DIpil Das

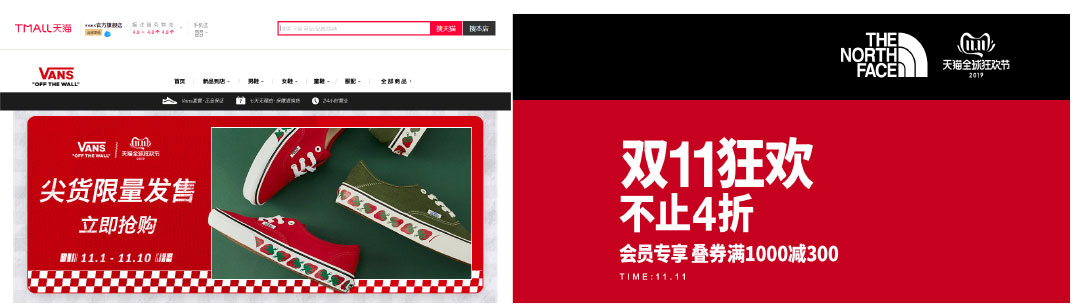

We have seen strong growth for domestic Chinese brands in the lead-up to Singles’ Day 2019. The global brands that remain optimistic about their potential to penetrate the market in China have made moves to invest in online advertisements to drive traffic and clicks. However, others feel pressured to increase sales through sales holidays such as Tmall’s Singles’ Day on November 11 and JD.com’s 618 Festival in June.

The increased quality of apparel and footwear offered by Chinese mid-market brands is set to impact the sales of global and US-based brands this Singles’ Day.

