Nitheesh NH

Introduction

What’s the Story? The department store sector has a heavy physical store footprint with a portfolio assortment spanning apparel, home, beauty and sometimes food. The global Covid-19 pandemic has impacted department store retailers around the world in similar ways, with shifts in consumer shopping preferences and online spending resulting in declining physical store sales, and overall changes in consumer behavior affecting category sales. As the US department store sector continues to recover from the impacts of the Covid-19 pandemic, it can look to international players for examples of key growth strategies and apply those learnings in fiscal 2022 and beyond. In this report, we explore five growth strategies that international department stores are implementing to navigate the pandemic-impacted environment and the new consumer. Why It Matters During the pandemic, Coresight Research estimates that US department store sales were down 33.2% in fiscal 2020 and down 15.4% in fiscal 2021 versus 2019 levels, based on company reports. Among the issues that department store retailers must consider with renewed urgency is how to maintain and grow online traffic. E-commerce became a key contributor for overall revenue in the sector in 2020, contributing 43.7% of total sector sales, we estimate—an all-time high. We believe that e-commerce penetration dipped in 2021 but remained high, at 35.7%, and will increase again to around 39.6% in 2022. However, the importance of the brick-and-mortar channel for department stores will not diminish; retailers must give customers new and compelling reasons to visit their stores.- For more on US department store e-commerce, read our separate report, E-Commerce Outlook: US Department Stores—After the Surge, What Next?

International Department Stores’ Growth Strategies: Coresight Research Analysis

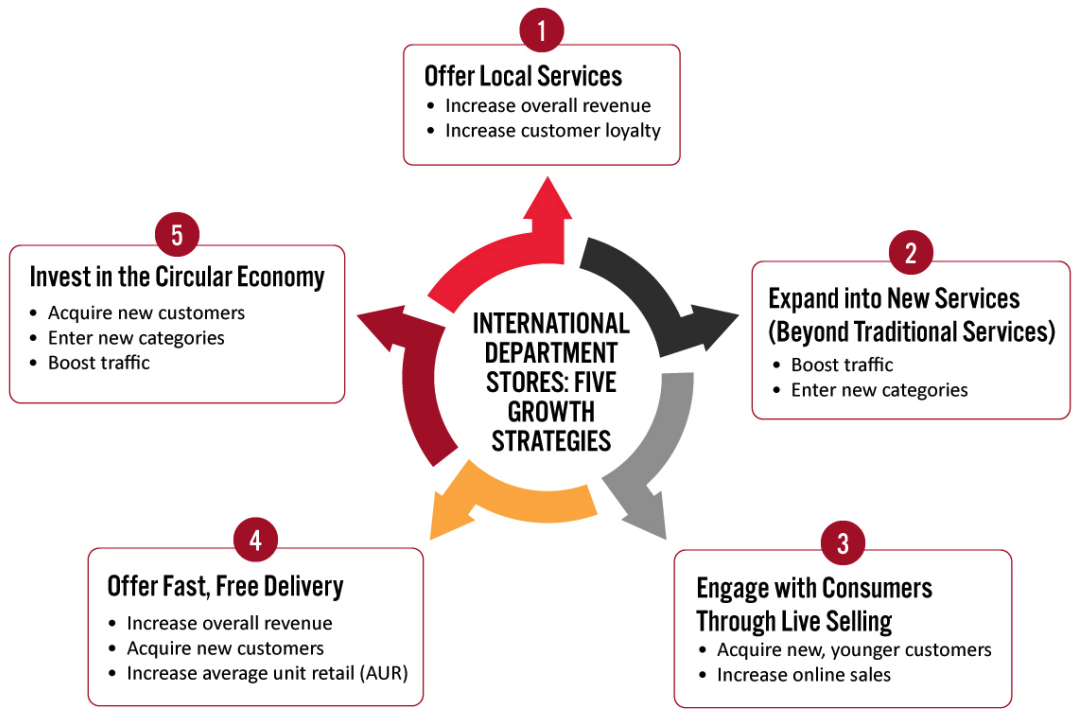

A silver lining from the Covid-19 pandemic is that department stores have become creative in finding previously undiscovered ways to reach and engage customers. New services and category offerings have had unintended positive outcomes, such as reaching new consumers, while other offerings were not as relevant until the pandemic. In Figure 1, we summarize five strategies that international department stores are implementing to grow revenues, expand their consumer base and increase traffic, among other benefits. We explore how US retailers can take learnings from each strategy in the following sections.Figure 1. International Department Stores: Five Growth Strategies [caption id="attachment_141725" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

