DIpil Das

Launched in 2011, Tencent’s WeChat has become a “super app” in China, playing an important role in consumers’ daily lives. Users can do everything from messaging and playing games to shopping, making payments and accessing government services. Tencent reported that WeChat has 1.15 billion monthly active users (MAUs) globally, as of September 2019. According to Allen Zhang, the creator of WeChat, Chinese users spend around one-third of their online time on WeChat. This massive user base provides opportunities for brands to connect with consumers and grow their businesses.

WeChat Official Accounts Act as a Content Marketing Tool

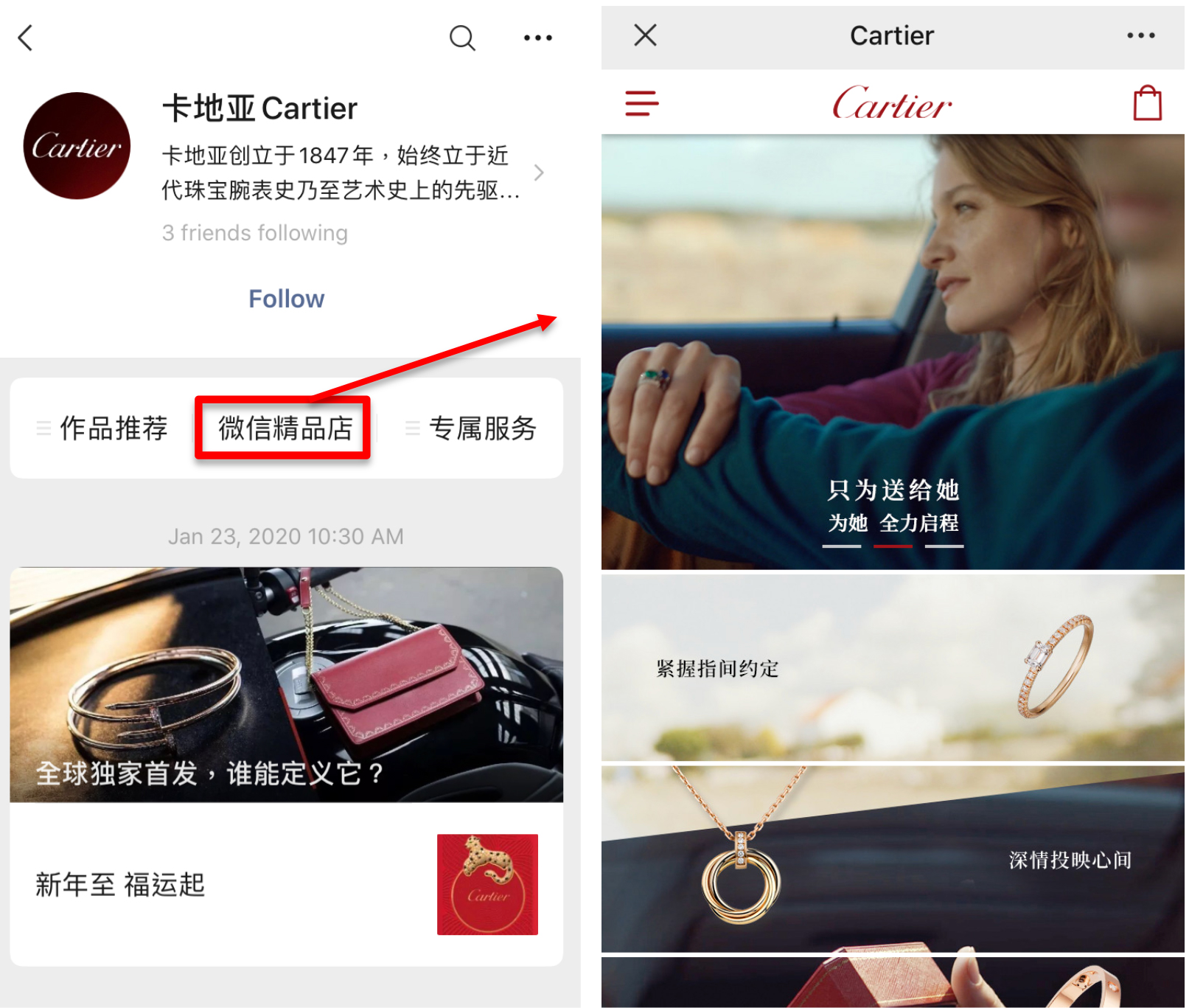

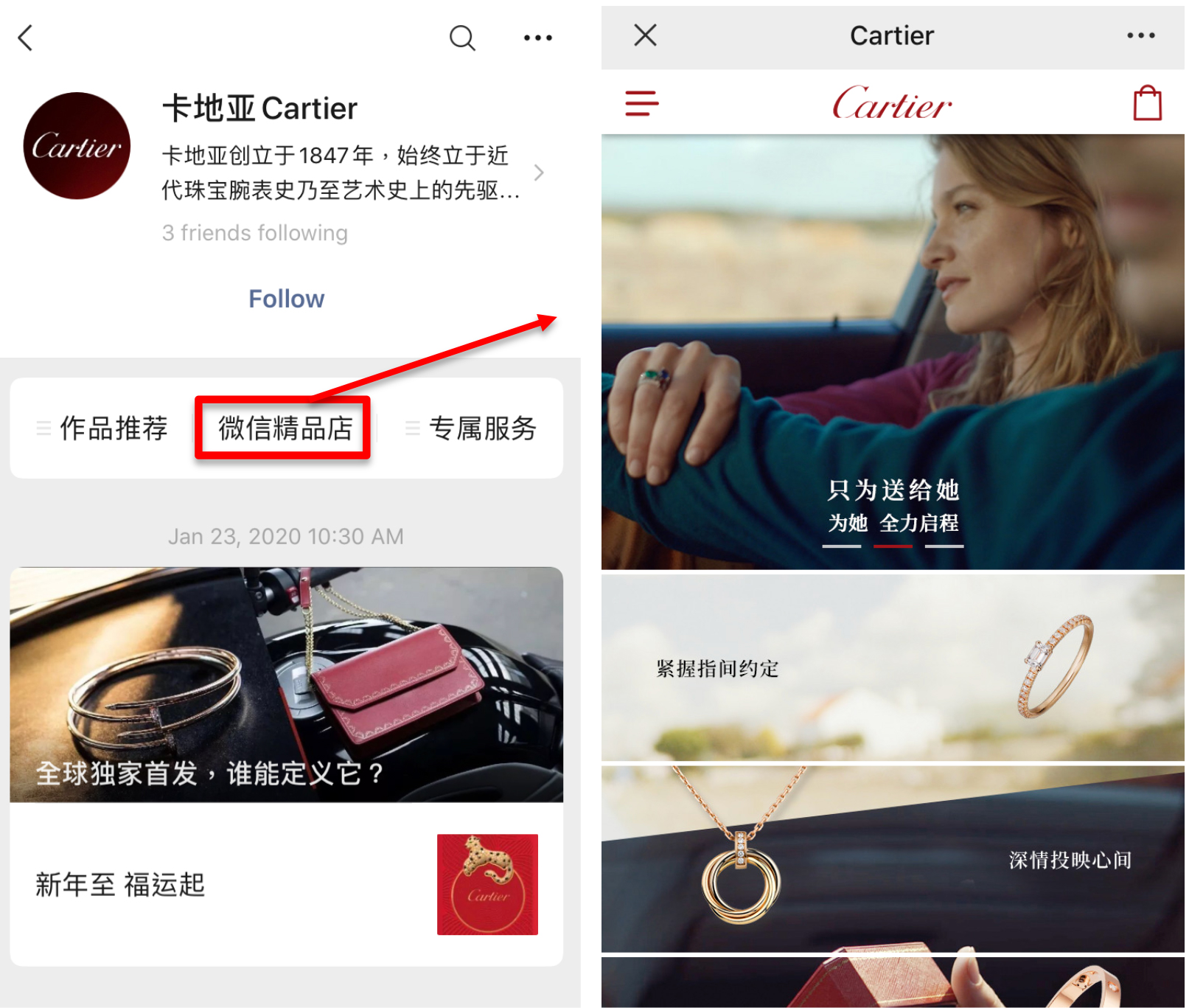

WeChat official accounts are similar to Facebook Pages, which serve as a content marketing channel to tell brands’ stories and enable them to interact with followers and customers. Over 80% of WeChat MAUs had subscribed to at least one official account as of February 2019, according to data provider Questmobile. Having a WeChat official account can therefore be a critical marketing strategy for brands to enter the China market; it enables them to send updates and push notifications about new products, latest promotions and offline events to their followers. More importantly, brands can include links to their mini-program stores to redirect consumers and drive sales.

There are two different WeChat official account types—service and subscription. With subscription accounts primarily designed for media and individual content providers, brands and retailers mostly create service accounts, which offer payment functions, interactive features, links to WeChat mini programs and customer services. New posts from the account owner also appear on users’ main chat interface, ensuring higher brand visibility. Brands can also partner with key opinion leaders that own a subscription account to promote and review their products.

[caption id="attachment_103845" align="aligncenter" width="700"] Cartier WeChat official account (left); Cartier’s WeChat store (right)

Cartier WeChat official account (left); Cartier’s WeChat store (right)

