albert Chan

Since the start of China’s economic reforms in the 1980s, companies have focused on the country’s big cities, referred to as “tier 1” cities, as economic growth and development was focused in those metropolitan areas. But as prosperity spreads across the country, the so-called lower-tier cities are seeing increased wealth—and attracting retail attention.

China’s Tier System

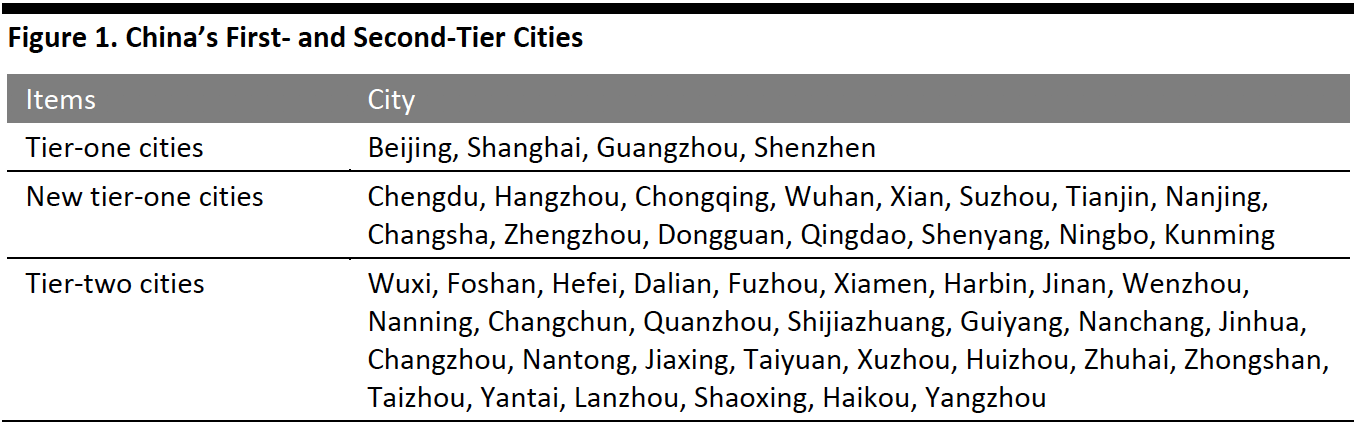

China’s tier system classifies cities based on perceived level of economic development, buying power of its residents, consumer sophistication and other factors. The list of cities is not produced nor recognized officially by the government, but there is widespread consensus in the country as to which cities belong to which tiers—and marketers, retailers and brands do pay attention and use the classification to guide sales and marketing. And, with economic prosperity spreading, more locales are entering the informal “tier 1” category, creating “new” tier-1 cities. (Please list below.)

[caption id="attachment_100957" align="aligncenter" width="700"] A total of 15 cities have joined the club of China’s new first-tier cities as they catch up with traditional metropolises such as Beijing, Shanghai, Guangzhou and Shenzhen, based on five criteria, including availability of commercial resources, connectivity, livability, lifestyle diversity and future growth potential, according to Shanghai-based financial media group China Business Network

