albert Chan

The Coresight Research team was in Las Vegas attending and participating in the Groceryshop 2019 conference, September 15-18. The conference brought together over 3,000 attendees and more than 200 speakers talking about the transformation of the retail industry, shifts in consumer behavior and innovations that are helping retailers keep up with fast-changing consumer expectations.

Deborah Weinswig, CEO and Founder of Coresight Research, kicked off the event by emceeing a Groceryshop Emerging Technology Spotlight session during which 19 innovators presented their retail technology solutions.

The chart below shows the 19 startups categorized by solution: Improved Shopping Experiences, Data and Insights, Next Generation Marketing and Operations and Supply Chain.

We profiled the 19 participating companies in detail in the following reports: Adrich, BrandChat, Babylon, CoupDog, Datasembly, Gather AI, Leaf Logistics, Macondo Ventures, MeisterDish, Oriient, Pick 'n' Watch, Retail Aware, Shopperations, ShopperMotion, Simplista, Simporter, Superup, Tastry and Tiliter Technology.

Keep an eye out for an upcoming Coresight Research report on the Groceryshop Emerging Technology Spotlight.

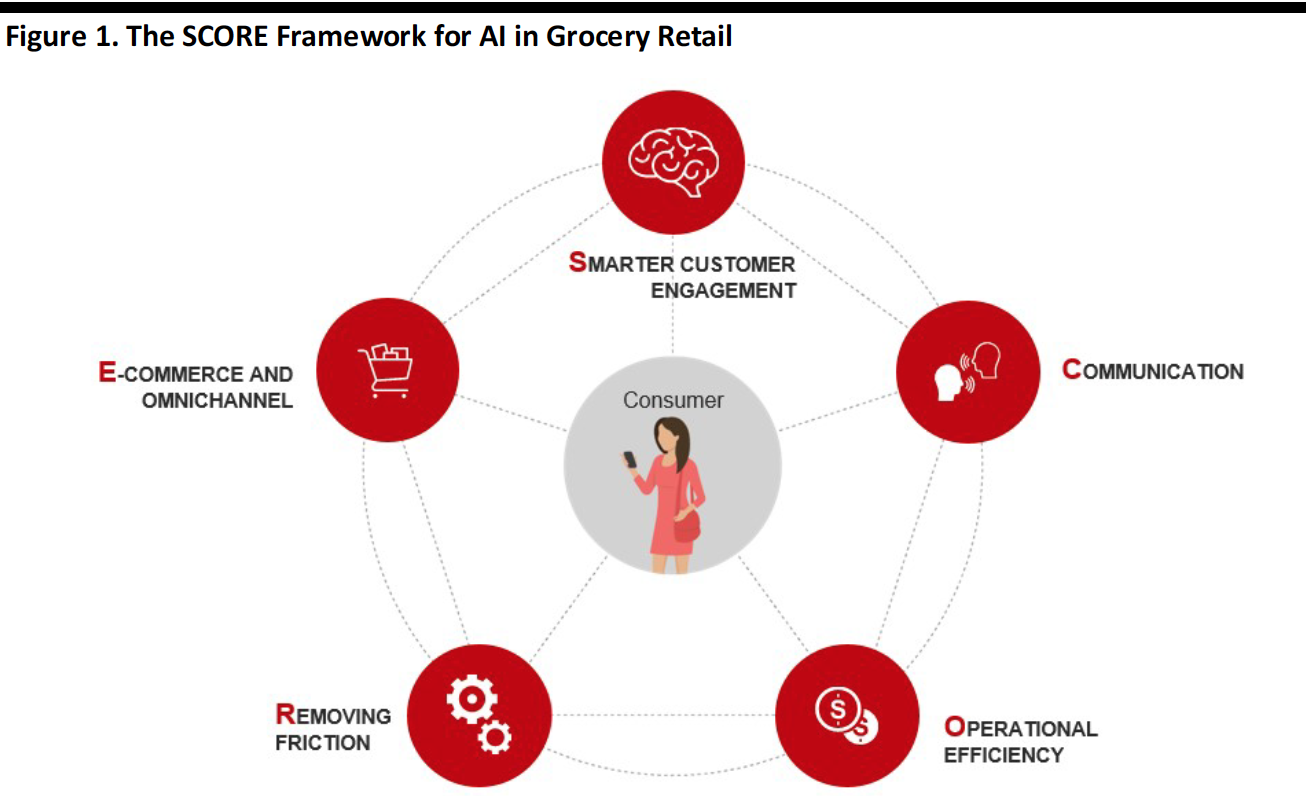

Weinswig also introduced Coresight Research’s SCORE framework for AI in grocery retail. This framework notes that AI offers the promise of smarter customer engagement, better communication with customers, improved operational efficiency, the removal of friction from the shopping process, and helping grocery retailers push further – and more profitably – into e-commerce and omnichannel retailing.