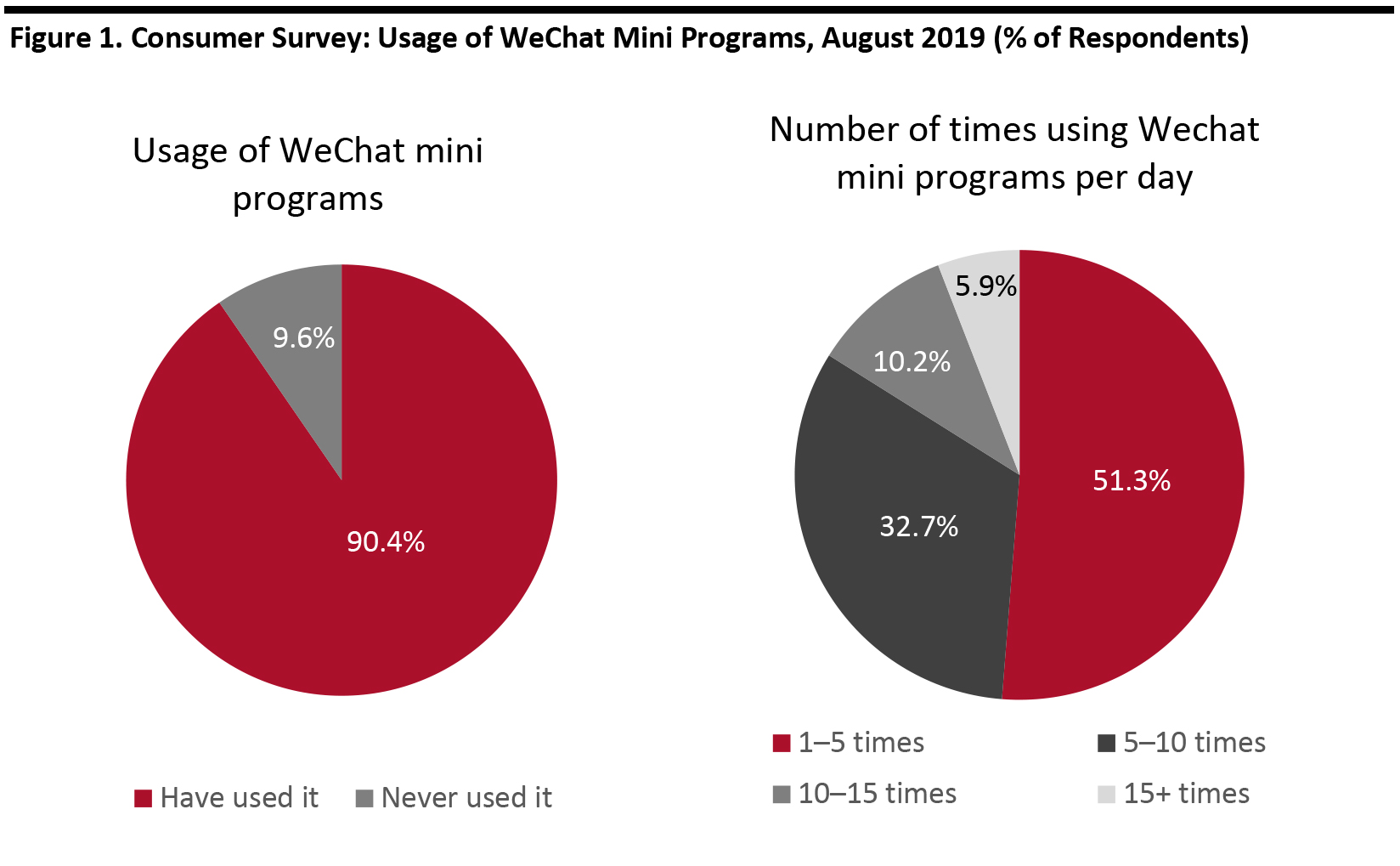

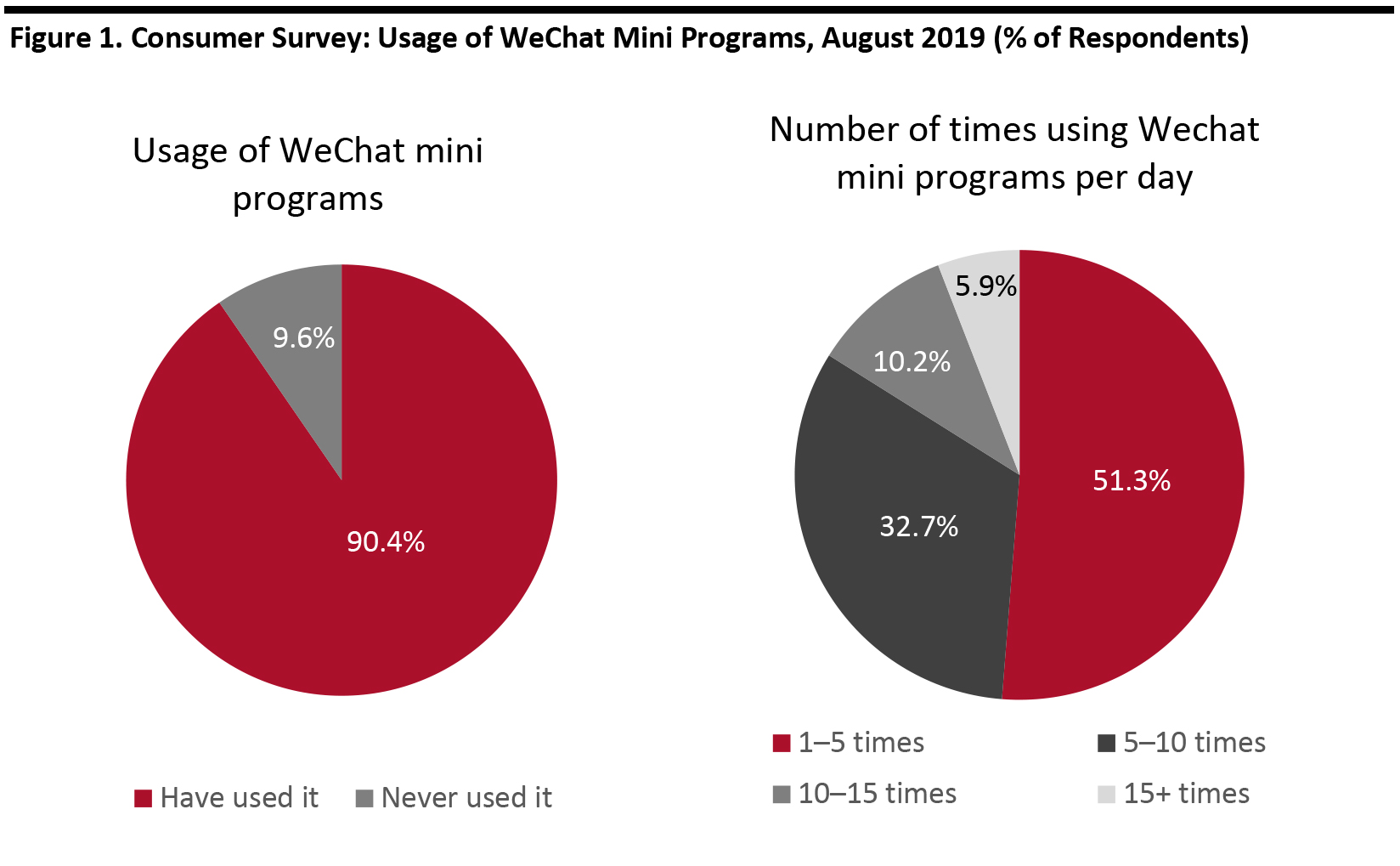

Source: WeChat [/caption] WeChat Mini Programs Enhance Brands’ Ability To Drive Traffic and Provide a Better Consumer Shopping Experience The use of WeChat mini programs has grown rapidly since the channel was launched in 2017, thanks to their expanded functionality compared to official accounts. Tencent reported that it has more than 300 million daily active users of mini programs, as of September 2019. A survey conducted by iResearch in August 2019 indicates that 90% of WeChat users use mini programs, and e-commerce was the most used mini-program category. The broad variety of mini programs offered in the app is also driving traffic and usage. As of June 2019, WeChat has over 2.3 million mini programs across 300 industries, versus 200,000 in Alipay and 100,000 in the Baidu app, according to Questmobile. [caption id="attachment_103846" align="aligncenter" width="700"] Base: 1,416 WeChat users in China

Base: 1,416 WeChat users in China

Source: iResearch/Coresight Research [/caption] In addition to increasing brand awareness and sales by reaching more potential customers, there are a number of advantages that mini programs offer brands. For example, brands have control over the design of their mini-program interfaces and can access user data to inform valuable consumer insights. The development of mini programs is also cheaper and simpler than regular apps, which makes them an appealing alternative, particularly as there is an existing user base to draw from and promote to, rather than starting from scratch with a new app. Furthermore, the app-within-app concept provides retailers with advanced features such as an online store and loyalty program, as well as exciting ways for users to engage with the brand, such as through interactive games. Mini programs are becoming an increasingly important e-commerce channel. At the WeChat Open Class Pro event in January 2020, Tencent announced that its users spent ¥800 billion ($115 billion) via mini programs in 2019, a 160% year-over-year increase. To compare, this is around 50% of the gross merchandise volume generated by JD.com in 2018. Tencent also plans to add more merchants and services—including livestreaming—to mini programs in 2020. A number of multinational brands and direct-to-consumer brands have been successfully capitalizing on the functionality of mini programs: Source: Shinsegae’s WeChat mini program[/caption]

