary delay.

In addition to providing the servers and routers that power enterprises and the Intranet, Cisco’s DNA for Retail products offer insights and analytics, automation and assurance, security and compliance, virtualization and digital-ready infrastructure.

Huawei is the world’s second largest smartphone vendor (after Samsung), according to IDC, and offers several sets of solutions for Smart Retail. The company’s Smart Store includes solutions for store management, product AI, electronic shelf labels, customer segment analysis, commodity management and retail Wi-Fi. Its Retail Cloud Platform includes support for SAP HANA plus the company’s own Fusion ROBO solution for managing IT hardware in branches. Huawei also offers Smart Warehouse, which uses Wi-Fi and IoT to ensure Internet access and the that goods are automatically registered as they go into and out of the warehouse.

Implications for Retail

Connectivity technology continues to improve, with wireline networks powered by fiber optics and 5G wireless offering the speeds necessary to manage the huge amounts of data being generated and processed.

E-Commerce

Technologies such as the Internet, ever-increasing networking speeds and the deployment of higher wireline and wireless data-transmission speeds enabled the e-commerce revolution.

Global e-commerce grew 18% in 2018 to hit $2.86 trillion and account for 15.2% of retail sales in 2018, according to digitalcommerce360. US e-commerce was $514 billion in 2018, accounting for 9.7% of US retail sales, according to the US. Department of Commerce.

PipeCandy tracks more than 250,000 e-commerce companies in the US, and categorizes some of the technology suppliers as follows:

Source: Company reports[/caption]

Cisco believes that the cloud, AI, the IoT, 5G wireless and Wi-Fi 6 are coming together to revolutionize how businesses operate and deliver experiences, and the company claims to be building the only integrated, secure technological foundation to accommodate these technologies. The new technology will enable the secure connection of users and devices from any location. Moreover, Cisco is integrating AI and machine learning across the entire portfolio to offer its customers greater insights, creating better and faster business results.

At the time of this report’s writing, Huawei had been added to the US Commerce Department’s Entity List, which means it has been determined to be acting contrary to US national security or foreign policy interests. However, on May 20, 2019 Huawei was granted a 90-day temporary delay.

In addition to providing the servers and routers that power enterprises and the Intranet, Cisco’s DNA for Retail products offer insights and analytics, automation and assurance, security and compliance, virtualization and digital-ready infrastructure.

Huawei is the world’s second largest smartphone vendor (after Samsung), according to IDC, and offers several sets of solutions for Smart Retail. The company’s Smart Store includes solutions for store management, product AI, electronic shelf labels, customer segment analysis, commodity management and retail Wi-Fi. Its Retail Cloud Platform includes support for SAP HANA plus the company’s own Fusion ROBO solution for managing IT hardware in branches. Huawei also offers Smart Warehouse, which uses Wi-Fi and IoT to ensure Internet access and the that goods are automatically registered as they go into and out of the warehouse.

Implications for Retail

Connectivity technology continues to improve, with wireline networks powered by fiber optics and 5G wireless offering the speeds necessary to manage the huge amounts of data being generated and processed.

E-Commerce

Technologies such as the Internet, ever-increasing networking speeds and the deployment of higher wireline and wireless data-transmission speeds enabled the e-commerce revolution.

Global e-commerce grew 18% in 2018 to hit $2.86 trillion and account for 15.2% of retail sales in 2018, according to digitalcommerce360. US e-commerce was $514 billion in 2018, accounting for 9.7% of US retail sales, according to the US. Department of Commerce.