1. Offer Local Services

Leading department stores are finding innovative ways to better serve their loyal, local customers—such as by extending in-store offerings to online services.

In November 2021, Galeries Lafayette Hausmann, a luxury department store in Paris, France, launched Gourmet, an online food-delivery site with the slogan, “The best artisans are coming to your home.” Consumers can order fully prepared catered meals from its top chefs, including Jean Paul Hevin, Petrossian and Pierre Herme, or select items to create their own meals from its fresh market, delicatessen and wine selection. Items are available for delivery or click and collect.

In store, Galeries Lafayette Hausmann’s food department, known by locals as “Le Gourmet,” is part of the home department, which covers nearly 37,700 square feet on three levels. Products include luxury and gourmet food brands, a food hall where consumers can dine in or pick up a takeaway meal, and a full grocery store with international delicacies and regional products. The Covid-19 pandemic resulted in reduced traffic at the store due to a drop in tourism and local Parisians not shopping or eating out; the retailer launched its online delivery service so that consumers could enjoy its Gourmet meals, local offerings, wines and grocery meal preparations.

Why Is This Strategy Effective?

Local services help to build traffic and loyalty from local customers, which is particularly important during times of disruption as we have seen amid the pandemic. As well as extending their own services online, department store retailers can build partnerships with local brands to increase traffic and tap into a loyal customer base.

2. Expand into New Services (Beyond Traditional Services)

Department stores are extending their service offerings beyond their traditional operations to provide consumers with new reasons to visit their physical stores and websites.

Onsite Optical Services

UK department store chain Marks & Spencer (M&S) announced on October 2, 2021, that it would launch its M&S Opticians services in 55 stores over the next 18 months, by April 2023. Each of the M&S Opticians branches will be operated by opticians and hearing care provider Owl Optical, part of Scrivens Opticians & Hearing Care. Customers will have the choice of M&S-branded optical frames as well as third-party frames. The company reported that the rollout follows a successful trial where the service received a customer satisfaction rate of 96% and a customer recommendation rate of 96%. The services are omnichannel; M&S is also offering customers the ability to book appointments online and virtually try on and purchase glasses.

M&S reported that the rollout of M&S Opticians is partly in response to changes in consumer behavior: The M&S Family Matters Index conducted in September 2021 found that 64% of 10,000 consumers across the UK plan to take their health more seriously than before the pandemic. Due to the Covid-19 pandemic, at least 10,000 people in England, Wales and Scotland have missed out on care essential to maintaining their sight, according to the UK Ophthalmology Alliance and The Royal College of Ophthalmologists. The M&S Opticians services therefore provide an essential service for customers, particularly as the M&S customer base skews older and this demographic tends to require more vision services.

[caption id="attachment_141726" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

1. Offer Local Services

Leading department stores are finding innovative ways to better serve their loyal, local customers—such as by extending in-store offerings to online services.

In November 2021, Galeries Lafayette Hausmann, a luxury department store in Paris, France, launched Gourmet, an online food-delivery site with the slogan, “The best artisans are coming to your home.” Consumers can order fully prepared catered meals from its top chefs, including Jean Paul Hevin, Petrossian and Pierre Herme, or select items to create their own meals from its fresh market, delicatessen and wine selection. Items are available for delivery or click and collect.

In store, Galeries Lafayette Hausmann’s food department, known by locals as “Le Gourmet,” is part of the home department, which covers nearly 37,700 square feet on three levels. Products include luxury and gourmet food brands, a food hall where consumers can dine in or pick up a takeaway meal, and a full grocery store with international delicacies and regional products. The Covid-19 pandemic resulted in reduced traffic at the store due to a drop in tourism and local Parisians not shopping or eating out; the retailer launched its online delivery service so that consumers could enjoy its Gourmet meals, local offerings, wines and grocery meal preparations.