WeChat Banner and Moments Ads Help Brands To Reach New Consumers

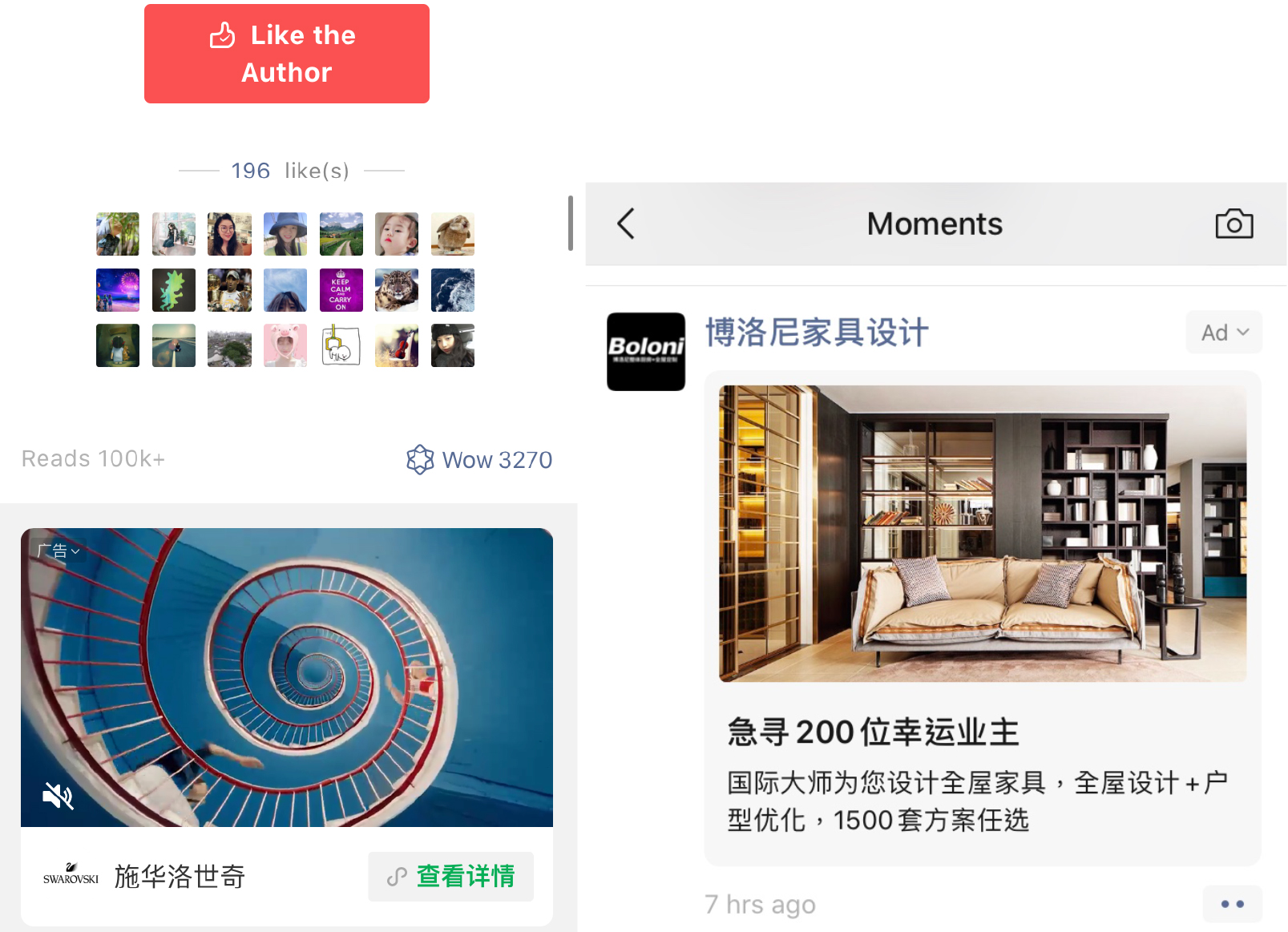

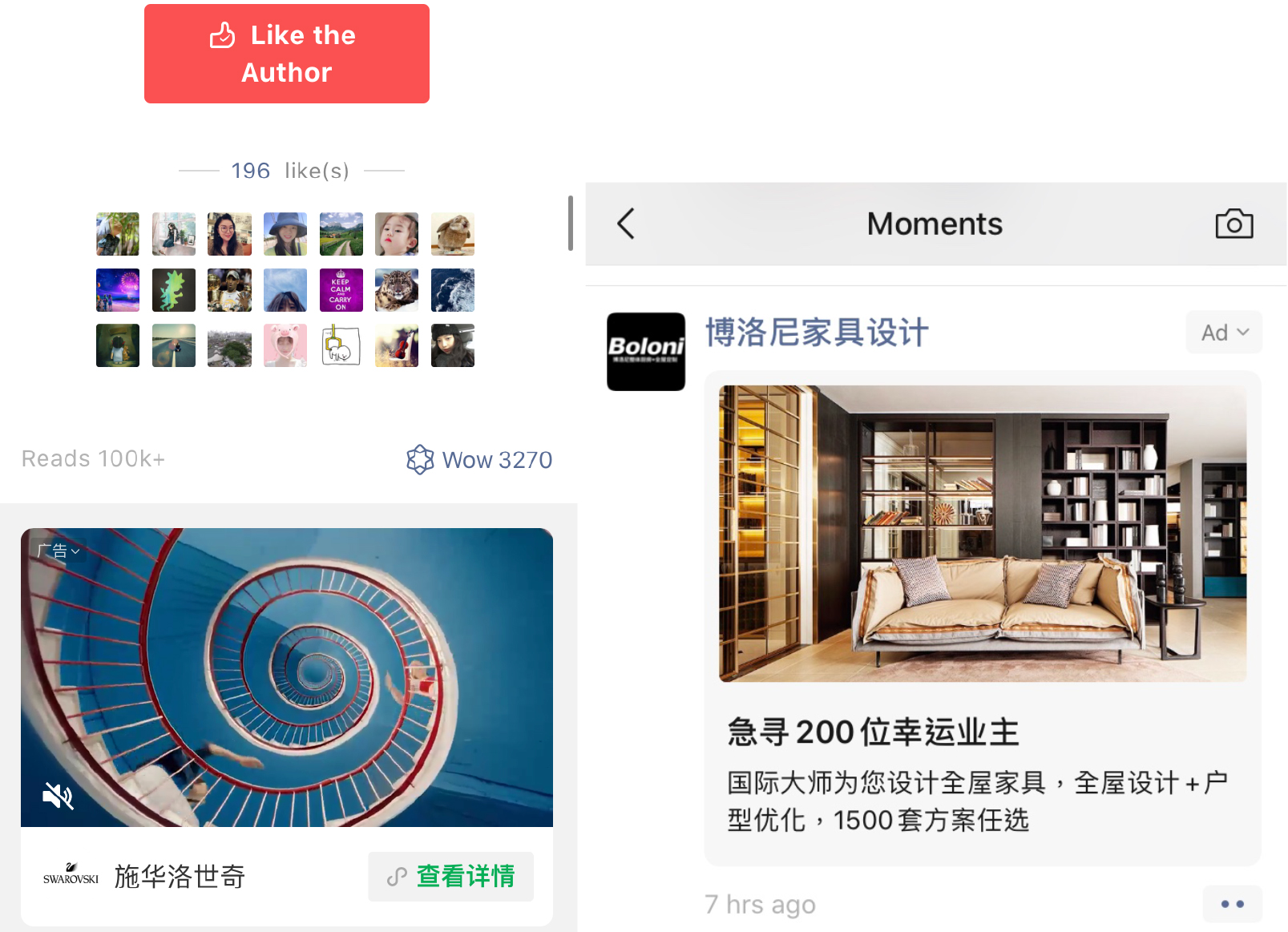

WeChat first launched in-feed adverts in 2015, and now advertising on WeChat has become more diverse. Brands can choose to place banner ads, WeChat Moments ads and Moments topic ads.

