Nitheesh NH

ICSC New York Deal Making brings together key players in real estate, connecting brands with tech innovators. The theme of this year’s event is “New Trends. New Tenants. New Technology.”

These are our key insights from the conference.

Experiential retail plays an important role in luring customers away from the Internet and into the store.

The keynote panel discussion, led by ICSC President and CEO Tom McGee, focused on innovation in experiential retail. McGee believes “we are in a retail renaissance,” and that experiential retail will drive this renaissance, pushing foot traffic back to brick-and-mortar stores.

McGee reviewed the many benefits of bringing customers back into stores, of keeping them there longer and encouraging them to make return visits:

- Bricks impact clicks: Opening a new physical store in a market leads to a 37% average increase in overall web traffic, according to data from ICSC. The data also shows that physical store closures drive down online traffic: In apparel by 9.5%, in home goods by 16.4% and 7.9% for department stores.

- The halo effect: According to an ICSC study, if a consumer spends $100 online then visits the store within 15 days, the customer spends an average of an additional $131, or $231 net spend. Similarly, when consumers buy $100 worth of goods in store and then shop online, they will spend an additional $167.

The bottom line is: Brick and mortar supports online, and online supports brick and mortar.

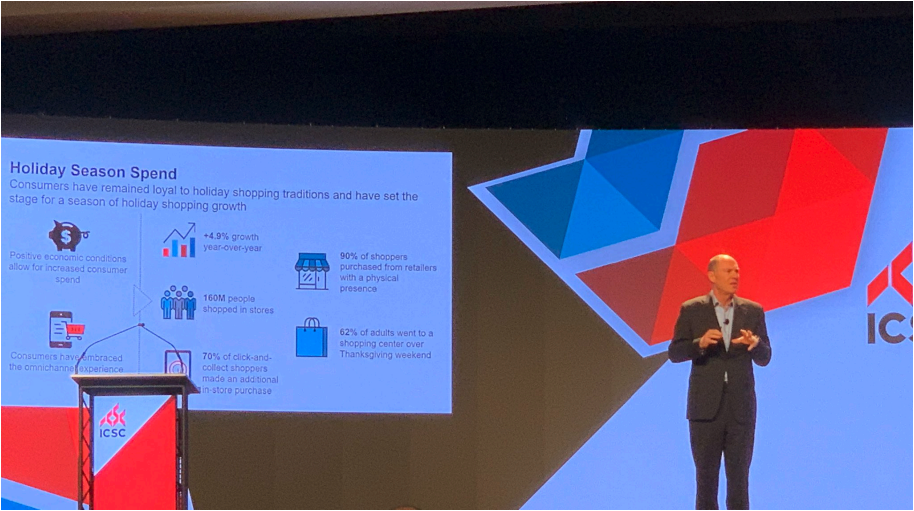

Consumers have remained loyal to holiday shopping traditions and have set the tone for a strong holiday shopping season. Positive economic conditions augur an increased consumer spend. 62% of adults went to a shopping center over Thanksgiving weekend, and most consumers embraced the omnichannel experience. 70% of shoppers who took advantage of BOPIS services when ordering online made an additional in-store purchase.

[caption id="attachment_101124" align="aligncenter" width="700"] Tom McGee, President and CEO of ICSC, talks about consumer shopping trends for the holiday season

Tom McGee, President and CEO of ICSC, talks about consumer shopping trends for the holiday seasonSource: Coresight Research[/caption] Significant opportunity exists to integrate in-store technology to drive engagement, but retailers must ensure tactics align with marketing efforts. With technology increasingly deployed into stores, retailers now have more data than ever before—but it must be effectively analyzed to get the shopping behavior insights that can help stores enhance the customer experience. Retailers need to ensure they use their technology solutions to get the most out of them, and most importantly that each solves a specific retailer pain point—as well as driving consumer engagement. Technology in brick-and-mortar stores should support (rather than overwhelm) marketing efforts. [caption id="attachment_101126" align="aligncenter" width="700"]

Tal Zvi Nathanel (middle), CEO and Co-Founder of Showfields; and, Zak Normandin (right), Founder and CEO of Iris Nova (a direct-to-consumer company that uses innovative tech to sell beverages in physical spaces), talk about the future of physical retail

Tal Zvi Nathanel (middle), CEO and Co-Founder of Showfields; and, Zak Normandin (right), Founder and CEO of Iris Nova (a direct-to-consumer company that uses innovative tech to sell beverages in physical spaces), talk about the future of physical retailSource: Coresight Research [/caption]

Outlet centers are experiencing a slowdown as value-for-money concepts move closer to the consumer, both online and offline.

Before, outlet stores offered lower prices, retail stores sold at full price with few discounts unless there was a sale or special event.

With the emergence of discount stores such as Marshalls, TJMaxx and Ross Stores, that dynamic is shifting and outlets are losing their price advantage. Even more challenging, outlets are typically in inconvenient locations that require shoppers to travel outside their local area.

Online penetration in US grocery is just 3%, but landlords are concerned online growth could impact the physical store.

A mere 3% of US grocery spending occurs online, according to a recent Bain & Co survey of more than 8,000 grocery shoppers across the country. While this number is small compared to other sectors, real-estate developers, landlords and commercial brokers are becoming increasingly concerned about the overall health of real estate as grocery could see exponential online growth in the coming years.

BOPIS services are driving significant changes for retailers and landlords.

BOPIS is another focal point for retail landlords. BOPIS has taken off as shoppers take advantage of the convenience of buying online but being able to quickly pick up items at a nearby store. For retailers, BOPIS offers the opportunity to integrate the online and in-store experiences to drive greater consumer engagement. But BOPIS is creating upheaval for real-estate owners, as mixed-use spaces come with different requirements. For example, as demand for drive-through pickup increases, retailers’ requirements for space in parking lots changes and, in some cases, increases.

The use of convenience stores as community centers is on the rise.

The January 2019 NACS Consumer Fuels Survey found that consumers have a favorable opinion of convenience stores, which sell about 80% of the fuel purchased in the US. More than three in four consumers (77%) say convenience stores share their values. Customers visit convenience stores frequently, for consumables, lottery tickets, gas and hot food, as well as to use the public restrooms. As convenience stores also have longer hours of operation and greater ease of access, they are increasingly being perceived as a form of community center.