albert Chan

What’s the Story?

Shopping cycles are accelerating, with consumers expecting fresh styles available frequently and shipped in ever-shorter times. We discuss two ways in which retailers can utilize technology to better adapt to shifting demand:

- Intelligent demand forecasting plays a key role in a retailer’s operations, connecting inventory, assortment, inventory allocation, pricing and discounting. Retailers can use technology such as artificial intelligence (AI) and machine learning (ML) to leverage data on consumer purchasing behaviors and preferences from across multiple channels, including social media, to forecast demand.

- Sourcing has yet to catch up with rapidly shifting consumer demand, with lead times for high-volume products measuring in terms of months. On-demand manufacturing technologies enable retailers and brands to better align manufacturing cycle times with the insights from AI predictions.

This report is part of Coresight Research’s series of roundtable discussions and research reports, entitled The New Age of Customer-First Supply Chains, in which we present key insights into strategic areas in which brands and retailers can take action to build a resilient and profitable supply chain.

- Read our separate report for an introduction to the series.

Why It Matters

Retailers and brands are facing challenges with regard to consumer demand, particularly against the backdrop of the Covid-19 pandemic. During the crisis, consumers distilled their shopping journeys into a few strategic store visits, with the expectation that those selected stores will cater to all their needs. These fewer trips make having the right product (or acceptable substitutes) in inventory critical. Even before the pandemic, the immediacy of the Internet and social media raised consumer expectations that they could have everything uniquely catered to them and available in short order.

There are many benefits for retailers in developing their ability to react more quickly to shifts in consumer demand:

- Accurate demand forecasting has major implications for revenues and margins; it enables retailers to enhance customer satisfaction by having the right products on the shelf at the right location and at the right time, avoiding stock-outs. This drives sales—and managing inventory and optimizing pricing also enhances profit.

- Products manufactured in a shorter timeframe are more likely to be aligned with rapidly shifting consumer tastes, and products that can be personalized and customized are even more likely to delight consumers and be less likely to be returned.

- Products in tune with customer demand are more likely to be sold at full price, avoiding excessive discounting and reducing waste.

- On-demand manufacturing reduces overheads and can protect retailers against shipping bottlenecks and international trade disputes.

Using AI To Meet Consumer Expectations: A Deep Dive

1. Intelligent Demand ForecastingIncreasing Consumer Expectations

Consumer expectations have risen alongside the increasing convenience and ease of shopping and greater offerings from retailers who have stepped up their offerings in response to a heightened level of competition. The desire for immediacy when shopping is true across both online and brick-and-mortar channels (see Figure 1).

Figure 1. Consumer Expectations When Shopping

[caption id="attachment_131220" align="aligncenter" width="350"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

In its 13th annual “Shopper Vision Study,” Zebra Technologies outlined the top three reasons shoppers leave a store without making a purchase:

- Desired item is out of stock.

- Checkout line/queue is too long.

- They can’t find the item on display.

There have been several factors that have served to “spoil” consumers, leading them to expect everything, and to get it right away in a noisy, highly competitive retail environment:

- Personalization and Customization

Demand for personalization has been more evident among millennials and Gen Z—and retailers have responded. One result has been the rise of fast-fashion apparel, with new designs on the shelf every couple of weeks. Moreover, the emergence of limited-time capsule collections and collaborations between disparate industries (for example, between Crocs and Balenciaga in footwear) offers small batches of unique inventory that generates and sells quickly. Brands such as Levi’s offer shops within their stores that enable customers to add names or designs to turn high-volume apparel into customized and personalized designs.

- Fragmentation of Consumer Attention Across Various Channels

With consumers having to shelter at home during lockdowns and many being reluctant to visit stores and malls after stores reopened, the brick-and-mortar channel has fallen behind digital channels in terms of product discovery and research, and places to socialize. Even before the pandemic, consumer attention was being spread across many online channels, including video- and content-sharing platforms and social media such as Facebook, Instagram, TikTok and Twitter. The ability of consumers to jump immediately from one online platform to another at home has fragmented their attention, and the digital channels have increased their expectations for immediate and personalized engagement with brands/retailers.