Why Is This Strategy Effective?

Local services help to build traffic and loyalty from local customers, which is particularly important during times of disruption as we have seen amid the pandemic. As well as extending their own services online, department store retailers can build partnerships with local brands to increase traffic and tap into a loyal customer base.

2. Expand into New Services (Beyond Traditional Services)

Department stores are extending their service offerings beyond their traditional operations to provide consumers with new reasons to visit their physical stores and websites.

Onsite Optical Services

UK department store chain Marks & Spencer (M&S) announced on October 2, 2021, that it would launch its M&S Opticians services in 55 stores over the next 18 months, by April 2023. Each of the M&S Opticians branches will be operated by opticians and hearing care provider Owl Optical, part of Scrivens Opticians & Hearing Care. Customers will have the choice of M&S-branded optical frames as well as third-party frames. The company reported that the rollout follows a successful trial where the service received a customer satisfaction rate of 96% and a customer recommendation rate of 96%. The services are omnichannel; M&S is also offering customers the ability to book appointments online and virtually try on and purchase glasses.

M&S reported that the rollout of M&S Opticians is partly in response to changes in consumer behavior: The M&S Family Matters Index conducted in September 2021 found that 64% of 10,000 consumers across the UK plan to take their health more seriously than before the pandemic. Due to the Covid-19 pandemic, at least 10,000 people in England, Wales and Scotland have missed out on care essential to maintaining their sight, according to the UK Ophthalmology Alliance and The Royal College of Ophthalmologists. The M&S Opticians services therefore provide an essential service for customers, particularly as the M&S customer base skews older and this demographic tends to require more vision services.

[caption id="attachment_141726" align="aligncenter" width="700"] M&S Opticians services are set to open in 55 store locations by April 2023

M&S Opticians services are set to open in 55 store locations by April 2023Source: Company reports[/caption] Furniture Rental Services UK department store John Lewis provides a furniture rental service in partnership with rental company Fat Llama. The offering enables customers to rent John Lewis products—including desks, chairs, dining tables and sofas—for three, six or 12 months, and they have the option to buy the rented product at any time. John Lewis reported in its annual report for the fiscal year ended January 30, 2021, that it plans to expand the rental offering: “Attitudes towards renting items and the sharing economy have dramatically shifted in recent years, and we know that renting and reselling items and recycling them is a growing priority for our customers. Renting furniture will give more customers access to high-quality products, as well as the latest designs.” John Lewis is a first mover in the furniture rental category, which should help drive traffic to the John Lewis website and may help the retailer boost sales in ancillary categories such as bedding, linens, towels, curtains and other home-related products. The service will also provide personalization and consumer engagement opportunities; the department store can collect and analyze data on customer shopping preferences to create targeted offers based on past rentals and purchases. Why Is This Strategy Effective? Offering nontraditional services enables retailers to attract a new consumer base and meet the needs of its existing customers. There are sales benefits, too: Once customers are in a retailer’s brick-and-mortar store or their website online, there is an increased likelihood that they may browse or purchase another item. This strategy also helps department stores to tap into growing categories and market segments, such as home. 3. Engage with Consumers Through Live Selling As physical stores closed due to pandemic-led lockdown measures, department stores shifted their focus to connecting with customers online, through live selling and consultations—bringing the personal in-store shopping experience to consumers digitally. Intime is China’s largest department store retailer, with 65 locations in the country—at which in-store operations were suspended amid Covid-19. During this time, Intime accelerated its livestreaming on Taobao Live, Alibaba’s livestreaming platform (the department store was acquired by e-commerce giant Alibaba in 2017), with more than 5,000 sales associates from Intime’s physical stores registering as livestreaming hosts, according to the company. The department store increased the number of livestreaming sessions it hosted to an average of 200 a day, running all day until midnight. Each livestream session on Taobao Live is linked to Intime’s online stores, which allows consumers to make purchases during the livestream. According to Intime, over 90% of orders through livestreaming were placed by new users that are different from the company’s regular shoppers; livestream shoppers are younger and have high levels of engagement, leaving lots of comments and feedback. Sales associates are able to learn a lot about these shoppers through the digital live-selling format. To boost online shopping through its Miaojie app, which lists more than 90% of Intime’s products, the department store offered free in-app purchases. This helped offset losses caused by declines in traffic to its physical stores, and in-store staff who were not busy livestreaming were able to help process online orders and prepare them for delivery. Intime reported to CNBC that its livestreaming and online efforts had helped the company to almost recover its sales in May 2020 to the same levels as in May 2019. UK department store John Lewis launched virtual services in April 2020 to meet the needs of consumers during a period of lockdown in three areas:

