DIpil Das

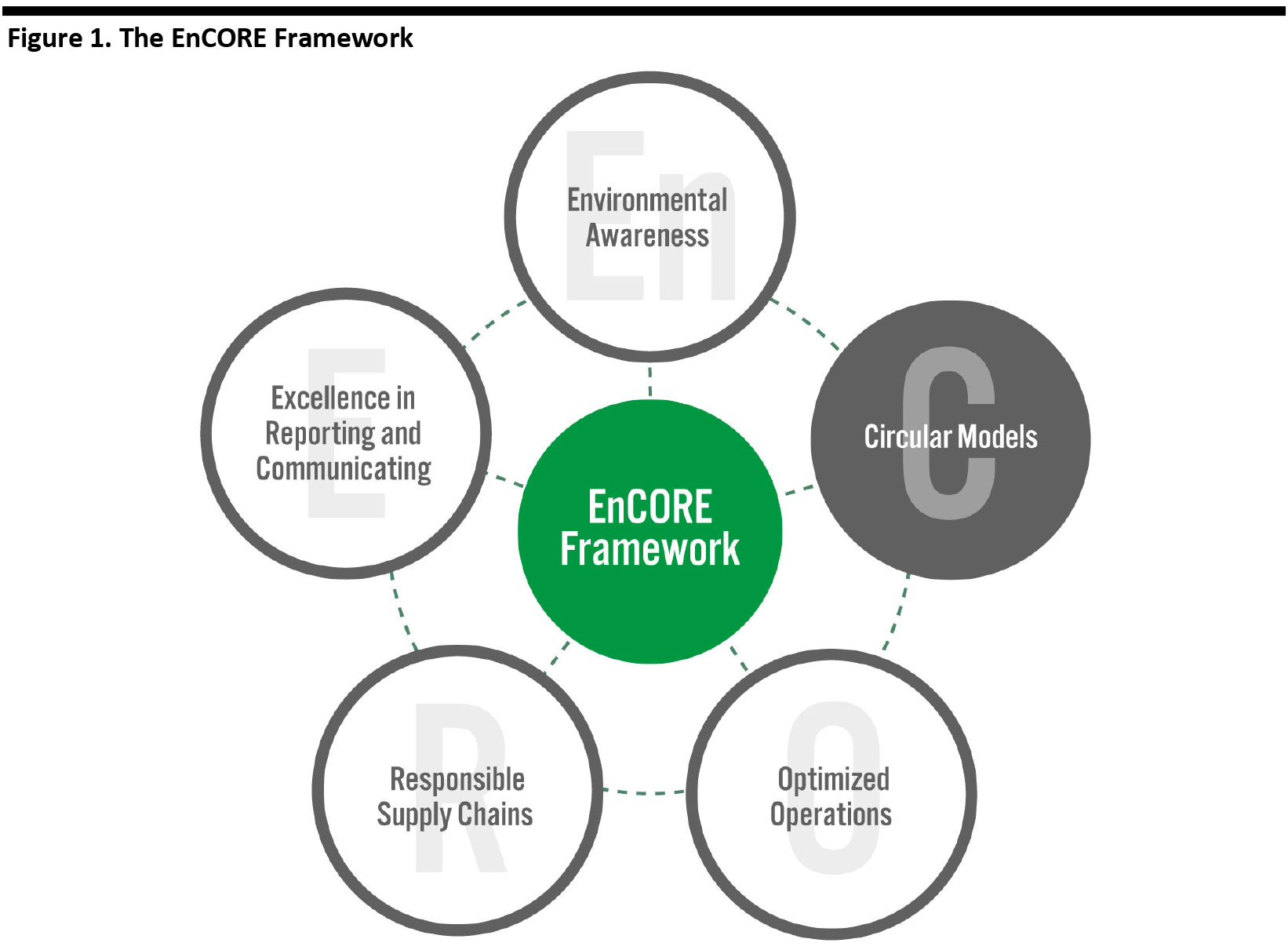

The increased importance of environmental sustainability worldwide is one of five forces that Coresight Research expects to make an impact in retail in 2020. We are seeing heightened global interest in sustainable processes, procedures and products by multiple consumers, employees and investors alike.

Coresight Research has therefore developed its new EnCORE framework to help retailers and brands frame their approach to environmental sustainability. This report is the second in a five-part series that introduces EnCORE. Each report will discuss one of the five components of the framework, providing a model through which retailers can begin to internalize a sustainability strategy. This report introduces the second element—where “C” stands for circular models.

