Nitheesh NH

With China’s recent relaxation of its one-child policy in 2016, alongside an increase in the average national household income, the parent-and-baby market has seen consistent growth across the country.

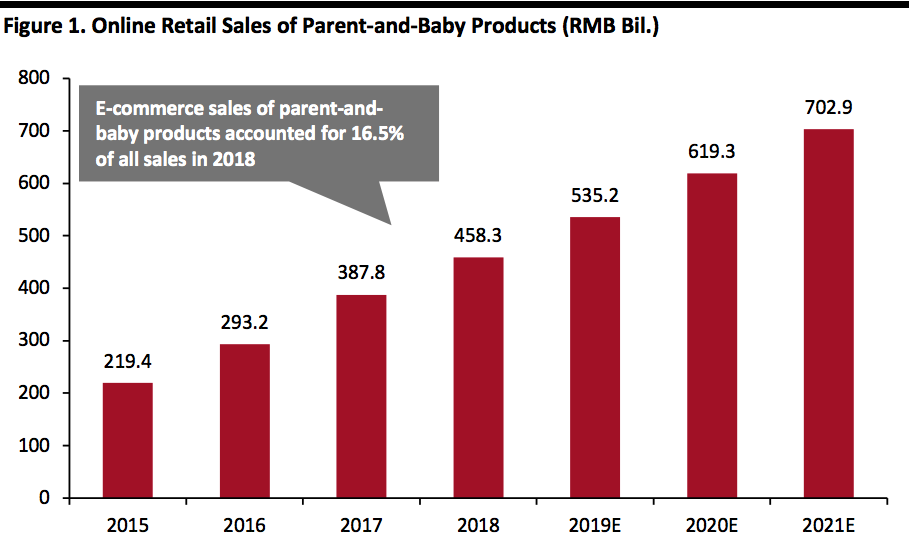

Online Retail Sales of Parent-and-Baby Products in China Are Growing Rapidly

The Chinese market for parent-and-baby products has grown rapidly in recent years, with retail sales expanding by a compound annual growth rate (CAGR) of 11.9% between 2013 and 2018. Sales reached ¥2.77 trillion (around $392 billion) in 2018, according to research firm Analysys. This CAGR compared favourably to that of overall retail sales in China, which totaled 9.4% in the same five-year period, based on data from the National Bureau of Statistics of China.

Online sales are growing even faster:

Source: Analysys[/caption]

