DIpil Das

“She Economy” was a term coined by China’s Ministry of Education in 2007 to describe the rising female-oriented market. According to Accenture, the number of females aged 20–60 years old reached around 400 million in 2018, out of the total population of 1.4 billion in China. It is estimated that this group of female consumers accounts for ¥10 trillion ($1.4 trillion) of consumption each year. Female consumers are becoming the driving force of economic growth in China.

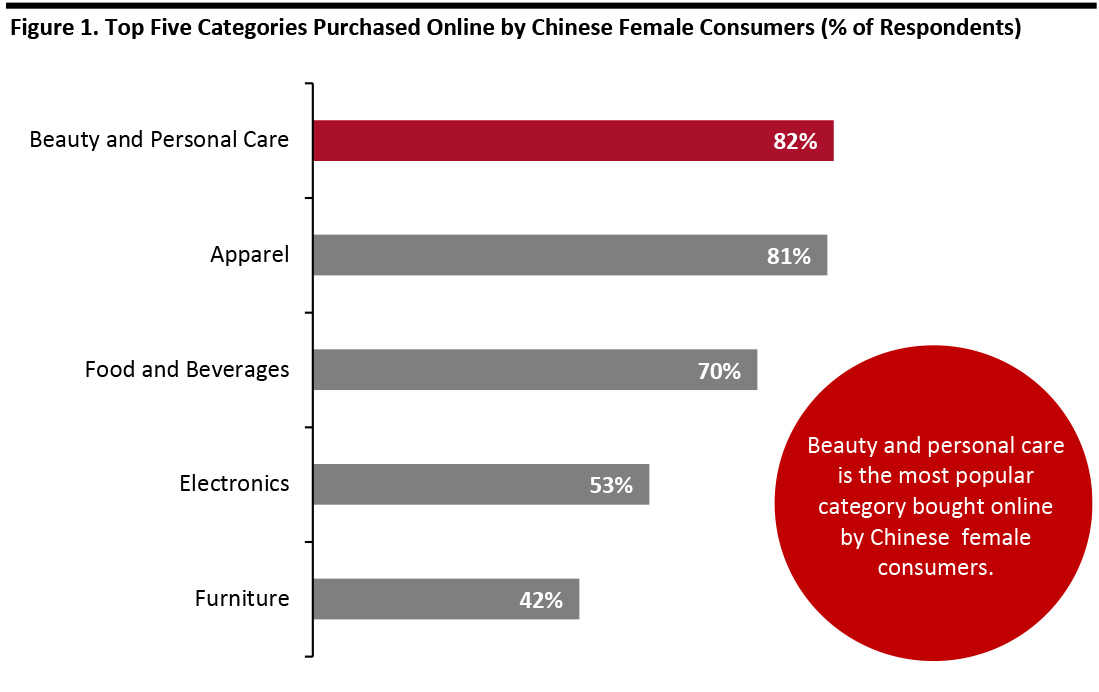

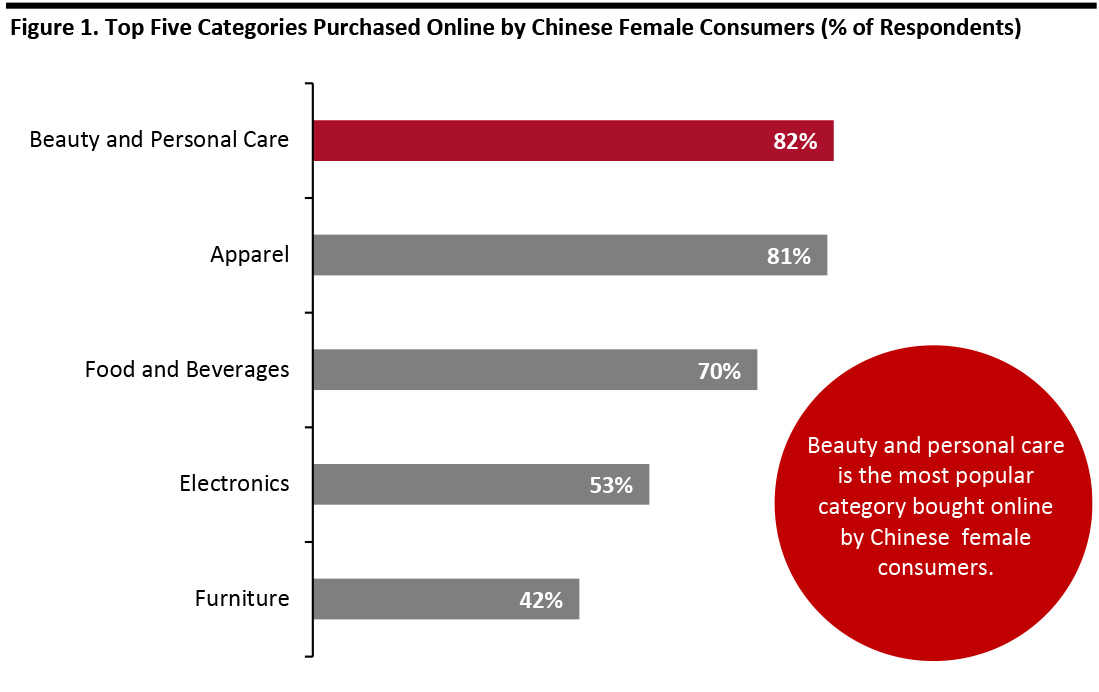

Base: 1,200 female consumers aged under 30 across four city tiers in China

Base: 1,200 female consumers aged under 30 across four city tiers in China

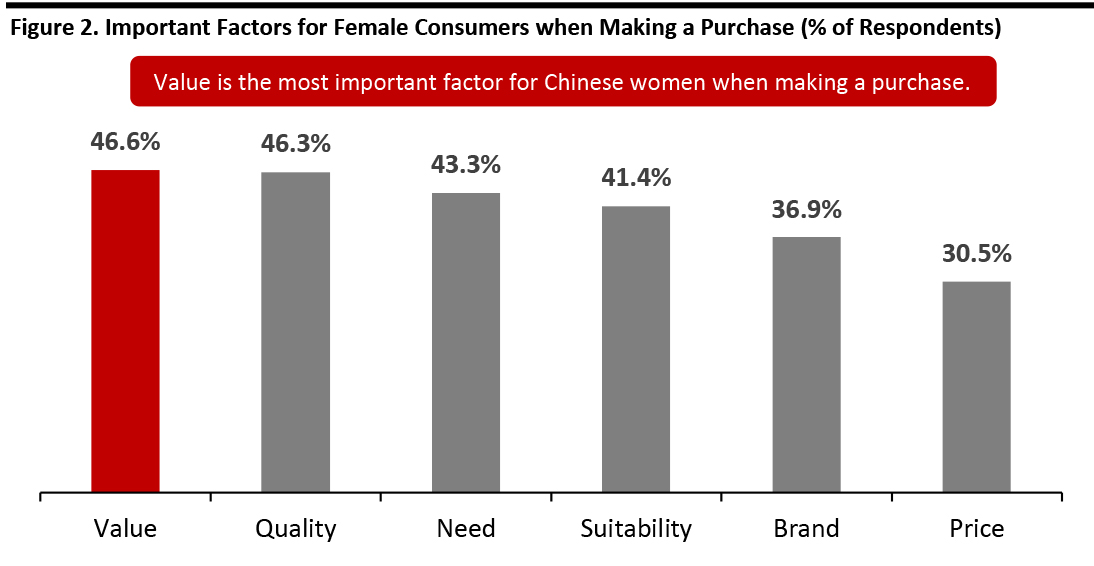

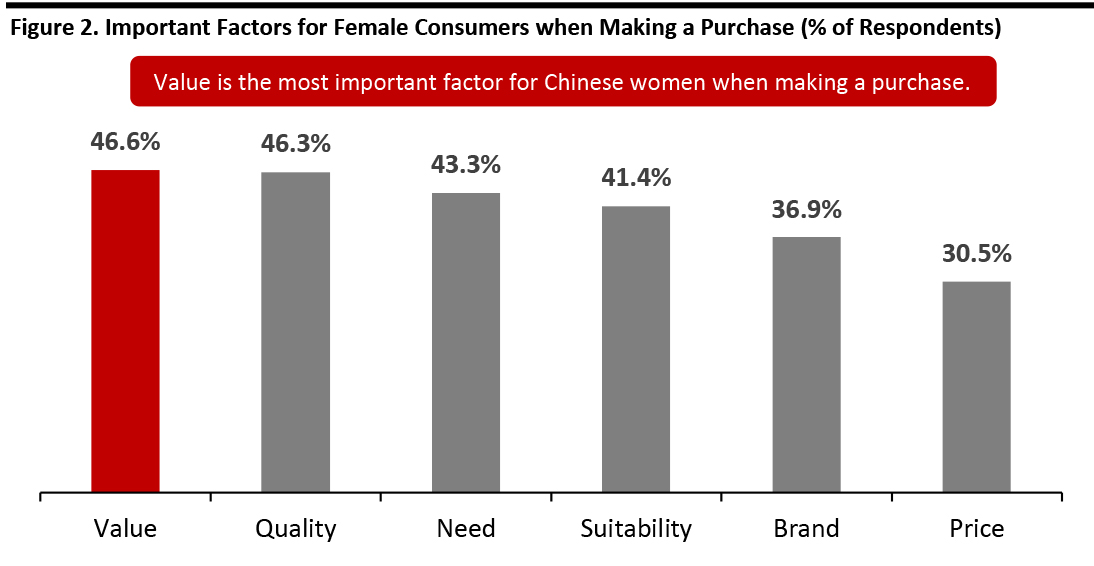

Source: iResearch/Coresight Research [/caption] 2. Sensitivity to quality and price In the digital age, Chinese female consumers tend to invest time in price comparison as they are sensitive to product quality and price. According to research conducted by VIP Shop and iResearch in February 2019, value and quality are two critical factors for Chinese middle-class female consumers when making a purchase. Some 88% of this demographic will buy from domestic sports brands due to their lower price points, although 88.8% said they are more willing to purchase