DIpil Das

On June 25, Japanese department store giant Takashimaya announced it would close its Shanghai store, the only outlet it has in China, on August 25. Takashimaya said it will also liquidate its Shanghai subsidiary, Shanghai Takashimaya, by February 2021.

What is Takashimaya?

Takashimaya is one of the oldest department store chains in Japan. Founded in 1831 in Kyoto from a clothing store, Takashimaya now has 17 stores in Japan and one store each in Singapore, Thailand and Vietnam.

Takashimaya opened its Shanghai store in December 2012 in Gubei, a wealthy residential area home to many affluent Japanese and Korean expats.

The store has a floor space of 40,000 square meters (around 430,556 square feet) on eight floors, about the size of a big Takashimaya outlet in Japan. The store aimed to deliver an authentic Japanese-style department store experience, featuring Japanese luxury products, premium clothing and skin-care brands, as well as a selection of Japanese restaurants and a supermarket.

[caption id="attachment_92165" align="aligncenter" width="700"] Takashimaya store in Shanghai, featuring products from the northern island of Hokkaido (left) and Aritayaki porcelain (right)

Takashimaya store in Shanghai, featuring products from the northern island of Hokkaido (left) and Aritayaki porcelain (right)

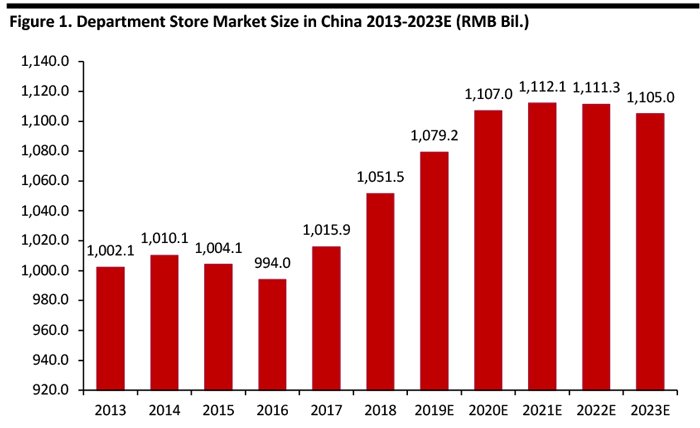

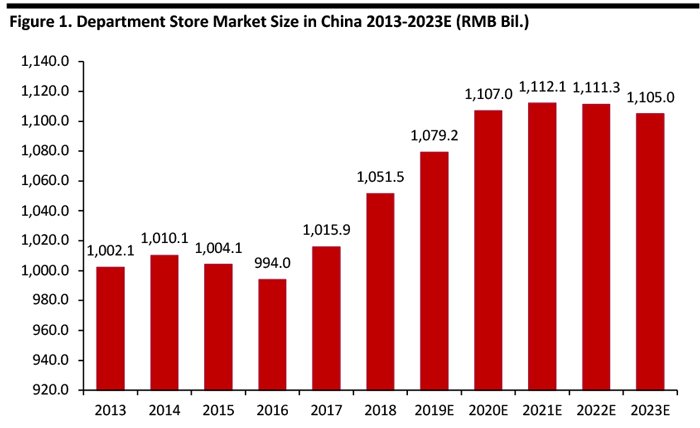

Source: Takshimaya Weibo site[/caption] How is Takashimaya Shanghai Doing? The Shanghai store posted an operating loss of JP¥900 million (around $8.3 million) as of February 2019, its seventh consecutive year of losses. When the store closes, it will incur a loss of up to JP¥3 billion (around $27.9 million) for its parent company, Takashimaya said. Takashimaya opened its store in Shanghai just as online shopping was taking off, which took away some business from the retailer. Online retail sales of physical goods in China hit ¥7.01 trillion (around $64.8 billion) in 2018, an increase of 25.4% year over year and accounting for 18.4% of China’s total consumer goods retail sales, according to the National Bureau of Statistics. Delays and changes development projects at adjacent commercial facilities that might have supported the store also hurt its prospects, such as a movie theater that was meant to open next door. The retailer hoped to leverage entertainment facilities to draw traffic. Furthermore, Takashimaya appears to have chosen its location poorly: Gubei is not a luxury hot spot, as opposed to Nanjing Road West, Huaihai Road East and Lujiazui, where well-known shopping malls concentrate, such as K11, Lippo Plaza and the Shanghai Times Square. Burberry similarly closed its flagship store in Gubei in March 2019, which it opened in 2013. China’s Department Store Sector China’s department store sector is projected to grow slowly through 2023, inching up to ¥1.10 trillion (around $161.0 billion), with sales expected to rise at a very modest CAGR of 1% from 2019 to 2023 and beginning to stagnate or even decline toward the end of the forecast period, according to Euromonitor International. [caption id="attachment_92558" align="aligncenter" width="700"] Source: Euromonitor International[/caption]

How Other Department Stores Have Survived Amid the Online Onslaught

Some department store operators in China have partnered with leading Internet companies or large-scale e-commerce players to implement digital transformation programs by leveraging the partners’ huge traffic flow, big data and logistics capabilities.

