WHAT IS INTURN IN A NUTSHELL?

INTURN, founded in 2013, is the first online marketplace built to enable brands and retailers to efficiently and confidentially buy and sell excess inventory on a global scale. It is a win-win solution for both brands and retailers to replace the existing time-consuming and error-prone liquidity process driving the off-price industry.

CAN YOU EXPLAIN THE OFF-PRICE MARKETPLACE?

The off-price marketplace for apparel and accessories consists of $250 billion of excess inventory sold globally every year. This represents over 20% of the $1.2 trillion global retail market for apparel and accessories that cannot be sold at full price. The inventory is later sold at a significant discount.

How did the off-price marketplace function prior to INTURN?

Without INTURN, the process is manual, linear and inefficient. Teams of employees cut and paste lines of basic inventory data and product attributes from multiple inventory systems into spreadsheets that are sent to potential buyers without associated product images. This requires costly manpower and leaves risk for human error. The lack of product images makes it difficult for buyers to properly evaluate the inventory assortment. The process also requires retailers to be contacted one at a time, which neglects the time sensitivity of the inventory shelf life and inhibits brands from maximizing profits. Additionally, negotiation processes are typically not accurately recorded and entail manually sorting through phone records and emails, leaving both brands and retailers with a lack of historical data that could be used for future transactions. As a result, brands and retailers face a large opportunity cost when transacting in this fashion.

Why is this process an issue?

The buying and selling of off-price inventory between brands and retailers is happening across all industries. The combination of wasted time, missed opportunity and lower prices devalues excess inventory and creates unnecessary discounts and billions of dollars of lost revenue for the brands and retailers.

How does the platform function as a solution?

INTURN has created a seamless and efficient process for the exchange of goods between businesses in the growing global off-price marketplace. Our platform, which consists of a series of brand-driven market networks, enables brands and retailers to buy and sell excess inventory in a private and secured marketplace anywhere in the world. It delivers better economics to both parties by reducing manual work processes, expanding accessible product information and integrating sophisticated analytics into retailer-brand negotiation processes. This results in error-free, quick transactions that recover additional value from the inventory that is sold. It is important to note that INTURN is a platform that facilitates a brand’s sales activities. Use of the platform’s varied features and capabilities and all business decisions are driven by each brand.

