DIpil Das

For centuries, westerners have developed a strong coffee culture. Chinese drink tea – but they too have turned it into a culture with a variety of styles and flavors. Amongst different categories of tea, bubble tea — tea and milk mixed with a layer of chewy tapioca pearls — has seen growing popularity. This and other popular flavors are being re-invented for a new generation, with colors and new innovative toppings – including cheese.

The Growing Bubble Tea Market in China

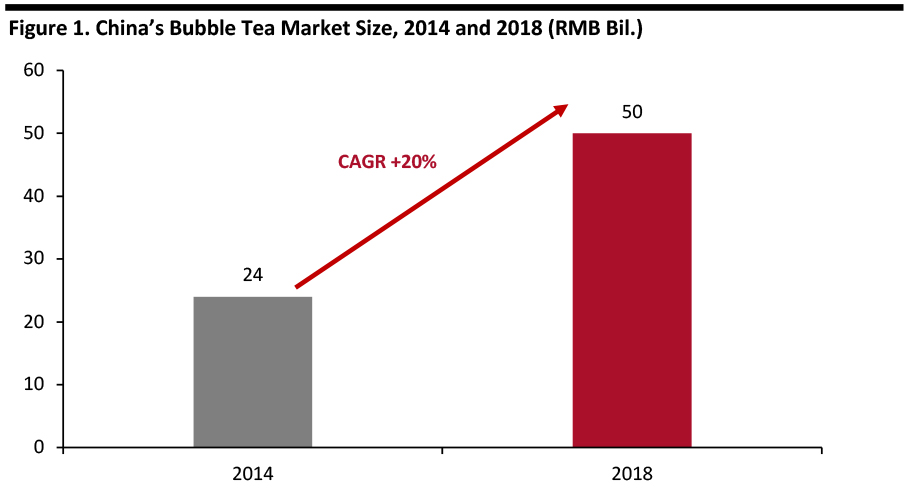

China had more than 410,000 bubble tea shops as of September 2018, and annual sales revenue for the industry passed ¥50 billion (around $7.1 billion) as of December 2018, according to market research company Qianzhan. The bubble tea industry grew at a CAGR of 20% between 2014 and 2018, from ¥24 billion (around $3.4 billion) in 2014.

[caption id="attachment_94900" align="aligncenter" width="700"] Source: Qianzhan/Coresight Research[/caption]

Source: Qianzhan/Coresight Research[/caption]

Meituan, an online food delivery platform, reported its users placed more than 210 million bubble tea orders in 2018, and 95% of Meituan’s users who are female and aged under 26 ordered bubble tea on a weekly basis.

What Makes Bubble Tea Popular?

Innovation in bubble tea is one of the reasons for its continued popularity. For instance, HeyTea’s cheese tea has become an Internet sensation, made from black tea and creamy cheese – a unique sweet-savory pairing.

[caption id="attachment_94901" align="aligncenter" width="700"] Cheese tea at HeyTea store

Cheese tea at HeyTea store Source: HeyTea [/caption]

HeyTea said its monthly revenue in each store is more than ¥1 million (around $142,300), and that it sold between 1,000 and 2,000 cups a day at each store as of 2017. Each cup of HeyTea costs around ¥11-¥29 (around $1.6-$4.1), with an average of ¥25 (around $3.6). As of August 2019, HeyTea had 395 stores across China and two in Singapore, according to the company’s website.

Apart from innovations in recipes, bubble tea makers have created themed teahouses that have become hangout spots for millennials. For instance, bubble tea brand Nayuki’s Tea turned its shop in Jiangsu province into a pink-themed store.

[caption id="attachment_94902" align="aligncenter" width="700"] Nayuki’s Tea in Nantong city, Jiangsu province

Nayuki’s Tea in Nantong city, Jiangsu province Source: Weibo/Nayuki’s Tea [/caption]

Bubble tea players leverage viral marketing: Customers who enjoy experiences in tea shops post photos of drinks and shops online to share with others, that in turn would encourage other urbanites to try and to create Instagrammable photos.

Bubble tea players are also eyeing collaboration with different sectors for further growth. For instance, tea brands such as Tian Ren have merged with bookstores, popular clothing brands and even restaurant chains in search of new customers.

[caption id="attachment_94903" align="aligncenter" width="700"] Tian Ren store inside an Eslite bookstore in Hong Kong

Tian Ren store inside an Eslite bookstore in Hong Kong Source: Facebook/Eslite [/caption]

Bubble Tea Players Gain Fundings

With bubble tea gaining popularity among customers, bubble tea startups have also drawn attention from investors. At least four Chinese bubble tea startups closed funding rounds in 2018:

- • HeyTea (喜茶), founded in 2012, received a ¥400 million financing (around $57 million).

- • ChaYanYueSe (茶颜悦色), founded in 2013, received an undisclosed amount of funding.

- • Nayuki’s Tea (奈雪の茶), founded in 2015, received an undisclosed amount in Series A financing.

- • Lelecha (乐乐茶), founded in 2016, secured a ¥200 million Series A round (around $30 million) funding.

Key Insights

China’s booming bubble tea market has experienced a high CAGR of 20% between 2014 and 2018, according to Qianzhan. Innovations in bubble tea recipes, modern tea houses serving as hang-out venues for consumers as well as viral marketing are factors that contribute to demand.