WeChat banner ads are similar to Google Display ads. They are located at the bottom of a subscription account’s contents. The other two types of digital advert are both inserted in WeChat Moments, which is similar to the News Feed in Facebook. Tencent’s 2018 annual report stated that over 750 million WeChat users read posts on Moments per day. Brands can include graphics, videos, interactive elements and limited-time promotions within Moments ads. WeChat Moments topic ads display the same content as WeChat Moments ads, but have a different landing page that allows consumers to comment on, repost and share the ad.

[caption id="attachment_103848" align="aligncenter" width="700"]

Source: Shinsegae’s WeChat mini program[/caption]

WeChat Banner and Moments Ads Help Brands To Reach New Consumers

WeChat first launched in-feed adverts in 2015, and now advertising on WeChat has become more diverse. Brands can choose to place banner ads, WeChat Moments ads and Moments topic ads.

WeChat banner ads are similar to Google Display ads. They are located at the bottom of a subscription account’s contents. The other two types of digital advert are both inserted in WeChat Moments, which is similar to the News Feed in Facebook. Tencent’s 2018 annual report stated that over 750 million WeChat users read posts on Moments per day. Brands can include graphics, videos, interactive elements and limited-time promotions within Moments ads. WeChat Moments topic ads display the same content as WeChat Moments ads, but have a different landing page that allows consumers to comment on, repost and share the ad.

[caption id="attachment_103848" align="aligncenter" width="700"] WeChat banner ad (left); WeChat Moments ad (right)

WeChat banner ad (left); WeChat Moments ad (right)

Source: WeChat [/caption] Implications for International Retailers and Brands WeChat has transformed from a social app to a super app that provides many monetization opportunities for brands. With its comprehensive ecosystem and broad user base, WeChat is poised to be an invaluable tool that brands use to engage with Chinese consumers and ultimately drive sales. A WeChat official account serves as a content marketing channel, with embedded links to redirect users to WeChat mini programs. The combination of content and e-commerce makes WeChat a one-stop shop for consumers to discover brands and purchase products seamlessly. Brands can also cooperate with key opinion leaders who own a subscription account to promote their products, as well as purchase banner and Moments ads to connect with target consumers.

Cartier WeChat official account (left); Cartier’s WeChat store (right)

Cartier WeChat official account (left); Cartier’s WeChat store (right) Source: WeChat [/caption] WeChat Mini Programs Enhance Brands’ Ability To Drive Traffic and Provide a Better Consumer Shopping Experience The use of WeChat mini programs has grown rapidly since the channel was launched in 2017, thanks to their expanded functionality compared to official accounts. Tencent reported that it has more than 300 million daily active users of mini programs, as of September 2019. A survey conducted by iResearch in August 2019 indicates that 90% of WeChat users use mini programs, and e-commerce was the most used mini-program category. The broad variety of mini programs offered in the app is also driving traffic and usage. As of June 2019, WeChat has over 2.3 million mini programs across 300 industries, versus 200,000 in Alipay and 100,000 in the Baidu app, according to Questmobile. [caption id="attachment_103846" align="aligncenter" width="700"]

Base: 1,416 WeChat users in China

Base: 1,416 WeChat users in China Source: iResearch/Coresight Research [/caption] In addition to increasing brand awareness and sales by reaching more potential customers, there are a number of advantages that mini programs offer brands. For example, brands have control over the design of their mini-program interfaces and can access user data to inform valuable consumer insights. The development of mini programs is also cheaper and simpler than regular apps, which makes them an appealing alternative, particularly as there is an existing user base to draw from and promote to, rather than starting from scratch with a new app. Furthermore, the app-within-app concept provides retailers with advanced features such as an online store and loyalty program, as well as exciting ways for users to engage with the brand, such as through interactive games. Mini programs are becoming an increasingly important e-commerce channel. At the WeChat Open Class Pro event in January 2020, Tencent announced that its users spent ¥800 billion ($115 billion) via mini programs in 2019, a 160% year-over-year increase. To compare, this is around 50% of the gross merchandise volume generated by JD.com in 2018. Tencent also plans to add more merchants and services—including livestreaming—to mini programs in 2020. A number of multinational brands and direct-to-consumer brands have been successfully capitalizing on the functionality of mini programs:

- Dior launched its seasonal Christmas mini program in November 2019, which featured a game to give users the opportunity to discover hidden brand-related elements in an illustration. The second part of the program was an invitation to visit Dior’s Christmas tree at the Plaza 66 shopping mall in Shanghai.

- Hermés debuted its mini program in July 2019. The brand uses the channel to present its craftsmanship and host a game in which users guess the tools used to create the brand’s products.

- L’Oréal’s Giorgio Armani was the first beauty brand to launch (in July 2019) a WeChat mini program that incorporates augmented reality (AR) technology. Using L’Oréal’s ModiFace AR technology, shoppers can virtually try on the brand’s lipstick shades and place orders—all within WeChat.