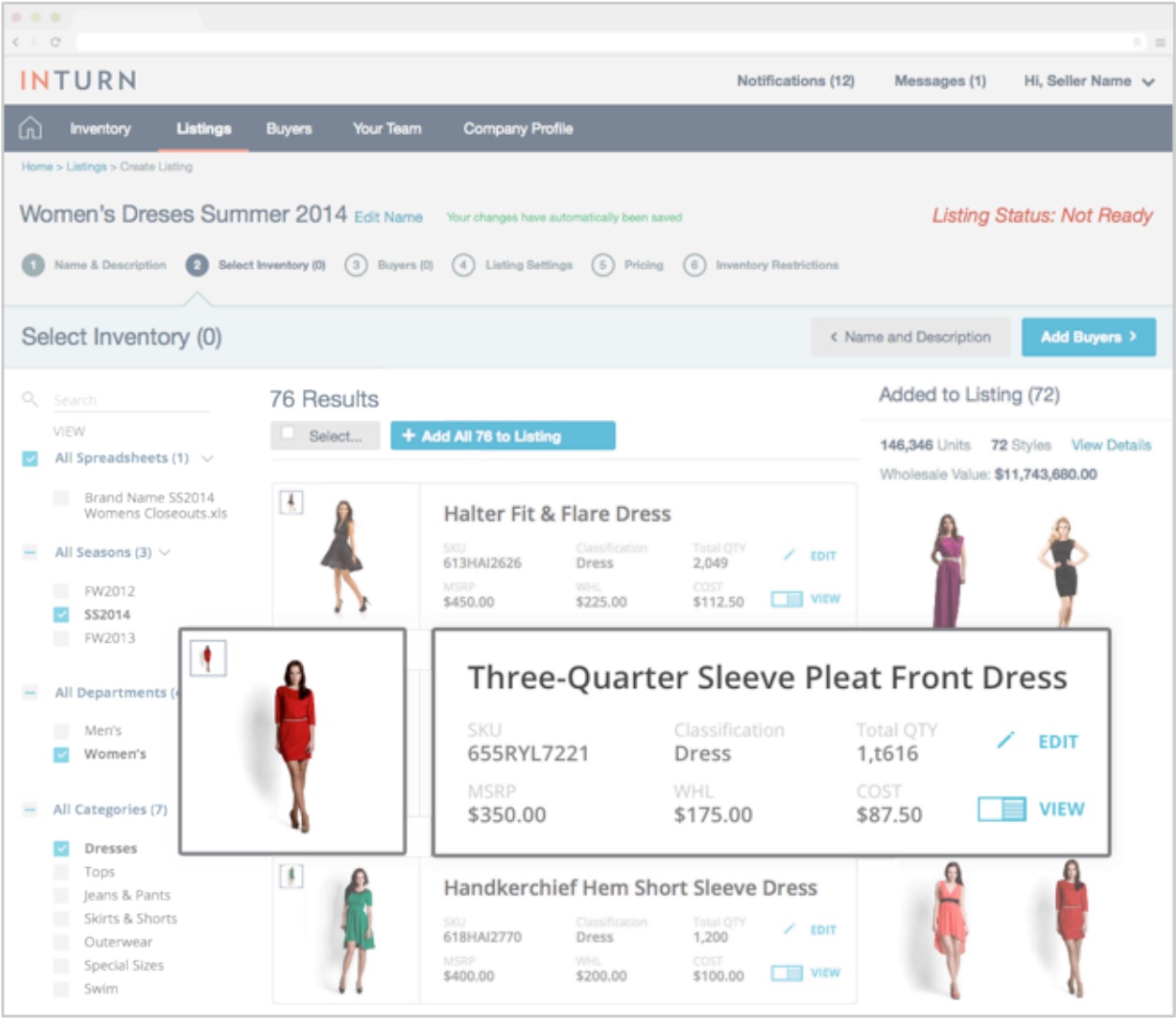

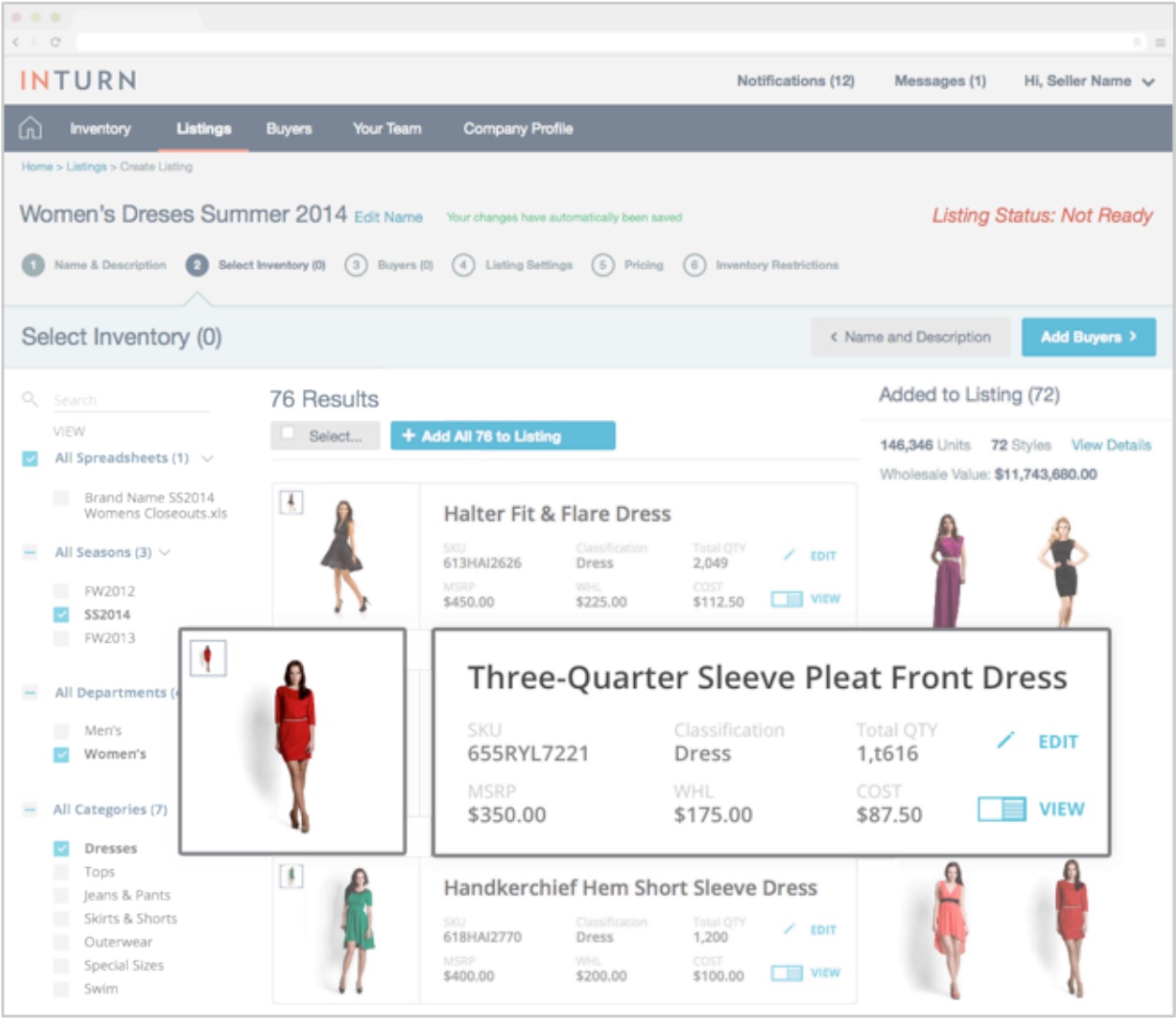

The platform offers an inventory management system—similar to those used on the back-end systems of e-commerce sites—where all data associated with the products is stored in one place (including rich content such as images, descriptions, colors, etc.). Inventory levels can be updated in real time, and the data import process is automatic, fast and accurate. The ease and speed of this system encourages brands to provide retailers with as much information as they have at their discretion. While INTURN is starting off with apparel and accessories brands and retailers, the platform addresses all verticals within retail.

Products and their information can be sorted and managed in a number of different ways by both brands and retailers. The goal is to enable brands to create a targeted assortment specific to the retailer based on interests and historical transactional patterns. The retailers can then use the same tool to analyse and explore the brand’s assortment to help them determine their final purchase.