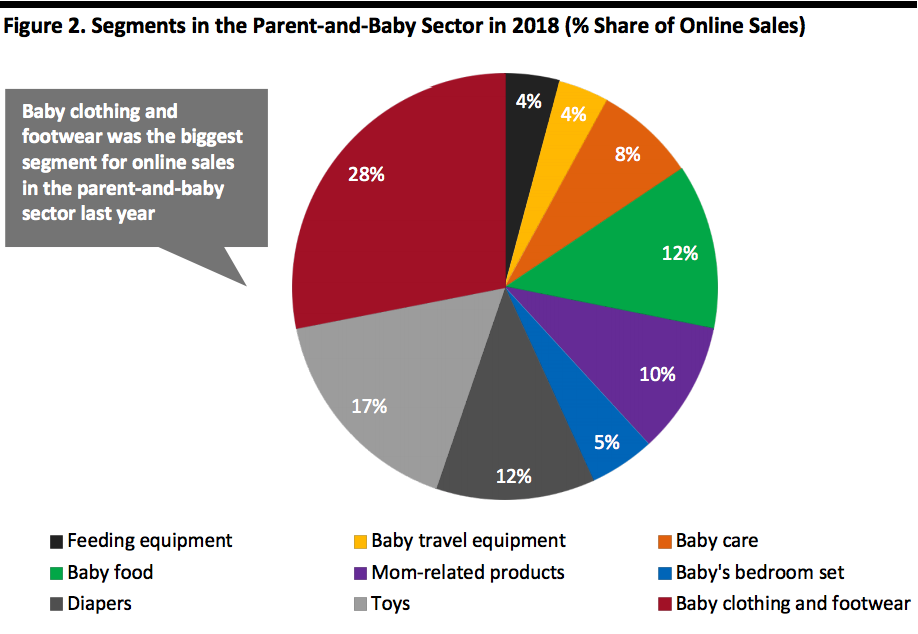

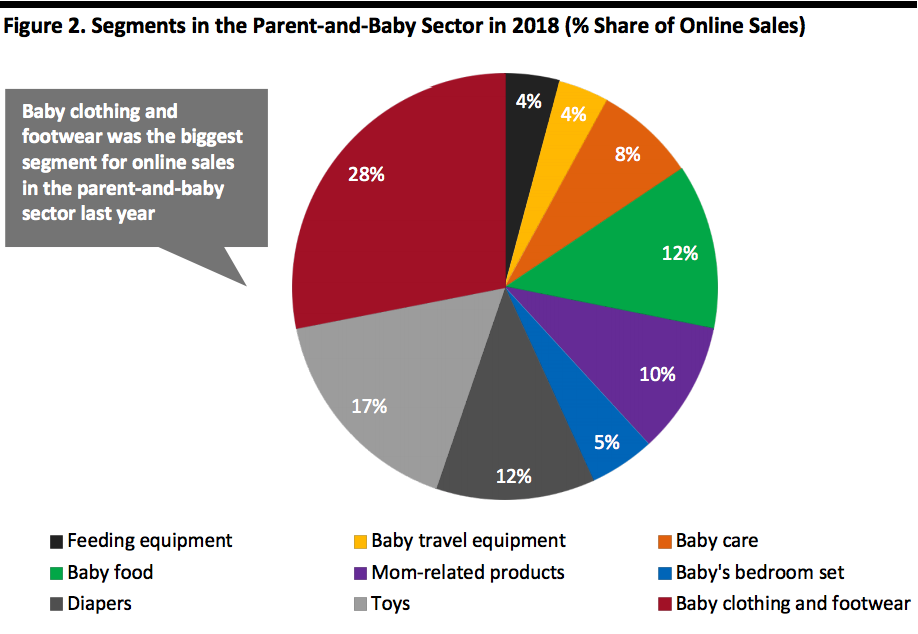

Baby clothing and footwear comprises the most popular segment online, as of July 2019: Totaling ¥25.8 billion ($3.7 billion), it accounted for 28% of total online sales in the parent-and-baby sector, according to data company ECdataway. Toys, diapers and baby food followed, with a market share of 17%, 12% and 12% respectively.

[caption id="attachment_99371" align="aligncenter" width="700"]

Source: Analysys[/caption]

Baby clothing and footwear comprises the most popular segment online, as of July 2019: Totaling ¥25.8 billion ($3.7 billion), it accounted for 28% of total online sales in the parent-and-baby sector, according to data company ECdataway. Toys, diapers and baby food followed, with a market share of 17%, 12% and 12% respectively.

[caption id="attachment_99371" align="aligncenter" width="700"] The “Baby’s bedroom set” segment comprises children’s bedding and furniture; “Baby travel equipment” includes car seats and strollers; and “Mom-related products” covers items such as maternity wear and nutrition products.

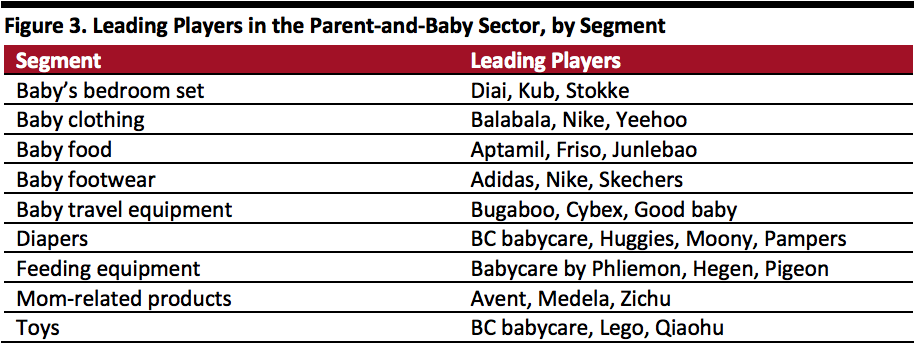

The “Baby’s bedroom set” segment comprises children’s bedding and furniture; “Baby travel equipment” includes car seats and strollers; and “Mom-related products” covers items such as maternity wear and nutrition products.

