albert Chan

The second Alibaba ONE Business Conference drew more than 2,000 leaders from brands and retailers across the world to discuss how they work with Alibaba to digitalize operations, acquire new customers and launch new products.

We discuss four key insights from presentations by Alibaba and other companies at the conference.

1. There is no online or offline division now, it is about whether a company is digital or not,” said Daniel Zhang, Executive Chairman and Chief Executive Officer of Alibaba Group.Zhang shared that Alibaba coined the expression New Retail in 2016 when many people thought there was a divide between online and offline and that the two should be operated separately. Fast forward to 2019, and retailers have come to realize that "we are operating in one business world where there is no online and offline division," and digitalization is the key to blending the two channels.

[caption id="attachment_101499" align="aligncenter" width="500"] Daniel Zhang, Executive Chairman and CEO of Alibaba

Daniel Zhang, Executive Chairman and CEO of AlibabaSource: Coresight Research[/caption]

2. Alibaba helps brands and retailers acquire new customers via its digital ecosystem.

A common pain point we heard from retailers at the conference was acquiring new customers. Yang Yinfen, CEO of snack brand Liang Pin Pu Zi (良品铺子) talked about how it was able to expand its reach to 1.2 million consumers in Shenzhen—and gain 600,000 as new customers within a year using Alibaba.

The brand detailed two ways in which Alibaba helped it:

- Linking its 100 offline stores in Shenzhen to Alibaba’s online mini store (轻店) system, which Alibaba calls a “light-weighted store,” but which is actually a mini-program that runs within Taobao, similar to WeChat’s mini-programs. On Taobao, Alibaba invites key opinion leaders (KOLs) across different social media platforms to open light-weighted stores, from short-video app Kwai and social media platform Weibo, for example.

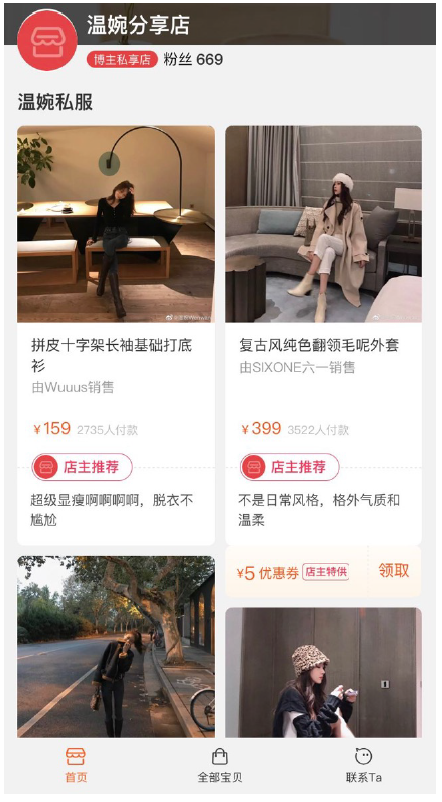

KOL Wenwan’s light-weighted store on Taobao

KOL Wenwan’s light-weighted store on TaobaoSource: Coresight Research/ Taobao[/caption]

So when KOLs post contents on their platforms such as Kwai and Weibo and include a link to their Taobao light-weighted store, followers can click and buy directly from the store, which also drives traffic from outside into Alibaba’s system.

- Setting up in-store fulfilment centers, which improved the rate of orders fulfilled within 24 hours from 60% to 90%.

Seeing positive results in Shenzhen, the brand expanded the approach to its 2,300 other stores across China during the Singles’ Day Shopping Festival. The company reported new customer acquisition hit 40% during the shopping festival, which even the brand did not expect.