- Ever-Faster Shipping

Amazon continues to define the standard for e-commerce vendors, starting with fast, free, two-day shipping for Prime members and then raising the standard with the introduction of free one-day delivery in mid-2019. Other e-commerce retailers now offer same-day delivery, and several grocery innovators are offering delivery in as little as 15–20 minutes. With these moves, consumers have come to expect delivery in two days or faster.

In a May 2021 survey conducted by Coresight Research and strategic consulting and media firm January Digital, “fast, free delivery for online orders” ranked as the top feature that was “very important” to US consumers when choosing a retailer or brand.

AI/ML as Enabling Technologies

AI/ML magnifies the value of data in two key ways:

- ML can turn data into projections, finding the most accurate forecasting model and adapting it over time to maintain accuracy.

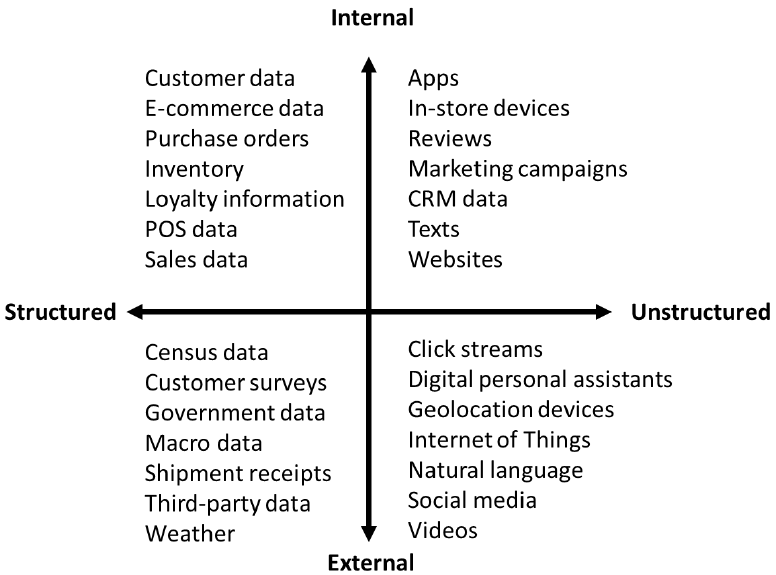

- AI/ML is able to find relationships, even unseen ones, among disparate types of data that are often stranded in siloes. The ability of AI to analyze structured and unstructured data in making predictions is essential. The figure below illustrates types of structured/unstructured and internal/external data.

Figure 2. Types of Structured and Unstructured Data, Internal and External

[caption id="attachment_131221" align="aligncenter" width="550"] Source: Institute for Business Planning and Forecasting[/caption]

Source: Institute for Business Planning and Forecasting[/caption]

ML-based demand forecasting is only about 50% accurate using historical data, but accuracy rises by 15%–30% when external data such as weather or the local event calendar is added, according to industry experts.

For example, weather-analytics company Planalytics reports that incorporating weather-driven demand data achieved the following results for several retailers:

- One grocer reduced days of supply by 40%.

- A restaurant reduced shrink by $115,000 and product sales by $56,000 through greater product availability.

- One national hardware co-op improved demand forecasting with weather data, realizing a 100-basis-point improvement in the service level and a 10-percentage-point accuracy increase at the subclass level, resulting in a three-percentage-point increase in demand forecasting accuracy.

