albert Chan

Livestreaming is fueling Chinese e-commerce: The livestreaming e-commerce market is worth ¥440 billion (around $63 billion) in 2019, according to Chinese financial services firm Everbright Securities. That equates to almost 9% of total e-commerce sales in China this year ($723 billion as estimated by Statista) or roughly 1% of total retail sales of consumer goods in 2019, based on data from the National Bureau of Statistics of China.

Livestreaming in E-Commerce

While most livestreaming platforms in the West are focused on gaming and entertainment, livestreaming is becoming a go-to option for Chinese consumers seeking new products and promotions. For instance, Taobao Live, Alibaba's dedicated livestreaming channel, generated sales of ¥20 billion ($2.85 billion) during Alibaba’s Singles’ Day 2019 shopping holiday on November 11. This accounted for around 7.5% of the company’s total sales of ¥268.4 billion ($38.4 billion).

Livestreaming is like television shopping, upgraded for the 21st century. It hosts real-time broadcasting of video content by presenters that model or try products. Viewers are able to immediately purchase the item from an embedded link online. Just as presenters do on shopping channels such as QVC, livestreaming hosts can sell a wide range of products, from apparel and cosmetics to electronics and cars.

What Selling Tactics Are Deployed in Livestreaming E-Commerce?

There are a few unique selling points of employing livestreaming for e-commerce:

- A curated selection of products: Livestreaming hosts carefully curate their product selection to their fans’ tastes, which leads to high conversion rates. Indeed, Taobao Live boasted that its conversion rate for sales across livestreaming was an astonishing 65% in 2018.

- Gifts and lowest price guaranteed: Taobao Live hosts often work with brands to give out gifts or product discounts to their fans, as livestreaming viewers are typically price-sensitive.

- Prize draws: Prize draws are a popular way for hosts to engage with viewers. For instance, livestreaming host Li Jiaqi usually starts his sessions with a competition to win high-value electronics, such as Dyson hairdryers, iPhone 11s and Xiaomi televisions.

- Limited-quantity and limited-time offers: Livestreaming hosts often adopt a flash-sale strategy, where each sale lasts for only a short time and the number of products available is limited. In addition, hosts will periodically announce the remaining quantities in order to increase the sense of urgency for viewers to place an order.

With these tactics, livestreaming hosts are able to draw large crowd of customers. For instance, during Singles’ Day 2019, Taobao’s top livestreaming host, Viya, held a live video session for eight hours, engaging a total of 43.15 million buyers. The “Lipstick King” Li Jiaqi livestreamed for more than six hours, drawing 36.8 million viewers.

What Are the Major Livestreaming Platforms for Brands To Sell to Chinese Consumers?

