DIpil Das

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

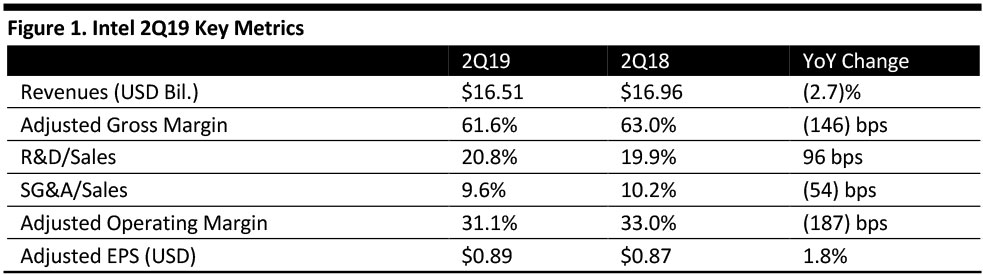

2Q19 Results

Intel reported 2Q19 revenues of $16.51 billion, down 2.7% year over year and slightly below the $15.68 billion the consensus estimate.

Adjusted EPS was $0.89, up 1.8% and in line with consensus. GAAP EPS, which includes the amortization of intangibles, the marking to market of equity securities and the associated tax effects, was $1.06, compared to $1.04 in the year-ago quarter.

Performance by Segment

- PC-centric revenues (what the company calls the Client Computing Group) were $8.8 billion, up 1.3%, owing to a strong mix of Intel's higher performance products, strength in the commercial segment, and customers buying ahead of possible tariff impacts. New, 10nm-based 10th Gen Core processors (code-named “Ice Lake”) are now shipping, with volume shipments expected for the 2019 holiday selling season.

- Data-centric revenues were $7.7 billion, down 6.9%.

- The Data Center Group (DCG, which includes products for the cloud, enterprise and communications infrastructure) reported revenues of $5.0 billion, down 10.2%.

- Revenues in the cloud segment declined 1%.

- Revenues in the communications service-provider segment grew 3%.

- Revenues in the enterprise and government segment declined 31%.

- Revenues in the IoT group hit a new record of $986 million, up 12% (up 23% excluding Wind River Systems, which was divested in April 2018) due to broad strength and greater demand for higher-performance processors.

- Mobileye reported revenues of $201 million, up 16% on continued customer momentum.

- Revenue in the non-volatile memory segment was $940 million, down 13% in a challenging pricing environment.

- Revenue in the Programmable Solutions Group was $489 million, down 5%.

- The Data Center Group (DCG, which includes products for the cloud, enterprise and communications infrastructure) reported revenues of $5.0 billion, down 10.2%.

Details from the Quarter

Management commented that results in the quarter were better than expected, as the growth of data and computing-intensive applications are driving demand in both the PC- and data-centric businesses.

The company commented that it had halted shipments to certain customers (i.e., Huawei) in response to the US government's revised entity list.

CEO Robert Swan outlines three major growth opportunities for Intel:

- Network infrastructure, which was a $4 billion business last year, growing at a 40% CAGR.

- The Internet of Things and autonomous driving: The company’s Mobileye subsidiary has grown at a 30% CAGR since its acquisition in 2017.

- Artificial intelligence: Chips in the data center could be a $10 billion opportunity by 2023. Intel is collaborating with Baidu on its Nervana Neural Network Processor for Training, which it will sample with other customers later this year.

Sale of the 5G Smartphone Model Business to Apple for $1 Billion

Separately, Intel announced it signed an agreement to sell its 5G smartphone modem business to Apple for $1 billion. According to the agreement, Apple will gain 2,200 Intel employees and intellectual property, raising Apple’s count to more than 17,000 wireless patents. The transaction is expected to close in the fourth quarter. Intel has been seeking to gain Apple as a customer for this business but announced the exit of the business in April after Apple reverted to Qualcomm as its main supplier.

Implications for Retail

New technologies such as new, faster processors, processors with embedded AI engines and technologies such as 5G wireless and IoT all enable retailers to offer better, more personalized services and experiences.

Outlook: Raises Annual Guidance

Intel raised revenue and EPS guidance for the full year (which excluded an expected $500 million gain from the planned divestiture of the 5G smartphone modem business):

- Revenues of $69.5 billion, down 2% year over year and up from $69.0 billion previously.

- Adjusted EPS of $4.40, down 4% year over year up from $4.35 previously.

For Q3, Intel expects:

- Revenues of $18.0 billion, down 6% year over year.

- Adjusted EPS of $1.24, down 12% year over year.