DIpil Das

The Coresight Research team was in Las Vegas for Cosmoprof North America 2019 – one of the leading B2B beauty trade shows in North America, drawing over 40,000 attendees and 1,400 exhibitors from 52 countries and incorporating a three-day education program for industry experts to share insights and information on emerging trends in beauty.

The three-day event was jammed with opportunities to see the latest trends in the industry and learn from key players how they’re using new strategies to tap the potential of the fast-changing market.

These are the top five insights we took from the event:

1. Beauty with a conscience is driving innovation across all beauty categories. BeautyStreams, a global trend and forecasting agency, worked with Cosmoprof to showcase key trends it spotted among this year’s exhibitors. Fernanda Pigatto, Global Marketing Director, Beauty Streams, described the company’s methodology and said the team met with each brand to assess the newness and innovation of its products. Laura Ziv, Executive Editor, highlighted that this year’s overarching theme is “beauty with a conscience,” which is much more than a trend and more of a core value that crosses all beauty categories.Consumers are looking for product traceability, sustainability and mindful living. Consumers are seeking zero-waste practices, ethical sourcing, and transparency in ingredients – but still want efficacy. Ziv said holistic innovations across touchpoints will differentiate brands of the future.

[caption id="attachment_94235" align="aligncenter" width="700"] Cosmo Talk: The Cosmoprof Trends Report: Las Vegas 2019; Laura Ziv, Executive Editor, BeautyStreams; Fernanda Pigatto, Global Marketing Director, Beauty Streams

Cosmo Talk: The Cosmoprof Trends Report: Las Vegas 2019; Laura Ziv, Executive Editor, BeautyStreams; Fernanda Pigatto, Global Marketing Director, Beauty Streams Source: Coresight Research [/caption]

The beauty with a conscience trend crosses into many related areas, such as vegan beauty – a growing trend, driven by millennials. Over 25% of US millennials say they are vegan or vegetarian, according to the Economist, which recently predicted 2019 will be the year of the vegan. What used to be a niche beauty opportunity is growing rapidly. Vegan beauty products must be cruelty-free, non-toxic and made with no animal products such as lanolin, honey, beeswax or gelatin.

But consumers today want results from vegan products that are equal to or even better than mainstream products: They will not accept lower quality because certain non-vegan ingredients are “missing.”

[caption id="attachment_94236" align="aligncenter" width="700"] Love Sun Body 100% Natural Origin Mineral Sunscreen

Love Sun Body 100% Natural Origin Mineral Sunscreen Source: Coresight Research [/caption]

Melanie Mills created her vegan, cruelty-free, gluten-free body Gleam Face & Body Radiance multi-cultural skin product in response to customer feedback. Mills worked on Dancing with the Stars, and said cast members often requested her bronzer because it does not easily transfer but also looks natural. The product uses six universal shades that melt into any skin tone. Mills calls her product “nature’s pantyhose.”

[caption id="attachment_94237" align="aligncenter" width="700"] Melanie Mills, founder of Gleam Face & Body Radiance (Vegan Beauty Brand)

Melanie Mills, founder of Gleam Face & Body Radiance (Vegan Beauty Brand) Source: Coresight Research [/caption] 2. Brands are aiming to go “zero waste” by reducing packaging. Another key theme of the event was cutting waste by reworking packaging – in some ways related to the clean beauty trend only focusing on the waste. We heard one company after another talking about how they are working to cut packaging to reduce the amount of waste going into landfill. Consumers are demanding this.

As consumers pay more attention to their impact on the planet, brands are working to find ways to reduce, reuse, repurpose, upcycle and transform waste into a usable commodity.

Major brands such as Unilever and L'Oréal have already pledged to use to use 100% recyclable, reusable and compostable plastic by 2025 and vegetarian beauty retailer Lush has opened a packaging free “Naked Shop” in the UK, free from plastic.