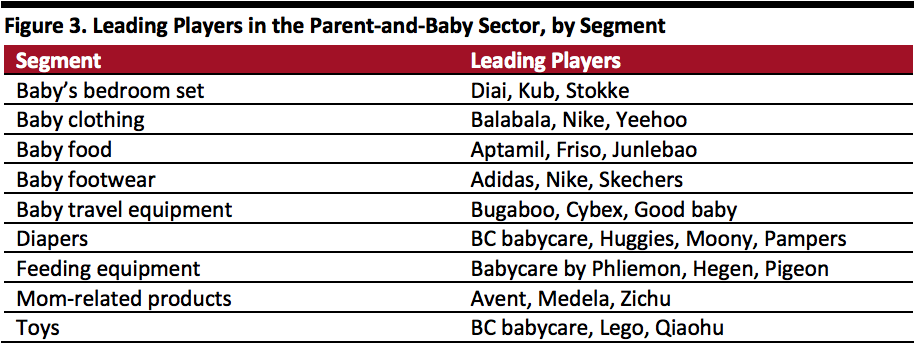

Source: ECdataway[/caption] Key Players in the Parent-and-Baby Market Various segments in the parent-and-baby sector in China are dominated by international brands. This may be because Chinese consumers perceive foreign products to meet higher standards of quality and safety than domestic brands—which are top priorities for consumers in this category—particularly following the melamine milk scandal in 2008. [caption id="attachment_99372" align="aligncenter" width="700"] Source: ECdataway[/caption]

International brands are especially popular online across multiple categories in the parent-and-baby sector, demonstrated by their performance in the build up to Singles’ Day 2019 (Alibaba’s annual Chinese shopping holiday on November 1). On October 21—the first day of the Singles’ Day pre-sales period on Tmall—Nike achieved ¥65.2 million ($9.2 million) in sales of baby clothing and footwear products, and Aptamil reached ¥27.3 million ($3.9 million) for its infant formula, according to ECdataway.