- Virtual nursery appointments—John Lewis advisors help consumers to answer questions, discuss products and discuss essentials during a one-hour video call. Following the call, the advisor emails a personalized shopping list to the consumer, based on their conversation.

- Virtual home design—Interior stylists help customers with home inspiration, support and advice via a one-hour video chat call. The projects span repurposing ideas and tips to making a space more comfortable, creating an area that is flexible for work, or taking on a new interior design project. During the video call, the stylist pulls together a mood board, ideas and shopping list and sends it to the customer following the call.

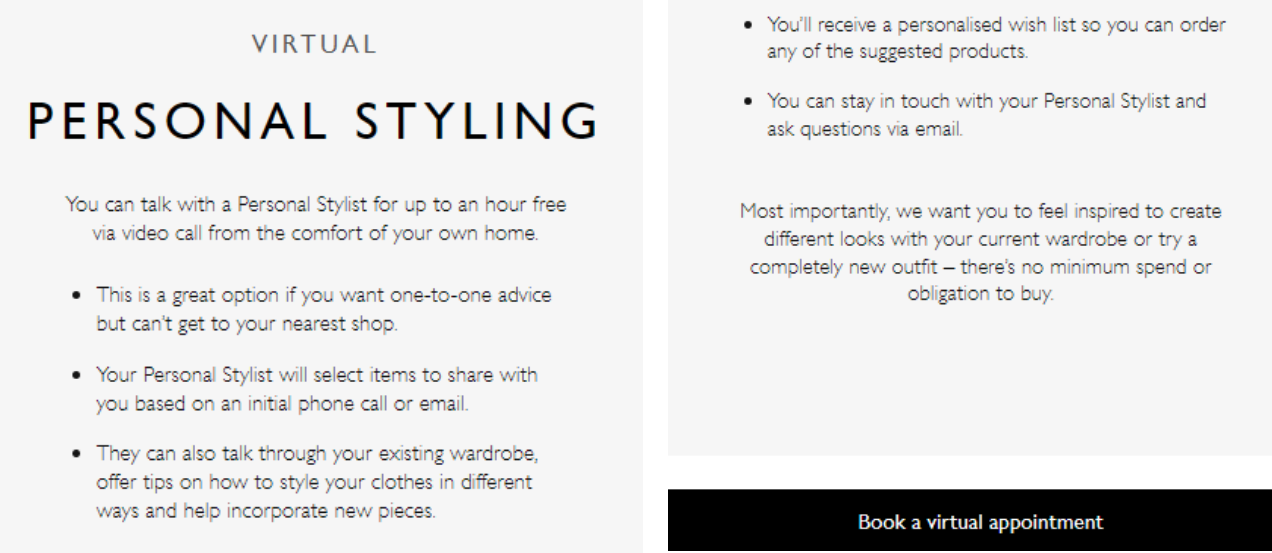

- Virtual styling—Personal stylists, providing guidance on key wardrobe staples, help consumers streamline wardrobes and de-clutter closets. Prior to the call, consumers fill out a questionnaire specifying the goal of the call (i.e., wardrobe refresh, closet decluttering, event preparation) as well as style preferences. The stylist will select personalized items based on the results, in preparation for the call. Stylists follow up the appointment with a personalized email detailing all that was discussed, including links to items on a wish list that a customer can order. John Lewis has over 150 personal stylists.