from foreign sports brands if they launch promotions or discounts. In fact, these consumers expressed that they tend to buy foreign sports products if they are priced the same as those from Chinese brands. The same logic works for beauty products. Although international brands such as L’Oréal, Estée Lauder and Lancôme remain the best sellers, domestic beauty brands including Florasis and Perfect Diary are gaining popularity, driven by their affordable prices and successful marketing strategies. With the extensive choices in the market, young female consumers are likely to turn to Chinese substitutes if foreign brands are too expensive for them to afford. [caption id="attachment_102269" align="aligncenter" width="700"] Base: 1,414 middle-class female consumers in China

Base: 1,414 middle-class female consumers in China

Source: iResearch/Coresight Research [/caption] 3. Pursuit of fulfillment and experiential shopping With the continuous economic growth, shopping is become more about the experience and mental fulfillment for Chinese women than it is a necessity. Considering the consumer journey, retailers should promote their brand values to garner interest from, and create a connection with, female shoppers. Balabala, a leading childrenswear brand in China, has successfully created a creative and playful image for kids, prompting their moms to purchase its products. Brands are leveraging their offline footprints and opening pop-up stores to enhance the shopping experience. The unique and limited-time experience creates excitement and engagement for consumers. The number of pop-up stores has been growing at a CAGR of over 100% since 2015, according to Jing Daily. Luxury brand Chanel launched its COCO Game Center in Shanghai in 2018, drawing people to wait in line for at least an hour to gain entry to the pop-up. [caption id="attachment_102270" align="aligncenter" width="700"] Chanel COCO Game Center pop-up in Shanghai

Chanel COCO Game Center pop-up in Shanghai

Source: Chanel Weibo [/caption] Implications for Foreign Retailers and Brands As a result of increased employment rates and higher incomes, Chinese female consumers are enjoying greater spending power. Beauty and apparel remain the most popular categories for Chinese female consumers, but health and wellness and parent-and-baby sectors also present opportunities for brands. Domestic brands are gaining popularity as women focus on value and quality, so it is important for foreign brands to offer value products that are catered to female consumers’ needs. Brands should also look to connect with female shoppers by leveraging offline stores to create fun and interactive shopping experiences.

What Drives the She Economy?