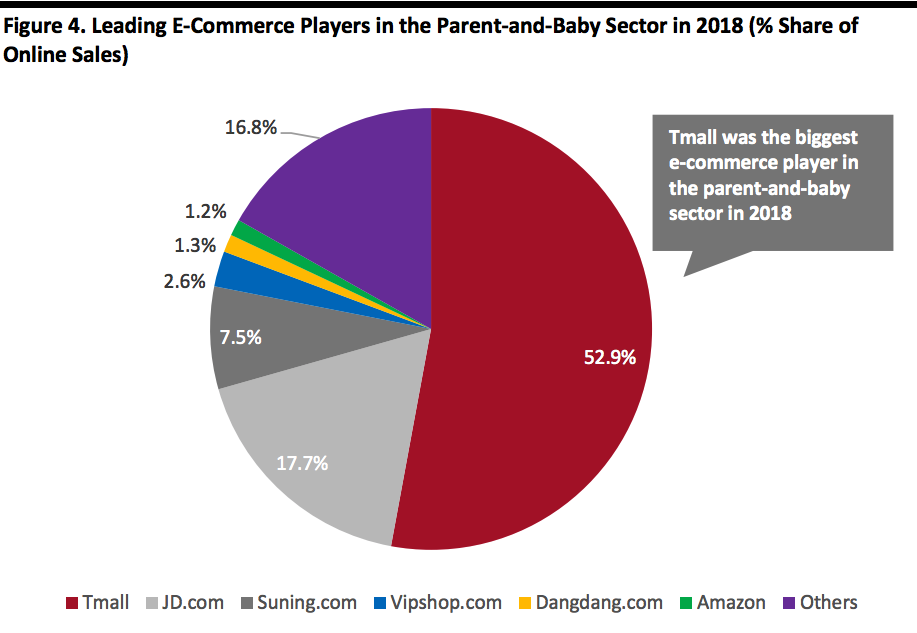

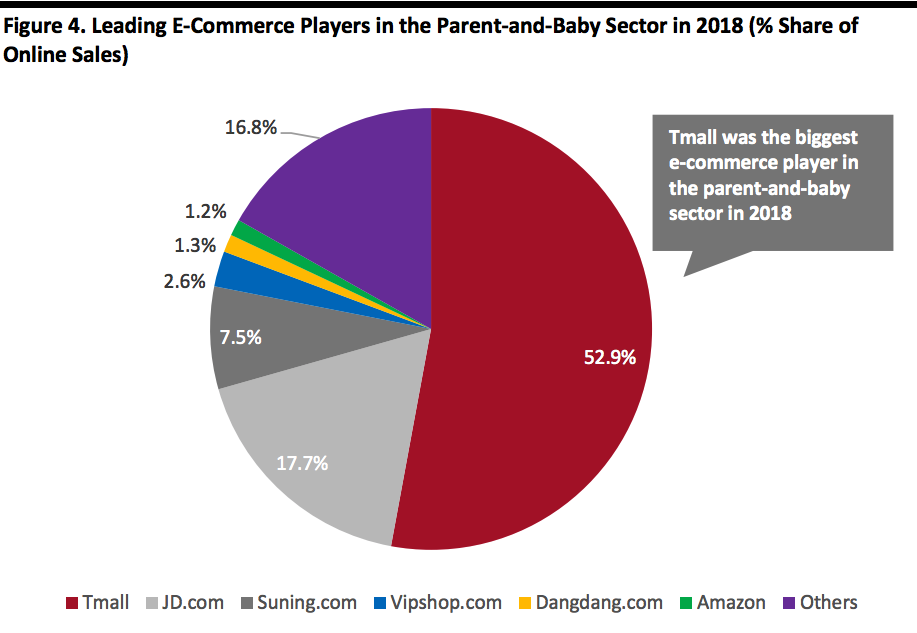

Tmall was the biggest online platform for the parent-and-baby category in 2018, accounting for an estimated 52.9% in online business-to-consumer sales, according to research firm CBNData. Tmall had around 200 million customers in this sector last year, and over 60% of those were born after 1990. The second-biggest e-commerce player was JD.com, accounting for 17.7% of online sales in the sector.

[caption id="attachment_99373" align="aligncenter" width="700"]

Source: ECdataway[/caption]

International brands are especially popular online across multiple categories in the parent-and-baby sector, demonstrated by their performance in the build up to Singles’ Day 2019 (Alibaba’s annual Chinese shopping holiday on November 1). On October 21—the first day of the Singles’ Day pre-sales period on Tmall—Nike achieved ¥65.2 million ($9.2 million) in sales of baby clothing and footwear products, and Aptamil reached ¥27.3 million ($3.9 million) for its infant formula, according to ECdataway.

Tmall was the biggest online platform for the parent-and-baby category in 2018, accounting for an estimated 52.9% in online business-to-consumer sales, according to research firm CBNData. Tmall had around 200 million customers in this sector last year, and over 60% of those were born after 1990. The second-biggest e-commerce player was JD.com, accounting for 17.7% of online sales in the sector.

[caption id="attachment_99373" align="aligncenter" width="700"] Source: Analysys[/caption]

Who Are the Customers?