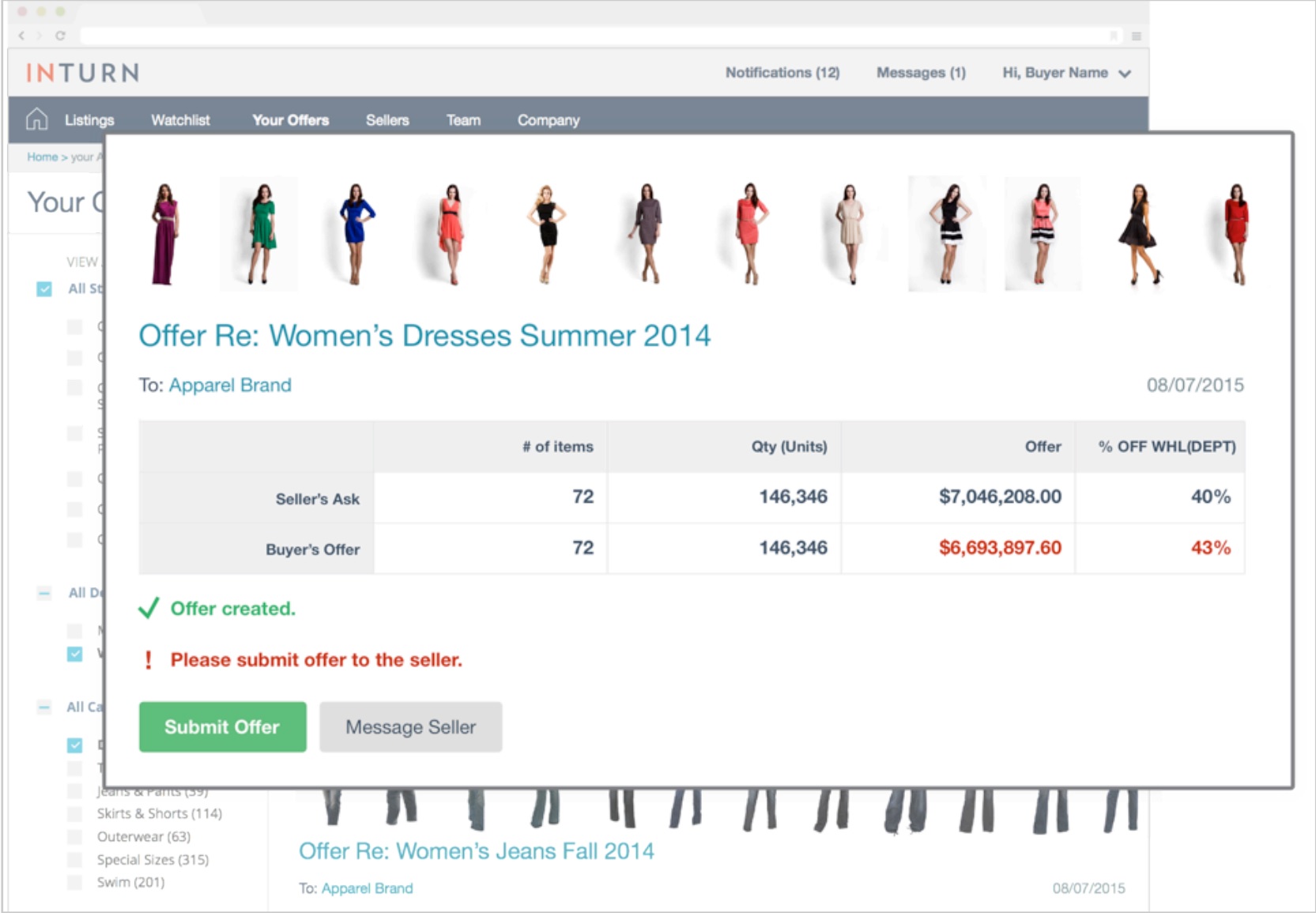

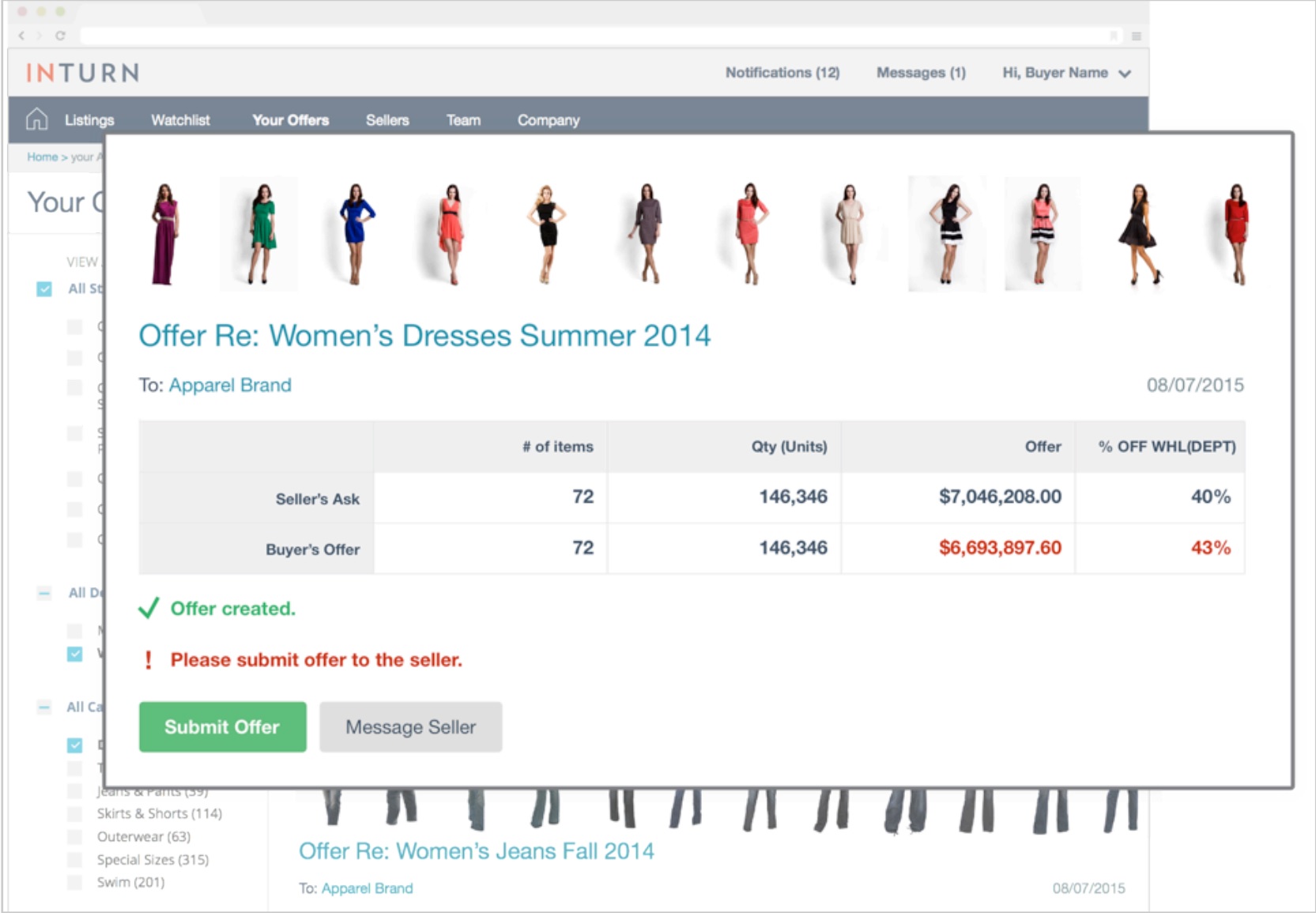

The platform also provides a cost and margin analysis tool that allows both brands and retailers to optimize their pricing and negotiations. Transactions, negotiations and historical data are recorded and analyzed to provide real-time information to be used going forward.

protecting the brand image. The platform also houses a network of retailers and brands that can be suggested based on inventory availability and retailers’ interests.

You described the platform as a “win-win” solution for brands and retailers. How so?

Brands win because they liquidate and maximize the value of their products through faster negotiations with optimal buyers and intelligently priced product.

Retailers win because they can see more available product and confidently buy product they know they want at a price they deem appropriate based on cost analysis.

How is the global off-price marketplace different from the US marketplace?