PipeCandy tracks more than 250,000 e-commerce companies in the US, and categorizes some of the technology suppliers as follows:

- 3D visualization

- Analytics

- Digital marketing

- Platforms

- Reviews

- Marketplaces

- Operations

- Product intelligence

Source: Apps Run the World[/caption]

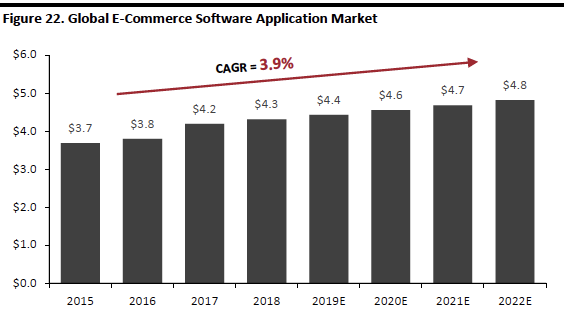

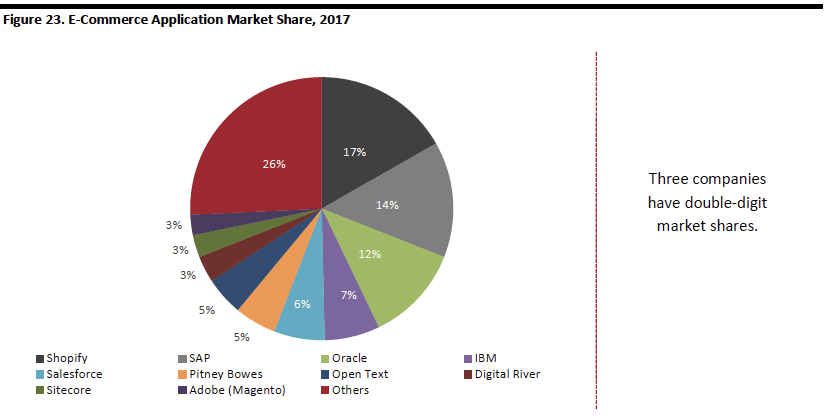

The figure below breaks down e-commerce software in 2017 for the top-10 vendors.

[caption id="attachment_89357" align="aligncenter" width="826"]

Source: Apps Run the World[/caption]

The figure below breaks down e-commerce software in 2017 for the top-10 vendors.

[caption id="attachment_89357" align="aligncenter" width="826"] Source: Company reports[/caption]

The Coresight RetailTech 20 companies that supply e-commerce vendors include:

Source: Company reports[/caption]

The Coresight RetailTech 20 companies that supply e-commerce vendors include:

- Adobe: Adobe Commerce Cloud integrates the acquired Magento Commerce platform (which offers commerce features, seamless shopping and other functions such as openness, customizability, security and marketplace) with the Adobe Experience Cloud (solutions for marketing, analytics, advertising and commerce).

- Alphabet: Google for Retail offers tools for retailers to manage products, advertise inventory and become a Google store, in addition to other services such as search, Google Analytics and Google Pay.

- IBM: The company’s WebSphere Commerce platform supports B2C, B2B and B2B2C models, in the mobile and social channels, with the ability to construct microsites with merchandising and marketing tools.

- Oracle: The Commerce Cloud offers a modular SaaS platform for B2B and B2C customers, including retail solutions such as customer acquisition and engagement, digital stores and digital-space monetization.

- Pitney Bowes: E-commerce solutions enable retailers to offer fulfillment, shipping, delivery, and returns – including cross-border commerce.

- Salesforce: The company bills CommerceCloud as the world’s leading B2B and B2C solution across the mobile, social, web and store channels.

- SAP: The company’s commerce easily integrates its Marketing Cloud, Sales Cloud, AP Service Cloud and SAP Customer Data Cloud with modules and accelerators designed for specific B2C and B2B verticals, including retail and fashion.

- Tencent: The company’s WeChat platform (a super-app) boasts more than one billion users and offers messaging, social media – and enables e-commerce using WeChat mini-apps and websites, supported by the company’s WeChat Pay mobile payment platform.

- Consumer smartphone apps: Consumers use apps to get pricing and additional information on products in the store.

- Customer tracking/identification: Use Bluetooth (beacons) or Wi-Fi to track customer movements in the store and communicate with customers’ smartphone apps.

- Electronic shelf labels: Enable remotely controlled, frequent updates and corrections of prices depending on demand, weather and competitor prices.