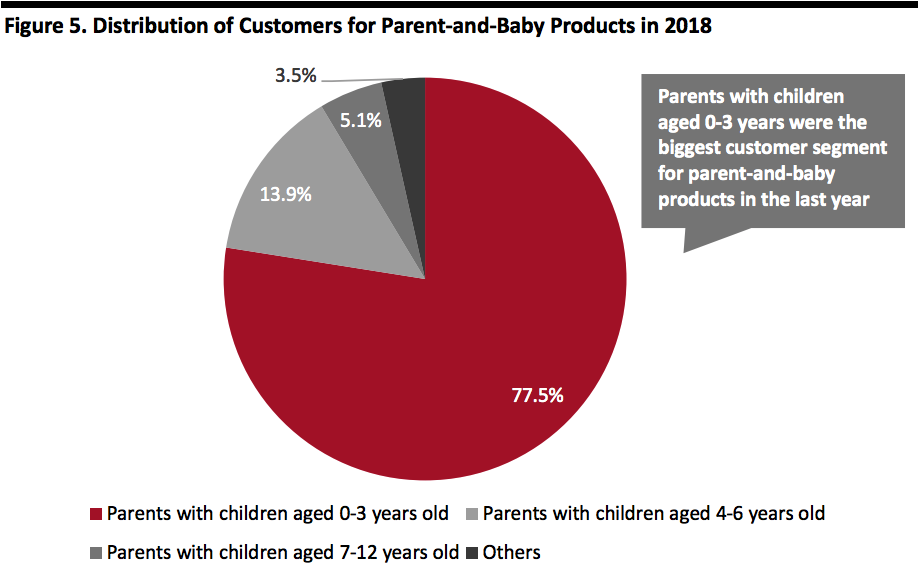

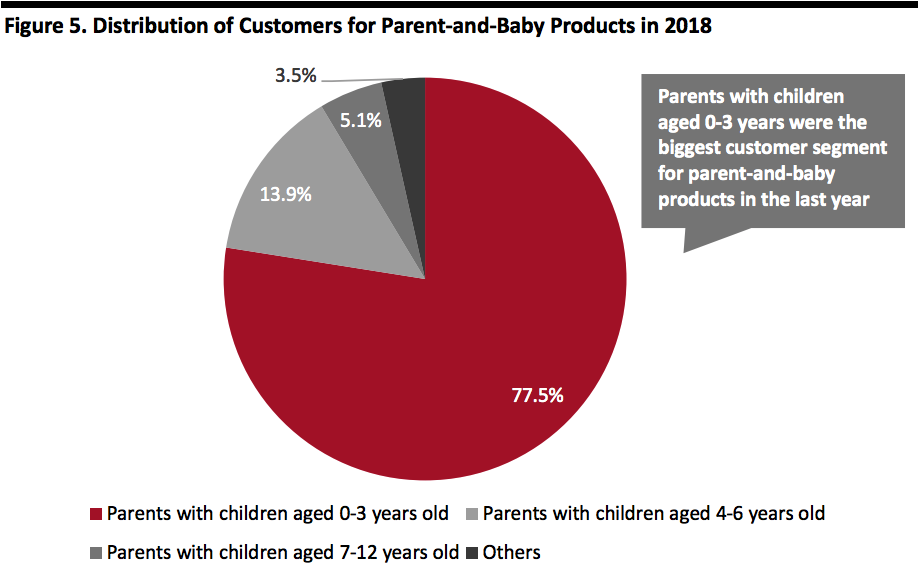

Parents with children aged 0-3 years were the largest consumer group for parent-and-baby online products in 2018, accounting for 77.5% of total sales, according to data firm MobData. The number of children in this age group totaled about 80 million in 2018, according to Guo Yufen, director of the Health and Family Planning Commission of Gansu province.

[caption id="attachment_99374" align="aligncenter" width="700"]

Source: Analysys[/caption]

Who Are the Customers?

Parents with children aged 0-3 years were the largest consumer group for parent-and-baby online products in 2018, accounting for 77.5% of total sales, according to data firm MobData. The number of children in this age group totaled about 80 million in 2018, according to Guo Yufen, director of the Health and Family Planning Commission of Gansu province.

[caption id="attachment_99374" align="aligncenter" width="700"] Source: MobData[/caption]

