Nitheesh NH

In July, several Chinese e-cigarette players raised investment funds, including Hangzhou-based e-cigarette maker SSSO.

Domestic and Foreign E-Cigarette Players Eye Expansion in China

On July 24, Hangzhou-based e-cigarette maker SSSO raised $25 million in an angel investment round, according to business information platform Crunchbase. The funds will be used to expand in both domestic and overseas markets. As of July 2019 the company said it was selling more than 10,000 e-cigarette devices each month via various sales channels such as its WeChat mini program.

Other Chinese e-cigarette startups have also raised capital in 2019, with more than 29 deals closed so far valued at ¥2 billion (around $190.5 million), according to Itjuzi, a business information service provider based in China.

E-cigarette company MOTI (魔笛, or “magic flute”) completed a Series A financing round with $31 million on July 17, according to research company EqualOcean . Shenzhen-based e-cigarette maker YouMe raised ¥73 million (around $10.65 million) in a Series A financing round in May, news provider KrAsia reported.

On July 19, US e-cigarette brand Juul teamed up with JD.com, a major e-commerce platform in China, to enter the Chinese market. Juul plans to sell its products on JD.com and spend more than $100 million in the next 15 months on branding and marketing operations in China.

The E-Cigarette Market

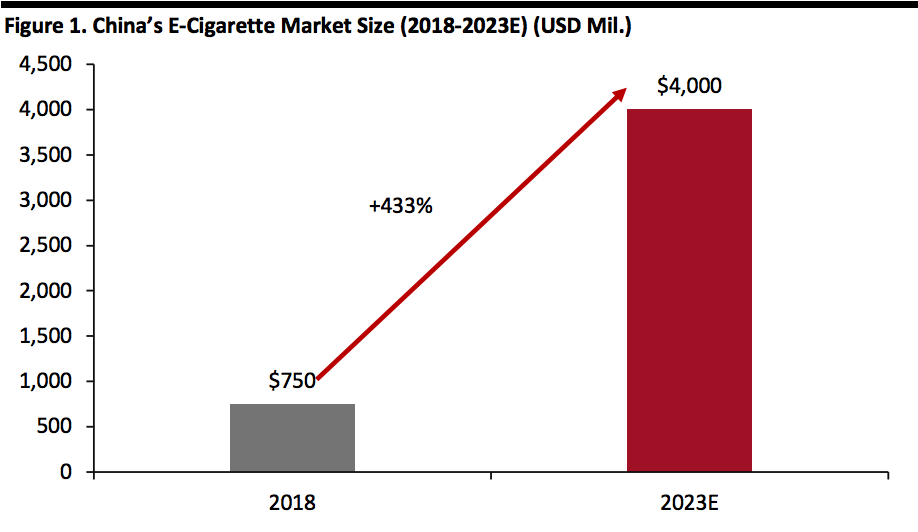

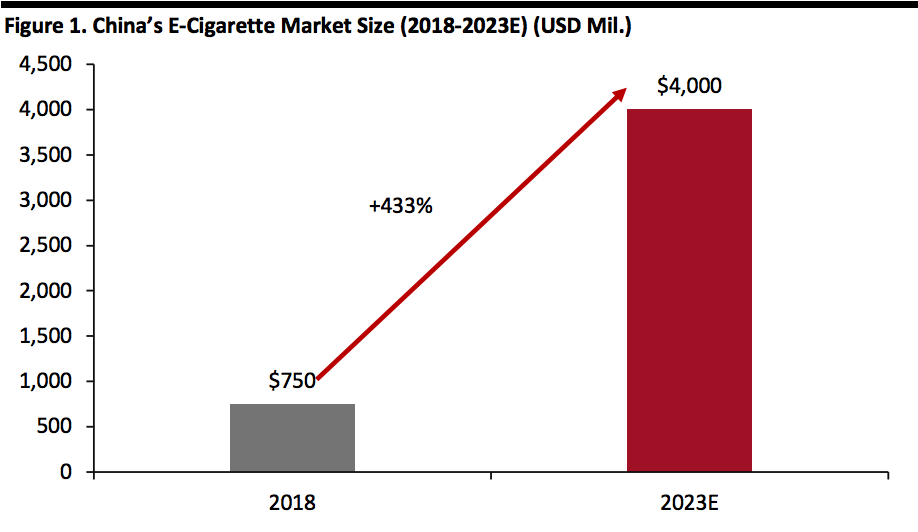

The global e-cigarette market grew to $15.8 billion in 2018 from $3.7 billion in 2013, according to Euromonitor International. China represented only $750 million of that market in 2018, according to Euromonitor. However, the size of China’s e-cigarette market is projected to reach over $4 billion by 2023, according to Sinolink Securities.

[caption id="attachment_94216" align="aligncenter" width="700"] Source: Euromonitor International/Sinolink Securities/Coresight Research[/caption]

China Plans to Regulate Its E-Cigarette Market

China is taking steps to regulate the e-cigarette market. China’s National Health and Family Planning Commission has begun research into e-cigarettes and plans to issue legislation for the industry, according to a July statement by Mao Qunan, the head of China’s National Health and Family Planning Commission.

In May, China's tobacco regulator, the State Tobacco Monopoly Administration, drew up a set of standards for e-cigarettes that specify the level of nicotine, the type of additives and designs allowed in battery-powered cigarette devices.

China's tobacco regulator shares offices and senior officials with the state-owned China National Tobacco — a government monopoly and by far the world's biggest cigarette producer. In 2013, it manufactured about 2.5 trillion cigarettes. Its next largest competitor, US tobacco firm Philip Morris International, produced 880 billion cigarettes, according to Bloomberg.