Intime Department Store, in which Alibaba took a 74% controlling stake and later privatized, leveraged Alibaba’s technology and digital strengths to integrate its membership system with Alibaba’s membership system. This enables Intime to use consumer analytics to plan product assortment.

Intime also rolled out online and offline integration initiatives, including an Intime app that allows customers to browse products, place orders and track delivery, as well as launching a store on Tmall. Intime teamed up with Alibaba’s logistics arm Cainiao and Ele.me to encourage users within one kilometer of a store to visit.

In 2018, Intime reported same-store sales increased a remarkable 37% year over year.

Department store operators have also invested in diversified retail formats and tapped into other business sectors to adapt. For instance, Golden Eagle Retail Group launched boutique supermarkets, bookstores, pet stores and beauty stores to cater to changing tastes in China’s fast-growing middle class.

Rainbow department store launched its own convenience store brand called Rainbow and Well. Retail research group IGD estimates China’s convenience store sector will see sales of ¥672.9 billion (around $6.2 billion) in 2022, with a CAGR of 10% from 2017 to 2022 — much stronger growth than the weak 1% CAGR department store sector is expected to see over roughly the same time frame.

Key Insights

Takashimaya will exit China after seven loss-making years, partly due to poor store location and partly due to stiff competition from online merchants and other department stores that have more enthusiastically embraced digitalization. China’s department-store sector is expected to see low growth at best in the coming years. This prospect has prompted other department store operators to diversify store formats and tap into other business sectors, such as convenience stores, beauty shops and pet products.

Source: Euromonitor International[/caption]

How Other Department Stores Have Survived Amid the Online Onslaught

Some department store operators in China have partnered with leading Internet companies or large-scale e-commerce players to implement digital transformation programs by leveraging the partners’ huge traffic flow, big data and logistics capabilities.

Intime Department Store, in which Alibaba took a 74% controlling stake and later privatized, leveraged Alibaba’s technology and digital strengths to integrate its membership system with Alibaba’s membership system. This enables Intime to use consumer analytics to plan product assortment.

Intime also rolled out online and offline integration initiatives, including an Intime app that allows customers to browse products, place orders and track delivery, as well as launching a store on Tmall. Intime teamed up with Alibaba’s logistics arm Cainiao and Ele.me to encourage users within one kilometer of a store to visit.

In 2018, Intime reported same-store sales increased a remarkable 37% year over year.

Department store operators have also invested in diversified retail formats and tapped into other business sectors to adapt. For instance, Golden Eagle Retail Group launched boutique supermarkets, bookstores, pet stores and beauty stores to cater to changing tastes in China’s fast-growing middle class.

Rainbow department store launched its own convenience store brand called Rainbow and Well. Retail research group IGD estimates China’s convenience store sector will see sales of ¥672.9 billion (around $6.2 billion) in 2022, with a CAGR of 10% from 2017 to 2022 — much stronger growth than the weak 1% CAGR department store sector is expected to see over roughly the same time frame.

Key Insights

Takashimaya will exit China after seven loss-making years, partly due to poor store location and partly due to stiff competition from online merchants and other department stores that have more enthusiastically embraced digitalization. China’s department-store sector is expected to see low growth at best in the coming years. This prospect has prompted other department store operators to diversify store formats and tap into other business sectors, such as convenience stores, beauty shops and pet products.

Takashimaya store in Shanghai, featuring products from the northern island of Hokkaido (left) and Aritayaki porcelain (right)