[caption id="attachment_104636" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Circular Models

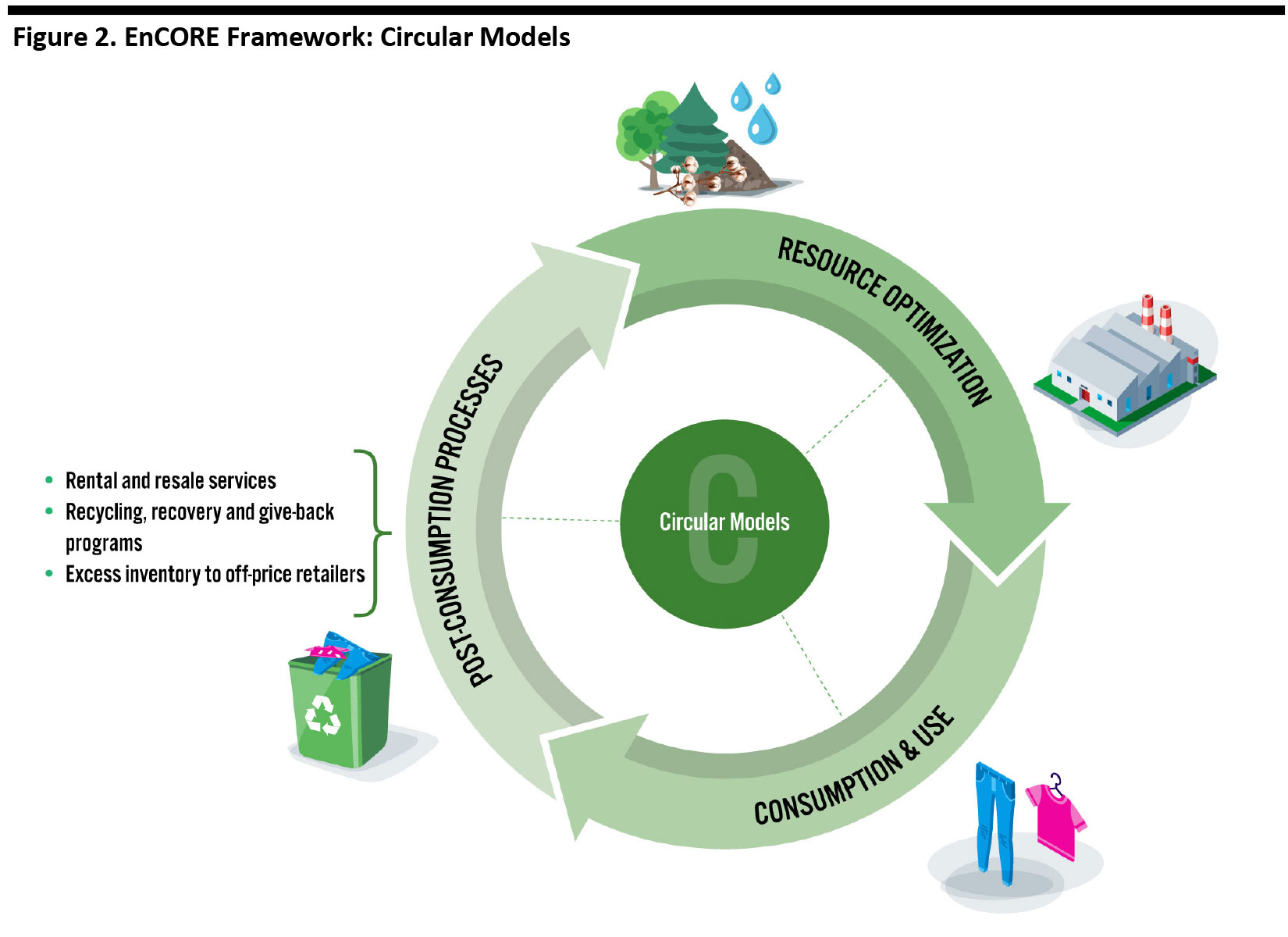

We see opportunities for retailers to adopt circular models that minimize the environmental impact of their products and maximize the circulation of materials back into the lifecycle.

[caption id="attachment_104637" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Circular Models

We see opportunities for retailers to adopt circular models that minimize the environmental impact of their products and maximize the circulation of materials back into the lifecycle.

[caption id="attachment_104637" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Resource Optimization

As an alternative to the linear economy, circular models emphasize the optimization of resources and the elimination of single-use products. Retailers striving towards zero waste should measure consumption, recycling rates and waste to find opportunities for improvement; considering the end of a product’s life is a good way to start. For a circular economy, design is key—to design out waste from the supply chain and include materials that can be used in closed loops. This means that materials are brought back into the production process and resources are continually repourposed in a recycle and reuse loop.

A business model that incorporates the use of environmentally friendly materials demonstrates a retailers commitment to environmental consciousness and sustainability, thus driving a positive impact across the value chain.

Rental and Resale Services

A resale mindset is developing among consumers, who are now thinking about afterlife value when they purchase products. Retailers are increasingly adding resale services to their offerings to capitalize on this trend—driving store traffic and attracting new consumers.