At the same time, the rapid growth in e-cigarettes has created concern in many countries – especially in the US. Many are concerned about young people using e-cigarettes, becoming dependent on nicotine and switching to smoking tobacco, which is cheaper and far more easily obtained. In June, San Francisco became the first major US city to effectively ban the sale and manufacture of e-cigarettes. Singapore has also banned e-cigarettes.

Key Insights

Domestic and foreign e-cigarette players are eying expansion in the China market, with e-cigarettes being promoted as safer alternatives to traditional cigarettes. In fact, the stated intended use (by many of the companies) is to provide a safer alternative for smokers to stop using tobacco. The size of China’s e-cigarette market is projected to reach over $4 billion by 2023, according to Sinolink Securities. However, whether the market ultimately reaches that potential depends on forthcoming regulations.

Source: Euromonitor International/Sinolink Securities/Coresight Research[/caption]

China Plans to Regulate Its E-Cigarette Market

China is taking steps to regulate the e-cigarette market. China’s National Health and Family Planning Commission has begun research into e-cigarettes and plans to issue legislation for the industry, according to a July statement by Mao Qunan, the head of China’s National Health and Family Planning Commission.

In May, China's tobacco regulator, the State Tobacco Monopoly Administration, drew up a set of standards for e-cigarettes that specify the level of nicotine, the type of additives and designs allowed in battery-powered cigarette devices.

China's tobacco regulator shares offices and senior officials with the state-owned China National Tobacco — a government monopoly and by far the world's biggest cigarette producer. In 2013, it manufactured about 2.5 trillion cigarettes. Its next largest competitor, US tobacco firm Philip Morris International, produced 880 billion cigarettes, according to Bloomberg.

At the same time, the rapid growth in e-cigarettes has created concern in many countries – especially in the US. Many are concerned about young people using e-cigarettes, becoming dependent on nicotine and switching to smoking tobacco, which is cheaper and far more easily obtained. In June, San Francisco became the first major US city to effectively ban the sale and manufacture of e-cigarettes. Singapore has also banned e-cigarettes.

Key Insights

Domestic and foreign e-cigarette players are eying expansion in the China market, with e-cigarettes being promoted as safer alternatives to traditional cigarettes. In fact, the stated intended use (by many of the companies) is to provide a safer alternative for smokers to stop using tobacco. The size of China’s e-cigarette market is projected to reach over $4 billion by 2023, according to Sinolink Securities. However, whether the market ultimately reaches that potential depends on forthcoming regulations.

Source: Euromonitor International/Sinolink Securities/Coresight Research[/caption]

China Plans to Regulate Its E-Cigarette Market

China is taking steps to regulate the e-cigarette market. China’s National Health and Family Planning Commission has begun research into e-cigarettes and plans to issue legislation for the industry, according to a July statement by Mao Qunan, the head of China’s National Health and Family Planning Commission.

In May, China's tobacco regulator, the State Tobacco Monopoly Administration, drew up a set of standards for e-cigarettes that specify the level of nicotine, the type of additives and designs allowed in battery-powered cigarette devices.

China's tobacco regulator shares offices and senior officials with the state-owned China National Tobacco — a government monopoly and by far the world's biggest cigarette producer. In 2013, it manufactured about 2.5 trillion cigarettes. Its next largest competitor, US tobacco firm Philip Morris International, produced 880 billion cigarettes, according to Bloomberg.

At the same time, the rapid growth in e-cigarettes has created concern in many countries – especially in the US. Many are concerned about young people using e-cigarettes, becoming dependent on nicotine and switching to smoking tobacco, which is cheaper and far more easily obtained. In June, San Francisco became the first major US city to effectively ban the sale and manufacture of e-cigarettes. Singapore has also banned e-cigarettes.

Key Insights

Domestic and foreign e-cigarette players are eying expansion in the China market, with e-cigarettes being promoted as safer alternatives to traditional cigarettes. In fact, the stated intended use (by many of the companies) is to provide a safer alternative for smokers to stop using tobacco. The size of China’s e-cigarette market is projected to reach over $4 billion by 2023, according to Sinolink Securities. However, whether the market ultimately reaches that potential depends on forthcoming regulations.

Source: Euromonitor International/Sinolink Securities/Coresight Research[/caption]

China Plans to Regulate Its E-Cigarette Market

China is taking steps to regulate the e-cigarette market. China’s National Health and Family Planning Commission has begun research into e-cigarettes and plans to issue legislation for the industry, according to a July statement by Mao Qunan, the head of China’s National Health and Family Planning Commission.

In May, China's tobacco regulator, the State Tobacco Monopoly Administration, drew up a set of standards for e-cigarettes that specify the level of nicotine, the type of additives and designs allowed in battery-powered cigarette devices.

China's tobacco regulator shares offices and senior officials with the state-owned China National Tobacco — a government monopoly and by far the world's biggest cigarette producer. In 2013, it manufactured about 2.5 trillion cigarettes. Its next largest competitor, US tobacco firm Philip Morris International, produced 880 billion cigarettes, according to Bloomberg.

At the same time, the rapid growth in e-cigarettes has created concern in many countries – especially in the US. Many are concerned about young people using e-cigarettes, becoming dependent on nicotine and switching to smoking tobacco, which is cheaper and far more easily obtained. In June, San Francisco became the first major US city to effectively ban the sale and manufacture of e-cigarettes. Singapore has also banned e-cigarettes.

Key Insights

Domestic and foreign e-cigarette players are eying expansion in the China market, with e-cigarettes being promoted as safer alternatives to traditional cigarettes. In fact, the stated intended use (by many of the companies) is to provide a safer alternative for smokers to stop using tobacco. The size of China’s e-cigarette market is projected to reach over $4 billion by 2023, according to Sinolink Securities. However, whether the market ultimately reaches that potential depends on forthcoming regulations.