- Inventory tracking: Technologies such as machine and RFID can track inventory as it moves from the supplier to warehouse to physical store.

- Product tracking: Technologies such as RFID can track the location of products within a store.

- (Mobile) Point-of-Sale (POS) terminals: The traditional cash register has evolved to become an intelligent, mobile device.

- Robotics: Robots are being used to greet customers, fetch items, assist in picking and packing items in distribution centers, count items on the shelf and even vacuum and mop store floors.

- Self-checkout terminals: Customers can scan and pay, wait times and freeing up sales associates to interact with customers.

- Smart displays: Displays can advertise new products, promotions, or even visualize how a beauty product or garment looks on the customer.

- Traffic measurement: Devices can use optical or thermal technology to measure customer traffic into and within the store to determine popular items and evaluate conversion ratios.

- Diebold-Nixdorf: The company’s offerings include modular, integrated and mobile point-of-sale (POS) and self-checkout (SCO) terminals and ordering kiosks, in addition to products and services for connected commerce and management of store-fleet availability and performance.

- NCR: Retail products and services include POS hardware and software, mobile tools for sales associates, self-checkout solutions, inventory management products and payment-processing products.

- Oracle: POS products include workstations, tablets and complete solutions.

Source: Cisco VNI Global IP Traffic Forecast 2017-2022[/caption]

Providers of IoT technology in the Coresight RetailTech 20 include:

Source: Cisco VNI Global IP Traffic Forecast 2017-2022[/caption]

Providers of IoT technology in the Coresight RetailTech 20 include:

- Huawei: The company offers a combination of hardware such as agents and gateways plus software application program interfaces (APIs) and applications.

- Intel: Product offerings include Quark processors for microcontrollers, Atom system-on-a-chip processors, and high-performance 7th-generation Core and Xeon processors.

- Analytics.

- Cloud applications.

- Customer relationship management (CRM).

- E-commerce/enterprise order management.

- Employee sales tools.

- Enterprise resource planning (ERP).

- Inventory optimization/management.

- Merchandise and assortment planning.

- Office applications.

- Omnichannel.

- Point of sale (POS).

- Supply chain.

- Website operation.

- Payments.

- Security.

- Training.

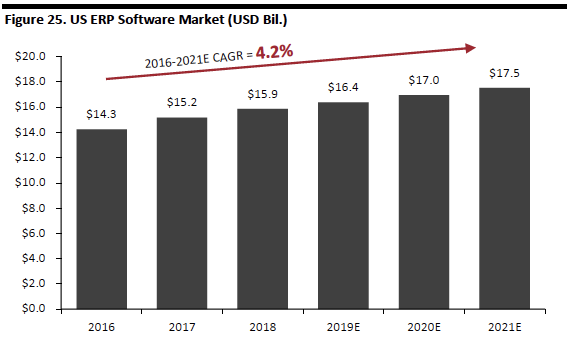

Source: Statista[/caption]

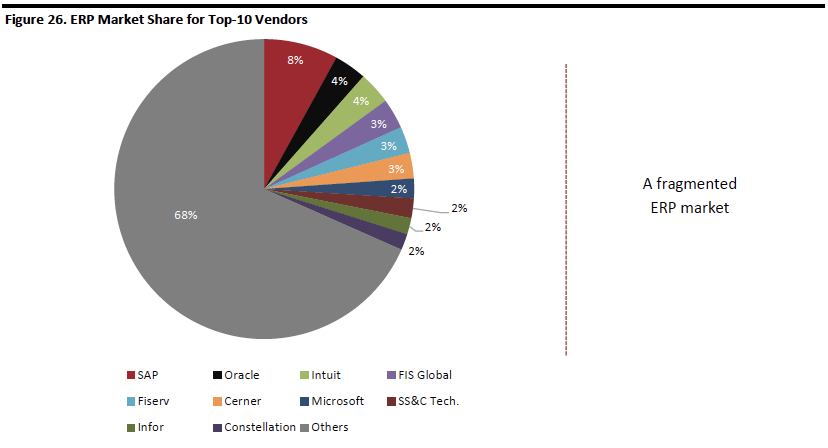

The figure below breaks down the ERP market shares, featuring the top-10 vendors.