According to the United Nations Conference on Trade and Development, fashion is the second most polluting industry globally, due to the high water consumption in production and high carbon emissions for shipping, among other factors. Furthermore, large volumes of apparel end up in landfill sites before the end of their useful lives. Combatting this, the apparel industry has recently been disrupted by digitally native rental and resale services; technology has connected supply and demand across countries and continents, replacing neighborhood consignment, thrift and pawn shops. Simultaneously, the stigma against secondhand goods has dissipated, benefiting online thrift stores and consignment services—such as ThredUp and luxury consignment marketplace The RealReal—and resulting in the emergence of an increasing number of rental programs. Although rental services involve additional shipping and product drycleaning, it is still a greener option compared to fast fashion, which sees overproduction that has detrimental effects on the environment.

Consumer acceptance of secondhand goods is also gaining momentum outside of the fashion sector. According to US-based outdoor recreation services retailer Recreational Equipment (REI), the ultimate goal of a circular economy is to decouple economic growth from resource consumption. The company sells used sleeping bags, tents, apparel, portable showers, bags, ski poles, snowboards and other gear. REI has also expanded its rental program to 75% of its brick-and-mortar stores, targeting consumers who may want to try new activities before investing too much in the associated gear, as well as those who prefer to rent over buy for environmental reasons, lack of storage or to save money.

US furniture and home décor retailer West Elm partnered with online rental service provider Rent the Runway (RTR) to offer modern décor under the RTR concept, where customers are able to rent furnishings in the short term, with the option to buy later. Products include hand-selected bundles of pillows, throws, shams and quilts to accessorize rooms. Elsewhere in the furniture market, Feather operates a subscription model that offers different prices for member or nonmember plans. Customers can rent individual furniture items or choose from full-room set options, and furniture is delivered and assembled within one week.

Sending Excess Inventory to Off-Price Retailers

Excess inventory is a common business reality, often a result of incorrect trend and sales forecasting. It is typically disposed of by being sent as waste to landfill, but there are alternative, sustainable options available. For example, retailers could recirculate stock with price markdowns, which would lower the impact on the retailer’s bottom line compared to disposal.

Liquidation companies buy merchandise at low price points below profit, allowing some cash recovery and freeing up space. Corporate trade, including off-price retail, allows the sale of inventory typically equal to the acquisition price, resulting in decreased cash loss. Establishing relationships with off-price retailers could therefore enable retailers to salvage some of the loss, or even make a small profit. Outlet stores and off-price retailers such as Burlington, Marshalls and T.J. Maxx, as well as e-commerce sites such as bluefly.com and overstock.com have witnessed increasing traffic in recent years. Off-price retail buyers can also be found at fashion trade shows.

Surplus stock ties up capital, so using off-price retailers is a good tactic for companies to offset incorrect demand forecasting and to increase their ability to re-invest in the business.

Recycling, Recovery and Give-Back Programs

Sustainable end-of-life processes include recycling and recovery programs that enable products to be reused or repurposed—deconstructed and incorporated back into the production cycle.

The apparel market provides numerous examples of these programs being implemented, whereby deconstructed recycled clothing is made into new fashions or shredded to make carpet padding or car insulation. Retailers can also convert masses of excess clothing or post-factory waste into yarn. Furthermore, clothing can be repaired and recirculated:

Source: Coresight Research[/caption]

Resource Optimization

As an alternative to the linear economy, circular models emphasize the optimization of resources and the elimination of single-use products. Retailers striving towards zero waste should measure consumption, recycling rates and waste to find opportunities for improvement; considering the end of a product’s life is a good way to start. For a circular economy, design is key—to design out waste from the supply chain and include materials that can be used in closed loops. This means that materials are brought back into the production process and resources are continually repourposed in a recycle and reuse loop.

A business model that incorporates the use of environmentally friendly materials demonstrates a retailers commitment to environmental consciousness and sustainability, thus driving a positive impact across the value chain.

Rental and Resale Services

A resale mindset is developing among consumers, who are now thinking about afterlife value when they purchase products. Retailers are increasingly adding resale services to their offerings to capitalize on this trend—driving store traffic and attracting new consumers.

According to the United Nations Conference on Trade and Development, fashion is the second most polluting industry globally, due to the high water consumption in production and high carbon emissions for shipping, among other factors. Furthermore, large volumes of apparel end up in landfill sites before the end of their useful lives. Combatting this, the apparel industry has recently been disrupted by digitally native rental and resale services; technology has connected supply and demand across countries and continents, replacing neighborhood consignment, thrift and pawn shops. Simultaneously, the stigma against secondhand goods has dissipated, benefiting online thrift stores and consignment services—such as ThredUp and luxury consignment marketplace The RealReal—and resulting in the emergence of an increasing number of rental programs. Although rental services involve additional shipping and product drycleaning, it is still a greener option compared to fast fashion, which sees overproduction that has detrimental effects on the environment.