Takashimaya store in Shanghai, featuring products from the northern island of Hokkaido (left) and Aritayaki porcelain (right)Source: Takshimaya Weibo site[/caption] How is Takashimaya Shanghai Doing? The Shanghai store posted an operating loss of JP¥900 million (around $8.3 million) as of February 2019, its seventh consecutive year of losses. When the store closes, it will incur a loss of up to JP¥3 billion (around $27.9 million) for its parent company, Takashimaya said. Takashimaya opened its store in Shanghai just as online shopping was taking off, which took away some business from the retailer. Online retail sales of physical goods in China hit ¥7.01 trillion (around $64.8 billion) in 2018, an increase of 25.4% year over year and accounting for 18.4% of China’s total consumer goods retail sales, according to the National Bureau of Statistics. Delays and changes development projects at adjacent commercial facilities that might have supported the store also hurt its prospects, such as a movie theater that was meant to open next door. The retailer hoped to leverage entertainment facilities to draw traffic. Furthermore, Takashimaya appears to have chosen its location poorly: Gubei is not a luxury hot spot, as opposed to Nanjing Road West, Huaihai Road East and Lujiazui, where well-known shopping malls concentrate, such as K11, Lippo Plaza and the Shanghai Times Square. Burberry similarly closed its flagship store in Gubei in March 2019, which it opened in 2013. China’s Department Store Sector China’s department store sector is projected to grow slowly through 2023, inching up to ¥1.10 trillion (around $161.0 billion), with sales expected to rise at a very modest CAGR of 1% from 2019 to 2023 and beginning to stagnate or even decline toward the end of the forecast period, according to Euromonitor International. [caption id="attachment_92558" align="aligncenter" width="700"]

Source: Euromonitor International[/caption]

How Other Department Stores Have Survived Amid the Online Onslaught

Some department store operators in China have partnered with leading Internet companies or large-scale e-commerce players to implement digital transformation programs by leveraging the partners’ huge traffic flow, big data and logistics capabilities.

Intime Department Store, in which Alibaba took a 74% controlling stake and later privatized, leveraged Alibaba’s technology and digital strengths to integrate its membership system with Alibaba’s membership system. This enables Intime to use consumer analytics to plan product assortment.

Intime also rolled out online and offline integration initiatives, including an Intime app that allows customers to browse products, place orders and track delivery, as well as launching a store on Tmall. Intime teamed up with Alibaba’s logistics arm Cainiao and Ele.me to encourage users within one kilometer of a store to visit.

In 2018, Intime reported same-store sales increased a remarkable 37% year over year.

Department store operators have also invested in diversified retail formats and tapped into other business sectors to adapt. For instance, Golden Eagle Retail Group launched boutique supermarkets, bookstores, pet stores and beauty stores to cater to changing tastes in China’s fast-growing middle class.

Rainbow department store launched its own convenience store brand called Rainbow and Well. Retail research group IGD estimates China’s convenience store sector will see sales of ¥672.9 billion (around $6.2 billion) in 2022, with a CAGR of 10% from 2017 to 2022 — much stronger growth than the weak 1% CAGR department store sector is expected to see over roughly the same time frame.

Key Insights

Takashimaya will exit China after seven loss-making years, partly due to poor store location and partly due to stiff competition from online merchants and other department stores that have more enthusiastically embraced digitalization. China’s department-store sector is expected to see low growth at best in the coming years. This prospect has prompted other department store operators to diversify store formats and tap into other business sectors, such as convenience stores, beauty shops and pet products.

Source: Euromonitor International[/caption]

How Other Department Stores Have Survived Amid the Online Onslaught

Some department store operators in China have partnered with leading Internet companies or large-scale e-commerce players to implement digital transformation programs by leveraging the partners’ huge traffic flow, big data and logistics capabilities.

Intime Department Store, in which Alibaba took a 74% controlling stake and later privatized, leveraged Alibaba’s technology and digital strengths to integrate its membership system with Alibaba’s membership system. This enables Intime to use consumer analytics to plan product assortment.

Intime also rolled out online and offline integration initiatives, including an Intime app that allows customers to browse products, place orders and track delivery, as well as launching a store on Tmall. Intime teamed up with Alibaba’s logistics arm Cainiao and Ele.me to encourage users within one kilometer of a store to visit.

In 2018, Intime reported same-store sales increased a remarkable 37% year over year.

Department store operators have also invested in diversified retail formats and tapped into other business sectors to adapt. For instance, Golden Eagle Retail Group launched boutique supermarkets, bookstores, pet stores and beauty stores to cater to changing tastes in China’s fast-growing middle class.

Rainbow department store launched its own convenience store brand called Rainbow and Well. Retail research group IGD estimates China’s convenience store sector will see sales of ¥672.9 billion (around $6.2 billion) in 2022, with a CAGR of 10% from 2017 to 2022 — much stronger growth than the weak 1% CAGR department store sector is expected to see over roughly the same time frame.

Key Insights

Takashimaya will exit China after seven loss-making years, partly due to poor store location and partly due to stiff competition from online merchants and other department stores that have more enthusiastically embraced digitalization. China’s department-store sector is expected to see low growth at best in the coming years. This prospect has prompted other department store operators to diversify store formats and tap into other business sectors, such as convenience stores, beauty shops and pet products.