albert Chan

Introduction

What’s the Story?

Founded in 2012, Instacart (owned by Maplebear) offers same-day online delivery and pickup services in the US and Canada. Its services allow customers to order groceries and other goods from participating retailers’ nearby stores, with a network of personal shoppers purchasing and delivering the items.

We examine Instacart’s next steps in diversifying its service offerings as it reportedly prepares for an initial public offering (IPO) in 2022.

Why It Matters

Instacart has been a huge beneficiary of the pandemic-driven increase in online grocery demand, which catapulted the company from a luxury service to almost an essential one. The company enables retailers to respond to the surge in online demand without investing in complex e-commerce infrastructure and delivery networks.

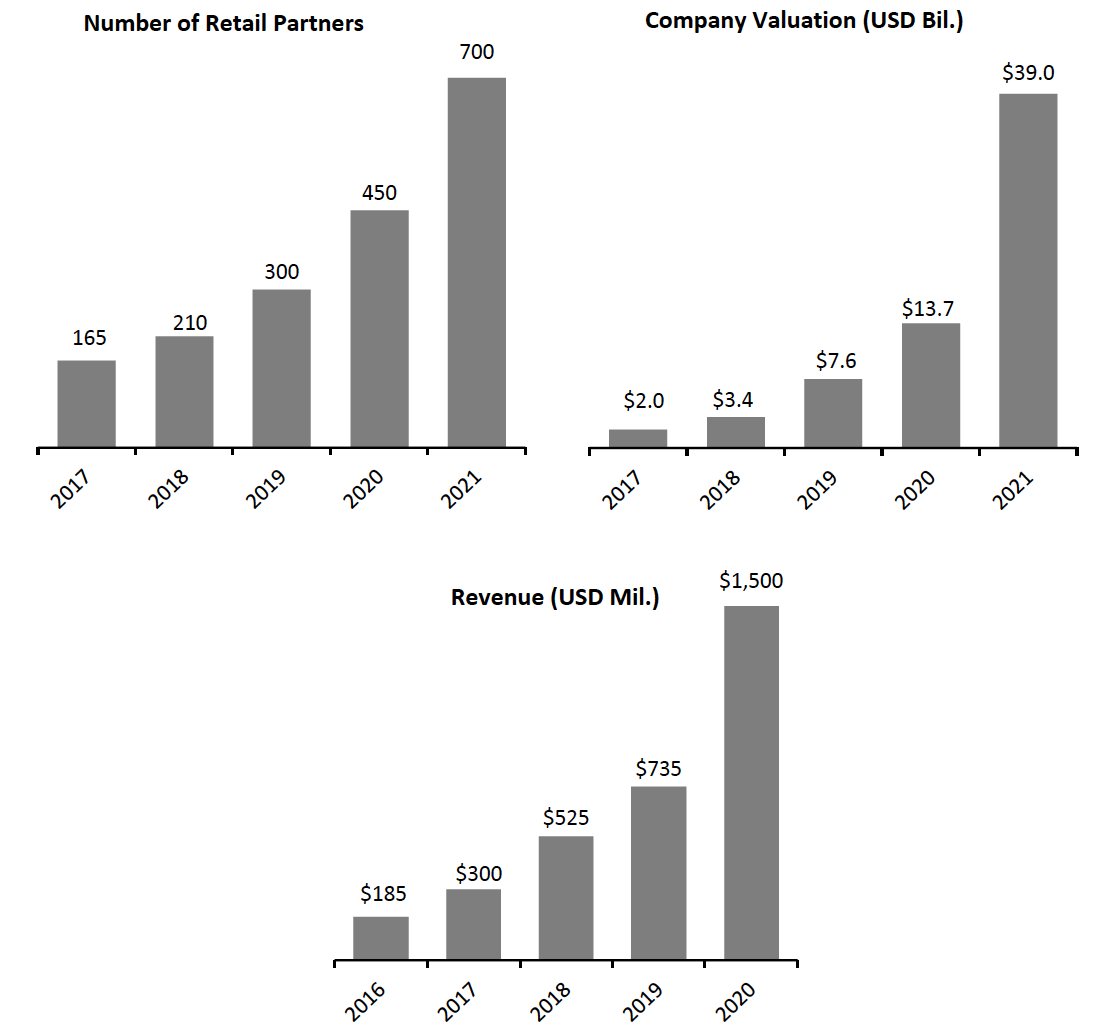

Instacart added around 250 grocery partners in 2021. It reportedly generated revenues of $1.5 billion in 2020, a 104% year-over-year increase. The company’s substantial growth has made it a serious contender in grocery e-commerce, alongside Amazon and Walmart.