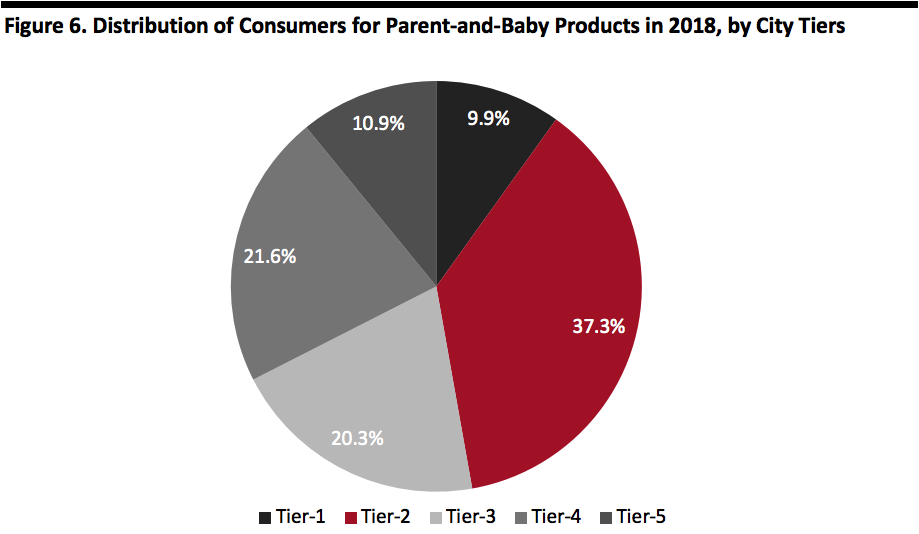

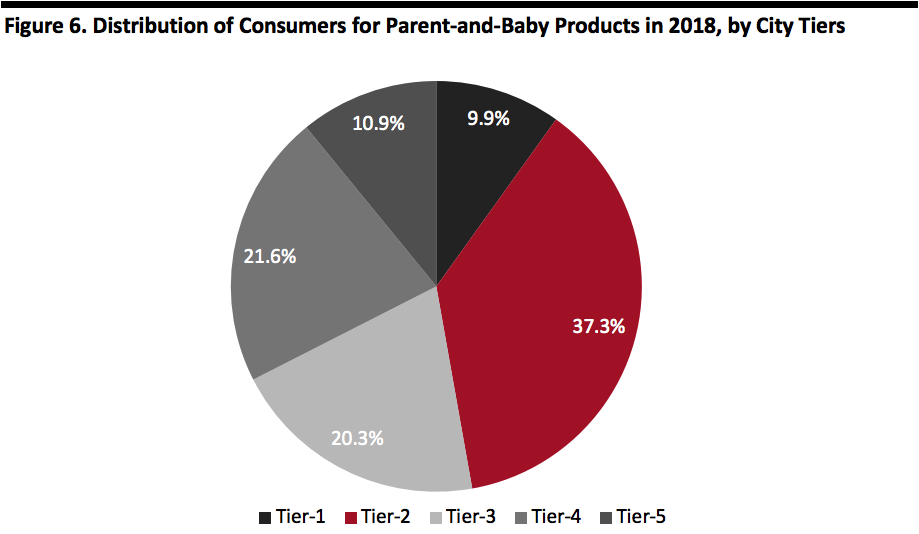

The majority of consumers are from lower-tier cities; last year, around 79.2% were from tier-two to -four cities, according to MobData. We believe that this is partly because, following the relaxation of the one-child policy, families in lower-tier cities are more willing to have a second child than those in first-tier cities who may be concerned about the high costs of raising and educating children.. Another reason is that the total population numbers in tier-two to -four cities are higher.

[caption id="attachment_99375" align="aligncenter" width="700"]

Source: MobData[/caption]

The majority of consumers are from lower-tier cities; last year, around 79.2% were from tier-two to -four cities, according to MobData. We believe that this is partly because, following the relaxation of the one-child policy, families in lower-tier cities are more willing to have a second child than those in first-tier cities who may be concerned about the high costs of raising and educating children.. Another reason is that the total population numbers in tier-two to -four cities are higher.

[caption id="attachment_99375" align="aligncenter" width="700"] Source: MobData[/caption]

What Does This Mean for Retailers and Brands?

The growing parent-and-baby market in China presents opportunities for retailers and brands, both domestic and international. As we have seen, baby clothing and footwear comprise the biggest segment, and brands could take advantage of this consumer demand by test-launching new products. That said, new offerings would need to be innovative and appealing to consumers in order for companies to remain competitive against major international players such as Adidas, Nike and Skechers.

Brands could also look to target specific Chinese consumer groups that have proven to provide more lucrative opportunities—parents from lower-tier cities that have children aged 0-3 years, for example.

Source: MobData[/caption]

What Does This Mean for Retailers and Brands?

The growing parent-and-baby market in China presents opportunities for retailers and brands, both domestic and international. As we have seen, baby clothing and footwear comprise the biggest segment, and brands could take advantage of this consumer demand by test-launching new products. That said, new offerings would need to be innovative and appealing to consumers in order for companies to remain competitive against major international players such as Adidas, Nike and Skechers.