John Lewis virtual styling appointments

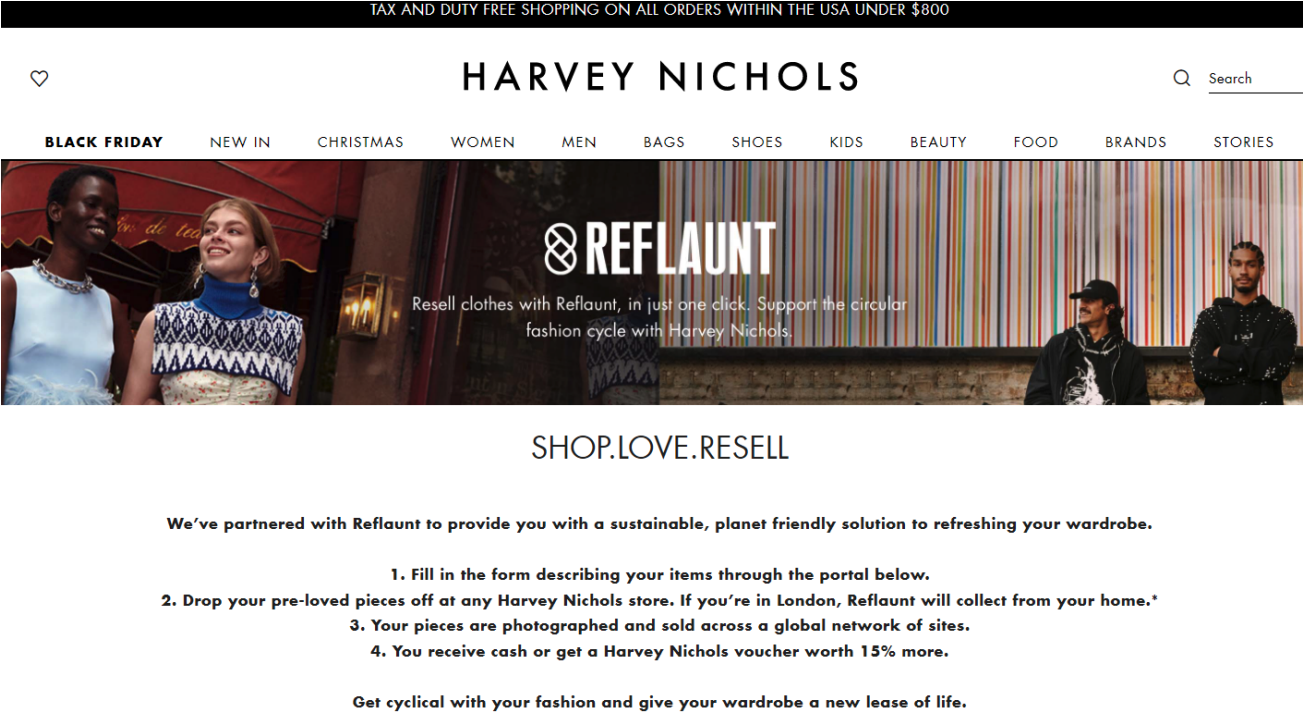

John Lewis virtual styling appointmentsSource: Company website[/caption] Why Is This Strategy Effective? Live selling complements a physical store strategy and can help department stores to reach a new, younger consumer. Virtual services enable retailers to grow online revenue while building a new consumer base. Virtual consultations provide department stores with a tremendous amount of data regarding consumer preferences that can help to inform buying, marketing and personalization decisions. Coresight Research believes that by blending entertainment and social engagement with instant purchasing, livestreaming e-commerce will continue to offer department store retailers an innovative channel with immense space for creating value for consumers. We have identified livestreaming as a key retail trend in 2022 and beyond. 4. Offer Fast, Free Delivery Consumers’ expectations for faster and lower-cost (free) delivery are continuously increasing; many shoppers make purchase decisions based on convenience, speed and cost. El Corte Inglés, Europe’s biggest department store chain, located in Spain, launched a subscription-based service in October 2020 for unlimited free 24-hour delivery for an annual fee. El Corte Inglés set up an app for mobile phones and other devices, where, for €19.90 (around $22.70) a year, customers can receive their order within 24 hours. This program extends to its entire store—clothing, cosmetics, jewelry, accessories, books, music and film, electronics and household appliances, as well as supermarket produce. Why Is This Strategy Effective? Department stores that offer ultra-fast delivery services and consumer convenience have a competitive advantage as consumers may select which retailer to purchase from based on how quickly they will receive their order. 5. Invest in the Circular Economy Once considered rare, resale and rental services are becoming standard, must-have categories for retailers due to consumer demand for sustainability. Resale, rental and upcycling are so popular right now because consumers are interested in unique, one-of-a-kind items, particularly in luxury, and these services are more sustainable, which is a high priority for Gen Zers in particular. Harvey Nichols, a UK department store, announced in August 2021 that it was partnering with resale service Reflaunt to provide consumers with the opportunity to sell pre-owned designer goods through Reflaunt’s platform. Sellers can receive 80% of the resale price or a Harvey Nichols store voucher. They can either bring their items into a Harvey Nichols store or have their items picked up. Reflaunt handles the rest of the process, including authentication, pricing and uploading product imagery on the website. The service is available in Harvey Nichols stores and online across the UK. [caption id="attachment_141729" align="aligncenter" width="700"]

Harvey Nichols’ resale service with Reflaunt