Consumer acceptance of secondhand goods is also gaining momentum outside of the fashion sector. According to US-based outdoor recreation services retailer Recreational Equipment (REI), the ultimate goal of a circular economy is to decouple economic growth from resource consumption. The company sells used sleeping bags, tents, apparel, portable showers, bags, ski poles, snowboards and other gear. REI has also expanded its rental program to 75% of its brick-and-mortar stores, targeting consumers who may want to try new activities before investing too much in the associated gear, as well as those who prefer to rent over buy for environmental reasons, lack of storage or to save money.

US furniture and home décor retailer West Elm partnered with online rental service provider Rent the Runway (RTR) to offer modern décor under the RTR concept, where customers are able to rent furnishings in the short term, with the option to buy later. Products include hand-selected bundles of pillows, throws, shams and quilts to accessorize rooms. Elsewhere in the furniture market, Feather operates a subscription model that offers different prices for member or nonmember plans. Customers can rent individual furniture items or choose from full-room set options, and furniture is delivered and assembled within one week.

Sending Excess Inventory to Off-Price Retailers

Excess inventory is a common business reality, often a result of incorrect trend and sales forecasting. It is typically disposed of by being sent as waste to landfill, but there are alternative, sustainable options available. For example, retailers could recirculate stock with price markdowns, which would lower the impact on the retailer’s bottom line compared to disposal.

Liquidation companies buy merchandise at low price points below profit, allowing some cash recovery and freeing up space. Corporate trade, including off-price retail, allows the sale of inventory typically equal to the acquisition price, resulting in decreased cash loss. Establishing relationships with off-price retailers could therefore enable retailers to salvage some of the loss, or even make a small profit. Outlet stores and off-price retailers such as Burlington, Marshalls and T.J. Maxx, as well as e-commerce sites such as bluefly.com and overstock.com have witnessed increasing traffic in recent years. Off-price retail buyers can also be found at fashion trade shows.

Surplus stock ties up capital, so using off-price retailers is a good tactic for companies to offset incorrect demand forecasting and to increase their ability to re-invest in the business.

Recycling, Recovery and Give-Back Programs

Sustainable end-of-life processes include recycling and recovery programs that enable products to be reused or repurposed—deconstructed and incorporated back into the production cycle.

The apparel market provides numerous examples of these programs being implemented, whereby deconstructed recycled clothing is made into new fashions or shredded to make carpet padding or car insulation. Retailers can also convert masses of excess clothing or post-factory waste into yarn. Furthermore, clothing can be repaired and recirculated:

Source: Decathlon[/caption]

Crucially, in addition to products, recycling and recovery programs can have a huge impact in increasing the sustainability of packaging. As part of Procter & Gamble’s (P&G’s) larger sustainability initiatives, Olay became the first mass-retail skincare brand to test refillable packaging by offering its Olay Regenerist Whip moisturizer with a recyclable refill pod, shipped in recycled paper. According to the company, the project will save 1,000,000lbs of plastic per 5 million jars sold.

[caption id="attachment_104639" align="aligncenter" width="700"]

Source: Decathlon[/caption]

Crucially, in addition to products, recycling and recovery programs can have a huge impact in increasing the sustainability of packaging. As part of Procter & Gamble’s (P&G’s) larger sustainability initiatives, Olay became the first mass-retail skincare brand to test refillable packaging by offering its Olay Regenerist Whip moisturizer with a recyclable refill pod, shipped in recycled paper. According to the company, the project will save 1,000,000lbs of plastic per 5 million jars sold.

[caption id="attachment_104639" align="aligncenter" width="700"] Source: P&G[/caption]

Key Insights

By employing circular models, retailers can harness opportunities to reduce their environmental impact while fulfilling consumer demand, often also resulting in economic advantages. A key compoment of the circular economy is in the reduction of waste, which would positively impact production and supply chains. There are a number of ways for retailers to achieve this, such as by operating resale and rental services and implementing recycling, recovery and give-back programs. Apparel retailers in particular should look to adopt these types of initiatives to combat the high levels of pollution produced by the fashion industry as a whole, as well as to give themselves a competitive advantage by aligning with consumer awareness of, and desire for, sustainability.

Source: P&G[/caption]

Key Insights

By employing circular models, retailers can harness opportunities to reduce their environmental impact while fulfilling consumer demand, often also resulting in economic advantages. A key compoment of the circular economy is in the reduction of waste, which would positively impact production and supply chains. There are a number of ways for retailers to achieve this, such as by operating resale and rental services and implementing recycling, recovery and give-back programs. Apparel retailers in particular should look to adopt these types of initiatives to combat the high levels of pollution produced by the fashion industry as a whole, as well as to give themselves a competitive advantage by aligning with consumer awareness of, and desire for, sustainability.

