albert Chan

In our monthly series Insights from China, we examine issues that affect international brands and retailers in China. We cover areas such as policy, consumer behavior, consumer sentiment, government regulations and the competitive landscape—as they affect business operations and the future outlook.

In this report, we analyze China’s growing male beauty market and how beauty brands can tap into this market and reach Chinese male consumers.

Male Beauty: An Underpenetrated Market in China

China’s beauty market is the second largest in the world just behind US and continues to grow in the wake of Covid-19 crisis, according to Cosmetic Business. Male beauty, which remains an underpenetrated market in China, has been gaining traction in recent years, and is one of the hottest trends in the nation’s beauty industry. Coresight Research’s survey of Chinese beauty consumers, conducted in late 2019, found that 46.8% of male respondents were interested in male grooming, making it the top beauty trend. In addition, 31.1% were interested in male makeup.

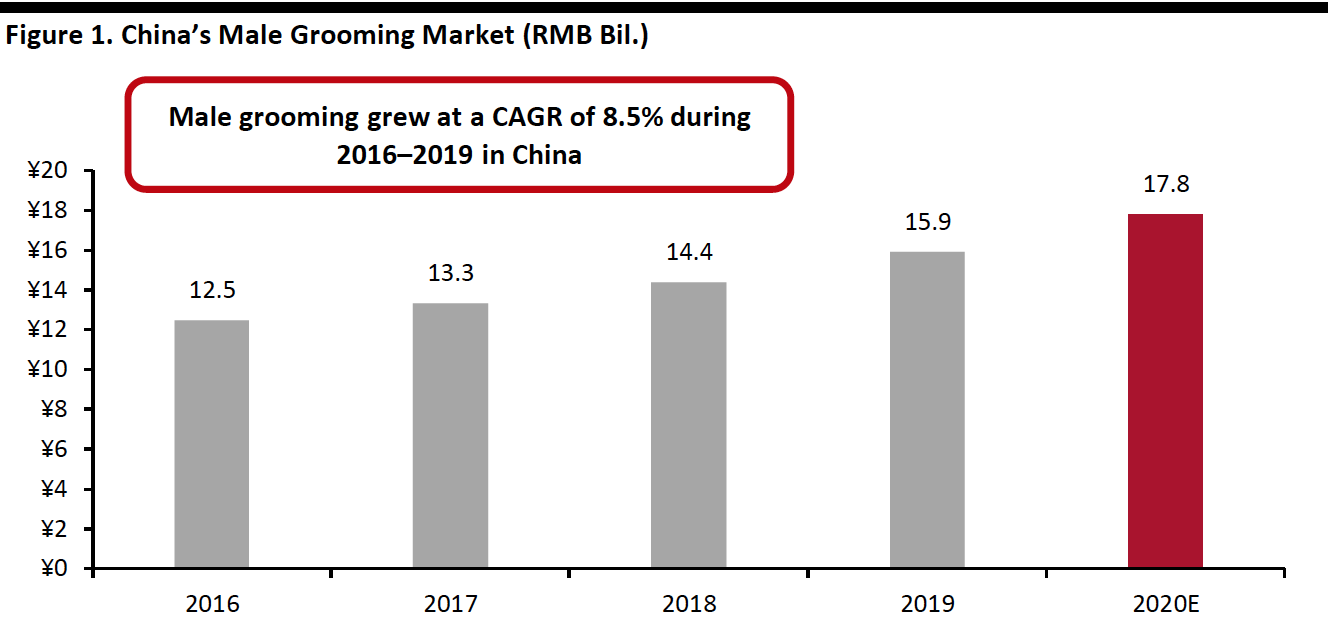

According to Chinese data firm iiMedia, China’s male grooming market—which includes men’s shaving, skin care, body care, hair care and fragrance products—totaled ¥15.9 billion (around $2.3 billion) in 2019, growing 10.4% year over year and at a CAGR of 8.5% from 2016. Growth is expected to remain solid in 2020, at 12.0%, despite the impact of the coronavirus pandemic, to reach ¥17.8 billion (around $2.7 billion). This compares to an estimated ¥395.8 billion ($60 billion) total beauty market in China, implying that male grooming is equivalent to around 4% of the total beauty market.