Brands could also look to target specific Chinese consumer groups that have proven to provide more lucrative opportunities—parents from lower-tier cities that have children aged 0-3 years, for example.

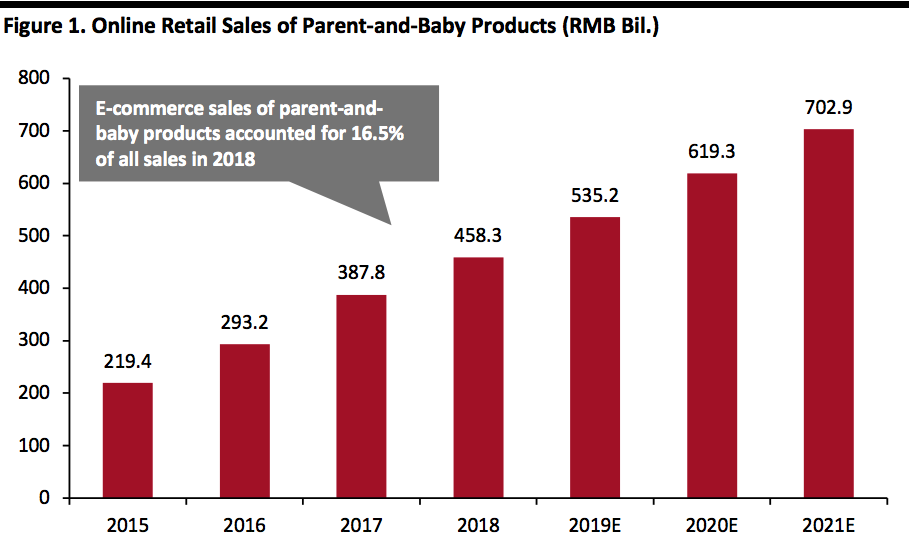

- Online retail sales of parent-and-baby products grew at a CAGR of 27.8% between 2015 and 2018, reaching ¥458.3 billion ($64.9 billion) last year, according to Analysys.

- These figures imply that e-commerce captured a 16.5% share of all sales in the category in 2018.

- Online sales of parent-and-baby products are projected to reach ¥702.9 billion ($99.6 billion) in 2021.

Source: Analysys[/caption]

Baby clothing and footwear comprises the most popular segment online, as of July 2019: Totaling ¥25.8 billion ($3.7 billion), it accounted for 28% of total online sales in the parent-and-baby sector, according to data company ECdataway. Toys, diapers and baby food followed, with a market share of 17%, 12% and 12% respectively.

[caption id="attachment_99371" align="aligncenter" width="700"]

Source: Analysys[/caption]

Baby clothing and footwear comprises the most popular segment online, as of July 2019: Totaling ¥25.8 billion ($3.7 billion), it accounted for 28% of total online sales in the parent-and-baby sector, according to data company ECdataway. Toys, diapers and baby food followed, with a market share of 17%, 12% and 12% respectively.

[caption id="attachment_99371" align="aligncenter" width="700"] The “Baby’s bedroom set” segment comprises children’s bedding and furniture; “Baby travel equipment” includes car seats and strollers; and “Mom-related products” covers items such as maternity wear and nutrition products.

The “Baby’s bedroom set” segment comprises children’s bedding and furniture; “Baby travel equipment” includes car seats and strollers; and “Mom-related products” covers items such as maternity wear and nutrition products.Source: ECdataway[/caption] Key Players in the Parent-and-Baby Market Various segments in the parent-and-baby sector in China are dominated by international brands. This may be because Chinese consumers perceive foreign products to meet higher standards of quality and safety than domestic brands—which are top priorities for consumers in this category—particularly following the melamine milk scandal in 2008. [caption id="attachment_99372" align="aligncenter" width="700"]

Source: ECdataway[/caption]

International brands are especially popular online across multiple categories in the parent-and-baby sector, demonstrated by their performance in the build up to Singles’ Day 2019 (Alibaba’s annual Chinese shopping holiday on November 1). On October 21—the first day of the Singles’ Day pre-sales period on Tmall—Nike achieved ¥65.2 million ($9.2 million) in sales of baby clothing and footwear products, and Aptamil reached ¥27.3 million ($3.9 million) for its infant formula, according to ECdataway.