[caption id="attachment_89359" align="aligncenter" width="828"]

Source: Statista[/caption]

The figure below breaks down the ERP market shares, featuring the top-10 vendors.

[caption id="attachment_89359" align="aligncenter" width="828"] Source: Apps Run the World[/caption]

ERP providers in the Coresight RetailTech 20 include:

Source: Apps Run the World[/caption]

ERP providers in the Coresight RetailTech 20 include:

- Infor: Offers its CloudSuite ERP for software for a variety of industries, including CloudSuite Fashion, which is tailored to the fashion industry.

- Microsoft: The company’s Dynamics 365 software offers applications for sales, service, marketing, finance and operations, HR, AI and managing digital content.

- Oracle: Its ERP cloud offers tools for financials, accounting, project management, procurement and risk management.

- Salesforce: In addition to CRM, the company’s platform offers functions including sales, service, marketing, engagement, analytics and productivity.

- SAP: ERP product offerings include SAP S/4 HANA (in regular and cloud versions), Cloud ERP, as well as other categories such as HR and people management, CRM and customer experience, digital supply chain and intelligent technologies.

- eBay (145 million accounts affected)

- Target (70 million customers and 40 million payment cards)

- Home Depot (56 million payment card numbers)

- TJX (45.7 million payment cards)

Source: The Economist Intelligence Unit[/caption]

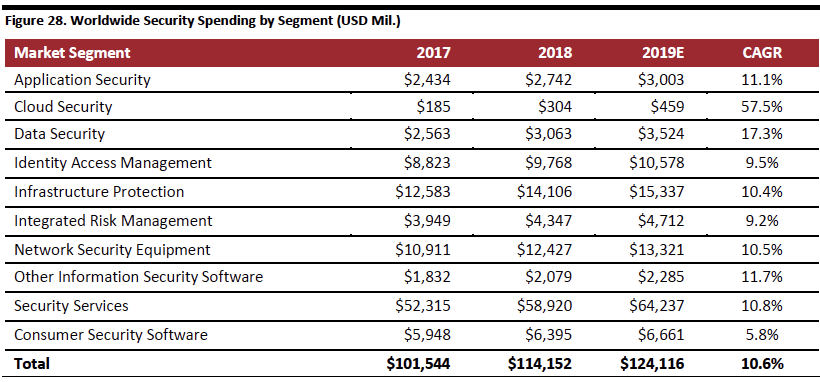

The table below details global security spending by segment, and cloud security, though the smallest segment is estimated to grow at the fastest rate, at a CAGR of 57.5% during 2017-2019E.

[caption id="attachment_89346" align="aligncenter" width="700"]

Source: The Economist Intelligence Unit[/caption]

The table below details global security spending by segment, and cloud security, though the smallest segment is estimated to grow at the fastest rate, at a CAGR of 57.5% during 2017-2019E.

[caption id="attachment_89346" align="aligncenter" width="700"] Source: Gartner/Coresight Research[/caption]

Activities of the Coresight RetailTech 20 in security include:

Amazon AWS’s security measures include built-in network firewalls, customer-controlled encryption, connectivity options for private or dedicated connections and automatic encryption of all traffic on the AWS global and regional networks between AWS secured facilities

Cisco provides a tailored security offering for retail comprising hardware, software, services and advice — called Cisco Security for Retail — that aims to offer end-to-end protection; safeguard customer, employee and credit-card data; protect before, during and after a cyberattack; reduce threat detection time and complexity.

Diebold Nixdorf’s expertise in security derives from its deep experience in providing automated teller machines (ATMs), point-of-sale (POS) systems and self-checkout machines. The company’s security product portfolio also includes solutions for maintaining physical and barrier security and its Vynamic software provides access protection, intrusion protection, hard-disk encryption and fraud detection.