[caption id="attachment_97686" align="aligncenter" width="700"] Source: Coresight Research[/caption]

Source: Coresight Research[/caption]

Below we note key insights from Groceryshop 2019.

CBD’s Surging Popularity Set to Increase

The market for cannabidiol (CBD) has been growing significantly in recent years – and after the US Congress passed a law in December 2018 that clarified its legal status, it is now legal for retail sale in all 50 states. The legislation (the Agriculture Improvement Act of 2018) also allows the transfer of legally-produced hemp or hemp-derived products across state lines.

This provided much needed relief for brands looking to tap into this fast-growing segment but nervous about the legal implications.

Product innovation will continue in this sector and fuel ongoing sales growth. With the market growing, distribution channels are also expanding, and contrary to the belief that CBD products are sold in mon-and-pop stores, chain retailers are in fact the leading channel with more than half the market.

Read the Coresight Research report Can CBD Save the Mall for more insights into this fast-growing trend.

Leverage Data to Improve the Consumer Experience

Consumers are increasingly interested in personalized products and services. Companies should examine how leveraging AI and machine learning can increase the power of the data they collect to help them better meet and even anticipate customer preferences.

Despite retailers’ heavy investments in technology in recent years, many still have only five data points for their algorithms, which tends to generate average results. Companies need to consider more than just consumer data, connecting demographics, life stage, lifestyle, social media and other lifestyle indicators to truly understand customers and predict behavior.

In addition to the very subtle patterns data analytics can make more obvious, companies need the capability to make recommendations during consumers’ various stages in life, or events such as starting a new diet or having children.

A Fragmented Beverage Market is Coming

Coca-Cola and Pepsi are leaders in the US beverage market. But new brands are making inroads with new consumers, which is fragmenting the beverage market. Some participants at the event were of the view that multi-billion-dollar beverage brands may be on the way out as we usher in a new era featuring a much wider variety of niche brands with highly curated flavorings targeting smaller audiences – but at two to three times the average price point of mass-marketed beverages.

The smaller market size allows these brands to retain their unique characteristics, creating brand equity that more widely distributed products sold at lower price points can’t match.

Gen Zers Love Technology and Care About Social Issues

Gen Zers are more likely to tag or share with friends than other age groups when engaging with digital content. Interactive videos and augmented/virtual reality-powered digital content can be a powerful tool to reach this group: TikTok has become a crucial tool to reach younger generations.

Gen Zers also care more about social issues than do millennials, with climate change among their top concerns. Brands that position themselves as being more environmentally friendly stand to secure greater brand loyalty from this group – as long as claims are true, as the market punishes misleading claims harshly.

Think Before You Adopt

Companies need to understand that digitalization is an organization-wide initiative – not something to be handled by IT alone. The challenging environment has pushed retailers to adopt more digital and omnichannel capabilities, but brands and retailers need a clear technology vision and strategy with specific objectives to ensure they adopt the best technology fit from the start. Often the most cutting-edge solution may not be the right one for a company’s digital transformation.

Online partnerships are another way to lower the risk profile of a huge digitalization transformation, but retailers should also bear in mind that some 66% of e-commerce platform partnerships end in divorce.

Data is Changing Companies’ Structures

Data has become a crucial part of the value chain, but the structure of many companies remains the same despite the changing environment around them. To adapt and drive efficiencies in today’s fast-changing retail technology landscape, companies need a dedicated data analytics team. These data analytics teams are the key to turning the waves of big data coming at them into actionable insights. Leading retailers are changing recruiting processes to focus more on talent with data analytics backgrounds. “Software developer” is now the third-most sought-after job in retail in 2017, and bringing this expertise in-house represents a shift in mentality from being a pure retail company to becoming more of a technology company. Some 68% of Fortune 1000 companies had a chief data officer in 2018, up from just 12% in 2012.

Act on Imperfect Data

The proliferation of technology has given companies the ability to collect massive amounts of information about customers, operations, inventory – everything. But the volume of data is so huge interpreting is a challenge – let alone ensuring its accuracy. That said, many expressed the view that it is better to risk taking action based on imperfect data, instead of waiting for the perfect data set that may never come.

Companies should test, iterate and develop new products and services to better understand their consumers. In doing, companies should also pay close attention to privacy concerns to ensure they walk the fine line between effective personalization and what could be perceived as collecting too much personal information.

See our previous coverage of Groceryshop 2019 here:

Groceryshop 2019: Day 1 Insights – Emerging Technology Spotlight

Groceryshop 2019: Day 2 Insights – Artificial Intelligence, Personalization and Growth Channels

Groceryshop 2019: Day 3 Insights – Algorithms and Data Steal the Show