[caption id="attachment_120458" align="aligncenter" width="700"] Source: iiMedia[/caption]

Source: iiMedia[/caption]

Makeup for men, which is not included in the male grooming categories, is still a niche beauty segment in China. However, it has witnessed rapid growth. Chinese investment firm Cyanhill Capital noted that men’s makeup achieved annual growth of over 50% for the past two years.

During Singles’ Day 2020 (from November 1 to 11), inventories for imported men’s makeup products increased by 3,000% year over year on Alibaba’s Tmall platform, according to the e-commerce giant, and overall, men’s makeup products saw sales growth of over 50%. On JD.com, half of the GMV from sales of lipsticks and fragrances during November 1–3 was contributed by male consumers.

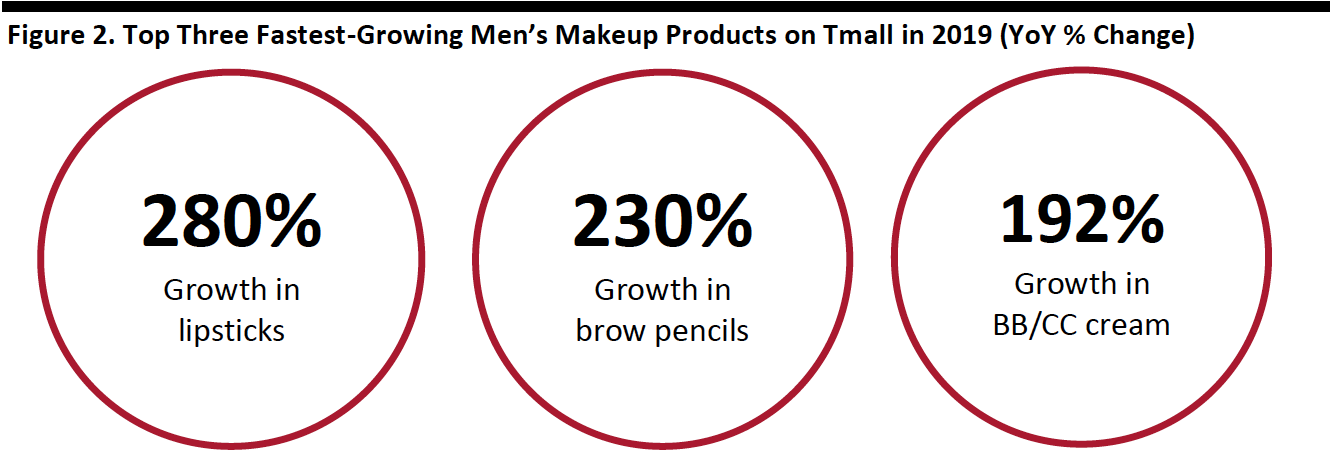

In 2019, total sales of men’s makeup products on Tmall jumped 67.9% year over year, with lipstick witnessing the fastest growth (see Figure 2).

[caption id="attachment_120459" align="aligncenter" width="700"] Source: Tmall[/caption]

Source: Tmall[/caption]

Factors Driving the Male Beauty Trend

There are multiple factors that are driving growth in China’s male beauty market. Male consumers generally having higher purchasing power than women and are becoming more conscious about their appearance.

Traditionally, the only skincare routine for older generations in China is to use soap to clean their face, and applying makeup is typically perceived as a feminine activity. Today, attitudes are changing, as young, post-90s consumers (born on or after 1990) are now the backbone of consumption: They are embracing the concept of the “appearance economy,” which believes that good physical appearance has a huge impact on their chances of social and economic success.

According to a survey conducted by iiMedia in 2020, some 65.1% of Chinese men had a positive attitude toward men paying attention to their appearance. A separate survey from social platform Weibo found that the proportion of Chinese men that would not use any beauty products declined from 31% in 2016 to less than 10% in 2019.

More content about male beauty is being generated by male celebrities and influencers, which is driving the trend. More than one-fifth of beauty KOLs (key opinion leaders) on video platforms Bilibili, Douyin and Kuaishou were men in 2019, according to data firm Caasdata. On social commerce platform Little Red Book (or Xiaohongshu), views of male beauty content in the first half of 2020 increased significantly year over year, with skincare topics seeing the highest views. Celebrity endorsements of male beauty products are also helping to shift public perception and offering a more diverse view of masculinity.