Source: Coresight Research[/caption]

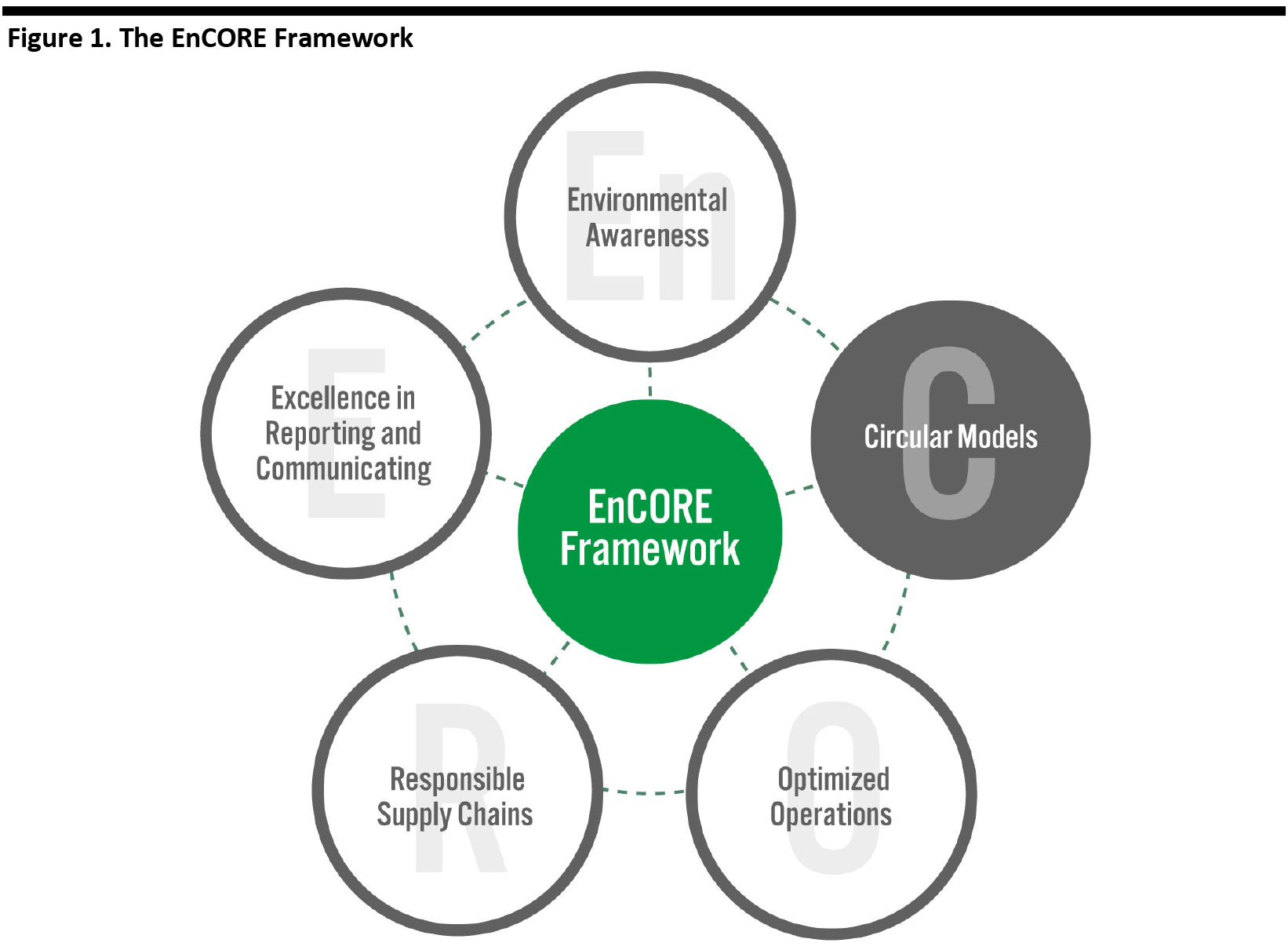

Circular Models

We see opportunities for retailers to adopt circular models that minimize the environmental impact of their products and maximize the circulation of materials back into the lifecycle.

[caption id="attachment_104637" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

Circular Models

We see opportunities for retailers to adopt circular models that minimize the environmental impact of their products and maximize the circulation of materials back into the lifecycle.

[caption id="attachment_104637" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Resource Optimization

As an alternative to the linear economy, circular models emphasize the optimization of resources and the elimination of single-use products. Retailers striving towards zero waste should measure consumption, recycling rates and waste to find opportunities for improvement; considering the end of a product’s life is a good way to start. For a circular economy, design is key—to design out waste from the supply chain and include materials that can be used in closed loops. This means that materials are brought back into the production process and resources are continually repourposed in a recycle and reuse loop.