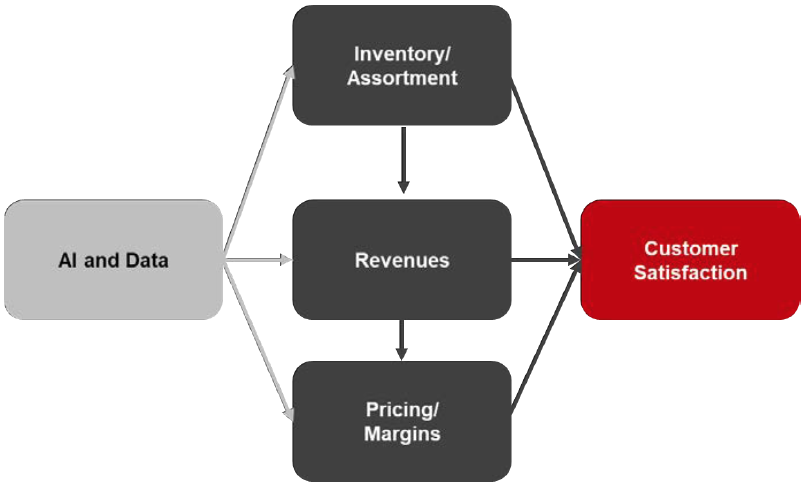

Demand forecasting has direct implications for a retailer’s inventory, assortment and pricing, which directly influence revenues and margins, as shown in Figure 3. Inventory availability has a direct influence on customer satisfaction, which in turn influences future revenues through return visits, positive reviews and word-of-mouth recommendation. Moreover, in a world in which consumers can easily compare prices online, the attractiveness and accuracy of pricing greatly influences customer satisfaction.

Figure 3. AI and Data in Demand Forecasting: Influences on Inventory, Revenues, Margins and Customer Satisfaction

[caption id="attachment_131222" align="aligncenter" width="550"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Leveraging AI and data offers several benefits for retailers, brands and, ultimately, consumers—including the following:

- Better coordination with suppliers

- Improved synchronization with customer demand

- Smoother supply chains

- Coordination with marketing campaigns

- Better coordination with corporate strategy and financial management

- Reduction of excess inventory, especially waste and spoilage in grocery

Success Cases

As mentioned above, demand forecasting is highly intertwined with inventory and assortment management, as well as pricing. Retail-focused AI software innovator Impact Analytics draws on a dynamic base of more than 15,000 model constructs for forecasting, replenishment and allocation; pricing, promotion and markdown optimization; and merchandise and assortment planning.

One retailer—which manages more than 850 locations and 470,000 SKUs (stock-keeping units) across the US and runs more than 10,000 promotions monthly—sought support from Impact Analytics’ pricing product suite. The company implemented Impact Analytics’ promotion optimization platform to manage its promotion strategy, saving roughly $20 million annually. The retailer was able to simulate various promotion points and create new campaigns in fewer than 10 seconds, according to Impact Analytics.

Other demand forecasting-related selected success cases for the innovator include the following:

- One apparel retailer improved its gross margin by 5% with assortment optimization.

- One pet-supply retailer realized a 20% increase in revenues and margins through promotion optimization, leading to a 5% improvement in the bottom line.

- One jewelry retailer reduced weeks of supply by 50% due to improvement in allocation.