Harvey Nichols’ resale service with ReflauntSource: Company website[/caption] Printemps’ 7th Heaven 7ième Ciel is a 14,000-square-foot space dedicated to circular fashion, located on the seventh floor of its main building on Boulevard Haussmann in Paris. The company unveiled its circular economy department on September 21, 2021. It is divided into two large areas, vintage and upcycling.

- Under “Second Printemps,” the department store offers restored vintage clothing and accessories from all over the world for men and women.

- The second space is devoted to eight rotating companies and startups focusing on secondhand, upcycling, repair and restoration, and customization. The brands featured at the pop-up stores will rotate every two to three months, according to Printemps. The initial launch companies include apparel upcycling service Tilli, vintage retailers Relique and Nuovo, sneaker care and customization service Docteur Sneaker, secondhand children’s clothes retailer Bonâge, and a selection of upcycled and recycled items from Printemps-owned online homeware retailer Made in Design.

- Resale: As part of its Project Earth initiative, Selfridges launched Resellfridges, a service through which consumers can sell and shop for preowned and upcycled garments. In the company’s “One Year On” report dated November 2021, Selfridges reported that over 7,000 items had been sold through Resellfridges to date.

- The Corner Shop: The Corner Shop at Selfridges features rotating brand-collaboration concepts, each focusing on circularity. In the summer of 2021, Selfridges launched “Resellfridges: The Wedding,” a resale shop of vintage and pre-owned wedding outfits and accessories. Today, there are eight shops in The Corner Shop that cover vintage womenswear, streetwear and iconic sportswear, T-shirts and sweatshirts, and film-inspired pieces.

- Rental: The retailer launched Selfridges Rental in the spring of 2021, for men’s and women’s designer fashion and accessories. In the company’s “One Year On” report, Selfridges reported that over 700 customers have participated in the rental program.

- Refill and recycle: Selfridges stocks over 1,000 refillable products. During the Project Earth launch campaign, the company trialed a partnership with recycling company TerraCycle to encourage customers to return their empty beauty packaging for recycling.

- Repair: The Repairs Concierge directs customers to services that can restore and rejuvenate products, ranging from jewelry to eyewear. Shoe, bag and clothing repair brand The Restory is one of the most popular services, according to Selfridges.

Selfridges Resellfridges resale service

Selfridges Resellfridges resale serviceSource: Company website[/caption] Why Is This Strategy Effective? Consumer interest in, and demand for, sustainability in retail is growing, and department stores need to capitalize on this trend to stay relevant and maximize traffic. Services that offer product restoration, rental and resale are particularly popular among younger consumers, particularly in the luxury category.

- Read more Coresight Research coverage of sustainability in retail.