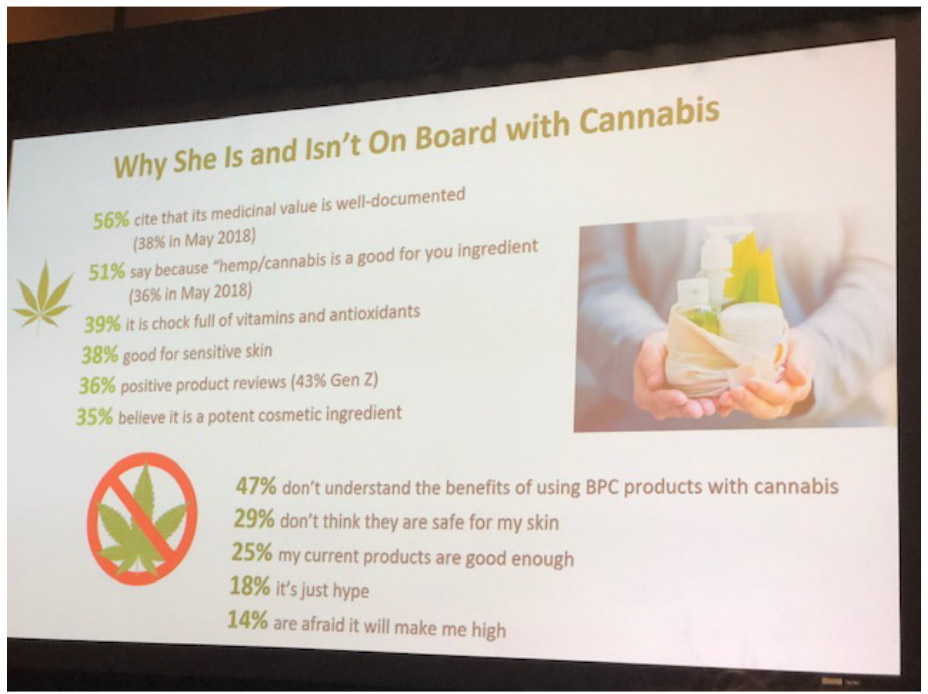

3. CBD in beauty and personal care is taking off. In the US, Gen Xers are most interested in BPC products with CBD or hemp and 56% of consumers cited medicinal value as a selling point. The most revealing information came during a panel discussion on “CBD & Beauty: the Next Five Years.” Denise Herich, Co-founder and Managing Partner at the Benchmarking Company presented results from two surveys that reached over 7,000 women globally. According to the survey, US Gen Xers are the most willing to try beauty and personal care products made with hemp or containing CBD at 77%, followed by millennials at 74%, Gen Zers at 68%, and baby boomers at 67%. Currently, 18% of US consumers use or have used beauty and personal care products that are cannabis-derived or contain hemp seed, hemp oil or CBD. [caption id="attachment_94238" align="aligncenter" width="700"] The Benchmarking Company results from two research studies, TBC’s 2018 Pink Report The New Age of Naturals and a report with insights from 7,000 women globally

The Benchmarking Company results from two research studies, TBC’s 2018 Pink Report The New Age of Naturals and a report with insights from 7,000 women globally Source: Coresight Research [/caption]

According to the company’s second survey conducted in February 2019, 56% of respondents cited medicinal value as a selling point for cannabis, up from 38% in May 2018.

[caption id="attachment_94239" align="aligncenter" width="700"] The Benchmarking Company results from two research studies, TBC’s 2018 Pink Report The New Age of Naturals and a report with insights from 7,000 women globally

The Benchmarking Company results from two research studies, TBC’s 2018 Pink Report The New Age of Naturals and a report with insights from 7,000 women globally Source: Coresight Research [/caption]

Speaking on the same panel, Stephen Letourneau, Chief Brand Officer, Cannuka, a premium skincare brand that combines CBD with Manuka honey, asserted the cannabis industry is moving dramatically more quickly than any other industry, even though regulations still impact how products are marketed and sold.

“All the retailers want in on CBD,” said Letourneau. “The market is demanding these products are available. Retailers that wouldn’t talk to you six months ago are flying you out today.” He credited Sephora for working diligently for years to trailblaze to make the products available. He added that Neiman Marcus was an early innovator in the space, and added that even mainstream QVC has asked for product samples.

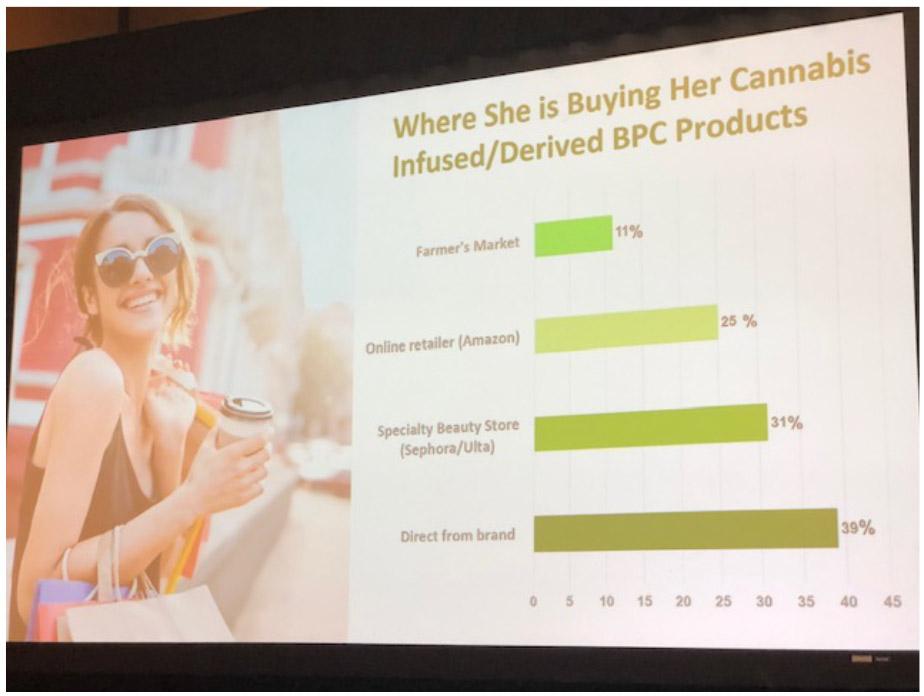

According to The Benchmarking Company research survey conducted in February 2019, 39% of respondents purchase cannabis infused or derived beauty and personal care products directly from the brands, while 31% purchase products from specialty retailers.