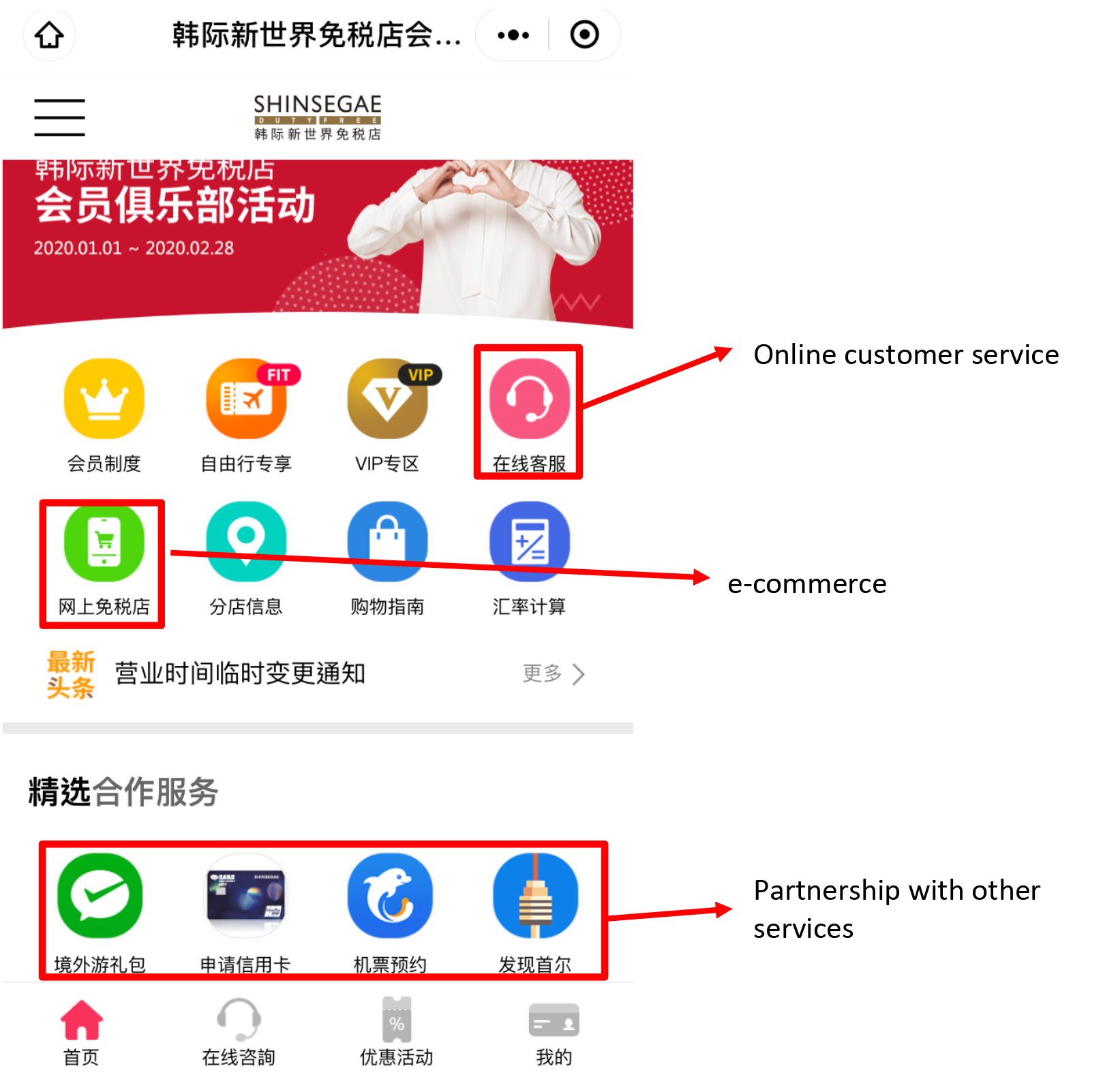

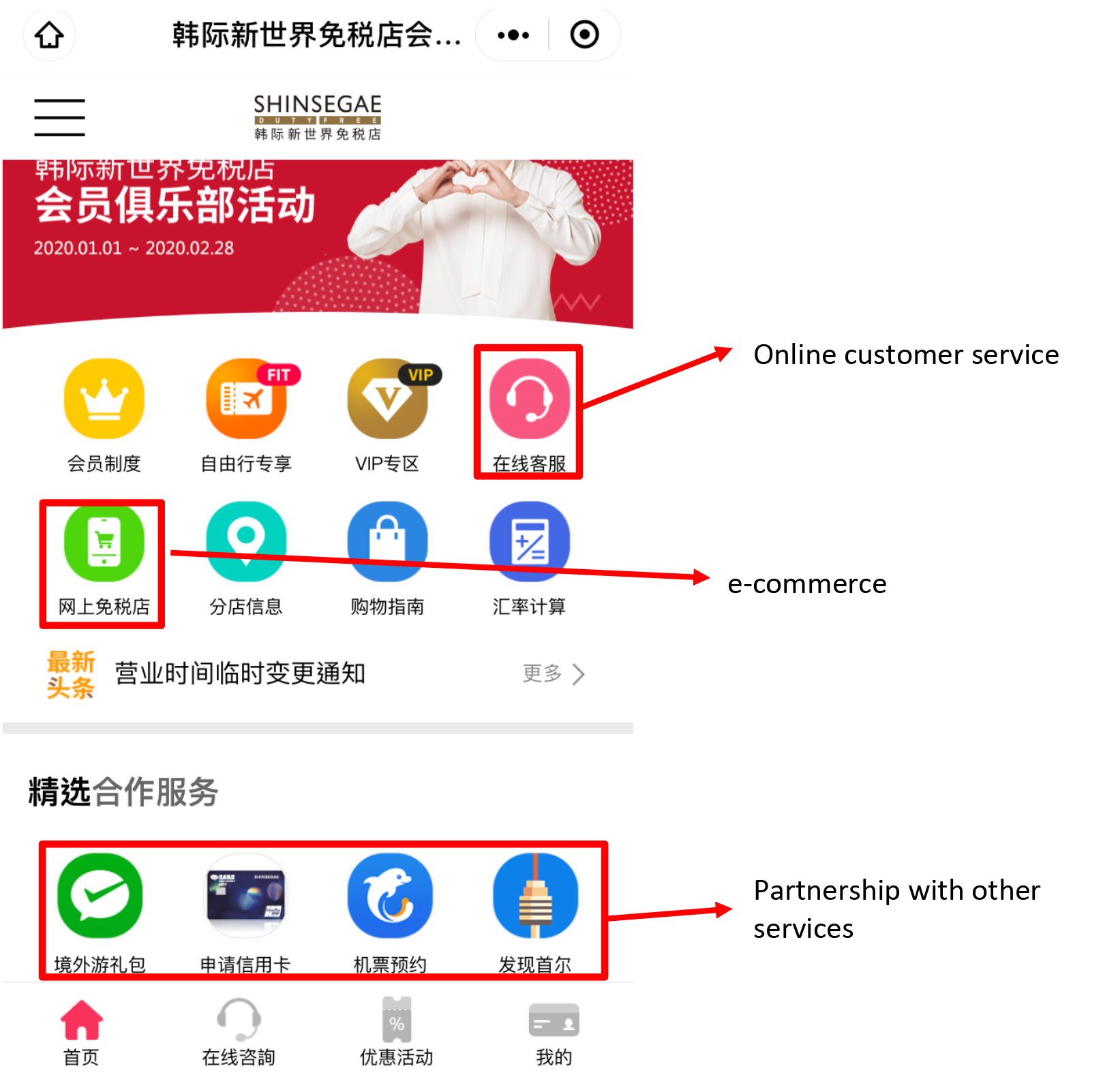

- Duty-free chain Shinsegae introduced its mini program in October 2019, which offers a membership program, duty-free shopping, exclusive promotions and customer service. The company also plans to incorporate more functions by partnering with airlines, hotels and foreign exchanges.

- Rothy’s, a direct-to-consumer footwear brand, rolled out its mini program in February 2019 as part of its China-entry strategy. Consumers can choose to personalize their shoes in the mini program, which is powered by AR technology.

Source: Shinsegae’s WeChat mini program[/caption]

WeChat Banner and Moments Ads Help Brands To Reach New Consumers

WeChat first launched in-feed adverts in 2015, and now advertising on WeChat has become more diverse. Brands can choose to place banner ads, WeChat Moments ads and Moments topic ads.

WeChat banner ads are similar to Google Display ads. They are located at the bottom of a subscription account’s contents. The other two types of digital advert are both inserted in WeChat Moments, which is similar to the News Feed in Facebook. Tencent’s 2018 annual report stated that over 750 million WeChat users read posts on Moments per day. Brands can include graphics, videos, interactive elements and limited-time promotions within Moments ads. WeChat Moments topic ads display the same content as WeChat Moments ads, but have a different landing page that allows consumers to comment on, repost and share the ad.

[caption id="attachment_103848" align="aligncenter" width="700"]

Source: Shinsegae’s WeChat mini program[/caption]

WeChat Banner and Moments Ads Help Brands To Reach New Consumers