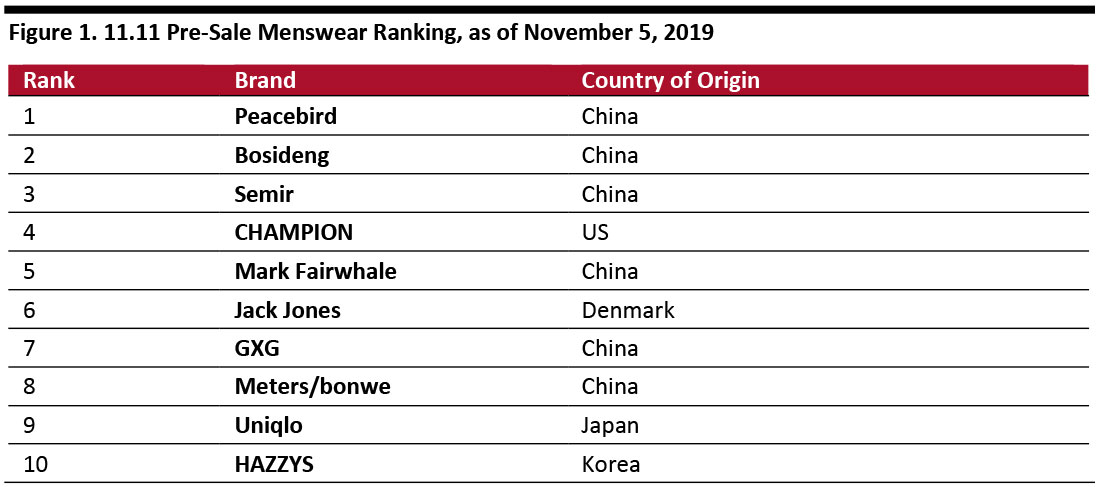

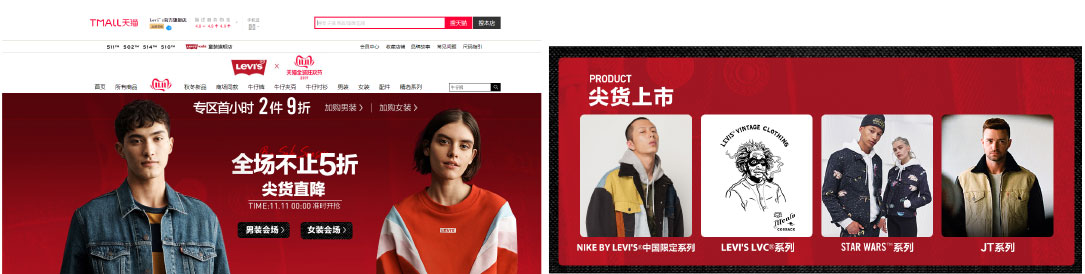

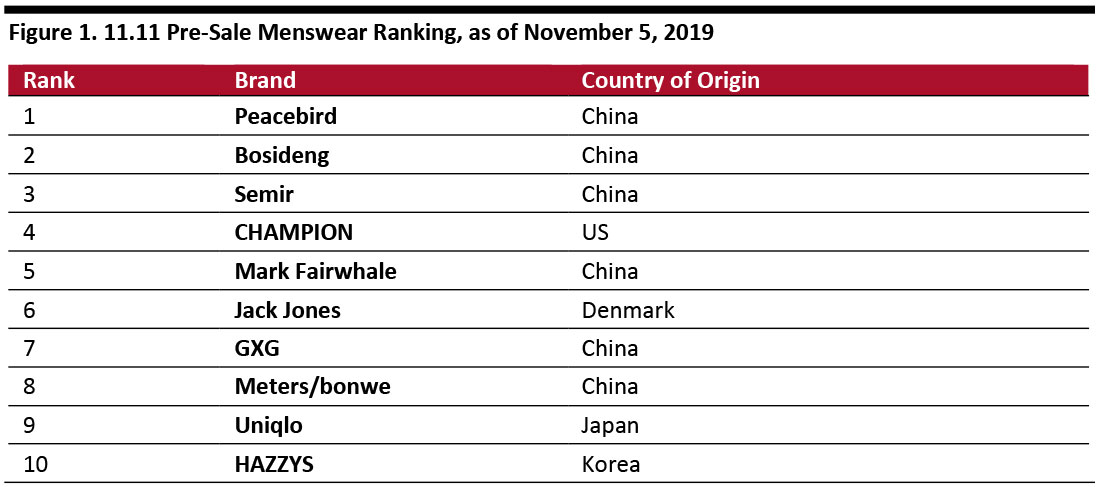

Dataway, a market research firm based in China, has published rankings of the most successful brands during the Singles’ Day pre-sale period. Featuring highly on both the menswear and womenswear lists are Peacebird and Bosideng. Both of these are Chinese companies, demonstrating the increasing brand power of indigenous brands.

[caption id="attachment_99339" align="aligncenter" width="700"] Source: Dataway[/caption]

[caption id="attachment_99340" align="aligncenter" width="700"]

Source: Dataway[/caption]

[caption id="attachment_99340" align="aligncenter" width="700"] Source: Dataway[/caption]

Peacebird, one of the top fashion brands in Mainland China, views innovation, product quality and competitive pricing as its key differentiators. The company was launched more than 20 years ago and sells affordable fashion in lower-tier cities in China, particularly to Gen-Z and millennial trendsetters (those born between 1980 and 2000). In recent years, Peacebird has been working to minimize its harmful impact on the environment across manufacturing, packaging, storage, transportation and other activities.

[caption id="attachment_99341" align="aligncenter" width="700"]

Source: Dataway[/caption]

Peacebird, one of the top fashion brands in Mainland China, views innovation, product quality and competitive pricing as its key differentiators. The company was launched more than 20 years ago and sells affordable fashion in lower-tier cities in China, particularly to Gen-Z and millennial trendsetters (those born between 1980 and 2000). In recent years, Peacebird has been working to minimize its harmful impact on the environment across manufacturing, packaging, storage, transportation and other activities.

[caption id="attachment_99341" align="aligncenter" width="700"] Peacebird’s Tmall store launched a campaign for 11.11. Each product has a detailed description attesting to its quality.

Peacebird’s Tmall store launched a campaign for 11.11. Each product has a detailed description attesting to its quality.

Source: Tmall [/caption] Bosideng, a brand that sells down clothing, is available at more than 3,000 retail locations. Its modern down coats feature high-quality zippers and pockets. The brand is being repositioned to better compete with high-end companies, and it is expanding internationally by opening physical stores in the UK and expanding its online presence into the US. Bosideng products are now available in over 20 countries. [caption id="attachment_99342" align="aligncenter" width="700"] Bosideng uses waterproof, lightweight fabrics to manufacture down clothing.