Figure 1. Instacart: Key Metrics [caption id="attachment_141846" align="aligncenter" width="700"]

Source: BusinessOfApps.com/company reports[/caption]

Source: BusinessOfApps.com/company reports[/caption]

However, Instacart faces stiff competition from established services including DoorDash and Uber Eats, alongside well-funded vertically integrated startups such as Gopuff, Gorillas and JOKR. In addition, Amazon is reportedly planning to launch a delivery service in 2022, catering to third-party retailers, supermarkets and vendors—placing it in direct competition with Instacart. Against this backdrop, Instacart is looking to broaden its services, moving beyond logistics toward becoming a retail enablement platform.

Analyzing Instacart’s Next Growth Steps: Coresight Research Analysis

Instacart Makes Acquisitions in Catering Software and Automated Checkout Solutions

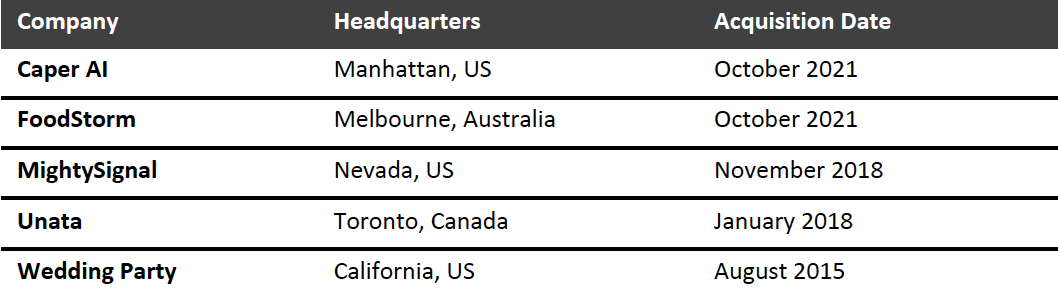

After more than three years without an acquisition, Instacart announced in October 2021 that it had bought catering and order-ahead software company FoodStorm. Less than two weeks later, the grocery delivery provider announced another acquisition, of automated checkout solutions provider Caper AI, for $350 million. The two acquisitions in rapid succession underscore Instacart’s drive to evolve in a rapidly changing grocery market.

We summarize Instacart’s total acquisitions in Figure 2 and explore Caper AI and FoodStorm in further detail below.

Figure 2. Instacart’s Acquisitions [caption id="attachment_141847" align="aligncenter" width="700"]

Source: Company reports[/caption]

Source: Company reports[/caption]

Caper AI

Grocery remains a predominantly offline sector, despite the pandemic-driven surge in e-commerce seen over the last two years. Through its acquisition of Caper, Instacart hopes to play a key role in the brick-and-mortar space, transforming the in-store shopping experience and checkout process, and improving its value proposition in the face of increased competition from DoorDash and Uber.

Caper AI offers a portfolio of automated checkout and smart-cart technology solutions, many of which are deployed in major national grocery retailers across North America. The company’s smart cart has a built-in navigation and product location system for in-store shoppers. The cart also displays a list of available promotions and recommendations. Instacart has stated that it will work toward efficiencies of scale with Caper AI to reduce hardware production costs, making its smart carts and counters more affordable.

Instacart aims to help retailers unify their in-store and online shopping experiences. The company will gradually integrate Caper AI’s technology into its app and its retail partners’ e-commerce stores—enabling shoppers to build online shopping lists ahead of time and check off items while they shop.

Caper AI’s smart carts offer a way for retailers to provide personalized deals while they shop, helping companies understand their customers’ journeys through stores and push location-based product deals. According to Caper AI, implementing smart-cart solutions is cheaper for retailers than automated checkout systems, which involve retrofitting entire stores with overhead cameras and sensors.

However, the company faces several obstacles. Given the high cost of smart carts, grocers will not likely be inclined to use them unless Instacart makes them available at low or no cost. Meanwhile, collecting more in-store shopping and behavioral data—a benefit for Instacart—could put it at further odds with retailers.

