DIpil Das

Introduction

What’s the Story? We have revised the Coresight 100 list of leading global retailers—for a third time—and for the better. This year’s list includes companies selected on the basis of several performance criteria—we have also broadened the list’s global coverage and added one new research sector: consumer packaged goods (CPG). The full list is included in the report appendix. Why It Matters The Coresight 100 list defines and sets the direction and tone for our company research coverage for the year, comprising key sectors and companies that best suit our research ideas and capabilities. It also represents our view of the most important and influential brands and retailers that we believe our readers and subscribers should pay attention to. The list forms the basis for our company profiles, earnings updates, sector coverage and deep-dive research reports throughout the year. Starting this year, we will track the stock performance of the Coresight 100 versus major global retail indexes.Coresight 100 List for 2022: Coresight Research Analysis

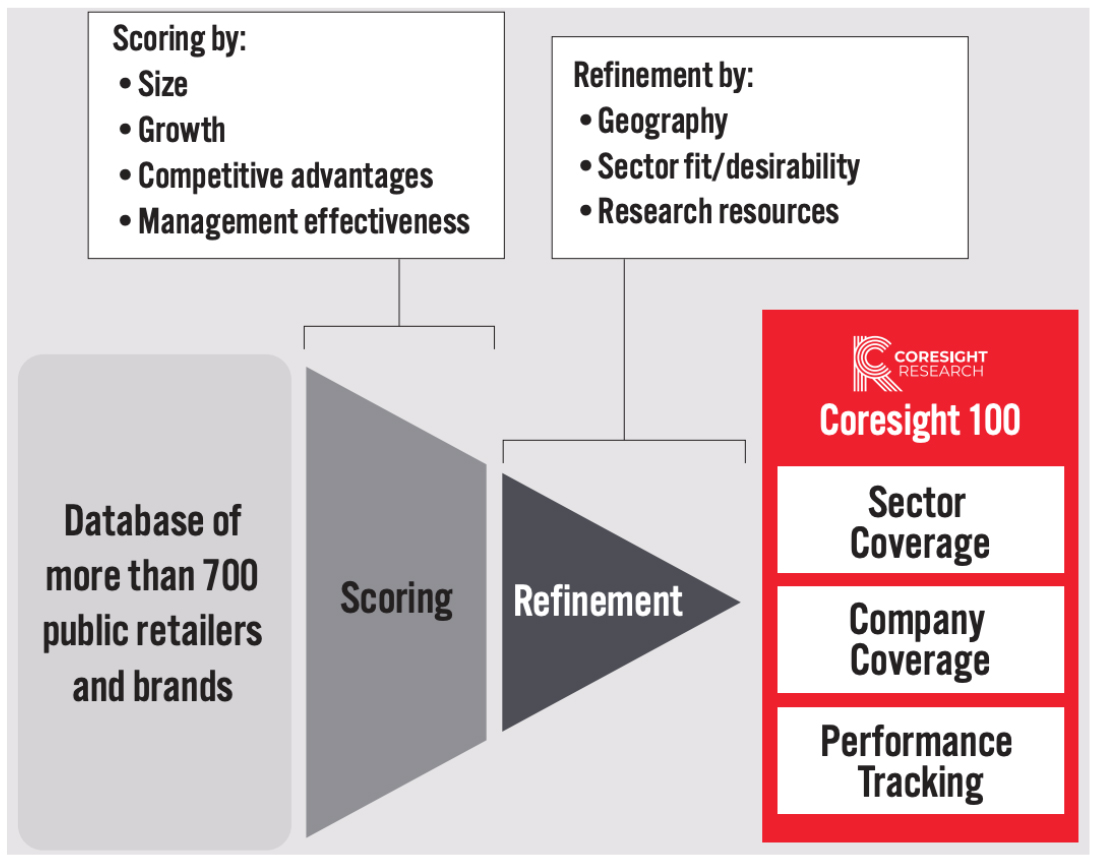

We first launched the Coresight 100 list of retail companies in 2018, and it has evolved as we have fine-tuned our research coverage and capabilities. The Coresight 100 list for 2022 has introduced a merit-based screening process to refine our database of more than 700 public brands and retailers down to 100 companies. We used size, growth, competitive advantages and management performance as criteria to distill this database of companies into a short list, which we then conformed to our sector, geographic and research resources to come up with the final C100 list for 2022. 1. What’s New in the Coresight 100 for 2022? The 2022 Coresight 100 list has been redesigned to meet the following goals:- Be more global

- Be more in line with stock performance

- Focus on public companies

- Restore coverage of the important CPG sector

- Feature trackable performance

Figure 1. Overview of Changes to Coresight 100 Selection Criteria [wpdatatable id=1650 table_view=regular]

Source: Coresight Research In terms of sector coverage, we have removed REITs and pure e-commerce marketplaces, which we plan to cover in more focused sector lists in the future. For the Coresight 100, we have opted to return to exclusively covering public companies due to the greater availability of data and financial information. Additionally, we have applied our selection criteria to all companies—no longer subjectively including innovators. 2. Sector and Geographic Coverage The 2022 Coresight 100 for 2022 includes a broader group of geographies and sectors.