Bosideng uses waterproof, lightweight fabrics to manufacture down clothing.

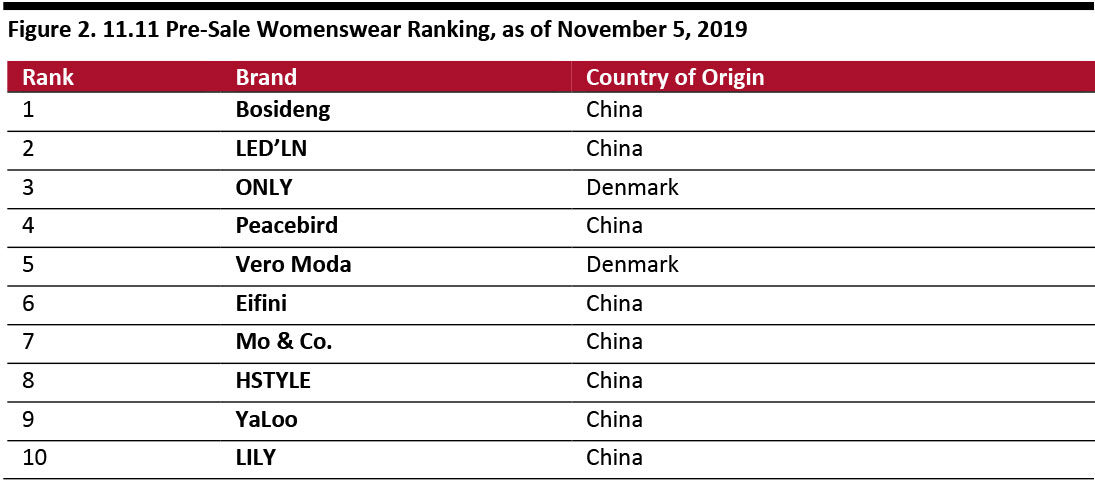

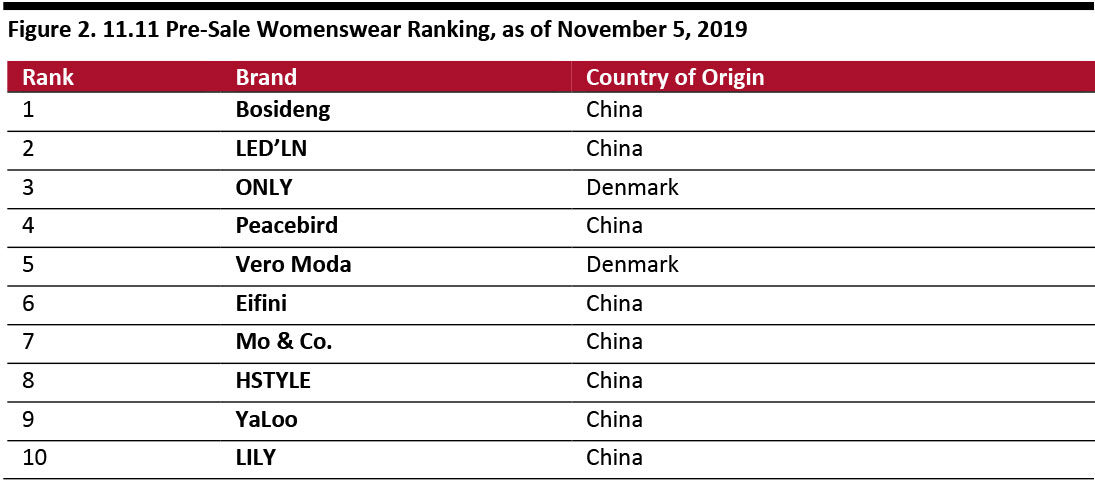

Source: Tmall [/caption] Optimized product pricing—supported by local marketing strategies and the influence of key opinion leaders—is diverting sales from global brands. This trend is growing exponentially, and we expect it to continue in the intermediate term. As Chinese consumers continue to gravitate towards social media to consume news and personal updates, it is unsurprising that online platforms have also become a breeding ground for product recommendations and a new kind of word-of-mouth marketing. This has led to the emergence of key opinion leaders (KOLs). Strong KOL support for a brand can be effective in diverting sales from global brands, and we expect this trend to continue in the intermediate term. For example, PVH—a brand owner whose subsidiary brands include Calvin Klein, Izod and Tommy Hilfiger—experienced a decline in traffic both in stores and online, according to its results from the second quarter of fiscal year 2019. This has been attributed to the rising trade tensions between China and the US, ongoing protests in Hong Kong and the strength of the US dollar. Overall, the company is not overly optimistic about the holiday selling season. Similarly, Gap reported that sales in its Asia segment declined 12.6% year over year in the second quarter this year. Guess is also seeing soft performance in China. [caption id="attachment_99343" align="aligncenter" width="700"] Source: Company Reports/Coresight Research[/caption]

Consumers in China have a lot of choice; global brands need to localize their marketing and retail strategies as well as offer superior-quality merchandise.

There are some good examples of brands localizing their marketing campaigns in the Chinese market. Nike has driven double-digit growth in Greater China every quarter for more than five years. Its current percentage of sales exposure in China is 15.9%. The Nike App is available in 21 countries, and it is set to go live in China this holiday, which could boost digital sales. Nike Digital grew over 70% in the first quarter of fiscal year 2020, in part due to its strategic partnerships with Tmall and WeChat. Nike has launched a promotional campaign on its Tmall store for Singles’ Day this year.

[caption id="attachment_99344" align="aligncenter" width="700"]

Source: Company Reports/Coresight Research[/caption]

Consumers in China have a lot of choice; global brands need to localize their marketing and retail strategies as well as offer superior-quality merchandise.

There are some good examples of brands localizing their marketing campaigns in the Chinese market. Nike has driven double-digit growth in Greater China every quarter for more than five years. Its current percentage of sales exposure in China is 15.9%. The Nike App is available in 21 countries, and it is set to go live in China this holiday, which could boost digital sales. Nike Digital grew over 70% in the first quarter of fiscal year 2020, in part due to its strategic partnerships with Tmall and WeChat. Nike has launched a promotional campaign on its Tmall store for Singles’ Day this year.

[caption id="attachment_99344" align="aligncenter" width="700"] Nike’s Tmall store has launched an 11.11 campaign with various promotions.

Nike’s Tmall store has launched an 11.11 campaign with various promotions.