How Beauty Brands Can Reach Chinese Male Consumers

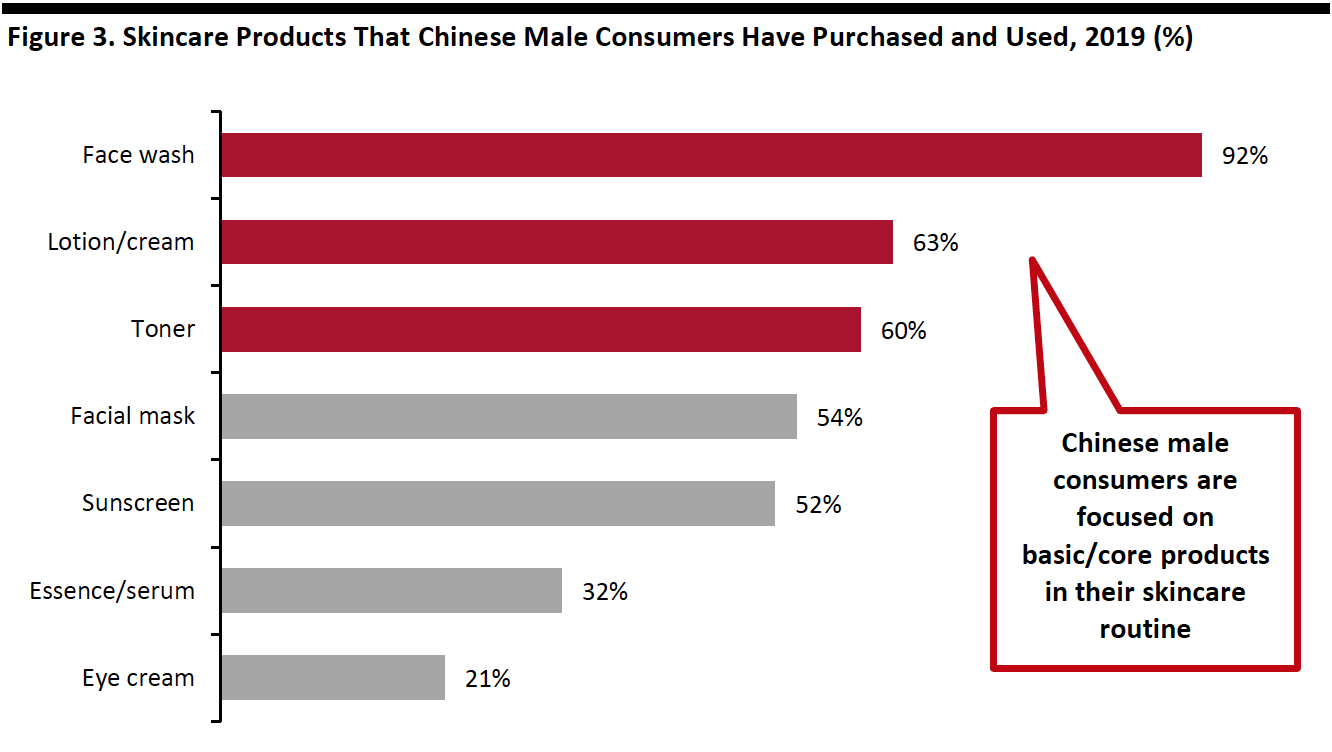

While current demand for beauty products among Chinese male consumers is primarily focused on basic skincare items, young men are increasingly trying a wider range of products. In order to meet changing demand, a growing number of international and domestic brands are launching products exclusively for men.

[caption id="attachment_120460" align="aligncenter" width="700"] Source: CBNData[/caption]

Source: CBNData[/caption]

The male grooming market in China is largely dominated by international brands, such as Biotherm (L’Oréal), Kiehl’s, Lab Series (Estée Lauder) and Nivea. On November 1, 2020, the first sale day of Singles’ Day, nine of the top 10 bestselling men’s grooming brands on Tmall were international brands, according to Alibaba. In the makeup category, numerous brands have launched product lines specifically to cater to men in China in recent years.