[caption id="attachment_141849" align="aligncenter" width="450"] Caper AI’s smart cart

Caper AI’s smart cartSource: Company website[/caption]

FoodStorm

Instacart plans to integrate FoodStorm’s technology to help grocery retailers streamline their meal offerings. FoodStorm’s software automates catering/prepared foods ordering, production, payment and fulfillment in one centralized system. The FoodStorm acquisition will help Instacart bring a larger proportion of grocery retailers’ inventory online and provide them with a significant growth opportunity—order-ahead items and prepared foods are typically more profitable than traditional groceries. Instacart noted that customers who purchased prepared foods and catering items—such as cakes, sushi and hot and cold side dishes—on its marketplace have significantly larger basket sizes and shop more frequently than those customers who do not.

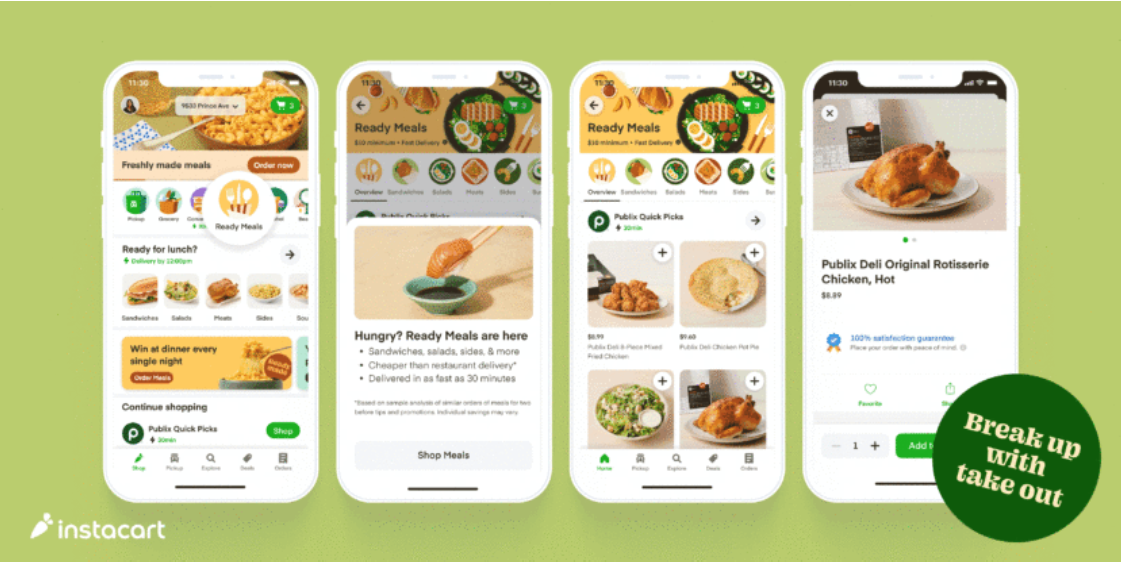

Building on this acquisition, Instacart announced the launch of a “Ready Meals” hub on its app in January 2022—aiming to make it easier for shoppers to discover and order ready-made meals from major grocery stores, including Food Lion, Giant, Kroger, Publix and Stop & Shop.

[caption id="attachment_141850" align="aligncenter" width="550"] Instacart’s Ready Meals Hub

Instacart’s Ready Meals HubSource: Company website[/caption]