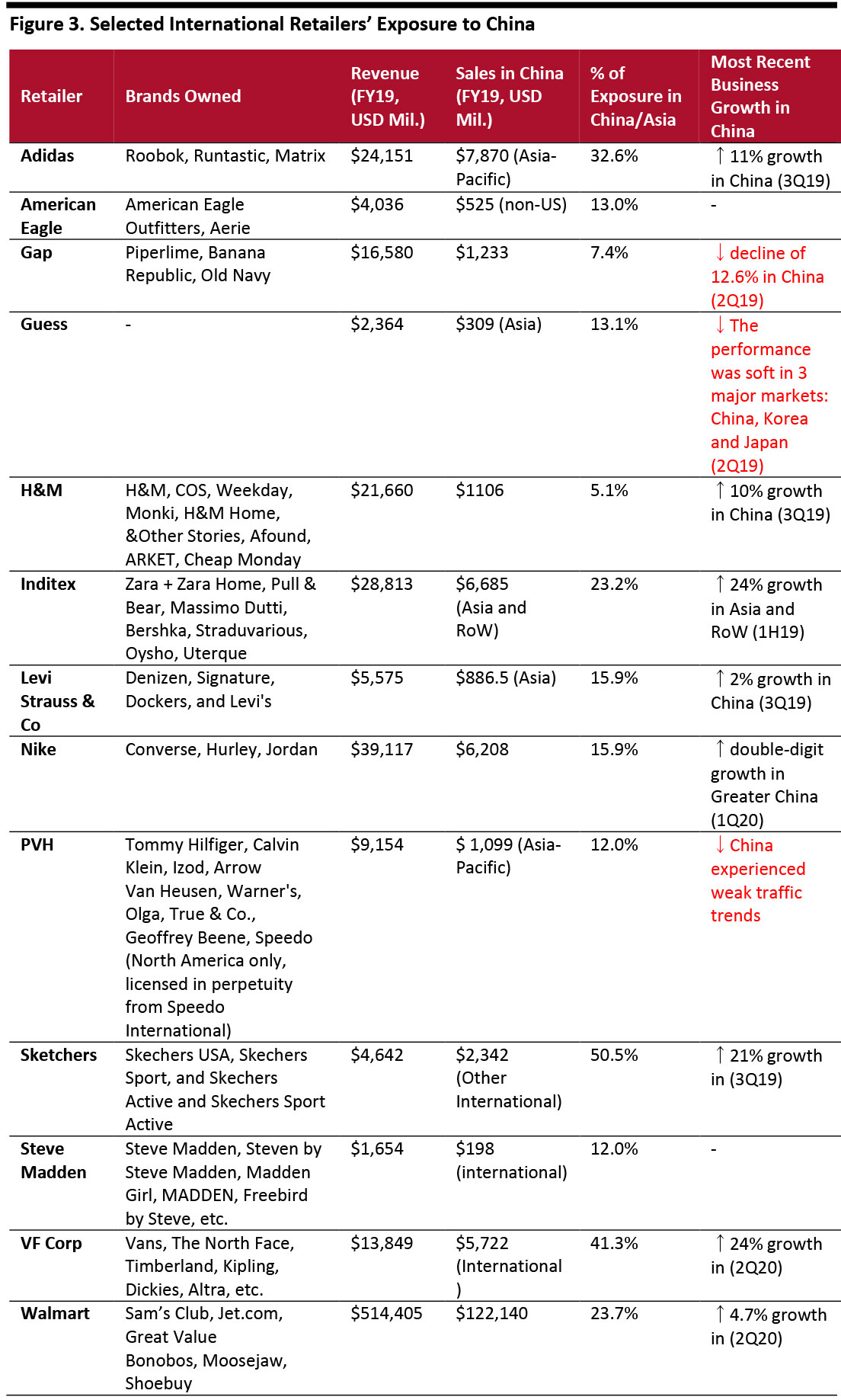

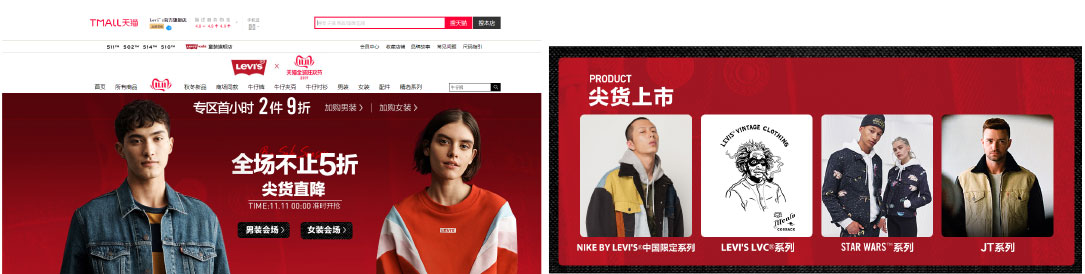

Source: Tmall [/caption] Levi’s has been a very popular brand in China over recent years. In its third quarter of fiscal year 2019, the brand’s sales rose a modest 2% in China. However, at company-operated stores, sales grew by mid-single digits, reflecting positive comps. Levi’s estimates that tariffs on imports to the US from China will have a negligible financial impact on its business. [caption id="attachment_99345" align="aligncenter" width="700"] The Levi’s Tmall store launched a Singles’ Day campaign, featuring promotions and collaborations with Nike and Star Wars. Source: Tmall [/caption]

China is one of H&M’s biggest markets. Launched on Tmall in spring 2018, H&M continued to expand its footprint in China by also launching Monki and H&M Home stores on Tmall. The company’s contemporary fashion brand COS was also launched successfully during autumn 2018.