Tmall was the biggest online platform for the parent-and-baby category in 2018, accounting for an estimated 52.9% in online business-to-consumer sales, according to research firm CBNData. Tmall had around 200 million customers in this sector last year, and over 60% of those were born after 1990. The second-biggest e-commerce player was JD.com, accounting for 17.7% of online sales in the sector.

[caption id="attachment_99373" align="aligncenter" width="700"]

Source: ECdataway[/caption]

International brands are especially popular online across multiple categories in the parent-and-baby sector, demonstrated by their performance in the build up to Singles’ Day 2019 (Alibaba’s annual Chinese shopping holiday on November 1). On October 21—the first day of the Singles’ Day pre-sales period on Tmall—Nike achieved ¥65.2 million ($9.2 million) in sales of baby clothing and footwear products, and Aptamil reached ¥27.3 million ($3.9 million) for its infant formula, according to ECdataway.

Tmall was the biggest online platform for the parent-and-baby category in 2018, accounting for an estimated 52.9% in online business-to-consumer sales, according to research firm CBNData. Tmall had around 200 million customers in this sector last year, and over 60% of those were born after 1990. The second-biggest e-commerce player was JD.com, accounting for 17.7% of online sales in the sector.

[caption id="attachment_99373" align="aligncenter" width="700"] Source: Analysys[/caption]

Who Are the Customers?

Parents with children aged 0-3 years were the largest consumer group for parent-and-baby online products in 2018, accounting for 77.5% of total sales, according to data firm MobData. The number of children in this age group totaled about 80 million in 2018, according to Guo Yufen, director of the Health and Family Planning Commission of Gansu province.

[caption id="attachment_99374" align="aligncenter" width="700"]

Source: Analysys[/caption]

Who Are the Customers?

Parents with children aged 0-3 years were the largest consumer group for parent-and-baby online products in 2018, accounting for 77.5% of total sales, according to data firm MobData. The number of children in this age group totaled about 80 million in 2018, according to Guo Yufen, director of the Health and Family Planning Commission of Gansu province.

[caption id="attachment_99374" align="aligncenter" width="700"] Source: MobData[/caption]

The majority of consumers are from lower-tier cities; last year, around 79.2% were from tier-two to -four cities, according to MobData. We believe that this is partly because, following the relaxation of the one-child policy, families in lower-tier cities are more willing to have a second child than those in first-tier cities who may be concerned about the high costs of raising and educating children.. Another reason is that the total population numbers in tier-two to -four cities are higher.

[caption id="attachment_99375" align="aligncenter" width="700"]

Source: MobData[/caption]

The majority of consumers are from lower-tier cities; last year, around 79.2% were from tier-two to -four cities, according to MobData. We believe that this is partly because, following the relaxation of the one-child policy, families in lower-tier cities are more willing to have a second child than those in first-tier cities who may be concerned about the high costs of raising and educating children.. Another reason is that the total population numbers in tier-two to -four cities are higher.

[caption id="attachment_99375" align="aligncenter" width="700"] Source: MobData[/caption]

What Does This Mean for Retailers and Brands?

The growing parent-and-baby market in China presents opportunities for retailers and brands, both domestic and international. As we have seen, baby clothing and footwear comprise the biggest segment, and brands could take advantage of this consumer demand by test-launching new products. That said, new offerings would need to be innovative and appealing to consumers in order for companies to remain competitive against major international players such as Adidas, Nike and Skechers.

Brands could also look to target specific Chinese consumer groups that have proven to provide more lucrative opportunities—parents from lower-tier cities that have children aged 0-3 years, for example.

Source: MobData[/caption]

What Does This Mean for Retailers and Brands?

The growing parent-and-baby market in China presents opportunities for retailers and brands, both domestic and international. As we have seen, baby clothing and footwear comprise the biggest segment, and brands could take advantage of this consumer demand by test-launching new products. That said, new offerings would need to be innovative and appealing to consumers in order for companies to remain competitive against major international players such as Adidas, Nike and Skechers.

Brands could also look to target specific Chinese consumer groups that have proven to provide more lucrative opportunities—parents from lower-tier cities that have children aged 0-3 years, for example.