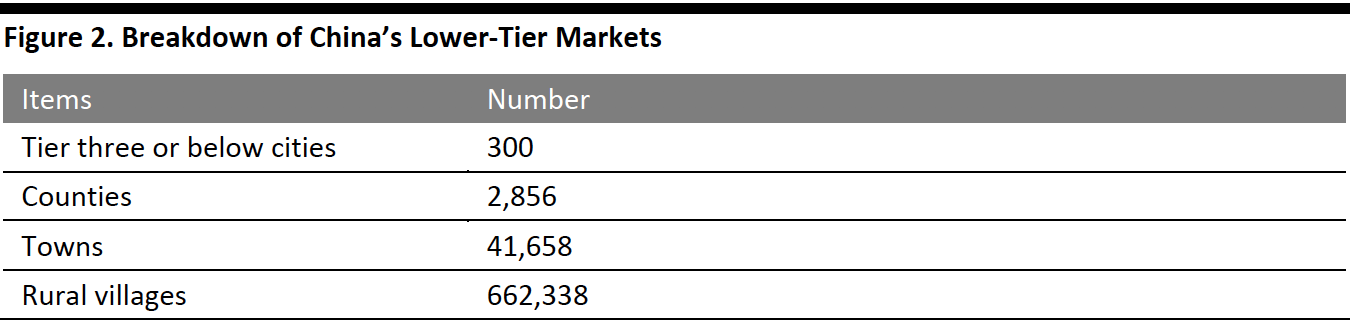

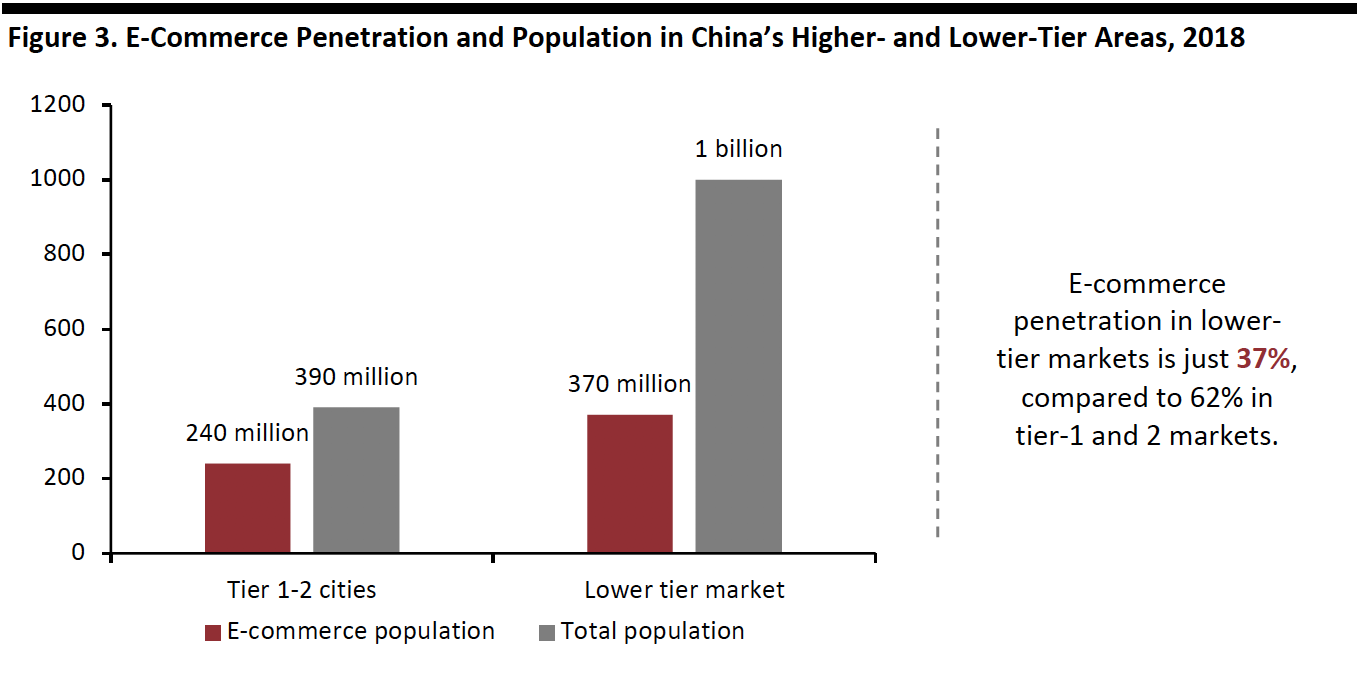

A total of 15 cities have joined the club of China’s new first-tier cities as they catch up with traditional metropolises such as Beijing, Shanghai, Guangzhou and Shenzhen, based on five criteria, including availability of commercial resources, connectivity, livability, lifestyle diversity and future growth potential, according to Shanghai-based financial media group China Business NetworkSource: China Business Network[/caption] China’s tier-1 and tier-2 cities include some 390 million people—240 million of whom shop online, an e-commerce penetration rate of around 62%. The Potential in China’s Lower-Tier Markets China’s lower-tier markets (tier three and below) include cities, towns and rural villages that account for almost 95% of the country’s land area. The entire lower-tier market includes some 300 cities, 2,856 counties, 41,658 towns and 662,338 rural villages, according to the National Bureau of Statistics and the Ministry of Civil Affairs of the People’s Republic of China. [caption id="attachment_100958" align="aligncenter" width="701"]

Source: National Bureau of Statics[/caption]

Source: National Bureau of Statics[/caption]

China’s lower-tier areas account for nearly two-and-half times the population of tier-1 and tier-2 cities—but only about 60% of the country’s total number of online shoppers.