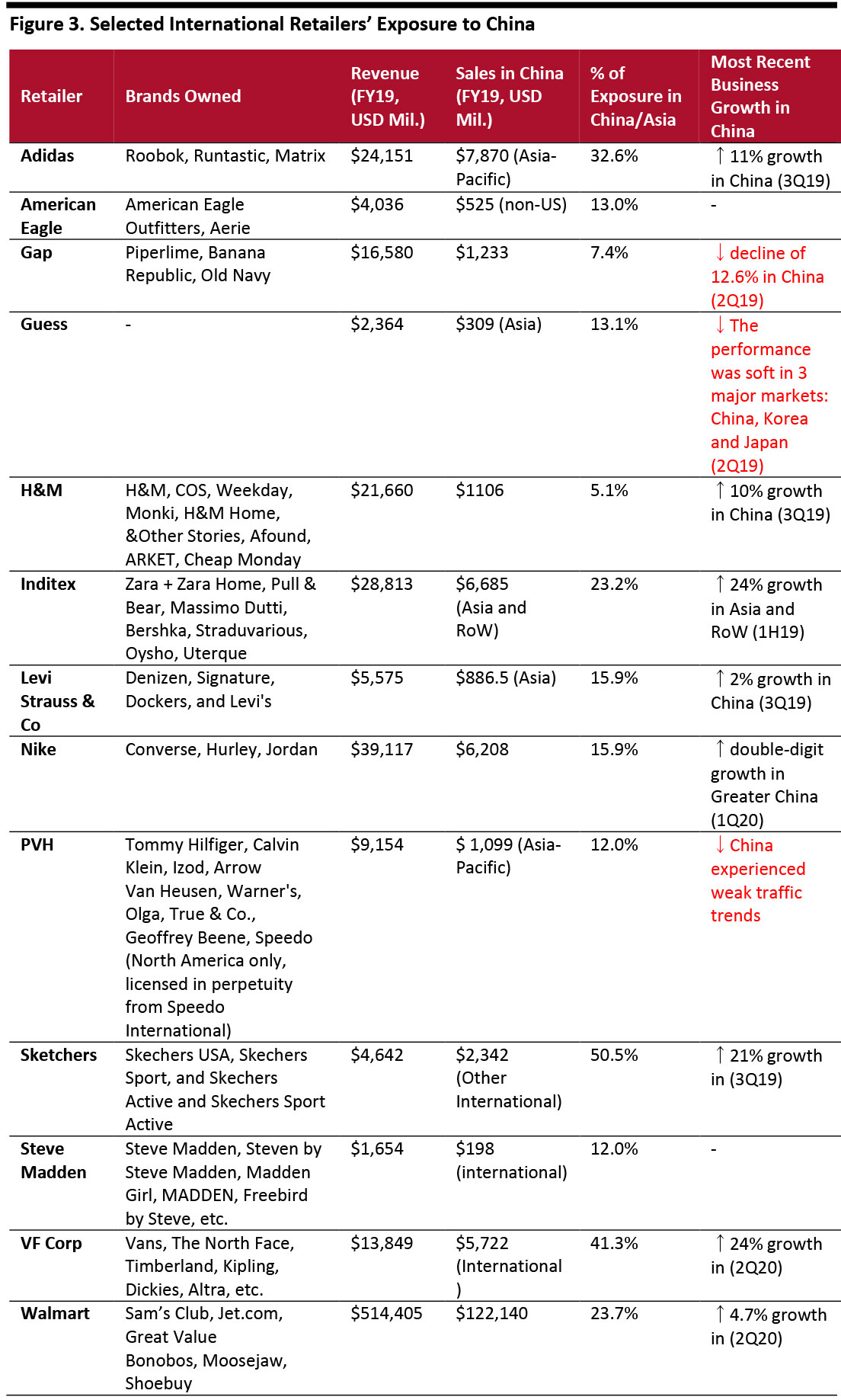

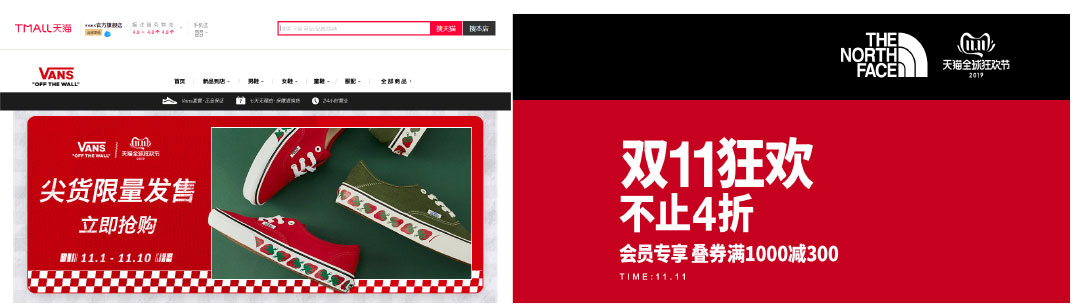

VF Corp has seen particularly strong growth of 24% in China, including balanced double-digit growth across channels and at each of its “Big 4” brands: Dickies, Timberland, The North Face and Vans. To date, the company has not experienced a meaningful change in consumer behavior as a result of trade tension.

[caption id="attachment_99346" align="aligncenter" width="700"]

The Levi’s Tmall store launched a Singles’ Day campaign, featuring promotions and collaborations with Nike and Star Wars. Source: Tmall [/caption]

China is one of H&M’s biggest markets. Launched on Tmall in spring 2018, H&M continued to expand its footprint in China by also launching Monki and H&M Home stores on Tmall. The company’s contemporary fashion brand COS was also launched successfully during autumn 2018.

VF Corp has seen particularly strong growth of 24% in China, including balanced double-digit growth across channels and at each of its “Big 4” brands: Dickies, Timberland, The North Face and Vans. To date, the company has not experienced a meaningful change in consumer behavior as a result of trade tension.

[caption id="attachment_99346" align="aligncenter" width="700"] Vans and North Face, subsidiary brands of VF Corp, enjoy high popularity on Tmall.

Vans and North Face, subsidiary brands of VF Corp, enjoy high popularity on Tmall.

Source: Tmall[/caption]

Source: Dataway[/caption]

[caption id="attachment_99340" align="aligncenter" width="700"]

Source: Dataway[/caption]

[caption id="attachment_99340" align="aligncenter" width="700"] Source: Dataway[/caption]

Peacebird, one of the top fashion brands in Mainland China, views innovation, product quality and competitive pricing as its key differentiators. The company was launched more than 20 years ago and sells affordable fashion in lower-tier cities in China, particularly to Gen-Z and millennial trendsetters (those born between 1980 and 2000). In recent years, Peacebird has been working to minimize its harmful impact on the environment across manufacturing, packaging, storage, transportation and other activities.

[caption id="attachment_99341" align="aligncenter" width="700"]

Source: Dataway[/caption]

Peacebird, one of the top fashion brands in Mainland China, views innovation, product quality and competitive pricing as its key differentiators. The company was launched more than 20 years ago and sells affordable fashion in lower-tier cities in China, particularly to Gen-Z and millennial trendsetters (those born between 1980 and 2000). In recent years, Peacebird has been working to minimize its harmful impact on the environment across manufacturing, packaging, storage, transportation and other activities.