WeChat first launched in-feed adverts in 2015, and now advertising on WeChat has become more diverse. Brands can choose to place banner ads, WeChat Moments ads and Moments topic ads.

WeChat banner ads are similar to Google Display ads. They are located at the bottom of a subscription account’s contents. The other two types of digital advert are both inserted in WeChat Moments, which is similar to the News Feed in Facebook. Tencent’s 2018 annual report stated that over 750 million WeChat users read posts on Moments per day. Brands can include graphics, videos, interactive elements and limited-time promotions within Moments ads. WeChat Moments topic ads display the same content as WeChat Moments ads, but have a different landing page that allows consumers to comment on, repost and share the ad.

[caption id="attachment_103848" align="aligncenter" width="700"] WeChat banner ad (left); WeChat Moments ad (right)

WeChat banner ad (left); WeChat Moments ad (right) Source: WeChat [/caption] Implications for International Retailers and Brands WeChat has transformed from a social app to a super app that provides many monetization opportunities for brands. With its comprehensive ecosystem and broad user base, WeChat is poised to be an invaluable tool that brands use to engage with Chinese consumers and ultimately drive sales. A WeChat official account serves as a content marketing channel, with embedded links to redirect users to WeChat mini programs. The combination of content and e-commerce makes WeChat a one-stop shop for consumers to discover brands and purchase products seamlessly. Brands can also cooperate with key opinion leaders who own a subscription account to promote their products, as well as purchase banner and Moments ads to connect with target consumers.