- 14 geographies:

- Australia

- Canada

- Greater China

- France

- Germany

- Italy

- Japan

- The Netherlands

- Spain

- Sweden

- Switzerland

- The UK

- The US

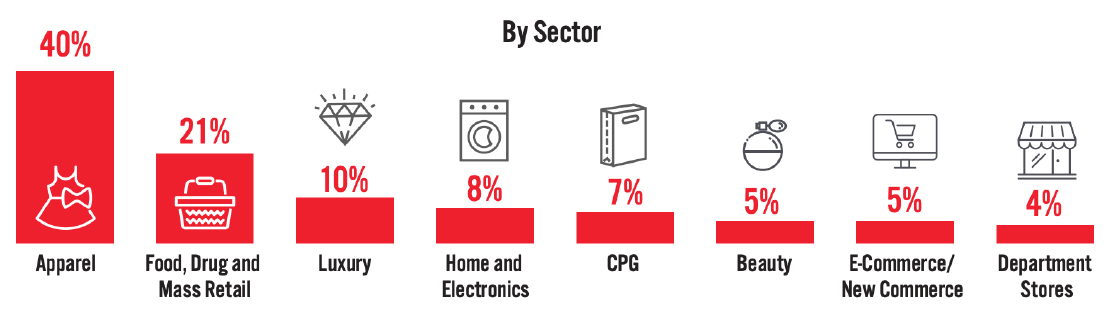

- Eight major sectors:

- Apparel brands and retailers

- Beauty brands and retailers

- CPG companies

- Department stores

- E-commerce/new commerce companies

- Food, drug and mass retailers

- Home and home-improvement retailers

- Luxury brands and retailers

Figure 2. Coresight 100 List by Sector [caption id="attachment_140370" align="aligncenter" width="700"]

See report appendix for the Coresight 100 list

See report appendix for the Coresight 100 list Source: Coresight Research [/caption] 3. Selection Criteria The evolution of geographical, sector and company coverage is detailed in Figure 3 below.

Figure 3. Overview of Changes to Coresight 100 Selection Criteria [wpdatatable id=1651 table_view=regular]

Source: Coresight Research One major change in 2022 is the introduction of performance criteria to create a shortlist from our database of more than 700 retailers and brands. Our criteria take into account the following metrics:

- Company size

- Revenue growth

- Competitive advantages

- Management execution

Figure 4. Coresight 100 List for 2022: Performance Criteria and Selection Process [caption id="attachment_140371" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

4. Performance Tracking

Following the launch of the new list on February 1, 2022, we will track the performance of the Coresight 100 as an equal-weighted stock index against appropriate benchmarks.

The table below calculates the performance of our two previous Coresight 100 lists—keeping in mind that they were largely designed to highlight significant large retailers, rather than to measure and optimize stock performance, though the second version included innovators and private companies. In the table, we see that the performance of the Coresight 100 lagged behind major indexes during 2018–2020, but outperformed them during 2020–2022.

Source: Coresight Research[/caption]

4. Performance Tracking

Following the launch of the new list on February 1, 2022, we will track the performance of the Coresight 100 as an equal-weighted stock index against appropriate benchmarks.

The table below calculates the performance of our two previous Coresight 100 lists—keeping in mind that they were largely designed to highlight significant large retailers, rather than to measure and optimize stock performance, though the second version included innovators and private companies. In the table, we see that the performance of the Coresight 100 lagged behind major indexes during 2018–2020, but outperformed them during 2020–2022.

Figure 5. Performance of Coresight 100 Indexes Versus Selected Stock Indexes [wpdatatable id=1652 table_view=regular]

Source: S&P Capital IQ/Coresight Research

What We Think

The many changes brands and retailers have experienced during the past two years amid the pandemic, present an opportune context to modify the Coresight 100 list—bringing it in line with the current retail environment, Coresight Research’s global footprint, and the ever-increasing significance of data. We have created a more global, data-focused list that is also more closely aligned with our research focus. We look forward to using this list as the basis for—but not as a limitation of—this year’s research coverage and research products. Ultimately, the Coresight 100 could be used by investors to track leading global retailers or by brands and retailers to follow important sector trends.Appendix: The Coresight 100 List

Appendix Figure 1. The Coresight 100 List for 2022 [wpdatatable id=1653 table_view=regular]

Source: S&P Capital IQ/Coresight Research