[caption id="attachment_99341" align="aligncenter" width="700"] Peacebird’s Tmall store launched a campaign for 11.11. Each product has a detailed description attesting to its quality.

Peacebird’s Tmall store launched a campaign for 11.11. Each product has a detailed description attesting to its quality. Source: Tmall [/caption] Bosideng, a brand that sells down clothing, is available at more than 3,000 retail locations. Its modern down coats feature high-quality zippers and pockets. The brand is being repositioned to better compete with high-end companies, and it is expanding internationally by opening physical stores in the UK and expanding its online presence into the US. Bosideng products are now available in over 20 countries. [caption id="attachment_99342" align="aligncenter" width="700"]

Bosideng uses waterproof, lightweight fabrics to manufacture down clothing.

Bosideng uses waterproof, lightweight fabrics to manufacture down clothing. Source: Tmall [/caption] Optimized product pricing—supported by local marketing strategies and the influence of key opinion leaders—is diverting sales from global brands. This trend is growing exponentially, and we expect it to continue in the intermediate term. As Chinese consumers continue to gravitate towards social media to consume news and personal updates, it is unsurprising that online platforms have also become a breeding ground for product recommendations and a new kind of word-of-mouth marketing. This has led to the emergence of key opinion leaders (KOLs). Strong KOL support for a brand can be effective in diverting sales from global brands, and we expect this trend to continue in the intermediate term. For example, PVH—a brand owner whose subsidiary brands include Calvin Klein, Izod and Tommy Hilfiger—experienced a decline in traffic both in stores and online, according to its results from the second quarter of fiscal year 2019. This has been attributed to the rising trade tensions between China and the US, ongoing protests in Hong Kong and the strength of the US dollar. Overall, the company is not overly optimistic about the holiday selling season. Similarly, Gap reported that sales in its Asia segment declined 12.6% year over year in the second quarter this year. Guess is also seeing soft performance in China. [caption id="attachment_99343" align="aligncenter" width="700"]