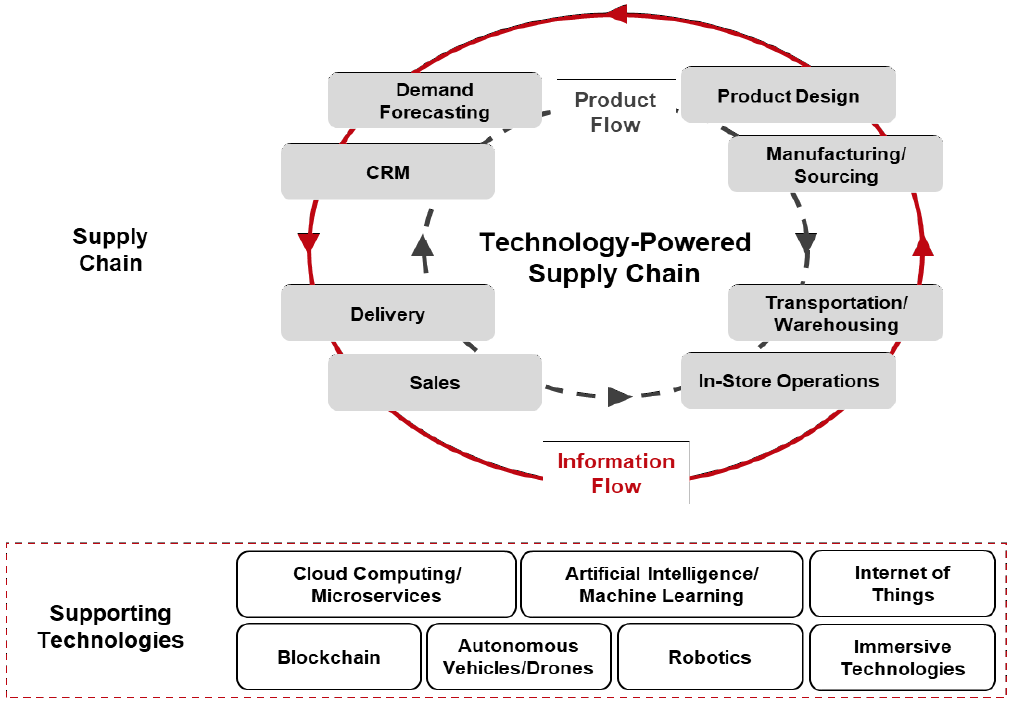

Whereas supply chains of the past were unidirectional—transferring product from factory to warehouse to store to consumer—modern technology-powered supply chains transmit data in the opposite direction, back to the factory and product designer, with information-sharing along the entire path (see Figure 4). This enables greater responsiveness, which reduces waste and improves financial performance due to better inventory control and reduced discounting from supply-demand mismatches.

Figure 4. Modern, Technology-Powered Supply Chain with Bidirectional Product and Information Flows

[caption id="attachment_131223" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

The modern, interconnected supply chain enables communication between all parties, factoring in real-time sales data and external information (such as customer sentiment from reviews and social media) into product design and development. The incorporation of data enables much shorter and more accurate product-development cycles, with brands and retailers able to design products that align with fashion trends and customer preferences.

Many companies, including Lectra’s Retviews, offer fashion-trend and competitive-landscape analysis services to support brands and retailers in recognizing and adapting to changing consumer tastes and competitors’ pricing strategies, ultimately enhancing their own profitability.

On-demand manufacturing represents a manufacturing approach that is complementary to traditional high-volume manufacturing and further enables brands and retailers to be more dynamic in responding to consumer demand. Although the following discussion primarily applies to apparel, the concept applies to many sectors.

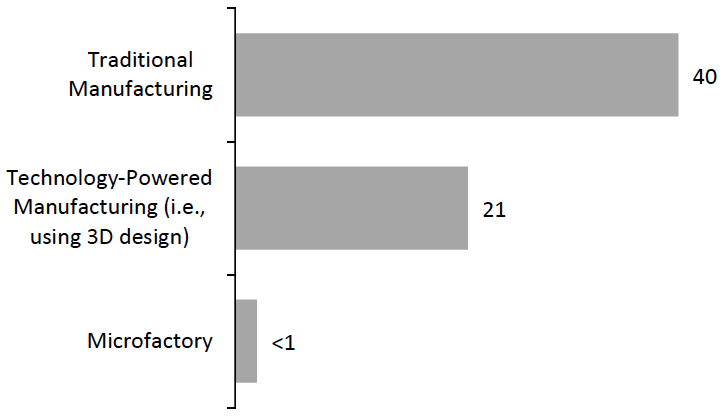

Looking at apparel specifically, traditional manufacturing times can span the greater part of a year, as shown in the figure below. Adding technologies such as 3D design and sourcing cuts lead times in half—a major achievement and likely to dramatically enliven the apparel industry. Still, these two approaches cannot match the lead times offered by a microfactory, which is a small manufacturing site that is able to print, cut and finish (through sewing) the production of apparel or other fabric-based products such as furniture coverings.

Figure 5. Selected Apparel-Manufacturing Lead Times, by Manufacturing Type (Weeks)

[caption id="attachment_131224" align="aligncenter" width="550"] Source: Gerber, a Lectra Company/Li & Fung[/caption]

Source: Gerber, a Lectra Company/Li & Fung[/caption]

As an example, the Gerber Innovation Center in New York City, pictured below, is a microfactory that features a Kornit printer (for printing on fabric), a Gerber Z1 cutter, and as well as sewing machines and other equipment. The center is able to print, cut and complete a piece of apparel in as few as a couple hours.