We believe lower-tier markets are poised to play a bigger role in driving consumption growth as disposable incomes rise. In 2018, disposable income grew 6.6% in rural areas, compared to 5.6% in urban areas, while personal consumption expenditure grew 8.4% in rural areas—but only 4.6% in urban areas, according to the National Bureau of Statistics.

And, despite rising access to the Internet in these areas, e-commerce has not kept up—which means there is opportunity to tap into rising wealth in these areas through digital channels.

Research firm MobTech estimates there were around 670 million Internet users in China’s lower-tier markets in 2018, but the e-ecommerce penetration rate was just 37%, according to Chinese research firm iResearch. This implies there is an untapped market of as many as 422 million Internet users who do not yet shop online. And, with a population over 1 billion, these markets also have the potential to add hundreds of millions of new Internet users as well—especially as mobile devices become more prevalent—who can be converted to online shoppers.

Indeed, Xingye Research estimates around 250 million new online shoppers will emerge from lower-tier markets over next six years.

[caption id="attachment_100959" align="aligncenter" width="700"] Source: iResearch[/caption]

Source: iResearch[/caption]

Xingye Research also estimates online retail sales of physical goods in lower-tier markets will account for 45% of total online retail sales in China, worth some ¥8.1 trillion (around $1.25 trillion) in 2025. This would represent a compound annual growth rate (CAGR) of 18.25% from 2018 to 2025. In comparison, online retail sales of physical goods in tier-1 and tier-2 cities will account for 54% of total online sales in China in 2025 to be worth ¥9.7 trillion (around $1.38 trillion), a still impressive but also much slower CAGR of 11.67%.