[caption id="attachment_94240" align="aligncenter" width="700"] The Benchmarking Company results from two research studies, TBC’s 2018 Pink Report The New Age of Naturals and another report with insights from 7,000 women globally

The Benchmarking Company results from two research studies, TBC’s 2018 Pink Report The New Age of Naturals and another report with insights from 7,000 women globally Source: Coresight Research [/caption] 4. The mobile device is usually the first place a new brand is discovered: Facebook encourages brands to be “mobile first and mobile best.” Facebook says the average person scrolls through 300 feet of feed on the mobile device every day, nearly the height of the Statue of Liberty. Today, new brands are discovered on a mobile device first: A brand’s feed has to be creative and noticeable. Second, it has to be rewarding for consumers: There has to be a compelling reason for the consumer to stop and look.

Facebook launched a resource for brands to see what other brands and retailers are doing for inspiration. And, brands experimenting with creative ideas internally should make sure they do so via mobile devices and not on desktops: Mobile is where the experience will take place, brands should evaluate the experience where it will happen.

Jenna Romero, Director of Social Media and Influencer Marketing at Winky Lux emphasized the importance of frequent posting. While there is no secret sauce for how often, companies can test, learn and iterate to fine tune messaging and cadence to resonate with consumers.

[caption id="attachment_94241" align="aligncenter" width="700"] (L to R) Allison Hersh Pace, Industry Manager of Beauty, Facebook; Jenna Romero, Director of Social Media and Influencer Marketing, Winky Lux; Andrea Nagel, Vice President of Content, CEW

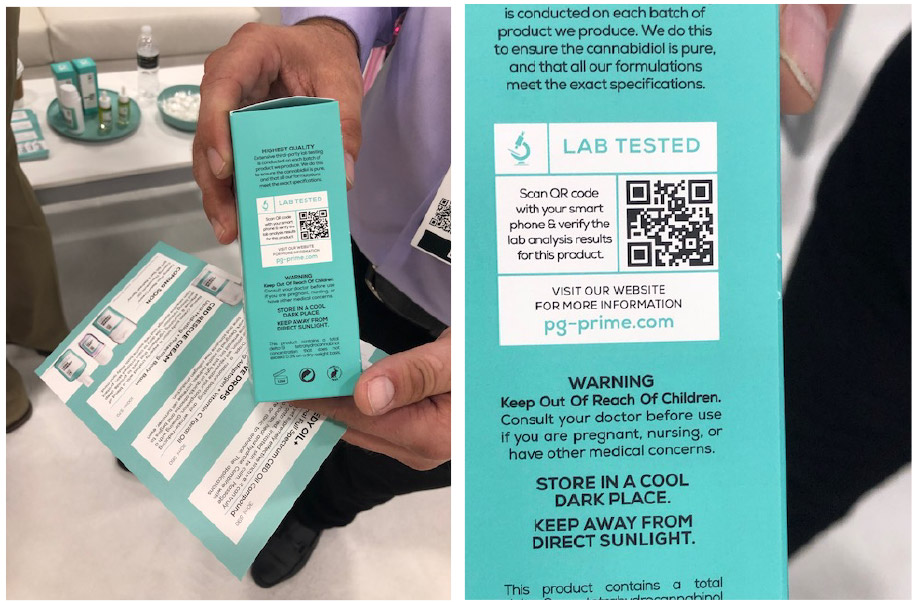

(L to R) Allison Hersh Pace, Industry Manager of Beauty, Facebook; Jenna Romero, Director of Social Media and Influencer Marketing, Winky Lux; Andrea Nagel, Vice President of Content, CEW Source: Coresight Research [/caption] 5. Brands are offering farm-to-shelf transparency by placing QR codes on packaging and more detailed information on ingredients. Physicians Grade, a Florida-based premium CBD company that specializes in tinctures, creams, sprays and capsules, puts QR codes on all its packaging so customers can trace the sourcing of product ingredients. Consumers can also scan to see the certificate of analysis (COA) from a third-party lab that cannot be tampered with, providing the content level of each ingredient and its source. The company said validation and certification that the ingredient levels and sources are legitimate is important for customers, particularly in the CBD industry. [caption id="attachment_94242" align="aligncenter" width="700"]

Physicians Grade

Physicians Grade Source: Coresight Research [/caption]

Consumers not only want to know where the ingredients come from, they also want transparency in just how natural “natural” products really are. Yope, a global bath, shower, hand and body, home fragrance and household cleaning brand based in Poland gives consumers information on the level of natural ingredients in each of its products, which varies by product. Its founder, Karolina Kuklińska-Kosowicz, said she wanted to put the fun back in beauty, and her product line includes animals from local artists to show Yope does not test on animals and is cruelty-free.

[caption id="attachment_94243" align="aligncenter" width="657"] Yope

Yope Source: Coresight Research [/caption]