A business model that incorporates the use of environmentally friendly materials demonstrates a retailers commitment to environmental consciousness and sustainability, thus driving a positive impact across the value chain.

Rental and Resale Services

A resale mindset is developing among consumers, who are now thinking about afterlife value when they purchase products. Retailers are increasingly adding resale services to their offerings to capitalize on this trend—driving store traffic and attracting new consumers.

According to the United Nations Conference on Trade and Development, fashion is the second most polluting industry globally, due to the high water consumption in production and high carbon emissions for shipping, among other factors. Furthermore, large volumes of apparel end up in landfill sites before the end of their useful lives. Combatting this, the apparel industry has recently been disrupted by digitally native rental and resale services; technology has connected supply and demand across countries and continents, replacing neighborhood consignment, thrift and pawn shops. Simultaneously, the stigma against secondhand goods has dissipated, benefiting online thrift stores and consignment services—such as ThredUp and luxury consignment marketplace The RealReal—and resulting in the emergence of an increasing number of rental programs. Although rental services involve additional shipping and product drycleaning, it is still a greener option compared to fast fashion, which sees overproduction that has detrimental effects on the environment.

Consumer acceptance of secondhand goods is also gaining momentum outside of the fashion sector. According to US-based outdoor recreation services retailer Recreational Equipment (REI), the ultimate goal of a circular economy is to decouple economic growth from resource consumption. The company sells used sleeping bags, tents, apparel, portable showers, bags, ski poles, snowboards and other gear. REI has also expanded its rental program to 75% of its brick-and-mortar stores, targeting consumers who may want to try new activities before investing too much in the associated gear, as well as those who prefer to rent over buy for environmental reasons, lack of storage or to save money.

US furniture and home décor retailer West Elm partnered with online rental service provider Rent the Runway (RTR) to offer modern décor under the RTR concept, where customers are able to rent furnishings in the short term, with the option to buy later. Products include hand-selected bundles of pillows, throws, shams and quilts to accessorize rooms. Elsewhere in the furniture market, Feather operates a subscription model that offers different prices for member or nonmember plans. Customers can rent individual furniture items or choose from full-room set options, and furniture is delivered and assembled within one week.

Sending Excess Inventory to Off-Price Retailers

Excess inventory is a common business reality, often a result of incorrect trend and sales forecasting. It is typically disposed of by being sent as waste to landfill, but there are alternative, sustainable options available. For example, retailers could recirculate stock with price markdowns, which would lower the impact on the retailer’s bottom line compared to disposal.

Liquidation companies buy merchandise at low price points below profit, allowing some cash recovery and freeing up space. Corporate trade, including off-price retail, allows the sale of inventory typically equal to the acquisition price, resulting in decreased cash loss. Establishing relationships with off-price retailers could therefore enable retailers to salvage some of the loss, or even make a small profit. Outlet stores and off-price retailers such as Burlington, Marshalls and T.J. Maxx, as well as e-commerce sites such as bluefly.com and overstock.com have witnessed increasing traffic in recent years. Off-price retail buyers can also be found at fashion trade shows.

Surplus stock ties up capital, so using off-price retailers is a good tactic for companies to offset incorrect demand forecasting and to increase their ability to re-invest in the business.

Recycling, Recovery and Give-Back Programs

Sustainable end-of-life processes include recycling and recovery programs that enable products to be reused or repurposed—deconstructed and incorporated back into the production cycle.

The apparel market provides numerous examples of these programs being implemented, whereby deconstructed recycled clothing is made into new fashions or shredded to make carpet padding or car insulation. Retailers can also convert masses of excess clothing or post-factory waste into yarn. Furthermore, clothing can be repaired and recirculated:

Source: Coresight Research[/caption]