[caption id="attachment_101501" align="aligncenter" width="650"] The customer acquisition panel- from left to right: Sun Yanyan, Marketing Manager, Alimama; Fang Jun, Vice President (Data and Digital), Unilever; Li Yonghe, President of Tmall Supermarket; Ye Guohui, Manager of Alipay

The customer acquisition panel- from left to right: Sun Yanyan, Marketing Manager, Alimama; Fang Jun, Vice President (Data and Digital), Unilever; Li Yonghe, President of Tmall Supermarket; Ye Guohui, Manager of AlipaySource: Coresight Research[/caption]

3. Alibaba’s TMIC empowers brands and retailers to launch new products to stay competitive.

TMIC helps businesses identify product trends from consumer data, form an initiative concept, create prototypes, launch and make continual improvement based on user feedback. Chinese coffee brand San Dun Ban (三顿半) said it used TMIC’s trend data to launch a coffee product to target young consumers, a demographic with which the company has low popularity. The new, Alibaba data-driven product helped the company boost post-90s (those born after 1990) customers 15% in 2019.

Indeed, Alibaba has become a driver of new product launches. By September 2019, Alibaba had supported the launch of 90 million products, according to the company, with around one million new products launched on Tmall during 2019 Singles’ Day Shopping Festival alone.

And Alibaba is aiming for more, with plans to help brands and retailers launch over 100 million new products from 2020 to 2022, said Jiang Fan, President of Tmall and Taobao.

[caption id="attachment_101502" align="aligncenter" width="650"] The product innovation panel-from left to right: Jet Jing, Vice President, Alibaba; Ye Yong, Vice President, Jo Young; Chris Tung, Chief Marketing Officer, Alibaba; Wu Jun, Founder of San Dun Ban Coffee; and, Jiang Fan, President of Tmall and Taobao

The product innovation panel-from left to right: Jet Jing, Vice President, Alibaba; Ye Yong, Vice President, Jo Young; Chris Tung, Chief Marketing Officer, Alibaba; Wu Jun, Founder of San Dun Ban Coffee; and, Jiang Fan, President of Tmall and TaobaoSource: Coresight Research[/caption]

4. Alibaba helps companies undertake digital transformation.

At the conference, a number of companies discussed the value of Alibaba’s Ding Talk, a comprehensive workplace app that helps brands digitalize operations and improve efficiency. The Ding Talk app provides office administrative and collaboration functions, including chat, Internet calling, file transfer and HR functions such as applying for leave.

- Consumer packaged goods company Libai (立白) said Ding Talk helps facilitate smooth communication across its entire supply chain, including more than 1,100 distributors, 35,000 sales associates and 5,800 delivery drivers. The company said Ding Talk improved operational efficiency 80%. The company was so impressed by the results is started work on its own version of Ding Talk, which it calls DuDu.

- Eyewear company Nova Vision, famous for its eyewear brand Baodao (宝岛), said Ding Talk helps motivate sales associates. Using Ding Talk, sales associates can show customers who can’t find a pair of frames they like other options online at Baodao’s Tmall store. Sales associates get a commission for sales, and the online tool helps them sell more by expanding in-store selection to include the entire online offering.

Liu Jizhong, COO of Nova Vision, discusses Ding Talk

Liu Jizhong, COO of Nova Vision, discusses Ding TalkSource: Coresight Research[/caption]

If the same consumer purchases more glasses in the future (even without the sales associate’s involvement), the associate still gets commission as the consumer becomes linked to that specific associate with the initial purchase, providing a real incentive to get consumers signed up and online. Baodao asked its 5,000 associates in 1,200 stores install Ding Talk, according to Liu Jizhong, COO of Nova Vision.

[caption id="attachment_101504" align="aligncenter" width="1436"] The organization digitalization panel, from left to right: Huang Lei, President, Taobao University; Liu Jizhong, Chief Operating Officer, Nova Vision; Zhang Jianfeng, Chief Technology Officer, Alibaba; Chen Zebin, Chief Executive Officer, Libai; Chen Hang, Chief Executive Officer, Ding Talk

The organization digitalization panel, from left to right: Huang Lei, President, Taobao University; Liu Jizhong, Chief Operating Officer, Nova Vision; Zhang Jianfeng, Chief Technology Officer, Alibaba; Chen Zebin, Chief Executive Officer, Libai; Chen Hang, Chief Executive Officer, Ding TalkSource: Coresight Research[/caption]