A Closer Look at Lower-Tier Market Internet Users

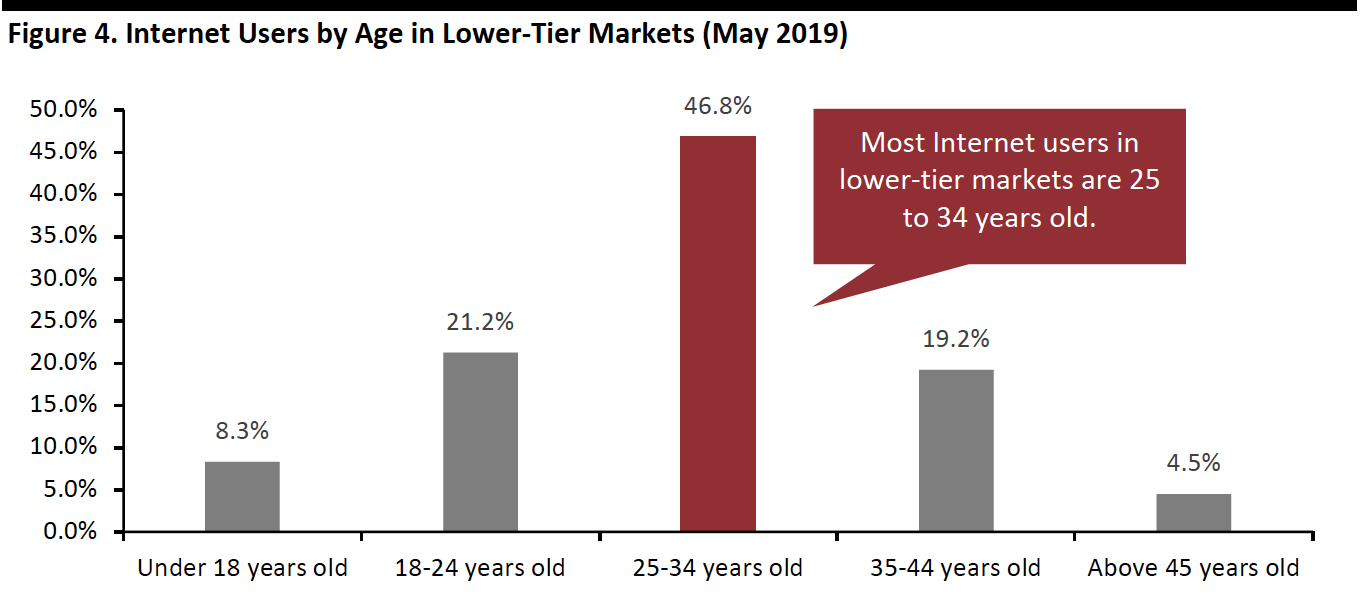

Among the 670 million Internet users in lower-tier markets, there are some demographic differences. There are slightly more women Internet users in lower-tier markets than in first- and second-tier markets, according to the China Internet Network Information Center.

And, Internet users form a slightly narrower age bracket: some 46.8% were 25 to 34 years old as of May 2019, according to MobTech, compared to 48% of Internet users being between 20 and 39 in China overall, according to the China Internet Network Information Center.

[caption id="attachment_100960" align="aligncenter" width="700"] Source: MobTech[/caption]

Source: MobTech[/caption]

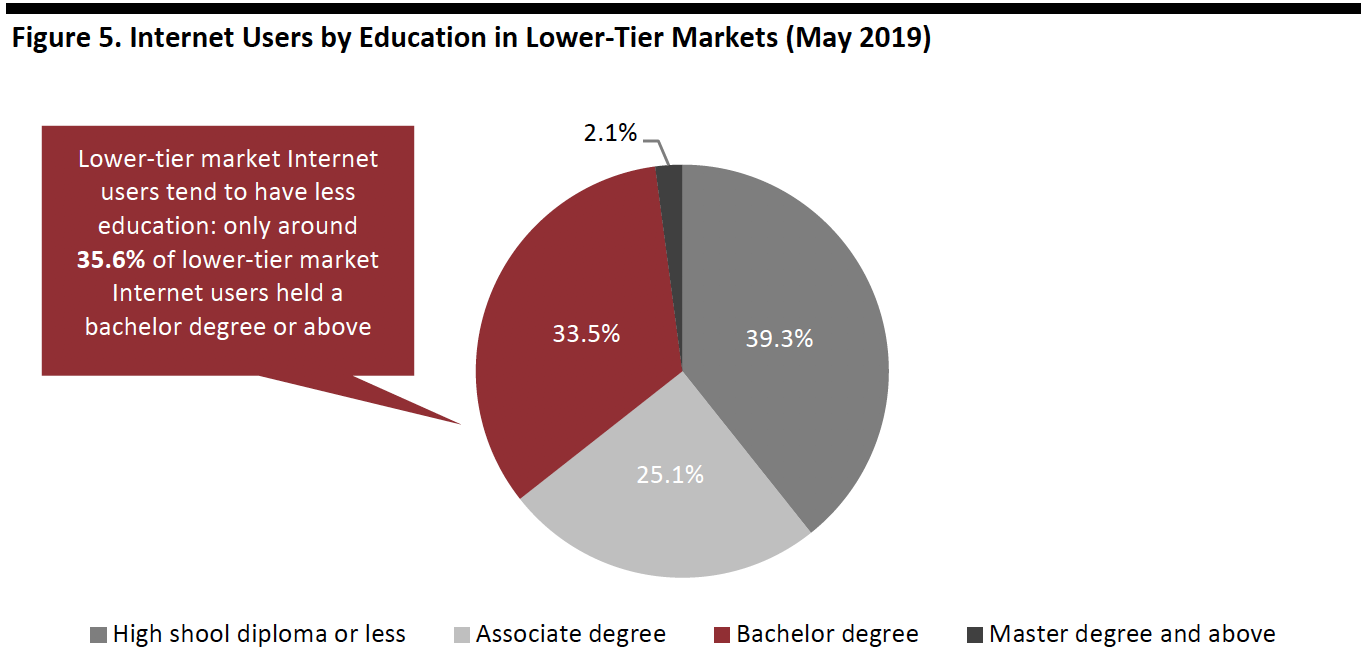

Lower-tier market Internet users also tend to have less education than their tier-1 and tier-2 counterparts. Around 33.5% of lower-tier market Internet users held a bachelor’s degree as of May 2019, according to data from MobTech, compared to 47.8% in tier-1 and tier-2 cities, according to big data firm Jiguang.