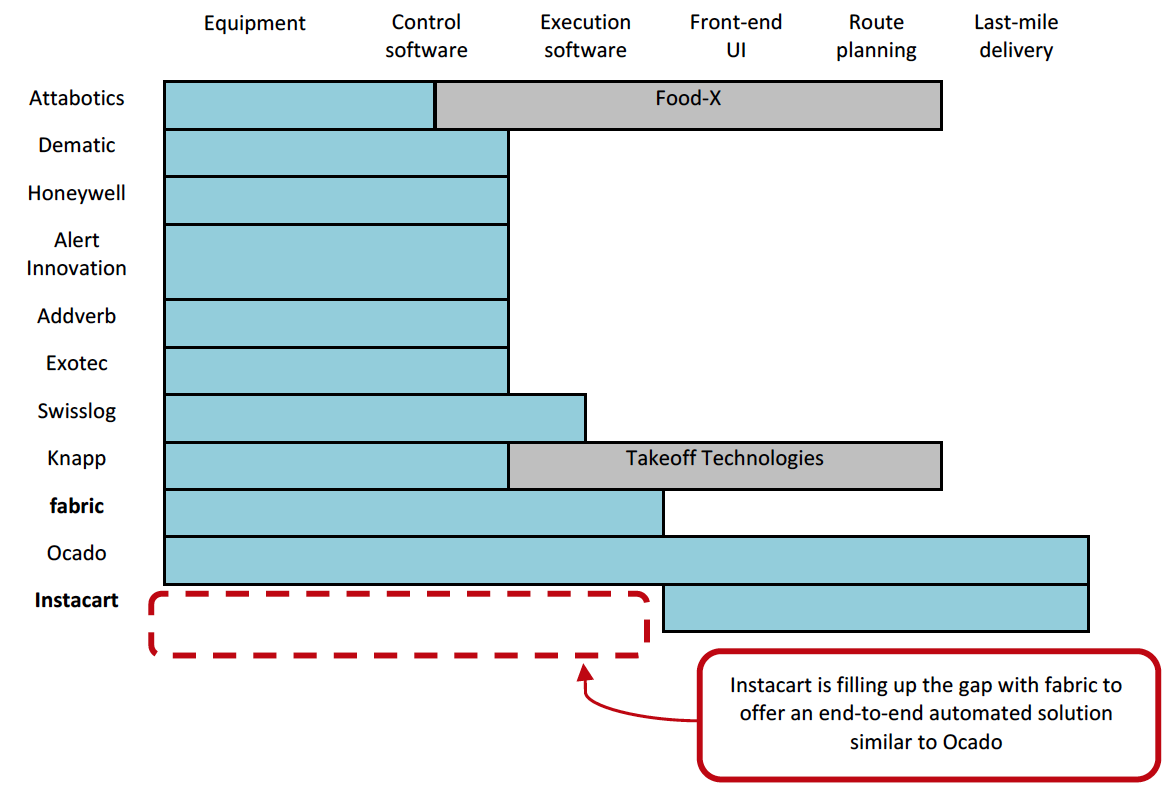

Instacart Partners with Fabric To Offer Fulfillment as a Service

Instacart announced a multi-year partnership with headless e-commerce platform provider fabric in July 2021 that will see the two companies jointly offer automated order fulfillment services to North American grocery retailers. The initiative will combine Instacart’s e-commerce ordering and delivery process with fabric’s robot-powered item-picking technology. Retailers will be able to outfit these micro-fulfillment systems inside existing retail spaces or in dedicated warehouses, managed by Instacart and fabric. When a customer places a grocery order online, robots will assemble the items and Instacart shoppers will pack them; the completed orders will be made ready for curbside pickup or delivered to customers’ homes. Instacart plans to kick off early-stage concept pilots for the initiative in 2022.

Adding robotics to support order fulfillment is a key adjustment for Instacart—made necessary by increased online grocery demand. Although its legacy model, involving sending shoppers to stores, still works for many retailers, this approach is inefficient at high volumes, resulting in Instacart workers clogging aisles and checkout lines. The company’s partnership with fabric will potentially increase efficiencies and improve profitability—it may also provide a key area of differentiation from rivals such as DoorDash and Uber Eats.