[caption id="attachment_120461" align="aligncenter" width="700"] Source: Jumeili[/caption]

Source: Jumeili[/caption]

Below, we discuss how beauty brands can reach Chinese male beauty consumers.

Esports Sponsorship and Partnership

Brands can employ marketing strategies in areas in which Chinese men generally show great interest, such as sports and esports, to promote their products and increase brand exposure.

L’Oréal’s high-end skincare brand Biotherm owns a product line for men, Biotherm Homme. The brand invited esports team QGhappy from Tencent’s game Honor of Kings and livestreamer Feng Timo to a game event held at a department store in Chengdu in June 2019. Members from the team shared their experience of using Biotherm’s newly launched Fermented Essence when having to stay up late for tournaments. Feng’s commentary of the event was livestreamed to audiences, who were also invited to play a friendly match with the team.

[caption id="attachment_120462" align="aligncenter" width="550"] Source: Biotherm’s Weibo account[/caption]

Source: Biotherm’s Weibo account[/caption]

Estée Lauder’s Lab Series took a similar approach last year by sponsoring the Invictus Gaming professional esports team in League of Legends. Lab Series also ran a marketing campaign on Weibo with hashtag #iGXinDuiyou (“new teammate”), and those that posted using the hashtag could win a set of Lab Series products.

Brand Collaboration

Brand mashups are popular in China as a means to drive consumer excitement and increase brand exposure. China’s first male beauty brand, GF, collaborated with streetwear brand NPC to launch crossover products. The two brands also held a pop-up in Shanghai Shimao Plaza, where consumers could learn more about male skincare tips and how they could update their clothing style to improve their overall appearance.

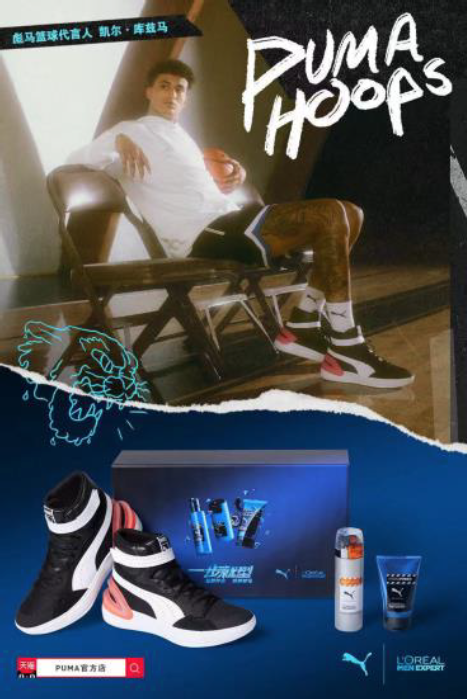

L’Oréal has teamed up with sports brand Puma to unveil several limited-edition gift boxes. Featured products targeted men’s post-workout skincare routine, with facewash, toner and lotion to keep their face clean while staying hydrated, as well as hair spray and pomade to style their hair after exercising. A separate bundle also contained Puma’s new Sky Modern sneaker. On Weibo, L’Oréal invited consumers to purchase any of the featured beauty products offline at the drugstore Watsons and share on Weibo to win Puma’s sneaker.

[caption id="attachment_120463" align="aligncenter" width="250"] Source: Puma’s Weibo account[/caption]

Source: Puma’s Weibo account[/caption]

What We Think

The male beauty market in China is poised to grow as male consumers, especially younger generations, focus more on enhancing their appearance and become increasingly willing to invest in beauty products. The male grooming market is expected to total $2.8 billion this year, although male makeup remains a relatively niche market in China.

The underpenetrated male beauty market presents huge opportunities for existing players and new brands. While skincare products for men are more basic, we expect to see growing demand for more advanced and alternative products; brands should continue to innovate in product formulations to cater for men. With men typically viewing skincare routines as a functional step rather than an experience, brands could consider offering customized beauty subscription offerings. Makeup brands can use this model to test the water with more subtle products that encourage men to further experiment in the beauty category, such as tinted moisturizer and tinted lip balm.

Brands must maintain their focus on social media to increase brand exposure and educate male consumers on product benefits or applications, thus driving purchasing behavior. Brands could explore product promotion in esports, using sponsorship, partnership and crossover brand collaboration to effectively target male consumers.