Johnson Controls provides the Tyco Security Products it acquired, which offer access control, video, location-based tracking and intrusion detection.

SAS offers several product lines to detect fraud, ensuring anti-money laundering/countering the financing of terrorism (AML/CFT) compliance, a cybersecurity package in addition to software to assist investigations.

Implications for Retail

The several high-profile hacking scandals reinforce the need for retailers to make protecting customer data of the highest importance. Fortunately, there is an entire cybersecurity industry with many emerging innovators, and many cutting-edge solutions employ AI to find unanticipated irregularities in network usage that can alert you to potential hacking.

Source: Gartner/Coresight Research[/caption]

Activities of the Coresight RetailTech 20 in security include:

Amazon AWS’s security measures include built-in network firewalls, customer-controlled encryption, connectivity options for private or dedicated connections and automatic encryption of all traffic on the AWS global and regional networks between AWS secured facilities

Cisco provides a tailored security offering for retail comprising hardware, software, services and advice — called Cisco Security for Retail — that aims to offer end-to-end protection; safeguard customer, employee and credit-card data; protect before, during and after a cyberattack; reduce threat detection time and complexity.

Diebold Nixdorf’s expertise in security derives from its deep experience in providing automated teller machines (ATMs), point-of-sale (POS) systems and self-checkout machines. The company’s security product portfolio also includes solutions for maintaining physical and barrier security and its Vynamic software provides access protection, intrusion protection, hard-disk encryption and fraud detection.

Johnson Controls provides the Tyco Security Products it acquired, which offer access control, video, location-based tracking and intrusion detection.

SAS offers several product lines to detect fraud, ensuring anti-money laundering/countering the financing of terrorism (AML/CFT) compliance, a cybersecurity package in addition to software to assist investigations.

Implications for Retail

The several high-profile hacking scandals reinforce the need for retailers to make protecting customer data of the highest importance. Fortunately, there is an entire cybersecurity industry with many emerging innovators, and many cutting-edge solutions employ AI to find unanticipated irregularities in network usage that can alert you to potential hacking.

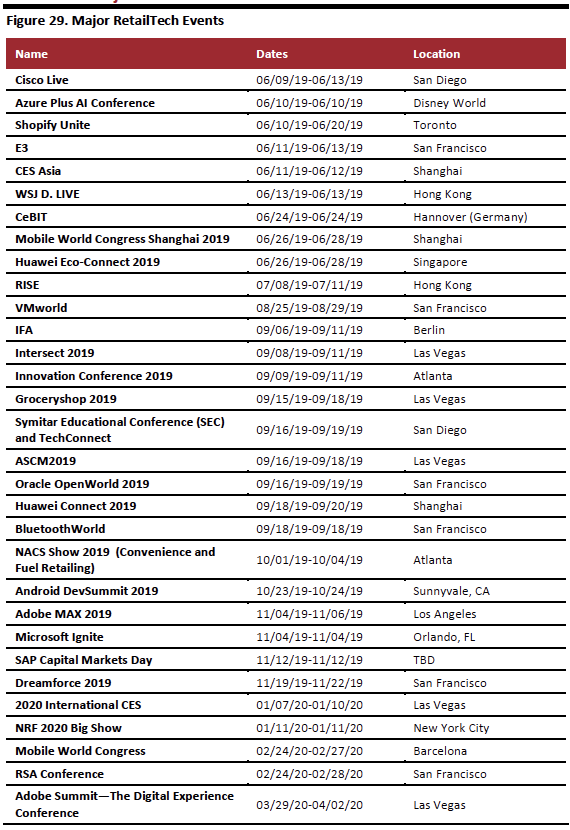

Calendar of Major RetailTech Events

[caption id="attachment_89347" align="aligncenter" width="570"] Source: Company reports[/caption]

Source: Company reports[/caption]