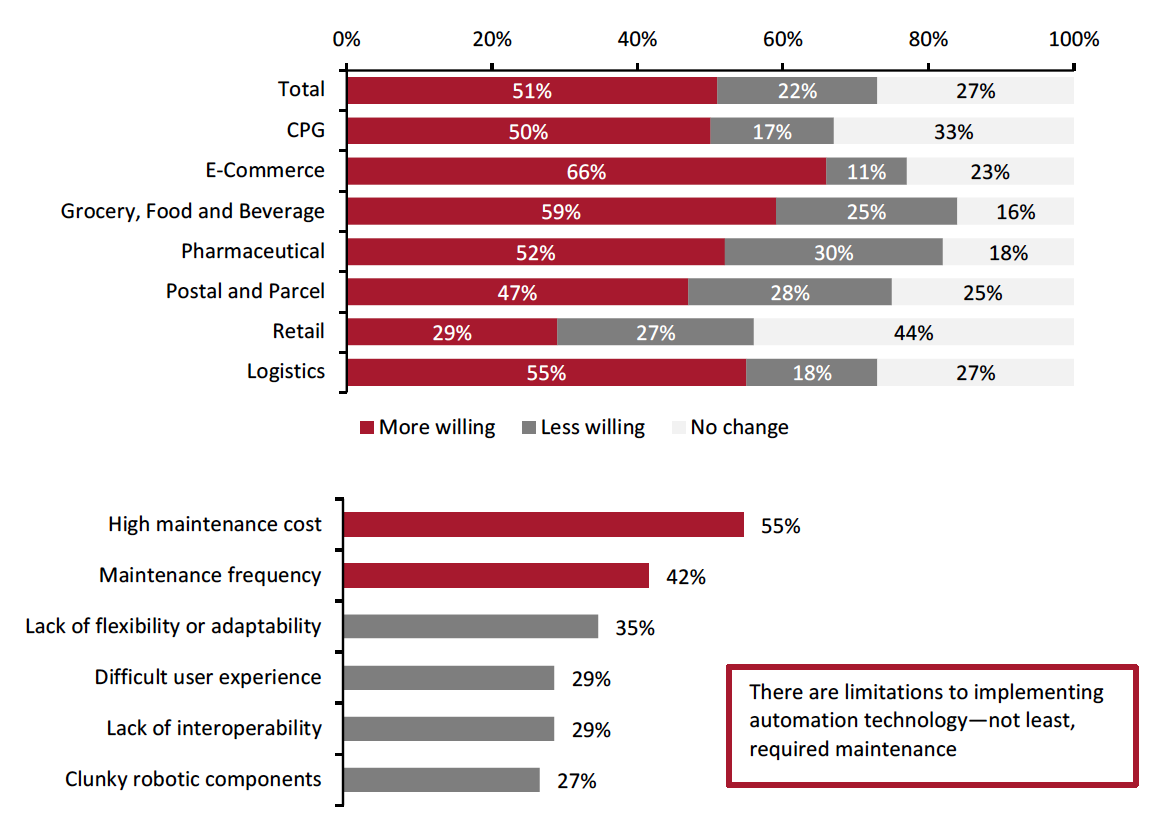

Many US grocers are increasingly open to investing in automation to survive rapidly changing market conditions, with the Covid-19 pandemic having severely strained supply chains and online operations, combined with wage inflation and difficulties in recruiting warehouse workers. A survey conducted by automated solutions provider Honeywell Intelligrated in mid-2020 found that more than half of US companies are more willing to invest in automation due to the pandemic. However, the cost and frequency of maintenance were identified as the most important limitations for the use of automation technology (see Figure 3).

Figure 3. US Companies: Change in Willingness To Invest in Automation Due to Covid-19 (Top) and Most Important Limitations for Companies That Invested in Automation (Bottom) (% of Respondents)

[caption id="attachment_141851" align="aligncenter" width="700"] Base: 434 US-based professionals in senior roles at companies that directly manage warehouses, distribution centers or fulfillment centers, surveyed April 21–May 7, 2020

Base: 434 US-based professionals in senior roles at companies that directly manage warehouses, distribution centers or fulfillment centers, surveyed April 21–May 7, 2020Source: Honeywell Intelligrated/KRC Research[/caption]

We believe that Instacart and fabric’s off-the-shelf, end-to-end solution may appeal to small and medium grocers that find it prohibitively expensive to build and maintain their own automated infrastructure. The target market for the Instacart-Fabric partnership will largely be the players that do not possess the technical capability or the funding to develop such infrastructure internally.

Figure 4. Micro-Fulfillment Center Technology Providers: Levels of Service

[caption id="attachment_141852" align="aligncenter" width="700"] Source: Interact Analysis[/caption]

Source: Interact Analysis[/caption]

Instacart Pushes Further into Advertising

Instacart is among a growing group of companies, including Albertsons, Kroger and Walmart, that are managing their own retail media networks. Like those retailers, Instacart possesses a significant amount of data on shopping habits, which is attractive to advertisers. In May 2020, Instacart launched a new self-serve advertising program that CPG brands can use to promote their products on the company’s website and app. The new self-service tool, “Featured Products,” is keyword targeted, allowing advertisers to bid on relevant keywords and promote products related to those search terms.

Instacart has introduced more advertising placements after the number of advertisers on the platform grew five times in 2020 and Featured Products placement saw fill rates triple in the same year, according to the company. Instacart raised $265 million in new funding in March 2021 and identified its advertising business as a key area it will look to bolster with the investment.

Instacart is also making significant hires with advertising backgrounds to strengthen its retail media team. In August 2021, the company appointed Fidji Simo as its new CEO, replacing Founder Apoorva Mehta. Simo previously served as VP and Head of the Facebook app, as well as overseeing Facebook’s mobile monetization strategy and advertising business. Additionally, in December 2021, Instacart hired Stephen Howard-Sarin to lead its retail media group. Howard Sarin previously served as VP of Strategy and Transformation at Walmart Connect, Walmart’s advertising business.