Source: Company Reports/Coresight Research[/caption]

Consumers in China have a lot of choice; global brands need to localize their marketing and retail strategies as well as offer superior-quality merchandise.

There are some good examples of brands localizing their marketing campaigns in the Chinese market. Nike has driven double-digit growth in Greater China every quarter for more than five years. Its current percentage of sales exposure in China is 15.9%. The Nike App is available in 21 countries, and it is set to go live in China this holiday, which could boost digital sales. Nike Digital grew over 70% in the first quarter of fiscal year 2020, in part due to its strategic partnerships with Tmall and WeChat. Nike has launched a promotional campaign on its Tmall store for Singles’ Day this year.

[caption id="attachment_99344" align="aligncenter" width="700"]

Source: Company Reports/Coresight Research[/caption]

Consumers in China have a lot of choice; global brands need to localize their marketing and retail strategies as well as offer superior-quality merchandise.

There are some good examples of brands localizing their marketing campaigns in the Chinese market. Nike has driven double-digit growth in Greater China every quarter for more than five years. Its current percentage of sales exposure in China is 15.9%. The Nike App is available in 21 countries, and it is set to go live in China this holiday, which could boost digital sales. Nike Digital grew over 70% in the first quarter of fiscal year 2020, in part due to its strategic partnerships with Tmall and WeChat. Nike has launched a promotional campaign on its Tmall store for Singles’ Day this year.

[caption id="attachment_99344" align="aligncenter" width="700"] Nike’s Tmall store has launched an 11.11 campaign with various promotions.

Nike’s Tmall store has launched an 11.11 campaign with various promotions. Source: Tmall [/caption] Levi’s has been a very popular brand in China over recent years. In its third quarter of fiscal year 2019, the brand’s sales rose a modest 2% in China. However, at company-operated stores, sales grew by mid-single digits, reflecting positive comps. Levi’s estimates that tariffs on imports to the US from China will have a negligible financial impact on its business. [caption id="attachment_99345" align="aligncenter" width="700"]

The Levi’s Tmall store launched a Singles’ Day campaign, featuring promotions and collaborations with Nike and Star Wars. Source: Tmall [/caption]

China is one of H&M’s biggest markets. Launched on Tmall in spring 2018, H&M continued to expand its footprint in China by also launching Monki and H&M Home stores on Tmall. The company’s contemporary fashion brand COS was also launched successfully during autumn 2018.

VF Corp has seen particularly strong growth of 24% in China, including balanced double-digit growth across channels and at each of its “Big 4” brands: Dickies, Timberland, The North Face and Vans. To date, the company has not experienced a meaningful change in consumer behavior as a result of trade tension.

[caption id="attachment_99346" align="aligncenter" width="700"]

The Levi’s Tmall store launched a Singles’ Day campaign, featuring promotions and collaborations with Nike and Star Wars. Source: Tmall [/caption]

China is one of H&M’s biggest markets. Launched on Tmall in spring 2018, H&M continued to expand its footprint in China by also launching Monki and H&M Home stores on Tmall. The company’s contemporary fashion brand COS was also launched successfully during autumn 2018.

VF Corp has seen particularly strong growth of 24% in China, including balanced double-digit growth across channels and at each of its “Big 4” brands: Dickies, Timberland, The North Face and Vans. To date, the company has not experienced a meaningful change in consumer behavior as a result of trade tension.

[caption id="attachment_99346" align="aligncenter" width="700"] Vans and North Face, subsidiary brands of VF Corp, enjoy high popularity on Tmall.

Vans and North Face, subsidiary brands of VF Corp, enjoy high popularity on Tmall. Source: Tmall[/caption]