[caption id="attachment_100961" align="aligncenter" width="700"] Source: MobTech[/caption]

Source: MobTech[/caption]

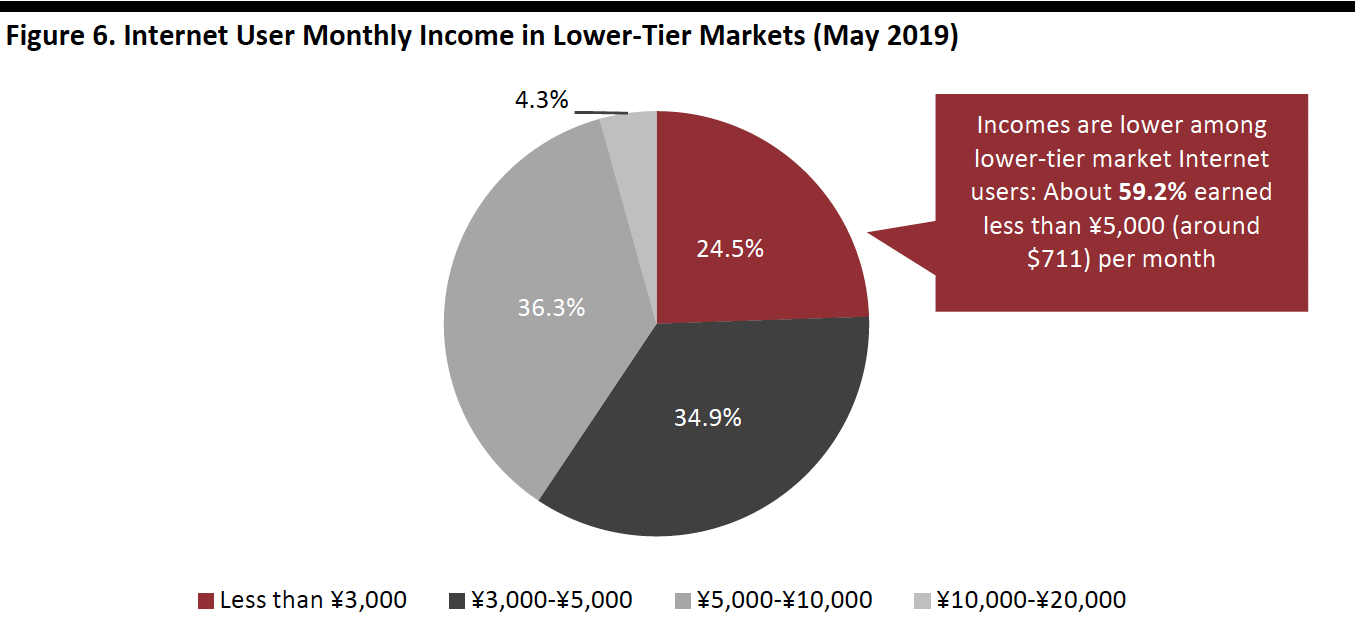

Incomes are also lower among lower-tier market Internet users. About 59.2% earned less than ¥5,000 (around $711) per month as of May 2019, according to MobTech. Whereas around 54% of tier-1 and tier-2 city residents earned between ¥4,500 and ¥15,000 (around $639 and $2,132) per month, according to Tencent.

[caption id="attachment_100962" align="aligncenter" width="700"] Source: MobTech[/caption]

Source: MobTech[/caption]

Which Are the Major E-Commerce Players in Lower-tier Markets?

