DIpil Das

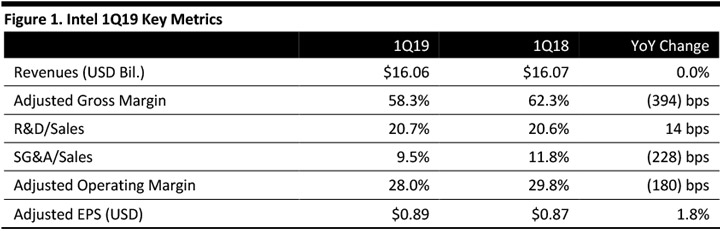

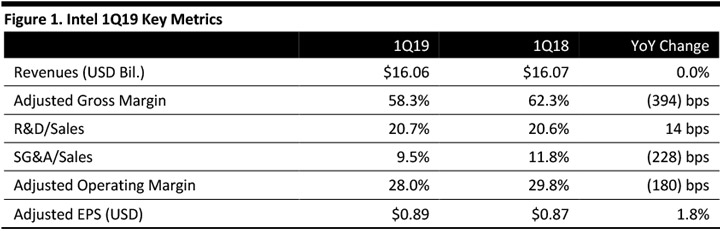

[caption id="attachment_85376" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

1Q19 Results

Intel reported 1Q19 revenues of $16.06 billion, flat year over year and in line with the consensus estimate.

Adjusted EPS was $0.89, up 1.8% and beating consensus by $0.02. GAAP EPS. Which includes the amortization of intangibles, the marking to market of equity securities and the associated tax effects, was $0.87, compared to $0.93 in the year-ago quarter.

Performance by Segment

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Intel reported 1Q19 revenues of $16.06 billion, flat year over year and in line with the consensus estimate.

Adjusted EPS was $0.89, up 1.8% and beating consensus by $0.02. GAAP EPS. Which includes the amortization of intangibles, the marking to market of equity securities and the associated tax effects, was $0.87, compared to $0.93 in the year-ago quarter.

Performance by Segment

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Intel reported 1Q19 revenues of $16.06 billion, flat year over year and in line with the consensus estimate.

Adjusted EPS was $0.89, up 1.8% and beating consensus by $0.02. GAAP EPS. Which includes the amortization of intangibles, the marking to market of equity securities and the associated tax effects, was $0.87, compared to $0.93 in the year-ago quarter.

Performance by Segment

Source: Company reports/Coresight Research[/caption]

1Q19 Results

Intel reported 1Q19 revenues of $16.06 billion, flat year over year and in line with the consensus estimate.

Adjusted EPS was $0.89, up 1.8% and beating consensus by $0.02. GAAP EPS. Which includes the amortization of intangibles, the marking to market of equity securities and the associated tax effects, was $0.87, compared to $0.93 in the year-ago quarter.

Performance by Segment

- PC-centric revenues (what the company calls the Client Computing Group) were $8.6 billion, up 4.5%, owing to a strong mix of higher-performance products and strength in gaming, large commercial products and modems. The company commented that its first processor using 10nm technology, code named Ice Lake, remains on track for shipment in volume during the 2019 holiday season.

- Data-centric revenues were $7.4 billion, down 4.4%.

- The Data Center Group (DCG, which includes products for the cloud, enterprise, and communications infrastructure) reported revenues of $4.9 billion, down 6.3%.

- Revenues in the cloud segment grew 5%.

- Revenues in the communications service-provider segment declined 4%.

- Revenues in the enterprise and government segment declined 21%.

- Revenues in the IoT group were $910 million, up 8.3%.

- Mobileye reported revenues of $209 million, up 38.4%.

- Revenue in the non-volatile memory segment was $915 million, down 12.0% in a challenging pricing environment.

- Revenue in the Programmable Solutions Group was $486 million, down 2.4%.

- The Data Center Group (DCG, which includes products for the cloud, enterprise, and communications infrastructure) reported revenues of $4.9 billion, down 6.3%.

- The second-generation Xeon Scalable processor family with an integrated deep learning boost.

- More than 50 workload-optimized Xeon processors.

- A 56-core, 12 memory-channel Xeon Platinum 9200 processor.

- The new Agilex line of field programmable gate arrays (FPGAs) that use 10nm chip technology.

- Revenues of $15.6 billion, down 3%.

- Adjusted EPS of $0.89 (below the $1.01 consensus) and GAAP EPS of $0.83.

- Revenues of $69.0 billion, down 3% year over year and down from $71.5 billion previously.

- The company now expects DCG revenues to be down by the low single digits due to a tough comparison, continued China weakness and inventory and capacity absorption.

- The growth forecast for the PC-centric segment remains in the low single digits.

- Adjusted EPS of $4.35 (down 5%) and GAAP EPS of $4.14.