Women are being empowered in China, as we are seeing increasing employment rates and higher incomes for female workers: According to data from the National Bureau of Statistics, women accounted for 43.7% of total employment in China in 2018. The International Labour Organization also reported that China took the lead in participation of women in the labor force, with a participation rate of over 70%, which is much higher than Asia-Pacific average. Chinese females are more likely to enter the workforce to fulfill their self-value, as they tend to achieve higher levels of education than men. Despite a gender pay gap, Chinese women shop and spend more than men, and they are usually the main decision-makers in family spending. Financial services company Guotai Junan estimates that overall consumption by Chinese women increased by 81% from 2013 to 2018. Furthermore, women account for an estimated 55% of online spending, according to CNBC, and not just on products for themselves: Chinese females shop for the whole family, contributing to sales of products for men and in the parent-and-baby market.Three Significant Trends of the She Economy

In order to capture the growing female market in China, there are three primary trends that foreign retailers should note, which we discuss below. 1. Increased spending on beauty products Beauty is one of the fastest-growing segments in China retail. Impacted by society’s focus on appearance and to please themselves, Chinese females are increasingly investing in beauty category—for skincare and makeup products, for example. A survey conducted by iResearch in March 2019 indicates that 82% of Chinese female consumers aged under 30 purchase beauty and personal care products online, making it the most popular category for that demographic. The innovative retail ecosystem in China—which incorporates social media, livestreaming and shopping festivals—allows consumers to discover beauty brands and products in a fun way, thus driving purchases. In addition to beauty, health and wellness and parent-and-baby are two emerging sectors that have huge growth potential in China, powered by female consumers. [caption id="attachment_102268" align="aligncenter" width="700"] Base: 1,200 female consumers aged under 30 across four city tiers in China

Base: 1,200 female consumers aged under 30 across four city tiers in China Source: iResearch/Coresight Research [/caption] 2. Sensitivity to quality and price In the digital age, Chinese female consumers tend to invest time in price comparison as they are sensitive to product quality and price. According to research conducted by VIP Shop and iResearch in February 2019, value and quality are two critical factors for Chinese middle-class female consumers when making a purchase. Some 88% of this demographic will buy from domestic sports brands due to their lower price points, although 88.8% said they are more willing to purchase from foreign sports brands if they launch promotions or discounts. In fact, these consumers expressed that they tend to buy foreign sports products if they are priced the same as those from Chinese brands. The same logic works for beauty products. Although international brands such as L’Oréal, Estée Lauder and Lancôme remain the best sellers, domestic beauty brands including Florasis and Perfect Diary are gaining popularity, driven by their affordable prices and successful marketing strategies. With the extensive choices in the market, young female consumers are likely to turn to Chinese substitutes if foreign brands are too expensive for them to afford. [caption id="attachment_102269" align="aligncenter" width="700"]

Base: 1,414 middle-class female consumers in China

Base: 1,414 middle-class female consumers in China Source: iResearch/Coresight Research [/caption] 3. Pursuit of fulfillment and experiential shopping With the continuous economic growth, shopping is become more about the experience and mental fulfillment for Chinese women than it is a necessity. Considering the consumer journey, retailers should promote their brand values to garner interest from, and create a connection with, female shoppers. Balabala, a leading childrenswear brand in China, has successfully created a creative and playful image for kids, prompting their moms to purchase its products. Brands are leveraging their offline footprints and opening pop-up stores to enhance the shopping experience. The unique and limited-time experience creates excitement and engagement for consumers. The number of pop-up stores has been growing at a CAGR of over 100% since 2015, according to Jing Daily. Luxury brand Chanel launched its COCO Game Center in Shanghai in 2018, drawing people to wait in line for at least an hour to gain entry to the pop-up. [caption id="attachment_102270" align="aligncenter" width="700"]

Chanel COCO Game Center pop-up in Shanghai

Chanel COCO Game Center pop-up in Shanghai Source: Chanel Weibo [/caption] Implications for Foreign Retailers and Brands As a result of increased employment rates and higher incomes, Chinese female consumers are enjoying greater spending power. Beauty and apparel remain the most popular categories for Chinese female consumers, but health and wellness and parent-and-baby sectors also present opportunities for brands. Domestic brands are gaining popularity as women focus on value and quality, so it is important for foreign brands to offer value products that are catered to female consumers’ needs. Brands should also look to connect with female shoppers by leveraging offline stores to create fun and interactive shopping experiences.