The global off-price marketplace is not as robust and established as in the US. Generally speaking, even when brands have thousands of retailers in a given market, their liquidation is concentrated in one or two points of distribution, causing sales to not be fully optimized. Additionally, brands often price their inventory differently depending on location, with price differences sometimes over 25% even in adjacent countries. These price variances are usually based on brand perception, currency and the cost of living in those countries. These differences lead to diminished profits.

How does INTURN address these global exchange challenges?

INTURN enables global brands to optimize the off-price market by removing the inefficiencies and barriers, such as varied pricing, currency issues and underdeveloped infrastructure. To address the global exchange challenges, INTURN provides brands and retailers with analysis of the sale activities in global markets, including pricing systems and product negotiations in the market economy. This information is then used as recommended price optimization for brands selling excess inventory using different currencies within the platform.

Tell us a bit more about INTURN’s background

INTURN was founded in 2013 by myself (Ronen Lazar) and Charlie Ifrah. We had an excellent work chemistry developed over seven years and several successful startups. Retail veterans Michael Newman, previously Vice Chairman, COO and CFO of Ralph Lauren, and David Margolis, Founder and President of The TJX Companies’ Winners division, were brought on to guide the company. Financial support came from prominent retail investors, including Beanstalk Ventures, Forerunner Ventures, Novel TMT Ventures, Lerer Hippeau Ventures and T5 Capital. We have since assembled a strategic team with varied experience and backgrounds, including from Amazon, eBay and Google.

INTURN, founded in 2013, is the first online marketplace built to enable brands and retailers to efficiently and confidentially buy and sell excess inventory on a global scale. It is a win-win solution for both brands and retailers to replace the existing time-consuming and error-prone liquidity process driving the off-price industry.

INTURN, founded in 2013, is the first online marketplace built to enable brands and retailers to efficiently and confidentially buy and sell excess inventory on a global scale. It is a win-win solution for both brands and retailers to replace the existing time-consuming and error-prone liquidity process driving the off-price industry.

The platform offers an inventory management system—similar to those used on the back-end systems of e-commerce sites—where all data associated with the products is stored in one place (including rich content such as images, descriptions, colors, etc.). Inventory levels can be updated in real time, and the data import process is automatic, fast and accurate. The ease and speed of this system encourages brands to provide retailers with as much information as they have at their discretion. While INTURN is starting off with apparel and accessories brands and retailers, the platform addresses all verticals within retail.

Products and their information can be sorted and managed in a number of different ways by both brands and retailers. The goal is to enable brands to create a targeted assortment specific to the retailer based on interests and historical transactional patterns. The retailers can then use the same tool to analyse and explore the brand’s assortment to help them determine their final purchase.

The platform also provides a cost and margin analysis tool that allows both brands and retailers to optimize their pricing and negotiations. Transactions, negotiations and historical data are recorded and analyzed to provide real-time information to be used going forward.

The platform offers an inventory management system—similar to those used on the back-end systems of e-commerce sites—where all data associated with the products is stored in one place (including rich content such as images, descriptions, colors, etc.). Inventory levels can be updated in real time, and the data import process is automatic, fast and accurate. The ease and speed of this system encourages brands to provide retailers with as much information as they have at their discretion. While INTURN is starting off with apparel and accessories brands and retailers, the platform addresses all verticals within retail.

Products and their information can be sorted and managed in a number of different ways by both brands and retailers. The goal is to enable brands to create a targeted assortment specific to the retailer based on interests and historical transactional patterns. The retailers can then use the same tool to analyse and explore the brand’s assortment to help them determine their final purchase.

The platform also provides a cost and margin analysis tool that allows both brands and retailers to optimize their pricing and negotiations. Transactions, negotiations and historical data are recorded and analyzed to provide real-time information to be used going forward.

protecting the brand image. The platform also houses a network of retailers and brands that can be suggested based on inventory availability and retailers’ interests.

protecting the brand image. The platform also houses a network of retailers and brands that can be suggested based on inventory availability and retailers’ interests.