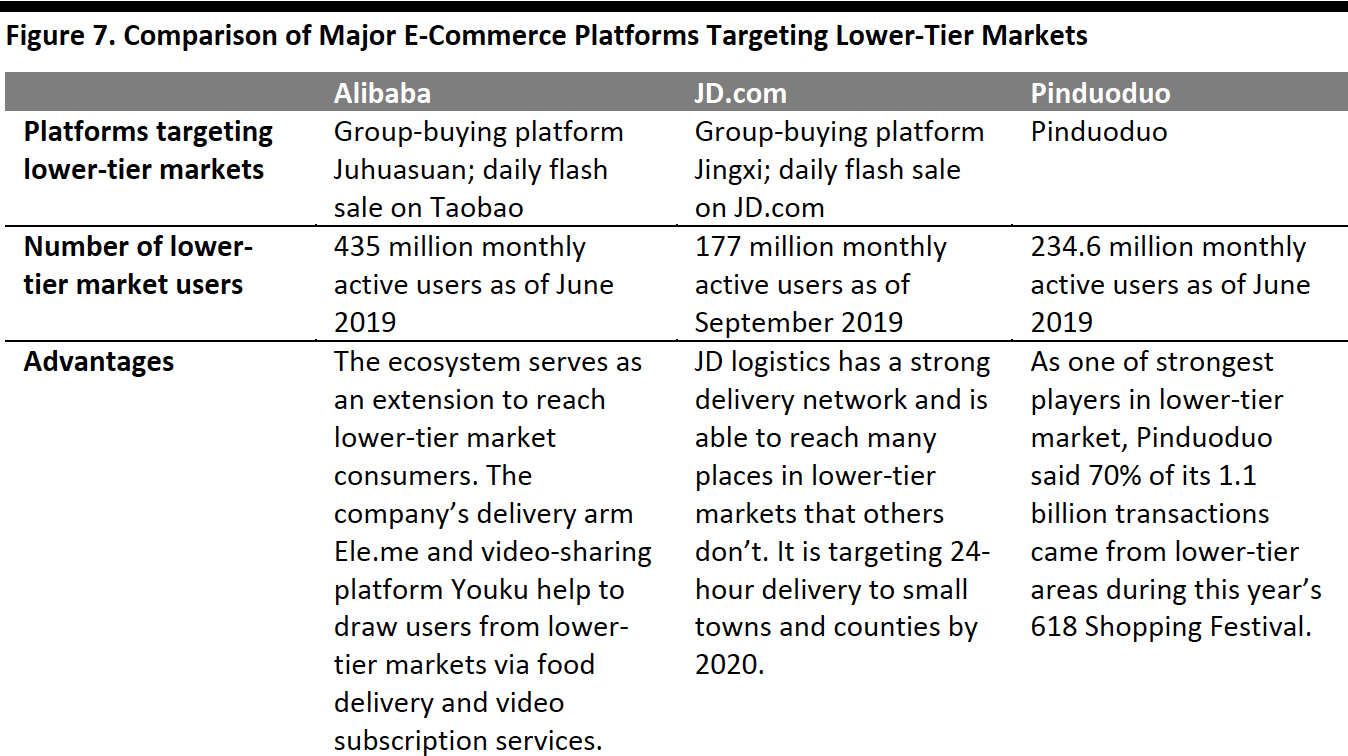

E-commerce players have been working to tap into the growing potential in lower-tier markets. In 2018 Alibaba launched a few marketing campaigns to target price-sensitive lower-tier market customers using its group-buying platform Juhuasuan and the daily flash sale page on Taobao called Tiantian Temai. Indeed, group buying has become an important tactic to reach residents of lower—tier cities. In 2019, JD.com followed by rebranding its group-buying platform to attract users from lower-tier markets, adding new features such as livestreaming.

Pinduoduo already has a strong presence in lower-tier markets. Pinduoduo said 70% of its 1.1 billion transactions came from lower-tier areas during this year’s 618 Shopping Festival.

[caption id="attachment_100963" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

Implications for Brands and Retailers

Given the younger profile of the typical Internet user in lower-tier markets and lower income, companies need to offer products at more competitive price points than they do in tier-1 and tier-2 cities.

Alibaba’s Tiantian Temai has been working with factories to produce consumer-to-manufacturer (C2M) products to drive down costs and pass that savings to consumers to better compete on price.

Brands and retailers looking to target lower-tier markets can also work with established e-commerce platforms to reach less-accessible lower-tier market consumers. JD.com has a strong logistics presence in lower-tier markets, while Alibaba can meet a wide range of needs for consumers in lower-tier markets.

Brands and retailers can also adopt the group-buying model. Users enjoy not only the social part of forming a group to buy, but also the savings. Group-buying platforms such as Alibaba’s Juhuasuan, JD.com’s Jingxi and Pinduoduo are all working to target their platforms to users in lower-tier markets.