[caption id="attachment_131225" align="aligncenter" width="550"] Gerber Innovation Center

Gerber Innovation CenterSource: Coresight Research[/caption]

The digital foundation of on-demand manufacturing enables shorter manufacturing times, for shorter end-to-end cycle times for consumers. Products are more likely to be aligned with fashion trends and can accommodate personalization and customization—extending to the use of body-scanning technology to achieve a superior fit. These benefits improve customer satisfaction and thus reduce costly returns for brands and retailers, as well as generating positive reviews that drive repeat business.

Microfactories are more efficient due to their smaller size, consuming fewer resources and generating less waste, thus offering a more sustainable approach to manufacturing. Despite their lesser scale, microfactories can offer reasonable margins for retailers and brands due to the combination of a personalization/customization premium and substantial efficiency.

On-demand manufacturing provides retailers and brands with a greater degree of control over the manufacturing process, compared to an overseas factory. This also offers a degree of protection from the repercussions of global trade issues and port congestion.

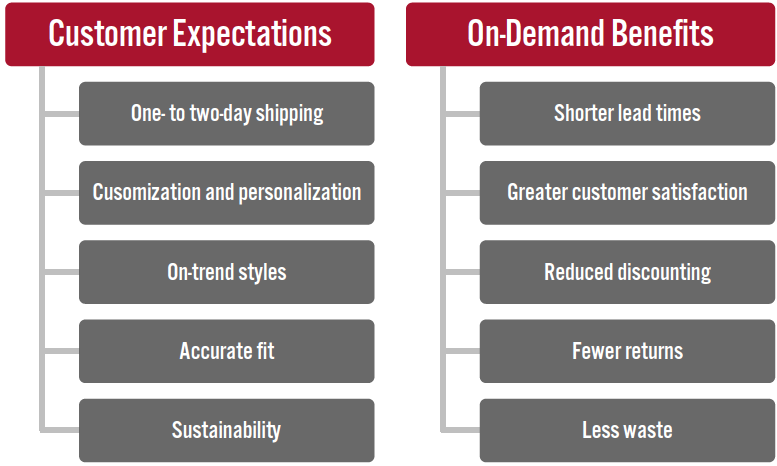

We summarize the benefits of on-demand manufacturing for retailers/brands and consumers in Figure 6.

Figure 6. Benefits of On-Demand Manufacturing for Retailers/Brands and Consumers

[caption id="attachment_131226" align="aligncenter" width="550"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

independent apparel-printing houses, there are few integrated printing-cutting-sewing shops. Retailers and brands embracing the appeal of on-demand manufacturing could drive this industry forward. Alternatively, a visionary entrepreneur could create a new enterprise featuring a network of microfactories, or a large company could finance the formation of a network of independent, on-demand manufacturing shops.

What We Think

Intelligent demand forecasting and on-demand manufacturing are technology-powered concepts that can support brands and retailers in being more flexible to shifts in the consumer market, and thus increase profitability and reduce risk.

A tightly integrated, data-fueled supply chain links consumer desires and preferences with product development and manufacturing, meaning that on-trend products arrive faster—pleasing consumers and reducing discounting and waste.

Meeting consumer expectations of having everything delivered in a short timeframe is critical amid a heightened competition in the e-commerce space: Microfactories would enable retailers and brands to offer customized, personalized and better-fitting apparel in competitive lead times.

Implications for Brands/Retailers

- Retailers can employ demand forecasting to keep customers happy by reducing the risk of stock-outs.

- Demand forecasting enhances inventory efficiency and reduces working capital.

- Doing demand forecasting well can raise revenues and protect margins, enhancing the bottom line.

Implications for Real Estate Firms

- Retailers using demand forecasting to optimize inventory will require less storage space in stores and warehouses.

- The growing on-demand manufacturing/microfactory category will require suitable manufacturing space near shipping hubs.

Implications for Technology Vendors

- The continued growth and fast development of AI/ML technology offers opportunities for developers of platforms, tools and applications.

- There are also opportunities for the development of demand forecasting software customized for individual retail segments.

- Digital design and manufacturing software is in its early stages, with multiple opportunities in design, process management, manufacturing and connection with e-commerce platforms.