Advertising will be critical to Instacart’s differentiation from other gig-economy services such as Uber and DoorDash. When ordering a ride or a dinner from a restaurant, consumers are less likely to be lured by marketing into buying other products or services. However, when searching for items to fill a grocery basket, adverts offering related or similar products are more likely to have an impact.

Instacart’s growth trajectory will likely spur many CPG brands to initiate or accelerate their relationships with the company. It aggregates over 700 retailers onto a single platform and has an extensive geographical footprint, allowing brands to allocate to their entire retailer network with a single investment—which is significantly easier than enlisting retailer-specific platforms one by one. As the whole lifecycle of shopping behavior occurs on Instacart (research, browsing, transacting and repurchasing), brands can use the platform as another method of engaging customers at each stage of their buying journey. Instacart also presents opportunities for advertisers in the alcohol and spirits category, who cannot market online with traditional retailers.

Instacart Moves into the Rapid Delivery Space

Amid mounting pressures from a new crop of startups that promise to deliver groceries in as little as 10 minutes, Instacart rolled out a 30-minute “Priority Delivery” service in May 2021. According to the company, Priority Delivery differentiates itself as it does not sacrifice selection for speed. Instant delivery competitors typically offer fewer than 3,000 products, while Instacart shoppers can choose from 25,000–30,000 or more grocery items.

In September 2021, Instacart teamed up with Kroger to launch a virtual convenience store offering fresh food, meal solutions, snacks and other products in as little as 30 minutes. The service, “Kroger Delivery Now,” carries a comprehensive selection of 25,000 items and is available through Kroger’s more than 2,700 grocery stores. Kroger maintains that this new offering is a part of its flexible long-term digital strategy which includes Ocado sheds, micro-fulfillment centers and in-store fulfillment. Molitor stated that Kroger’s extension of partnership with Instacart is to offer an expedited last-mile service, which is separate from simply providing an e-commerce experience.

Instacart announced a similar offering in partnership with Publix in November 2021. Known as “Publix Quick Picks,” the service will be available across Publix’s entire seven-state footprint, allowing customers to shop from the company’s assortment of fresh groceries, meals and household essentials for delivery in as little as 30 minutes. In January 2022, Instacart also partnered with Ahold Delhaize to offer rapid delivery of convenience items, with the service available from more than 1,400 stores.

We believe that the added convenience of rapid delivery with Instacart will unlock additional new customer acquisition opportunities for retailers and improve customer engagement. Furthermore, a relatively expansive SKU (stock-keeping unit) range for high-speed delivery is rare in the industry, particularly one including a wide selection of fresh items. The offering also aims to fulfill immediate demand from specific consumer segments, complementing the weekly grocery shop that forms the basis of its existing retailer/Instacart offering.

However, retailers expect to charge meaningful markups on products available on the Priority Delivery service, which will likely erode price perception over time. Additionally, as we have noted in the past, maintaining control of customer and vendor relationships in online grocery is critical for retailers. When retailers outsource to hyperlocal delivery providers, they also lose large amounts of customer data considered an important asset by most companies—including shopping frequency, product preferences and household information—which are subsequently collected and owned by delivery companies. This hinders retailers from predicting future demand and deploying data-driven resources to improve customer experience, spending and loyalty.

What We Think

Instacart is pivoting itself toward becoming a white-label technology provider for retailers in both online and brick-and-mortar space. Instacart’s acquisition of Caper AI and its partnership with fabric to offer retailers fulfillment-as-a-service illustrates the company’s move to evolving into a one-stop-shop for technology. However, Instacart will have to convince grocers it is an enabler and not a competitor before licensing its technology.

We also expect Instacart to leverage FoodStorm to help grocery retailers launch or expand ghost kitchen offerings in the near future. The pandemic has strengthened the prospects of ghost kitchens as more consumers have turned to online delivery for prepared meals to consume at home.

Although Instacart’s advertising platform is in its infancy, it represents a huge opportunity for the company. We believe that Instacart will rapidly develop its advertising capabilities with new features, such as livestreaming and conversational AI (artificial intelligence). Creating a more immersive experience will also unlock opportunities for more sponsored content from brands. In the future, Instacart may also pivot to helping retailers deploy, customize and maintain their own media solutions.

Appendix: Instacart Timeline

Appendix Figure 1. Instacart: A Timeline of Key Events, 2020–2022

[wpdatatable id=1731]