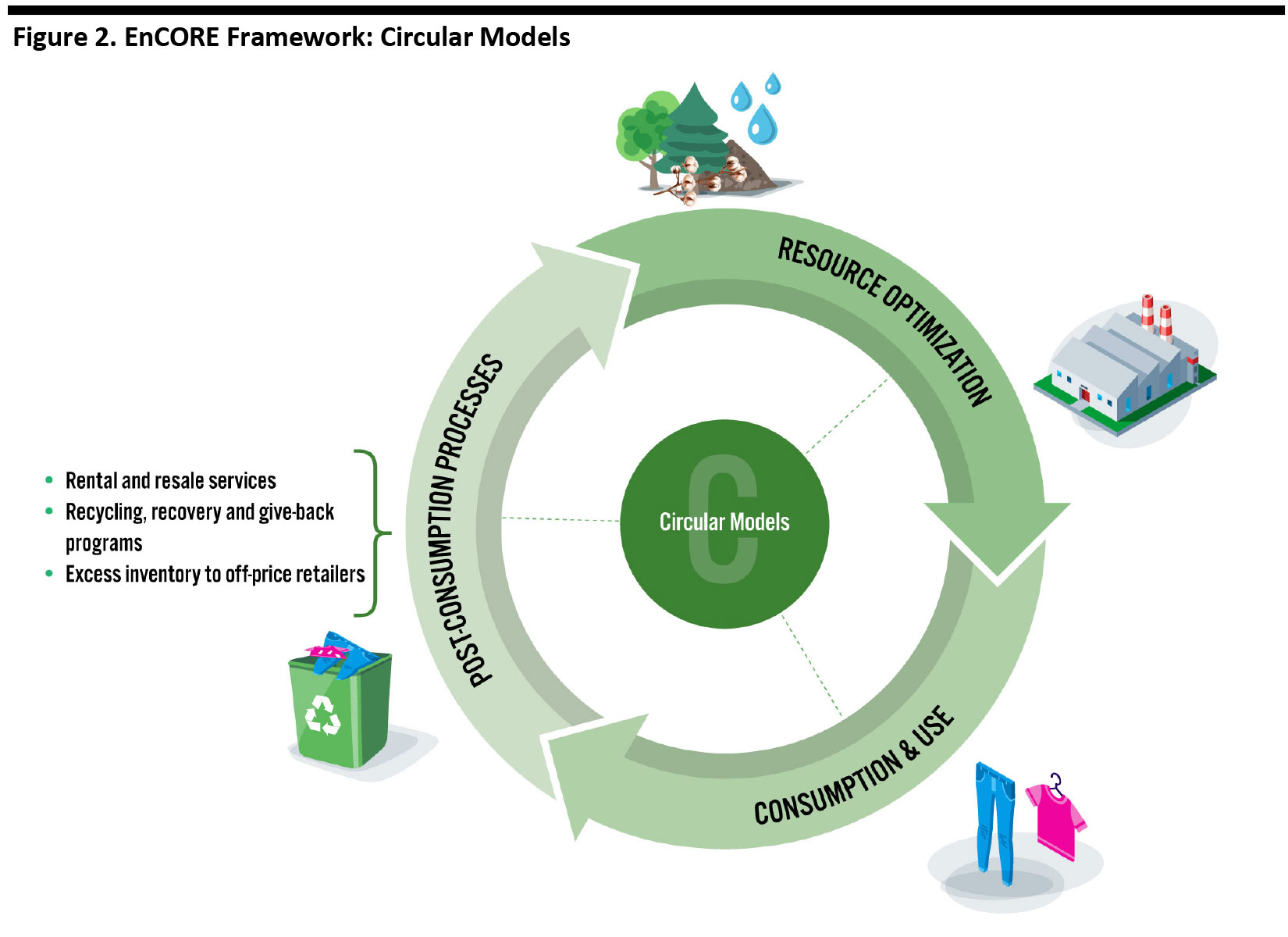

Resource Optimization

As an alternative to the linear economy, circular models emphasize the optimization of resources and the elimination of single-use products. Retailers striving towards zero waste should measure consumption, recycling rates and waste to find opportunities for improvement; considering the end of a product’s life is a good way to start. For a circular economy, design is key—to design out waste from the supply chain and include materials that can be used in closed loops. This means that materials are brought back into the production process and resources are continually repourposed in a recycle and reuse loop.

A business model that incorporates the use of environmentally friendly materials demonstrates a retailers commitment to environmental consciousness and sustainability, thus driving a positive impact across the value chain.

Rental and Resale Services

A resale mindset is developing among consumers, who are now thinking about afterlife value when they purchase products. Retailers are increasingly adding resale services to their offerings to capitalize on this trend—driving store traffic and attracting new consumers.

According to the United Nations Conference on Trade and Development, fashion is the second most polluting industry globally, due to the high water consumption in production and high carbon emissions for shipping, among other factors. Furthermore, large volumes of apparel end up in landfill sites before the end of their useful lives. Combatting this, the apparel industry has recently been disrupted by digitally native rental and resale services; technology has connected supply and demand across countries and continents, replacing neighborhood consignment, thrift and pawn shops. Simultaneously, the stigma against secondhand goods has dissipated, benefiting online thrift stores and consignment services—such as ThredUp and luxury consignment marketplace The RealReal—and resulting in the emergence of an increasing number of rental programs. Although rental services involve additional shipping and product drycleaning, it is still a greener option compared to fast fashion, which sees overproduction that has detrimental effects on the environment.

Consumer acceptance of secondhand goods is also gaining momentum outside of the fashion sector. According to US-based outdoor recreation services retailer Recreational Equipment (REI), the ultimate goal of a circular economy is to decouple economic growth from resource consumption. The company sells used sleeping bags, tents, apparel, portable showers, bags, ski poles, snowboards and other gear. REI has also expanded its rental program to 75% of its brick-and-mortar stores, targeting consumers who may want to try new activities before investing too much in the associated gear, as well as those who prefer to rent over buy for environmental reasons, lack of storage or to save money.