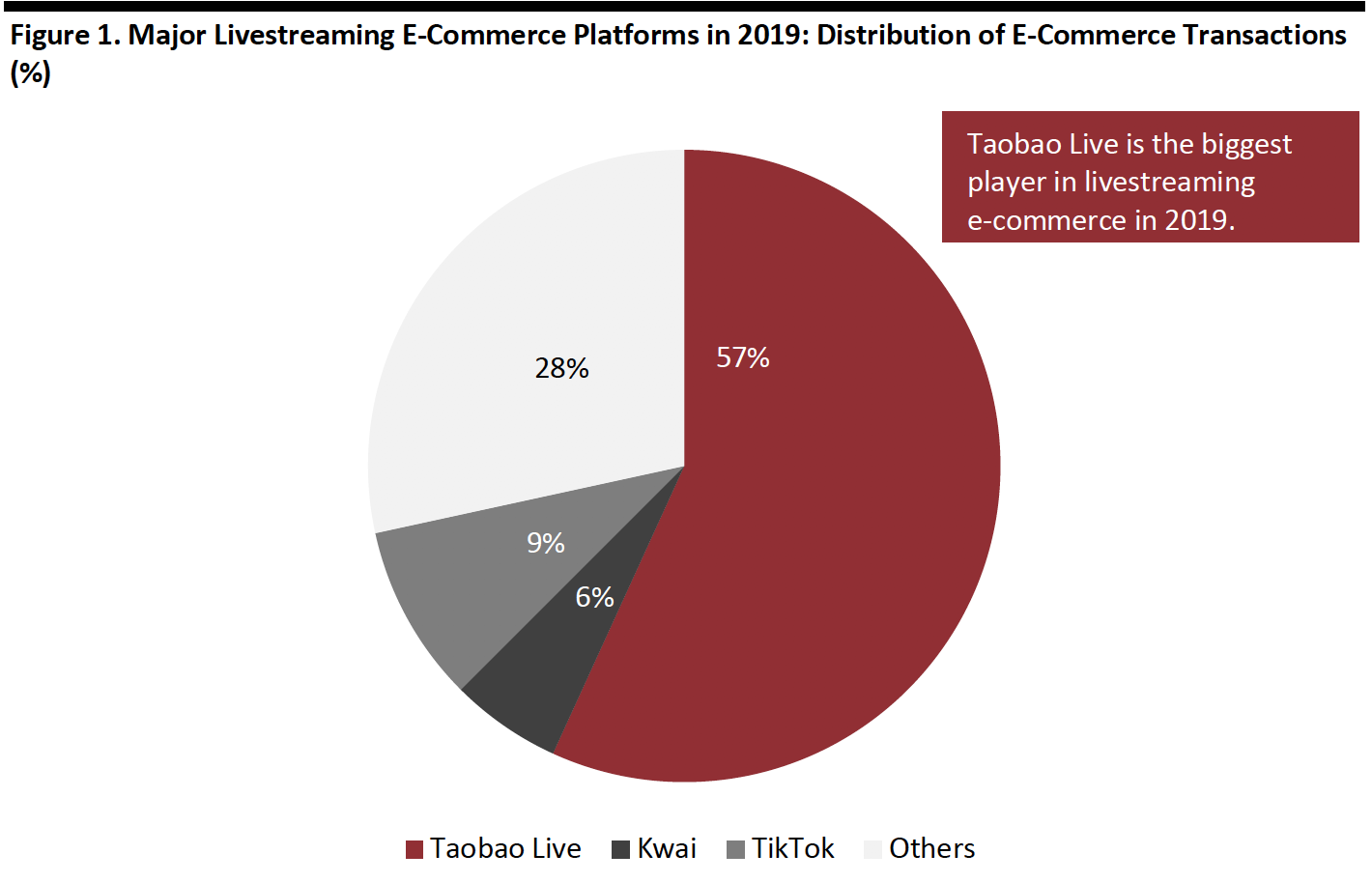

Taobao Live currently holds the largest share of the livestreaming e-commerce market in China, according to Everbright Securities. [caption id="attachment_110399" align="aligncenter" width="700"] Source: Everbright Securities/Coresight Research[/caption]

Source: Everbright Securities/Coresight Research[/caption]

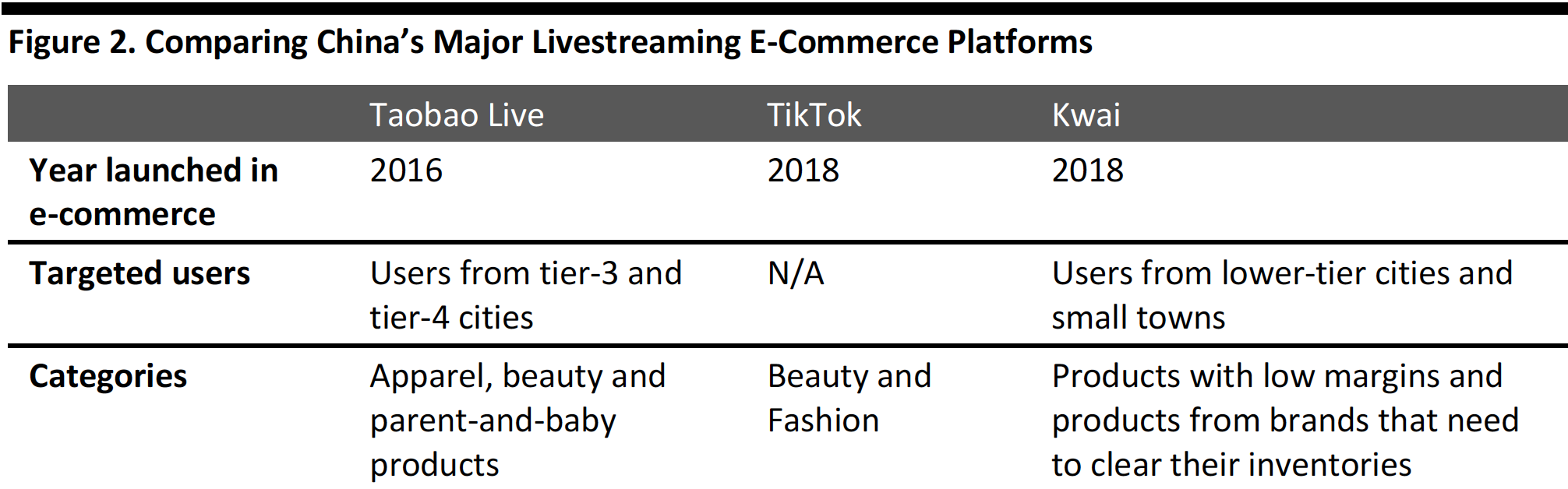

Taobao Live was launched in 2016 and was the first to use livestreaming to facilitate e-commerce. Following suite, TikTok linked up with Taobao and Tmall in March 2018, allowing viewers to buy products from these platforms without leaving the TikTok app. In June that year, Kwai introduced a similar feature that enables livestreamers to sell goods through an on-platform store.

Taobao Live features a wider range of products than its major rivals, including apparel, beauty and parent-and-baby products, whereas TikTok is focused on the beauty sector. L’Oréal’s official TikTok account has over 121,000 followers, as of November 23, 2019.

[caption id="attachment_100347" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

What Does This Mean for Retailers and Brands?

Livestreaming is supporting e-commerce sales growth in China. However, the nature of showcasing products through livestreaming implies that brands and retailers must work harder to make a sale, as products are being promoted through a highly personalized approach.

To some extent, livestreaming is a 21st-century iteration of television shopping. While lucrative on a company level, the latter has always been a niche retail channel: We estimate that television shopping channels accounted for less than 1% of total retail sales in the US in 2018, for example. By contrast, livestreaming may already contribute 1% of total retail sales in China, according to our analysis of estimates by Everbright Securities. Even while livestreaming is helping to power e-commerce growth, history may suggest a natural cap on the impact of this channel.

For different categories, brands and retailers can choose the most appropriate livestreaming platform. For instance, TikTok is the most suitable for specifically targeting beauty consumers, whereas Taobao Live offers greater category range, including apparel, beauty and parent-and-baby products.