US furniture and home décor retailer West Elm partnered with online rental service provider Rent the Runway (RTR) to offer modern décor under the RTR concept, where customers are able to rent furnishings in the short term, with the option to buy later. Products include hand-selected bundles of pillows, throws, shams and quilts to accessorize rooms. Elsewhere in the furniture market, Feather operates a subscription model that offers different prices for member or nonmember plans. Customers can rent individual furniture items or choose from full-room set options, and furniture is delivered and assembled within one week.

Sending Excess Inventory to Off-Price Retailers

Excess inventory is a common business reality, often a result of incorrect trend and sales forecasting. It is typically disposed of by being sent as waste to landfill, but there are alternative, sustainable options available. For example, retailers could recirculate stock with price markdowns, which would lower the impact on the retailer’s bottom line compared to disposal.

Liquidation companies buy merchandise at low price points below profit, allowing some cash recovery and freeing up space. Corporate trade, including off-price retail, allows the sale of inventory typically equal to the acquisition price, resulting in decreased cash loss. Establishing relationships with off-price retailers could therefore enable retailers to salvage some of the loss, or even make a small profit. Outlet stores and off-price retailers such as Burlington, Marshalls and T.J. Maxx, as well as e-commerce sites such as bluefly.com and overstock.com have witnessed increasing traffic in recent years. Off-price retail buyers can also be found at fashion trade shows.

Surplus stock ties up capital, so using off-price retailers is a good tactic for companies to offset incorrect demand forecasting and to increase their ability to re-invest in the business.

Recycling, Recovery and Give-Back Programs

Sustainable end-of-life processes include recycling and recovery programs that enable products to be reused or repurposed—deconstructed and incorporated back into the production cycle.

The apparel market provides numerous examples of these programs being implemented, whereby deconstructed recycled clothing is made into new fashions or shredded to make carpet padding or car insulation. Retailers can also convert masses of excess clothing or post-factory waste into yarn. Furthermore, clothing can be repaired and recirculated:

- Outdoor clothing company Patagonia operates a recycle and repurpose program and also offers repair and return services for garments and gear.

- Women’s clothing brand Eileen Fisher creates pieces with recirculation intent at the end of products’ life cycle, with the expectation that they will be returned and later made into new products.

- Everlane reuses materials to create sustainable cashmere and denim.

- Uniqlo has a recycling program that distributes wearable items to refugees and disaster victims; unwearable clothing is made into paper products and plastic fuel pellets.

- Zara provides used clothing to non-profit projects.

Source: Decathlon[/caption]

Crucially, in addition to products, recycling and recovery programs can have a huge impact in increasing the sustainability of packaging. As part of Procter & Gamble’s (P&G’s) larger sustainability initiatives, Olay became the first mass-retail skincare brand to test refillable packaging by offering its Olay Regenerist Whip moisturizer with a recyclable refill pod, shipped in recycled paper. According to the company, the project will save 1,000,000lbs of plastic per 5 million jars sold.

[caption id="attachment_104639" align="aligncenter" width="700"]

Source: Decathlon[/caption]

Crucially, in addition to products, recycling and recovery programs can have a huge impact in increasing the sustainability of packaging. As part of Procter & Gamble’s (P&G’s) larger sustainability initiatives, Olay became the first mass-retail skincare brand to test refillable packaging by offering its Olay Regenerist Whip moisturizer with a recyclable refill pod, shipped in recycled paper. According to the company, the project will save 1,000,000lbs of plastic per 5 million jars sold.

[caption id="attachment_104639" align="aligncenter" width="700"] Source: P&G[/caption]

Key Insights

By employing circular models, retailers can harness opportunities to reduce their environmental impact while fulfilling consumer demand, often also resulting in economic advantages. A key compoment of the circular economy is in the reduction of waste, which would positively impact production and supply chains. There are a number of ways for retailers to achieve this, such as by operating resale and rental services and implementing recycling, recovery and give-back programs. Apparel retailers in particular should look to adopt these types of initiatives to combat the high levels of pollution produced by the fashion industry as a whole, as well as to give themselves a competitive advantage by aligning with consumer awareness of, and desire for, sustainability.

Source: P&G[/caption]

Key Insights

By employing circular models, retailers can harness opportunities to reduce their environmental impact while fulfilling consumer demand, often also resulting in economic advantages. A key compoment of the circular economy is in the reduction of waste, which would positively impact production and supply chains. There are a number of ways for retailers to achieve this, such as by operating resale and rental services and implementing recycling, recovery and give-back programs. Apparel retailers in particular should look to adopt these types of initiatives to combat the high levels of pollution produced by the fashion industry as a whole, as well as to give themselves a competitive advantage by aligning with consumer awareness of, and desire for, sustainability.